For Australian Accounting and Corporate Services Firms

Powered by FastLaneRecruit – Your Partner in Offshore Talent Solutions

Is your Australian accounting or corporate services firm facing challenges in attracting and retaining top-tier talent? With rising operating costs, increasing local salary expectations, and a tightening pool of skilled professionals, many firms across Australia are now turning to offshore recruitment and remote staffing as a strategic and sustainable solution.

The accounting and corporate services sector in Australia is under growing pressure to maintain profitability while ensuring compliance and consistently delivering high-quality client services. Traditional hiring models can be costly and often lack the flexibility or scalability required to stay competitive in this evolving business environment.

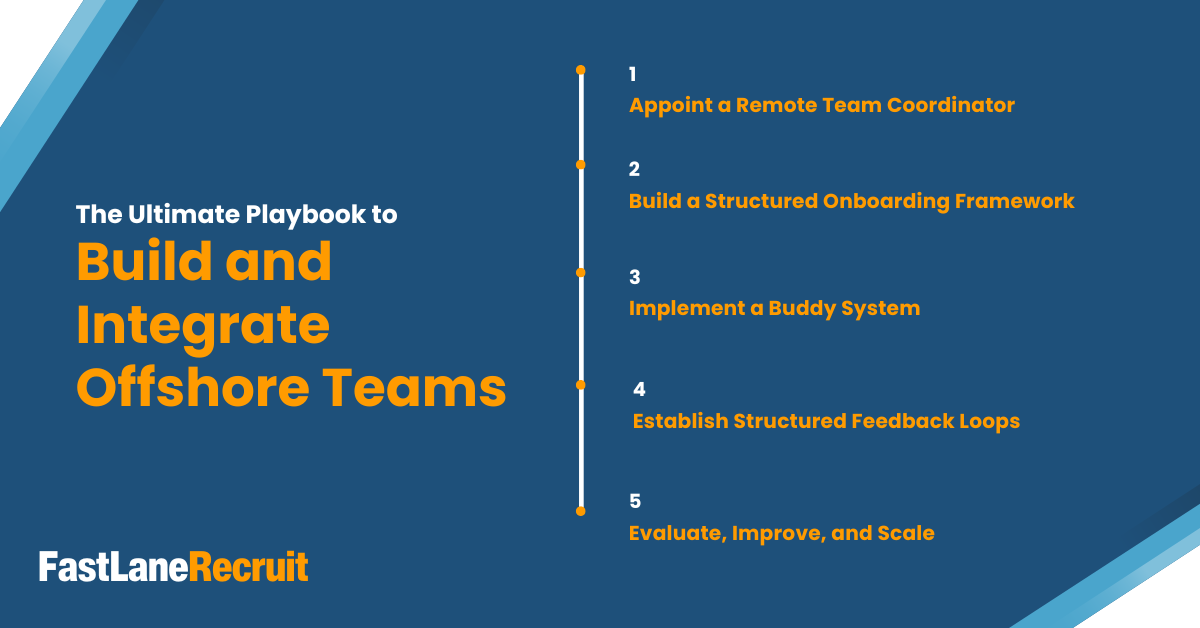

This comprehensive playbook provides a detailed, step-by-step framework to help your firm build and integrate high-performing offshore teams. Drawing on proven strategies and insights, it outlines practical steps to:

- Appoint a dedicated Remote Team Coordinator to oversee communication, onboarding, and performance

- Establish a comprehensive onboarding framework that ensures alignment with Australian standards

- Introduce a structured buddy system to accelerate cultural integration and boost engagement

- Create robust feedback loops that drive performance and accountability

- Conduct regular reviews to optimise your offshore operations and ensure continuous improvement

By implementing the strategies outlined in this playbook, your firm can confidently scale operations, reduce costs, and access a wider talent pool, all while maintaining the exceptional standards your clients demand.

Content Outline

Step 1: Appoint a Remote Team Coordinator

The first step in building a successful offshore team is to designate an internal coordinator responsible for managing your remote workforce. Appoint a Remote Team Coordinator within your Australian accounting or corporate services firm. This individual will be the primary point of contact for your offshore hires in Malaysia, ensuring consistency, accountability, and alignment with your firm’s goals.

The Remote Team Coordinator plays a crucial role in integrating offshore talent into your firm’s culture and operations. Their key responsibilities include:

- Overseeing the onboarding process and ensuring that new offshore staff understand your firm’s systems, processes, and expectations

- Tracking performance and providing regular feedback to maintain high standards and productivity

- Facilitating ongoing communication to bridge geographical and cultural gaps, fostering a sense of belonging and teamwork

- Acting as a liaison between your local team and offshore staff, addressing any issues or concerns promptly and professionally

By appointing a dedicated Remote Team Coordinator, your firm establishes a clear line of responsibility and accountability, which is essential for a seamless and successful offshore accounting Australia strategy. This role is particularly vital in managing virtual team management, supporting remote onboarding initiatives, and promoting staff engagement across locations.

Also Read: Guide for Australian Companies to Hire Malaysian Employees

Step 2: Establish a Structured Onboarding Framework

A meticulously structured onboarding framework is essential for ensuring your offshore team can operate at the same high standards as your Australian accounting or corporate services firm. Beyond simply providing access to systems, a comprehensive onboarding process is critical to embedding compliance, fostering a shared culture, and laying the foundation for long-term success.

Key Components of a Successful Offshore Onboarding Framework

IT Access and Systems Setup

Equip your offshore staff with seamless access to your core accounting platforms—such as Xero, MYOB, FYI Docs, Karbon, and Class Super—ensuring they are fully integrated into your firm’s workflows and capable of delivering consistent, high-quality output.

Process and Workflow Alignment

Provide targeted training that aligns offshore staff with your firm’s processes and workflows, underpinned by Australian accounting standards and best practices. Emphasize critical tasks such as ATO lodgement requirements, TPB compliance measures, and your firm’s internal control protocols.

Clear Policy Framework and Expectations

Develop a comprehensive FAQ and policy pack that establishes clear guidelines and expectations from day one. This should include:

- Defined working hours and Australian Eastern Daylight Time (AEDT) overlap to support real-time collaboration

- Leave policies that respect both Australian and Malaysian holiday calendars

- Established escalation channels for resolving operational or client-related concerns

- Communication norms and reporting structures to reinforce accountability and consistency

Data Security and Regulatory Compliance

Prioritize data security and privacy by delivering training that reinforces ATO and TPB data protection requirements. Ensure offshore staff understand the critical importance of confidentiality and compliance in handling sensitive client information.

A well-structured onboarding framework is more than a checklist; it is the foundation for building an offshore team that seamlessly integrates with your firm’s operations and culture. By investing in these core elements, your firm can confidently extend its capabilities offshore while upholding the highest standards of service and regulatory compliance.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

Step 3: Introduce a Buddy System

A robust buddy system is an invaluable tool for ensuring that your offshore team feels connected, supported, and fully integrated into your firm’s culture. Establishing structured peer mentoring relationships is a proven strategy for enhancing both productivity and employee retention offshore.

The Role of a Buddy System in Offshore Team Integration

Pair each new offshore hire with a local team member or experienced offshore colleague who can provide day-to-day guidance and act as a reliable first point of contact. This peer support accelerates the learning curve and helps offshore staff feel like valued members of your firm from the outset.

Benefits of a Structured Buddy Program

- Peer Mentoring Offshore Team: A dedicated buddy helps offshore staff understand how your firm’s processes and values translate to daily work, fostering confidence and competence.

- Cultural Integration: Buddies play a crucial role in providing Australian work culture training, ensuring offshore team members appreciate local nuances and expectations, which is essential for seamless collaboration.

- Early Issue Resolution: Through frequent check-ins—ideally daily in the first two weeks, then transitioning to weekly—buddies can identify and address issues early, reducing operational disruptions and promoting long-term stability.

- Improved Engagement and Retention: Offshore staff who feel connected to colleagues and supported in their roles are more engaged and less likely to seek alternative opportunities, directly supporting your firm’s employee retention offshore goals.

Implementing a buddy system not only bridges operational and cultural gaps but also sends a strong message that your firm values its offshore team as an integral part of your broader workforce. This foundation of peer support helps ensure that your offshore staff are engaged, empowered, and aligned with your firm’s standards of excellence.

Also Read: Common Offshoring Mistakes To Avoid In Accounting

Step 4: Create Structured Feedback Loops

Establishing structured feedback loops is critical to maintaining high standards and operational alignment within your offshore team. A well-defined feedback process not only drives continuous improvement but also enhances engagement and accountability across your remote workforce.

- Formalise Performance Review Cycles

Conduct regular remote staff performance reviews—monthly or quarterly—to monitor offshore team performance against clear, measurable KPIs. These reviews should focus on:- ATO task tracking: Ensuring offshore staff meet lodgement and compliance deadlines, including timely preparation and submission of ATO documentation.

- Offshore BAS preparation: Evaluating the accuracy and thoroughness of Business Activity Statements and other compliance-related tasks.

- Internal quality standards and adherence to client service expectations.

- Facilitate Two-Way Feedback and Virtual Employee Management

Feedback should be a two-way dialogue. Provide offshore staff with opportunities to share challenges, insights, and recommendations for process improvements. This open communication fosters trust and reinforces a culture of virtual employee management that prioritises collaboration and shared accountability. - Support Ongoing Professional Development

Use performance reviews to identify skill gaps and training opportunities. Enhance offshore staff capabilities by offering targeted professional development, such as:- Updates on Australian accounting, tax, and regulatory frameworks

- Advanced technical training in platforms like Xero, MYOB, and FYI Docs

- Cross-training opportunities to support progression from bookkeeping to advisory and compliance roles.

- Drive Long-Term Engagement and Retention

A structured feedback and review process goes beyond performance management—it strengthens your employee retention offshore strategy. Offshore staff who receive constructive feedback and see a clear path for growth are more likely to remain engaged and aligned with your firm’s goals.

By establishing a disciplined, transparent feedback loop, you ensure that your offshore team not only delivers exceptional work today but also evolves to meet your firm’s long-term operational and strategic objectives.

Also Read: Offshoring vs. Freelancing: Which is Better for Your Business?

Step 5: Review and Optimise Regularly

The successful management of an offshore team does not end with onboarding and integration. Regular review and optimisation are essential to ensure your offshore strategy remains aligned with your firm’s evolving goals and client expectations. This commitment to continuous improvement will help your firm scale offshore team Australia efforts confidently and sustainably.

- Conduct Quarterly Performance and Strategy Reviews

Schedule quarterly evaluations to assess your offshore team’s performance and identify opportunities to enhance collaboration and output. Involve both your Australian and offshore teams in these reviews to gain comprehensive insights into operational challenges and achievements. - Key focus areas for quarterly reviews should include:

- Process improvement offshoring: Identifying bottlenecks or inefficiencies and implementing refined workflows to improve productivity and accuracy.

- Team performance trends and skill development opportunities.

- Emerging compliance or regulatory updates from ATO, ASIC, or TPB that may require process adjustments.

- Align with Business Growth and Virtual Firm Expansion

Use these quarterly reviews as an opportunity to align your offshore strategy with your firm’s broader growth and virtual firm expansion plans. Consider how your offshore team can take on more complex tasks or expand service offerings, such as moving from basic bookkeeping to advanced tax preparation or audit support. - Support Continuous Learning and Cross-Training

As your offshore team grows, ensure you invest in ongoing learning and cross-training to build versatility and resilience. A culture of continuous improvement not only enhances performance but also strengthens retention and engagement. - Maximise the Value of Your Offshore Team

Regular reviews ensure your offshore staff remains a dynamic, integrated extension of your local operations. By staying proactive, you can adapt to client needs, maintain high standards of compliance, and ensure that your offshore strategy drives long-term value.

A disciplined approach to quarterly review and optimisation will empower your firm to confidently navigate the evolving business landscape while scaling your offshore capabilities strategically and sustainably.

Also Read: How to Choose an Offshore Provider for Your Business

Bonus Tips: Seamless Offshoring for Australian Firms

Successfully integrating offshore talent into your firm’s operations requires more than just processes—it demands strategic foresight and cultural alignment. Below are practical recommendations to help your firm achieve seamless offshoring and fully leverage the potential of your offshore workforce.

- Prioritise Local Software Familiarity: Select offshore staff who are proficient in the accounting platforms your firm relies on, such as Xero, MYOB, Karbon, BGL, and Class. Familiarity with these systems ensures offshore professionals can quickly align with your workflows and deliver results that meet Australian standards.

- Start with Compliance and BAS Preparation: Begin your offshore journey with well-defined tasks like bookkeeping, BAS preparation, and SMSF administration. These foundational tasks help build trust and confidence in your offshore team’s capabilities before expanding to more complex advisory or tax roles.

- Align Leave and Holiday Schedules: Coordinate your offshore staff’s leave with both Australian and Malaysian public holiday calendars. Proactively manage workflow disruptions and ensure service continuity, especially during peak reporting periods.

- Train in Australian Work Culture and Terminology: Provide tailored Australian work culture training to help offshore staff understand industry-specific terms and local work expectations. Clarify key concepts such as “super,” “TFN,” “fringe benefits,” and the nuances of ATO portals. This understanding promotes smoother collaboration and enhances your firm’s client-facing professionalism.

- Leverage Employer of Record (EOR) Services: Partnering with an EOR solution, like FastLaneRecruit, eliminates the need to establish a legal entity in Malaysia. This approach ensures full compliance with Malaysian employment laws, simplifies HR and payroll administration, and empowers your team to focus on core business activities.

- Drive Virtual Firm Expansion with Confidence: Embrace offshoring not as a short-term cost reduction tactic, but as a strategic pillar for virtual firm expansion. Offshore teams can enhance your service capacity, provide flexibility during peak periods, and allow your firm to adapt rapidly to market changes.

By incorporating these best practices, your firm can confidently integrate offshore professionals, foster sustainable growth, and strengthen your reputation as a forward-thinking and client-focused organisation.

Also Read: Benefits of Offshoring for Australian Businesses

Why Australian Firms Choose FastLaneRecruit

At FastLaneRecruit, we specialise in helping Australian professional services firms scale cost-effectively by connecting them with skilled offshore talent.

We support a wide range of clients from CPA firms to bookkeeping businesses and financial advisers across Australia and the broader Asia-Pacific region.

With FastLaneRecruit, you can:

- Hire experienced Malaysian accountants, payroll experts, and client service staff

- Comply with Malaysian employment laws using our EOR solution

- Cut operating costs by up to 60%

- Build a high-performing remote team, with support from a trusted recruitment partner

Book Your Free Discovery Call

Ready to build a future-proof offshore team? Let’s explore how FastLaneRecruit can support your growth.

Our complimentary consultation will help you:

- Identify the right roles to offshore

- Talent Sourcing, EOR and Payroll

- Map out onboarding, training, and workflows

Let’s start your offshoring journey with confidence. Book your free discovery call with FastLaneRecruit today