What Global Employers Should Know

Expanding your tech team globally can unlock incredible growth opportunities. Malaysia, with its vibrant tech ecosystem and competitive talent pool, has emerged as a prime destination for hiring full-stack developers. For global employers, this presents an exciting chance to scale their development capabilities efficiently. However, navigating Malaysia’s employment landscape without a clear understanding of local laws can be complex. Missteps in payroll, statutory contributions, or contract compliance can carry significant legal and financial consequences.

At FastLaneRecruit, we help global businesses hire Malaysian tech talent seamlessly and compliantly through our Employer of Record (EOR) service. This guide provides an overview of Malaysia’s employment laws as they relate to full-stack developers, offering practical tips and examples to ensure a smooth hiring process.

Content Outline

Key Summary

Understand Malaysia’s Employment Law Framework

Global employers must comply with the Employment Act 1955, including recent amendments, and other legislations like EPF, SOCSO, EIS, and OSHA to ensure lawful hiring and operations.

Employment Contracts Are Crucial

Clearly define job responsibilities, salary, benefits, working hours, leave, termination, and statutory compliance to avoid disputes and ensure clarity for full-stack developers.

Manage Payroll and Statutory Contributions Accurately

Employers must handle EPF, SOCSO, EIS contributions, and income tax deductions (MTD/PCB) correctly to remain compliant and protect employees’ rights.

Observe Working Hours, Leave, and Benefits

Full-stack developers are entitled to maximum 45 hours/week, overtime pay, annual and sick leave, maternity/paternity leave, and public holidays. Contracts should also clarify flexible or remote work arrangements.

Using an Employer of Record (EOR) Simplifies Hiring

Partnering with an EOR like FastLaneRecruit ensures legal employment, payroll, benefits, compliance, and HR support, allowing global companies to hire top Malaysian tech talent efficiently.

Reduce Legal and Operational Risks

An EOR mitigates risks of non-compliance, payroll errors, and misclassification, letting companies scale teams in Malaysia without establishing a local entity.

Overview of Malaysia’s Employment Law Framework

Understanding Malaysia’s employment laws is essential for global employers looking to hire full-stack developers. These laws ensure that both employees and employers are protected and that businesses operate fairly and legally. The foundation of employment regulation in Malaysia is the Employment Act 1955 (EA), which was most recently updated in 2023.

The EA sets out the rights and obligations of both employers and employees, covering key areas such as:

- Working hours – limits on weekly and daily work, rules for overtime, and rest periods.

- Wages – minimum wage requirements, salary payments, and rules for deductions.

- Leave entitlements – annual leave, sick leave, maternity/paternity leave, and public holidays.

- Termination procedures – notice periods, termination benefits, and protections against unfair dismissal.

It’s important to note that the EA does not cover every employee in Malaysia. Specifically, it generally applies to:

- Employees earning RM4,000 or less per month. Employees earning above this threshold are still protected by other laws, but certain provisions of the EA, like overtime pay or shift allowances, may not apply.

- Employees working in Peninsular Malaysia. Sabah and Sarawak operate under separate labor ordinances, so employers hiring in those states need to be aware of additional rules.

For global employers, this means that when hiring full-stack developers in Malaysia, you must ensure that your contracts, policies, and employment practices comply with the EA, including the updates introduced in the Employment (Amendment) Act 2022. These updates introduced important changes such as enhanced maternity protections, new rules for paternity leave, flexible working arrangements, and adjustments to the minimum wage.

In addition to the EA, there are several other important legislations that employers need to understand:

- Occupational Safety and Health Act 1994 (OSHA) – Requires employers to provide a safe and healthy work environment. This includes conducting risk assessments, providing safety training, and ensuring that employees have the necessary protective equipment.

- Income Tax Act 1967 – Employers are responsible for deducting income tax from their employees’ salaries and remitting it to the Inland Revenue Board of Malaysia (LHDN) on time. Understanding the tax system is critical to avoid penalties.

- Employees Provident Fund (EPF) Act 1991 – Mandates retirement savings contributions for Malaysian employees. Employers are required to contribute alongside employees to ensure long-term financial security.

- Social Security Organisation (SOCSO) Act 1969 – Provides social protection for employees, including coverage for workplace injuries, invalidity, and certain medical benefits.

- Employment Insurance System (EIS) – Offers financial support to employees who become unemployed, helping them bridge gaps while seeking new employment.

For global companies hiring full-stack developers in Malaysia, compliance with these laws is not optional. Misunderstanding or ignoring these regulations can result in fines, penalties, or legal disputes. Partnering with a local Employer of Record (EOR) like FastLaneRecruit ensures that your hiring is fully compliant, payroll is accurate, and your employees’ rights are fully protected.

Also Read: Why Malaysia Is Becoming a Hotspot for Offshore DevOps Engineers

Types of Employment in Malaysia

Understanding the different employment types is crucial for structuring contracts, payroll, and statutory contributions correctly. Full-stack developers may be hired under any of the following arrangements:

| Employment Type | Description | Typical Use Case for Developers |

| Full-Time | Employees work standard hours (up to 45 hours/week). | Permanent developers on ongoing projects. |

| Part-Time | Work hours ≤70% of full-time hours. | Developers assisting on smaller modules or part-time projects. |

| Contract | Fixed-term employment with specified duration. | Hiring developers for a defined project or system implementation. |

| Freelancer/Consultant | Project-based work, often paid hourly or per deliverable. | Short-term tasks; not considered employees; no statutory deductions required. |

Global employers must distinguish between contractors and employees carefully. Misclassification can result in penalties for non-compliance with payroll and statutory contribution obligations.

Employment Contracts & Key Clauses

A well-drafted employment contract is one of the most important documents when hiring in Malaysia. Not only does it provide legal protection for both the employer and employee, but it also sets clear expectations, reduces misunderstandings, and ensures compliance with Malaysian labor laws. This is particularly crucial when hiring full-stack developers, who often work on critical projects and handle sensitive data.

Here’s a breakdown of the key components that every employment contract should include:

1. Job Role & Responsibilities

Clearly defining the job role is essential. For full-stack developers, this includes:

- Technical responsibilities: e.g., “Design and develop both front-end and back-end components of web applications, using technologies such as React, Node.js, and MySQL.”

- Project ownership: e.g., “Lead the development of new feature modules and provide code review support for junior developers.”

- Deliverables & performance expectations: Specify timelines, quality standards, and project milestones.

Example: A full-stack developer contract may state: “The employee is responsible for delivering monthly feature updates for the company’s SaaS platform, maintaining server-side APIs, and participating in daily stand-up meetings.”

2. Salary & Benefits

Clearly outline the employee’s remuneration package, including:

- Monthly salary: State the amount and currency.

- Allowances: Such as transportation, internet, or meal allowances.

- Bonuses: Performance-based incentives or project completion bonuses.

- Benefits: Health insurance, EPF contributions, SOCSO coverage, or any company perks.

Example: “The employee will receive a monthly salary of RM6,500, inclusive of standard allowances. Additional performance-based bonuses will be awarded quarterly, subject to management evaluation.”

Also Read: DevOps Engineer Salary Guide 2025

3. Working Hours & Flexibility

Employment contracts should clearly define working hours, overtime policies, and flexibility options. For developers, this can include:

- Standard working hours (e.g., Monday–Friday, 9:00 am–6:00 pm).

- Overtime rates in compliance with the Employment Act for employees earning below RM4,000/month.

- Remote work arrangements or flexible schedules for international collaboration.

Example: “The employee is required to work 45 hours per week. Overtime exceeding the standard hours will be compensated according to statutory rates. Flexible working from home is permitted twice a week, provided project deadlines are met.”

4. Leave Entitlements

Employers must outline all forms of leave to comply with Malaysian law:

- Annual leave: Usually 8–16 days per year, depending on company policy and employee tenure.

- Sick leave: Paid sick leave as per the Employment Act.

- Maternity/paternity leave: Statutory entitlements updated under the Employment (Amendment) Act 2022.

- Other leave: Compassionate leave, public holidays, and optional unpaid leave.

Example: “The employee is entitled to 14 days of annual leave, 14 days of paid sick leave, and 60 days of maternity leave if applicable. Public holidays observed by the company will be granted as leave.”

5. Termination Clauses

Termination clauses clarify how either party can end the employment relationship, protecting both the employer and employee. Contracts should specify:

- Notice periods: Typically 1–3 months, depending on tenure.

- Grounds for termination: Poor performance, misconduct, redundancy, or mutual agreement.

- Severance entitlements: Statutory compensation and final salary payment in compliance with Malaysian law.

Example: “The employer may terminate the employment with one month’s notice for performance-related reasons. Employees terminated without cause will receive severance pay in line with statutory requirements.”

6. Statutory Compliance Clauses

All employment contracts must align with Malaysian legislation:

- Include clauses for EPF, SOCSO, and EIS contributions.

- Address income tax deductions through the Potongan Cukai Bulanan (PCB).

- Ensure that contracts reflect rights and obligations under the Employment Act 1955 and any relevant amendments.

Example: “The company will make all statutory deductions from the employee’s salary, including EPF, SOCSO, EIS, and income tax, as required by Malaysian law.”

Tip for Global Employers:

When hiring full-stack developers from abroad or managing international teams remotely, contracts should also:

- Clarify the governing law (Malaysian law applies).

- Define intellectual property ownership, especially for software code and digital assets.

- Include confidentiality and non-compete clauses where appropriate.

By drafting clear, comprehensive, and legally compliant contracts, global employers can avoid disputes, build trust, and ensure smooth collaboration with their Malaysian full-stack developer teams.

Also Read: Hiring DevOps Engineers in Malaysia: Skills, Tools, and Best Practices

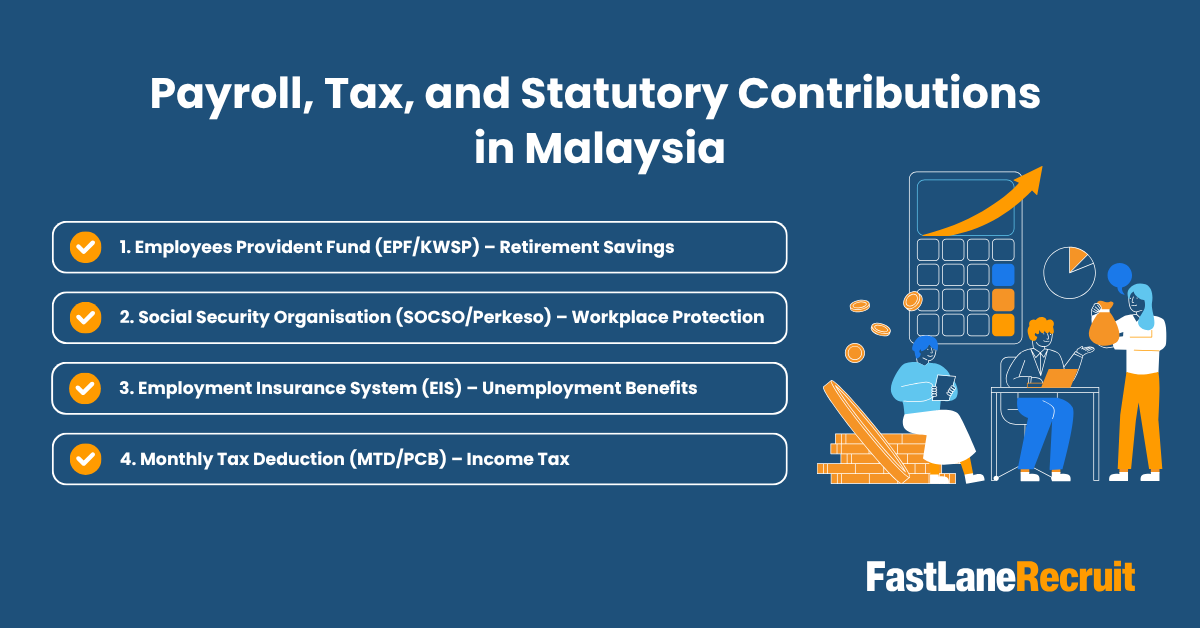

Payroll, Tax, and Statutory Contributions in Malaysia

For global employers hiring full-stack developers in Malaysia, managing payroll goes beyond simply paying salaries. Employers must also ensure compliance with statutory contributions, tax deductions, and employment laws. Failing to do so can lead to significant fines, legal penalties, and damage to your company’s reputation.

Below is a breakdown of the key payroll components and employer obligations in Malaysia, with practical examples for full-stack developer hires:

1. Employees Provident Fund (EPF/KWSP) – Retirement Savings

The EPF is Malaysia’s mandatory retirement savings scheme. Both employers and employees contribute a percentage of the employee’s salary each month.

| Statutory Fund | Description | Employer Contribution | Employee Contribution | Notes |

| EPF/KWSP | Retirement savings | 12–13% of monthly salary | 11% of monthly salary | Mandatory for Malaysian citizens and permanent residents; employers must register via EPF i-Akaun portal. |

Example:

If a full-stack developer earns RM8,000 per month:

- Employer contributes RM960 (12%)

- Employee contributes RM880 (11%)

The contributions are deposited monthly into the employee’s EPF account, providing long-term financial security.

Tip for global employers: Even if your company is foreign, if your employee is a Malaysian citizen or permanent resident, EPF contributions are mandatory. Using an Employer of Record (EOR) can simplify this process.

2. Social Security Organisation (SOCSO/Perkeso) – Workplace Protection

SOCSO provides social protection against workplace injuries, invalidity, and certain medical conditions. Both employer and employee contributions are required, but the rates vary depending on the employee’s salary.

| Statutory Fund | Description | Employer Contribution | Employee Contribution | Notes |

| SOCSO/Perkeso | Social protection | 1–3.25% of monthly salary | 0.5–1.75% of monthly salary | Mandatory for all employees under the Employment Act; protects against workplace accidents and occupational diseases. |

Example:

For a full-stack developer earning RM5,000/month:

- Employer contributes RM81.25 (1.625%)

- Employee contributes RM43.75 (0.875%)

SOCSO ensures that employees are covered for medical treatment and financial support in case of work-related injuries.

3. Employment Insurance System (EIS) – Unemployment Benefits

The EIS provides financial support to employees who lose their job, helping them bridge the gap until new employment is found. It is applicable to employees earning RM4,000 or less per month.

| Statutory Fund | Description | Employer Contribution | Employee Contribution | Notes |

| EIS | Unemployment benefits | 0.2% of salary | 0.2% of salary | Applies to employees earning ≤ RM4,000; provides temporary financial assistance and re-employment support. |

Example:

If a full-stack developer earns RM3,500/month:

- Employer contributes RM7

- Employee contributes RM7

EIS contributions are minimal but ensure that employees have access to support in case of job loss.

4. Monthly Tax Deduction (MTD/PCB) – Income Tax

Employers are responsible for deducting income tax from employees’ salaries and submitting it to the Lembaga Hasil Dalam Negeri (LHDN) by the 15th of the following month. This is known as the Monthly Tax Deduction (MTD) or Potongan Cukai Bulanan (PCB).

| Statutory Fund | Description | Employer Responsibility | Employee Contribution | Notes |

| MTD/PCB | Income tax withholding | Deduct and remit monthly to LHDN | N/A | Employers must issue annual EA forms to employees for tax filing purposes. |

Example:

A full-stack developer earning RM6,000/month may have RM300 deducted for income tax. The employer submits this directly to the LHDN to ensure compliance.

Tip for global employers: Understanding the local tax system is crucial to avoid penalties. EOR providers often handle MTD/PCB automatically, reducing administrative burdens.

Key Takeaways for Global Employers

- Statutory contributions are mandatory: EPF, SOCSO, and EIS contributions must be remitted monthly to avoid fines.

- Payroll accuracy is critical: Incorrect calculations for full-stack developers’ salaries or contributions can lead to penalties and employee dissatisfaction.

- Compliance with income tax laws: Deduct the correct MTD/PCB and provide annual EA forms.

- Use technology or EOR services: Payroll software or an Employer of Record like FastLaneRecruit can streamline contributions, ensure compliance, and handle international hires efficiently.

- Document everything: Maintain accurate records of payroll, contributions, and tax filings for at least 7 years, as required under Malaysian law.

Global companies hiring full-stack developers in Malaysia benefit from understanding payroll, statutory contributions, and tax obligations. Proper management ensures compliance, employee satisfaction, and operational efficiency.

Also Read: How to Outsource a DevOps Engineer Team Successfully

Working Hours, Leave Entitlements, and Benefits

Understanding working hours, leave entitlements, and employee benefits is crucial for global employers hiring full-stack developers in Malaysia. The Employment Act 1955 (EA) sets the baseline standards, but contracts and policies can offer additional flexibility depending on the nature of the role, especially for tech positions where remote work or flexible schedules are common.

1. Working Hours

Under Malaysian law:

- Maximum weekly hours: 45 hours per week (usually 8 hours per day).

- Overtime pay: Employees are entitled to overtime compensation if they work beyond standard hours, on rest days, or during public holidays.

Example:

A full-stack developer works from 9 AM to 6 PM, Monday to Friday, totaling 45 hours per week. If the developer is required to work on a Saturday for a project deadline:

- Hourly overtime rate is typically 1.5 times the normal hourly wage for weekdays.

- Overtime on rest days or public holidays may be 2–3 times the hourly rate, depending on employment terms and the Employment Act.

Tip for global employers: For remote full-stack developers in different time zones, clearly define core working hours and flexible hours to avoid confusion and ensure compliance with overtime rules.

2. Annual Leave

Annual leave is a statutory entitlement based on length of service:

| Years of Service | Minimum Annual Leave Entitlement |

| Less than 2 years | 8 days |

| 2–5 years | 12 days |

| More than 5 years | 16 days |

Example:

A full-stack developer who has worked for your company for 3 years is entitled to 12 days of paid annual leave per year. Employers can provide additional leave as part of the employment package to attract top tech talent.

Tip: Many tech companies offer flexible leave policies or “unlimited leave” frameworks to stay competitive, but these should still comply with minimum statutory requirements.

3. Sick Leave

Sick leave is granted based on length of employment and must be supported by a medical certificate if the leave exceeds two consecutive days.

| Length of Service | Paid Sick Leave Entitlement |

| Less than 2 years | 14 days |

| 2–5 years | 18 days |

| More than 5 years | 22 days |

Example:

If a full-stack developer falls ill for 5 days in the second year of employment, the employer must grant the leave with pay, provided a medical certificate is submitted.

Tip: Encouraging developers to take sick leave without stigma can reduce burnout, particularly in high-pressure tech projects.

4. Maternity and Paternity Leave

Recent amendments under the Employment (Amendment) Act 2022 have improved parental leave protections:

- Maternity leave: Minimum 98 days paid, applicable to female employees covered under the Employment Act.

- Paternity leave: Minimum 7 days paid, applicable to eligible male employees.

Example:

A female full-stack developer taking maternity leave will receive her full salary for 98 days, during which her position must be safeguarded. A male developer welcoming a child is entitled to 7 days paid paternity leave.

Tip: For global employers managing teams across multiple countries, ensure that contracts clearly reflect local parental leave entitlements to avoid misunderstandings or compliance issues.

Also Read: A Guide to Hiring DevOps Engineers in Malaysia

5. Public Holidays

Malaysian law mandates a minimum of 11 gazetted public holidays per year, including:

- New Year’s Day

- Hari Raya Aidilfitri

- Chinese New Year

- Christmas Day

- Other state-specific holidays

Example:

If a full-stack developer works on a public holiday, overtime pay applies, typically at double the normal daily rate.

Tip: Global companies should include holiday observance policies in contracts for remote developers, especially if they are working across multiple time zones or may not observe Malaysian holidays by default.

6. Flexible and Remote Work Considerations

Full-stack developers often require flexible schedules due to project-based work, collaboration across time zones, or agile development cycles. Employers should explicitly outline:

- Expected working hours and core collaboration periods

- Eligibility for overtime pay during off-hours work

- Guidelines for remote work, including equipment provision, communication standards, and performance expectations

- Leave approval processes and notice periods

Example:

A remote full-stack developer works from Kuala Lumpur but collaborates with a team in Sydney. Their contract may specify:

- Core hours: 10 AM–3 PM MYT

- Flexible hours outside core times

- Standard overtime pay for work exceeding 45 hours/week

Tip: Providing flexible work arrangements can help global companies attract top Malaysian tech talent while ensuring legal compliance.

Key Takeaways

- Understand statutory limits: Maximum 45 hours/week, with overtime compensation for extra hours, rest days, and public holidays.

- Provide clear leave entitlements: Annual, sick, maternity, paternity, and public holiday leave must align with the Employment Act.

- Contract clarity: Remote or flexible work arrangements should be explicitly stated to prevent disputes.

- Promote employee well-being: Encouraging leave usage and flexible schedules improves engagement and retention, especially for high-demand tech roles.

- Global compliance: For international employers, clearly communicate Malaysian entitlements to overseas HR teams and ensure payroll and benefits systems accommodate statutory requirements.

Hiring Full Stack Developers via an Employer of Record (EOR)

Global companies often face challenges navigating Malaysia’s employment laws. FastLaneRecruit’s Employer of Record (EOR) service simplifies hiring full-stack developers while ensuring full compliance.

How an EOR Helps:

- Payroll & Statutory Contributions – FastLaneRecruit handles EPF, SOCSO, EIS, and MTD/PCB remittance accurately.

- Contracts & Compliance – Employment agreements aligned with the Employment Act and statutory regulations.

- Onboarding & HR Management – Efficient employee onboarding, benefits administration, and performance monitoring.

- Risk Mitigation – Minimizes legal, financial, and administrative risks for global employers.

Example: A US-based tech company needs two full-stack developers in Kuala Lumpur. Instead of setting up a local entity, they engage FastLaneRecruit. The EOR employs the developers directly, ensures all statutory contributions are paid, manages payroll, and provides legal compliance oversight, allowing the company to focus on product development without HR headaches.

Compliance Tips for Global Employers

To stay compliant and optimize hiring processes, consider the following best practices:

- Keep Digital Employee Records – Store contracts, payslips, and tax forms securely for at least 7 years.

- Automate Payroll – Use payroll software or an EOR to ensure accurate calculations of salary, deductions, and contributions.

- Understand Tax Obligations – Ensure monthly MTD/PCB remittance to LHDN and issue annual EA forms.

- Stay Updated on Legislation – Employment laws and contribution rates change periodically; monitor MOHR and EPF updates.

- Provide Transparent Contracts – Clearly outline salary, leave, and benefits to prevent disputes.

- Prioritize Employee Experience – Timely payroll and accessible payslips improve engagement and retention.

Also Read: How to Successfully Outsource Data Engineering

Why FastLaneRecruit is Your Ideal EOR Partner in Malaysia

Navigating Malaysia’s employment laws can be complex, especially for global companies looking to hire full-stack developers without setting up a local entity. FastLaneRecruit acts as your trusted Employer of Record (EOR), taking care of the legal, administrative, and operational aspects of employment so you can focus on growing your business.

Here’s how partnering with FastLaneRecruit benefits your company:

1. Legal Employment Under Malaysian Law

FastLaneRecruit ensures that all full-stack developers you hire are legally employed in Malaysia, fully compliant with the Employment Act 1955 and its latest amendments under the Employment (Amendment) Act 2022. This includes contracts, statutory benefits, and adherence to local labor laws, reducing the risk of non-compliance penalties.

Example: Your Malaysian developer will have a clear employment contract outlining salary, leave, working hours, and termination clauses that meet legal standards.

2. Payroll, Taxes, and Statutory Contributions Managed Accurately

We handle all payroll processing, including:

- Monthly salary payments

- Income tax deductions (MTD/PCB)

- Contributions to EPF, SOCSO, and EIS

Example: A full-stack developer earning RM5,000/month will have all statutory contributions calculated and remitted correctly, ensuring no legal issues arise from underpayment or late submission.

3. Compliance with Employment Regulations

FastLaneRecruit ensures ongoing compliance with key Malaysian legislations:

- Employment Act 1955 (EA) – covering wages, overtime, leave, and termination

- EPF Act 1991 – retirement savings contributions

- SOCSO Act 1969 – social security coverage

- EIS – unemployment benefits

Example: If your developer works on public holidays or overtime, FastLaneRecruit calculates and manages the appropriate compensation in line with statutory requirements.

4. Streamlined HR and Onboarding

From contract issuance to benefits administration, FastLaneRecruit handles the entire HR lifecycle:

- Digital onboarding for employees

- Management of leave requests and entitlements

- Access to benefits, health insurance, and statutory contributions

- Employee support for payroll and compliance queries

Example: Your developer can access payslips online, view EPF contributions, and submit leave requests through a user-friendly portal without your intervention.

5. Mitigating Legal and Operational Risks

By using FastLaneRecruit as your EOR, you avoid the complexities and costs of setting up a local entity in Malaysia. You also reduce exposure to compliance risks, administrative errors, and local employment disputes.

Example: Instead of managing multiple employment contracts, payroll systems, and tax filings yourself, FastLaneRecruit ensures everything is accurate and fully compliant, letting your company scale efficiently.

6. Access to Top Malaysian Tech Talent

Malaysia is home to a growing pool of skilled full-stack developers. FastLaneRecruit allows you to hire top tech talent quickly and legally, regardless of whether your company is based in the US, Europe, or APAC.

Example: A Singapore-based startup can onboard a Malaysian full-stack developer in weeks, with all legal and payroll requirements handled by FastLaneRecruit, enabling immediate contribution to your projects.

Conclusion

Malaysia offers a strong talent pool of full-stack developers, competitive costs, and a growing tech ecosystem, making it an attractive destination for global companies. However, understanding and complying with local employment laws is critical to avoid penalties and ensure smooth operations.

FastLaneRecruit’s Employer of Record (EOR) service enables global employers to hire Malaysian developers efficiently and compliantly. From employment contracts and payroll management to statutory contributions and HR support, we handle all aspects of employment, allowing you to focus on building your tech projects.

Ready to hire full-stack developers in Malaysia without the compliance headaches?

Partnering with FastLaneRecruit simplifies hiring in Malaysia. From legal employment and compliance to payroll, benefits, and HR operations, we manage the entire process so you can focus on building your global development team efficiently and confidently.

Hire Malaysian full-stack developers seamlessly and build your full-stack developers in Malaysia with FastLaneRecruit’s EOR services. Get in touch today to start onboarding top talent in Malaysia.