Seamless Payroll Solutions for Your Malaysian Team

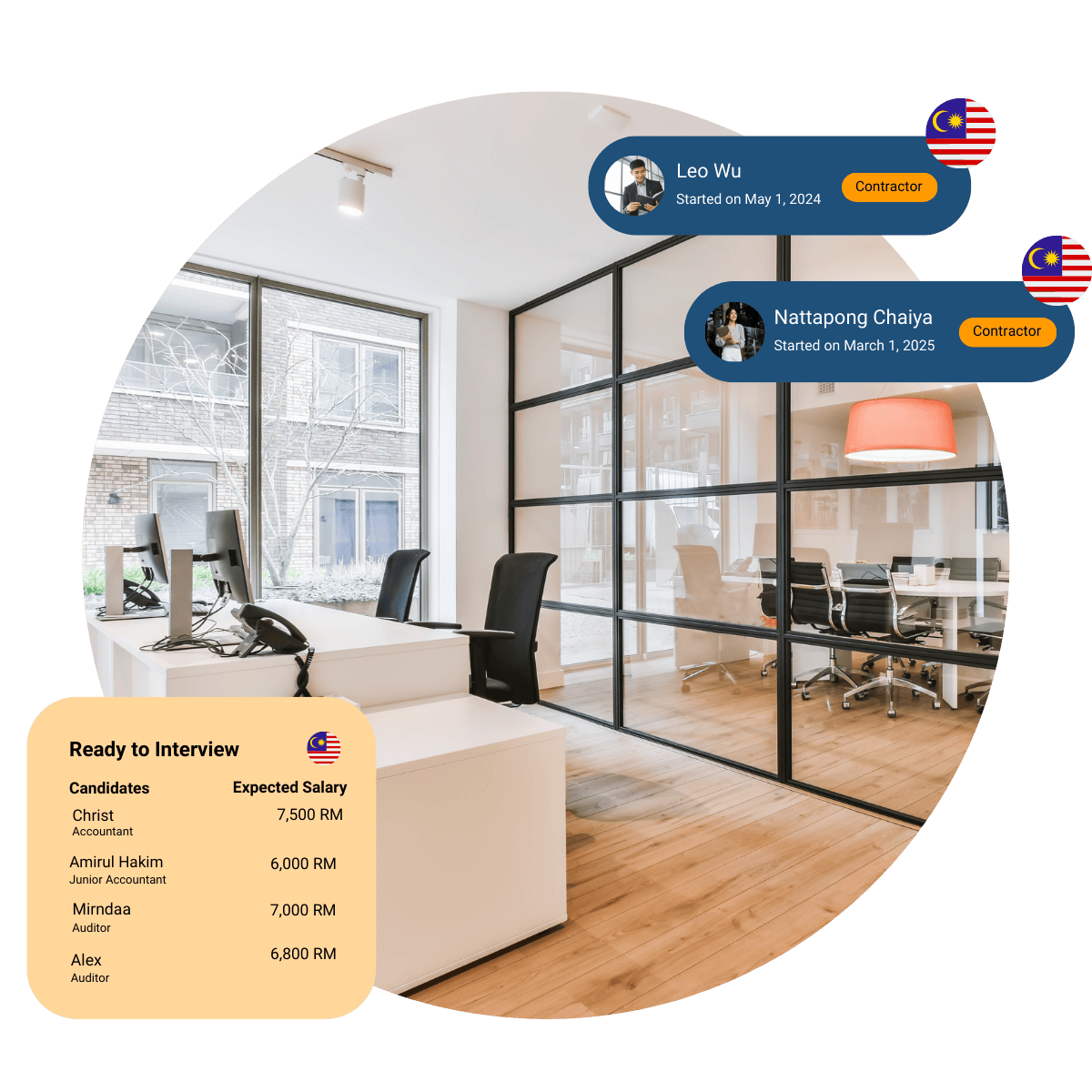

At FastLaneRecruit, we offer end-to-end payroll services exclusively for Malaysian talents hired through our recruitment, outsourcing, or Employer of Record (EOR) solutions. Whether you’re a company based in Singapore, Australia, Malaysia, the United States, or Hong Kong, we ensure your Malaysian hires are paid accurately, on time, and in full compliance with local employment regulations.

How Our Payroll Services Work

Our payroll service is an integrated solution designed to support clients who have engaged FastLaneRecruit to source, hire, and onboard talent in Malaysia. We act as your strategic HR partner, delivering a comprehensive workforce solution that includes:

Monthly Payroll Processing

Accurate salary calculations, statutory deductions, and contribution filings.

EPF, SOCSO, and EIS Compliance

Ensure full adherence to Malaysia’s statutory employment contributions.

Payslip Distribution

Secure, confidential electronic payslips sent directly to your employees.

Income Tax Calculations & Filing (PCB)

Real-time compliance with Malaysia’s monthly tax deduction (MTD) system.

Leave and Attendance Integration

Optional sync with leave tracking to ensure accurate payroll inputs.

End-of-Year Reporting

Form EA generation and annual reporting for employee tax declarations.

Who Is This For?

1

Companies based in Singapore, Australia, Hong Kong, the United States, or Malaysia

2

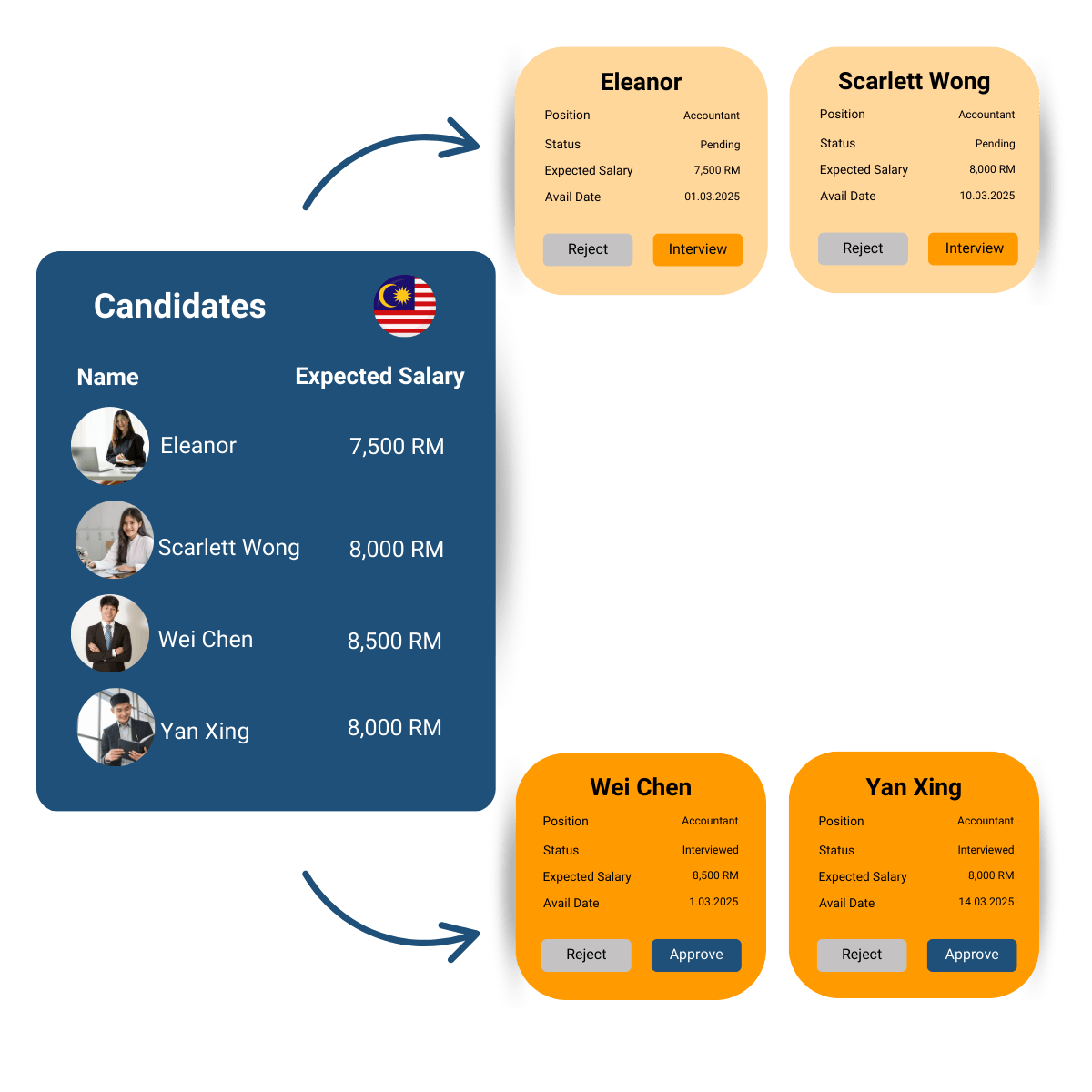

Businesses that have hired Malaysian talent through FastLaneRecruit’s recruitment, outsourcing, or EOR solutions

3

Employers seeking a compliant, efficient, and fully managed payroll solution for their Malaysian team

LEAVE YOUR MALAYSIA PAYROLL TO

Our Experts

Cloud-Based Payroll Solutions (Xero & Talenox)

We use powerful, cloud-based payroll platforms like Xero and Talenox, fully integrated with Malaysian payroll regulations. Automate salary processing, tax deductions, and statutory contributions while maintaining secure and centralised data access.

Comprehensive Reporting & Insights

Access detailed payroll reports, cost breakdowns, and tax summaries empowering your business with actionable payroll insights for better decision-making.

Integrated Tax Compliance

Stay stress-free with our end-to-end payroll compliance solutions:

- EPF (Employees Provident Fund) submissions and reporting

- SOCSO & EIS contributions (Perkeso)

- PCB (Potongan Cukai Bulanan) for income tax compliance

- HRDF levy reporting (if applicable)

We ensure full compliance with LHDN (Inland Revenue Board), KWSP (EPF), and PERKESO requirements.

Why Choose FastLaneRecruit for Payroll in Malaysia?

Recruitment to Payroll, All-in-One

Enjoy a seamless transition from hiring to payroll—one provider, one workflow.

Local Expertise, Global Reach

We serve companies across Singapore, Australia, Malaysia, the U.S., and Hong Kong, ensuring your Malaysian team is managed with precision and compliance.

No Local Entity Required

With our EOR model, you can hire and pay Malaysian employees without setting up a local company.

Compliant & Reliable

Stay ahead of evolving employment laws in Malaysia with a dedicated local support team.

Payroll Implementation & Setup

Transitioning to FastLaneRecruit’s payroll services is smooth and efficient.

Step 1: Payroll Review & Planning

We assess your payroll requirements, tax obligations, and compliance needs to develop a tailored payroll strategy.

Step 2: Customization & Data Migration

We securely transfer employee data, including tax and MPF details, and configure your payroll system.

Step 3: Testing & Validation

A parallel payroll run ensures accuracy by cross-verifying data before going live.

Step 4: Full Payroll Deployment

Once verified, we launch your payroll system, ensuring compliance with Hong Kong’s employment laws.

Payroll Implementation & Setup

Transitioning to FastLaneRecruit’s payroll services is smooth and efficient.

Step 1: Payroll Review & Planning

We assess your payroll requirements, tax obligations, and compliance needs to develop a tailored payroll strategy.

Step 2: Customization & Data Migration

We securely transfer employee data, including tax and MPF details, and configure your payroll system.

Step 3: Testing & Validation

A parallel payroll run ensures accuracy by cross-verifying data before going live.

Step 4: Full Payroll Deployment

Once verified, we launch your payroll system, ensuring compliance with Hong Kong’s employment laws.

Don’t Just Take Our Word for It – Hear from Our Clients

Compliant Payroll Services for Your Malaysian Workforce

Hiring the right talent is just the beginning, paying them accurately and compliantly is where we come in. With FastLaneRecruit, you get more than just payroll processing, you get peace of mind. Let us handle the complexities of Malaysian payroll, so you can focus on growing your team and your business across borders. Speak to our team today to learn how we can simplify payroll for your Malaysian hires.

Book A Free 30 mins Discovery Call