As businesses across the globe navigate rising labour costs, skills shortages, and increasing compliance demands, partnering with a Business Process Outsourcing (BPO) provider for accounting and finance delivery has become a trusted way to enhance operational resilience and scalability. Australia stands out as a mature market for outsourced accounting support, with experienced firms, strong regulatory frameworks, and internationally trusted accounting standards.

In this article, we will highlight the Top 20 Accounting BPO companies in Australia, evaluated based on industry reputation, service quality, security certifications, global delivery capability, and client performance. This guide is ideal for global companies, SMEs, accounting firms, and startups exploring options to streamline finance operations.

Content Outline

Key Summary

Specialised Accounting Expertise

Outsourced BPOs provide taxation, audit, payroll, and bookkeeping support, supporting accuracy, reporting integrity, and regulatory alignment

Regulatory Compliance

Aligns with Australian Accounting Standards (AASB) and ATO requirements, reducing risk of penalties.

Lower Operational Costs

Outsourcing helps companies optimise staffing structures, streamline hiring processes, and improve budget allocation while EOR models enable compliant overseas team expansion.

Scalability & Flexibility

Teams can be scaled up or down during peak periods such as audit season or year-end.

Digital Transformation

Access to cloud accounting tools (Xero, MYOB, SAP, QuickBooks) for automation and real-time reporting.

Top Providers

Leading firms include KPMG, Deloitte, EY, PwC, Accario, Cloudstaff, and EMAPTA.

Choosing a BPO

Check certifications, industry expertise, technology stack, transparent pricing, and service-level guarantees.

Employer of Record (EOR)

Legally hire overseas finance talent without setting up a local entity; EOR manages payroll, HR, and compliance.

Benefits Over In-House Teams

Faster hiring, senior expertise, 24/7 workflow, cost savings, and compliance support.

SME & Startup Friendly

Ideal for small businesses needing bookkeeping, payroll, and reporting without full-time staff.

Why Companies Use Accounting BPO Services in Australia

1. Access to Specialised Accounting Expertise

Accounting BPO providers deliver a wide range of professional services, including taxation, audit support, payroll management, financial reporting, and bookkeeping. These firms employ experienced accountants who stay updated with local regulations, helping businesses avoid costly errors and optimise financial processes.

Example: A US-based e-commerce brand partnered with an Australian BPO to centralise accounts payable (AP) and accounts receivable (AR). This ensured accurate reporting and compliance, allowing the company to make better-informed decisions without hiring a full in-house team.

Also Read: Top 20 Virtual Assistant Companies In Australia

2. Compliance with Strict Accounting Standards

Australia has stringent financial regulations, including Australian Accounting Standards (AASB) and Australian Taxation Office (ATO) requirements. Working with a BPO ensures all accounting practices align with these standards, reducing exposure to reporting inconsistencies and regulatory gaps.

Example: Companies outsourcing payroll and BAS reporting to Australian accounting BPOs can stay compliant with the ATO, avoiding mistakes in payroll tax filing or superannuation contributions. Reference: ATO Business Compliance Guidelines

3. Reduced Operational Overhead

Hiring in-house accounting teams often comes with significant costs such as salaries, benefits, recruitment, training, and software licenses. Outsourcing financial tasks to BPO providers helps reduce these overheads.

Example: By leveraging an Employer of Record (EOR) solution, companies can hire skilled Malaysian finance talent through a more efficient cost structure than building a full local team. while maintaining control over workflows and performance.

4. Scalability and Flexibility

Business demand fluctuates, especially during peak seasons like end-of-financial-year or audit periods. Accounting BPOs allow companies to scale their teams quickly to meet these demands without long-term hiring commitments.

Example: A medium-sized Australian retailer increased its outsourced finance team during audit season to ensure timely reporting and compliance, then scaled down after the period ended, optimising costs.

5. Improved Digital Transformation

Modern accounting BPOs provide access to cloud-based accounting and ERP tools such as Xero, MYOB, SAP, and QuickBooks. These systems enable real-time financial monitoring, automated reporting, and enhanced data accuracy.

Example: An Australian tech startup implemented a BPO solution to automate invoice processing and reconciliations in Xero, allowing executives to track financial performance via live dashboards and make strategic decisions faster.

Top 20 Accounting BPO Companies in Australia (2025)

The following companies are recognised for excellence in outsourced accounting services based on industry rankings, professional reviews, and compliance credentials. These firms provide a mix of audit, tax, bookkeeping, payroll, financial reporting, and back-office services.

1. BDO Australia

BDO Australia is one of the most established professional services firms providing outsourced accounting support through a structured and process-driven FAO model. Their outsourcing division manages cloud bookkeeping, payroll processing, accounts payable, accounts receivable, and monthly compliance reporting for companies that want consistent financial governance without overextending internal resources. Businesses benefit from BDO’s experienced finance teams, strong regulatory frameworks, and international best practices, which help streamline day-to-day accounting cycles while maintaining clarity in financial performance.

2. Grant Thornton Australia

Grant Thornton Australia provides outsourced financial management for companies navigating rapid growth or operational restructuring. Their FAO practice focuses on recurring financial reporting, management accounts, GST and BAS submissions, and CFO-level oversight without requiring permanent senior appointments. This makes the firm attractive to mid-market organisations that want a scalable outsourcing structure, professional guidance, and improved operational visibility while still maintaining control and accountability across finance functions.

Also Read: Top 20 IT Services Companies In Australia

3. TOA Global

TOA Global is a dedicated accounting outsourcing firm serving Australian and New Zealand accounting practices, offering trained offshore accountants and bookkeepers who specialise in Australian regulatory requirements. Their delivery approach centres on assigning full-time, dedicated remote staff who integrate into the client’s internal working structure, creating continuity in tasks such as reconciliations, payroll, tax documentation, and financial reporting preparation. This makes TOA Global a preferred outsourcing partner for firms seeking long-term capability expansion rather than transactional outsourcing support.

4. Global Remote Partners

Global Remote Partners provides outsourced bookkeeping, payroll and finance operations support for Australian companies seeking a stable external accounting team. Their delivery model is designed to reduce internal workload and enhance data integrity by ensuring daily entries, bank reconciliations, and reporting cycles are handled consistently. Businesses that want to maintain visibility and retain internal management oversight often view Global Remote Partners as a dependable extension of their finance department rather than a traditional outsourcing vendor.

5. TaxOZ

TaxOZ serves SMEs and professional practices that require outsourced accounting and taxation support without the overhead of maintaining a full internal finance team. Their services include processing of daily financial transactions, payroll administration, and preparation of tax documentation. Clients who rely on TaxOZ do so to stabilise their accounting workflows throughout the year and to avoid operational slowdowns caused by staffing gaps, reporting delays, or regulatory oversight challenges.

6. KLC & Co.

KLC & Co. supports Australian companies that are restructuring or upgrading their finance workflows by shifting repetitive accounting tasks to an external team. Their outsourced services cover the maintenance of daily bookkeeping records, invoice processing and account reconciliations, giving business owners clearer oversight of cashflow, payables and receivables. They are especially suitable for companies that want an outsourcing partner who focuses primarily on operational continuity rather than broad advisory engagements.

7. hammerjack

hammerjack delivers outsourced accounting and finance administration support through an Australian-managed offshore structure. They are known for providing trained finance staff who can integrate directly into a business’s internal ecosystem and take over tasks such as bookkeeping, reconciliations, and processing support. hammerjack is especially popular among small and mid-sized companies that want qualified staff operating under Australian expectations and execution standards, without needing to recruit and train teams themselves.

8. Priority1 Bookkeeping

Priority1 Bookkeeping is a boutique outsourcing provider that focuses on helping small businesses gain stability and visibility across their day-to-day finance activities. Their outsourced model ensures that invoices, supplier payments, payroll runs and month-end closing routines are handled accurately and on time. Companies rely on them when internal capacity is either inconsistent or insufficient to maintain accurate monthly reporting cycles.

9. Accounts NextGen

Accounts NextGen offers outsourcing solutions centred on usability and clarity, helping companies maintain healthy accounting structures while avoiding the administrative burden of managing every task in-house. Their outsourced workflow typically includes reconciliations, accounting system clean-up, monthly financial reports, and ongoing compliance actions. This makes Accounts NextGen a suitable choice for organisations looking for a reliable and operationally aligned outsourcing partner.

10. SEED PLUS

SEED PLUS provides outsourced finance operations designed for companies that want a steady, structured team handling their recurring accounting work. They assist businesses in maintaining accurate transaction data, clean financial ledgers, and dependable month-end close procedures. Their outsourcing model enables businesses to strengthen reporting consistency and financial discipline without adding permanent headcount.

11. Austral Accountants

Austral Accountants supports companies that want long-term outsourced accounting continuity alongside compliance awareness. They offer outsourced accounting services to ensure that bookkeeping entries, staff payroll, reporting cycles and tax-related documentation are maintained properly. Austral is often engaged by companies that need outsourced structure without sacrificing accuracy or transparency.

12. ORANGEIQ

ORANGEIQ helps businesses outsource their daily accounting routines to ensure accuracy and reliability across bookkeeping, financial statements preparation, and general accounts maintenance. Their services suit business owners seeking dependable and structured outsourced finance support that helps them prioritise growth and operations rather than administrative accounting activity.

Also Read: How to Build a Help Desk Technician Team in Malaysia: Skills & Requirements

13. Palladium Financial Group

Palladium Financial Group focuses on outsourced accounting services designed to bring structure and order to the financial operations of mid-sized businesses. Their support model centres on clarity and consistency, ensuring the finance function is not dependent solely on internal capacity. For business owners who prefer predictability, Palladium provides continuity in monthly financial administration.

14. Staff Domain

Staff Domain offers outsourced financial operations as part of its broader business process outsourcing proposition. Their outsourced accounting services act as an extension of a company’s internal team, managing bookkeeping, daily transaction posting, and account reconciliation. Their model suits companies aiming to stabilise their internal financial controls without expanding internal infrastructure.

15. Cloud8 – Accounting & Taxation

Cloud8 delivers outsourced financial operations for SMEs, helping organisations remove internal bottlenecks in bookkeeping, compliance and financial reporting. With Cloud8 overseeing routine financial data accuracy, companies gain more consistent records and clearer internal decision support from day-to-day transactional visibility.

16. Aone Outsourcing Solutions

Aone Outsourcing Solutions provides outsourced accounting and bookkeeping to help businesses manage payroll runs, BAS preparation, supplier invoicing, expense processing and ongoing reconciliations. Their outsourced operations model aims to restore structure to companies lacking internal finance stability or dedicated finance personnel.

17. Brisca

Brisca supports companies that want predictable outsourced accounting services under a structured workflow model. Their team handles ongoing financial entries, transaction records, month-end accounts closing and compliance documentation, giving businesses greater confidence in their finance operations during times of scale or resource shortage.

18. Accounting Gurus

Accounting Gurus provides core outsourced accounting tasks such as ledger upkeep, payroll support and accounts clean-up, maintaining operational accuracy for companies experiencing internal resourcing gaps or rapid growth. Companies that need a stable external finance continuity partner often utilise their services.

19. Australian Tax Specialists

Australian Tax Specialists offers outsourced accounting services with a focus on maintenance of clean records and continuity of reporting cycles. Their outsourcing solution allows companies to maintain compliance structures across daily finance administration without requiring internal capacity scaling.

20. Efficient Capital Solutions

Efficient Capital Solutions provides dependable outsourced financial record keeping and daily finance workflows for mid-sized businesses that need operational continuity. By assigning structured outsourced accounting processes, they help companies maintain ongoing visibility and improve daily administration reliability.

Also Read: Payroll and Compliance for Hiring Help Desk Technicians in Malaysia

Choosing the Right BPO Provider: Evaluation Checklist

When selecting a Business Process Outsourcing (BPO) provider, it’s important to carefully evaluate each potential partner. Use the following checklist to make an informed decision:

1. Certifications

What to Ask: Do they hold ISO 27001, SOC 2, or GDPR data compliance?

Why It Matters: Certifications ensure that the BPO follows internationally recognised standards for data security, privacy, and operational controls. This is especially important if your business handles sensitive financial, customer, or personal data.

Example: A provider with ISO 27001 certification demonstrates that your financial records will be securely managed according to best practices.

2. Industry Expertise

What to Ask: Do they support your sector, e-commerce, fintech, SaaS, retail, or others?

Why It Matters: Each industry has unique accounting, compliance, and reporting requirements. Choosing a provider experienced in your sector ensures smoother processes and fewer errors.

Example: A fintech company may require BPO support familiar with regulatory reporting, while an e-commerce business needs expertise in managing inventory, payment reconciliations, and sales tax compliance.

3. Technology Stack

What to Ask: Do they work with accounting and finance platforms like Xero, QuickBooks, MYOB, NetSuite, or SAP?

Why It Matters: A provider with the right technology experience ensures your financial data is efficiently managed and integrated into your existing systems.

Example: A company using Xero can benefit from a BPO that provides cloud accounting automation, real-time dashboards, and seamless reconciliation.

4. Transparent Pricing

What to Ask: Can they provide a clear cost structure and agreed-upon KPIs before signing a contract?

Why It Matters: Hidden fees or vague pricing can lead to budget overruns. Knowing the costs upfront and having measurable key performance indicators (KPIs) ensures accountability.

Example: A provider may offer a fixed monthly fee for bookkeeping plus additional fees for audits, which should be clearly documented in the contract.

5. Service-Level Guarantees

What to Ask: Are performance metrics defined for turnaround times, accuracy, and reporting quality?

Why It Matters: Service-level agreements (SLAs) help you measure performance and ensure the BPO delivers consistent, high-quality service.

Example: Guarantees like “95% on-time payroll processing” or “monthly reporting accuracy above 99%” give your business confidence in the partnership.

Tip: When evaluating a BPO provider, request case studies, client references, and compliance certifications. This helps you verify their track record and ensures your business processes are in safe hands.

Also Read: Why Malaysia Is a Growing Destination for Offshore Help Desk Technicians

Cost Comparison Example: Hiring Local vs Overseas Accounting Specialists

| Category | Local Staff (Australia) | Remote Accounting Specialist (via Global EOR Malaysia) |

| Annual salary average | AUD 80,000–120,000 | AUD 25,000–35,000 |

| Employer payroll obligations | Superannuation, taxes, insurance | Included via EOR |

| Hiring time | 8 – 14 weeks | 2 – 8 weeks |

| Scalability | Limited | High |

Source: Australian Government Fair Work Ombudsman salary data https://www.fairwork.gov.au

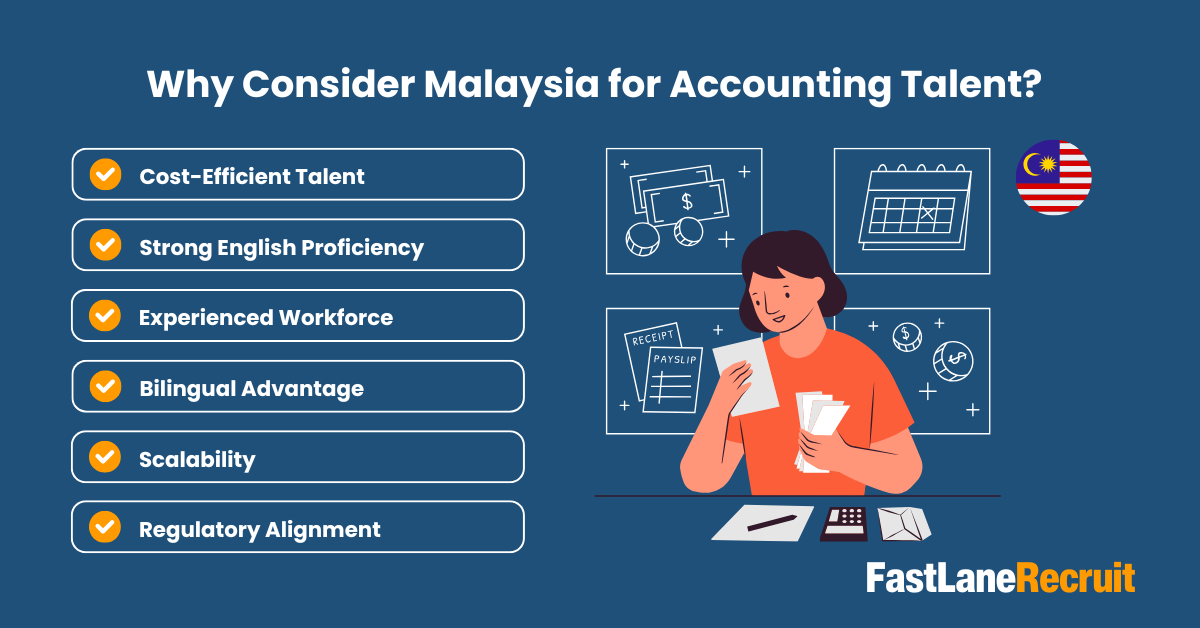

Why Consider Malaysia for Accounting Talent?

Malaysia has emerged as a cost-effective and skilled hub for finance and accounting professionals, making it an attractive option for businesses looking to expand their finance teams.

- Cost-Efficient Talent: Hiring skilled accountants in Malaysia is significantly cheaper than in Australia, reducing payroll expenses while maintaining high-quality work.

- Strong English Proficiency: Malaysian professionals are fluent in English, ensuring smooth communication and reporting with international teams.

- Experienced Workforce: Many Malaysian accountants are trained in global standards and familiar with tools like Xero, MYOB, SAP, and QuickBooks, supporting seamless integration with your existing systems.

- Bilingual Advantage: Malaysian talent often speaks both English and Malay, which can be useful for regional reporting or multinational operations.

- Scalability: Companies can quickly scale teams through remote hiring models like Employer of Record (EOR) without the overhead of local entity setup.

- Regulatory Alignment: Professionals familiar with Australian accounting standards can ensure compliance and accurate reporting across borders.

Example: A mid-sized Australian e-commerce company hired a Malaysian finance team via an EOR to handle AP/AR, payroll, and reporting. This reduced operational costs by 60% while maintaining accuracy and timely compliance with ATO standards.

Employer of Record(EOR) Service: A Smarter Alternative for Traditional Outsourcing

Hire Global Accounting Talent Without Setting Up a Local Entity

If your company wants the benefits of global talent but prefers to avoid the complexities of compliance, legal registrations, and entity setup in another country, an Employer of Record (EOR) model offers an efficient solution. Unlike traditional outsourcing where an external firm manages full finance operations, an EOR enables companies to build overseas capability by hiring professionals who work directly within their internal workflows, while the EOR manages employment, payroll administration, and compliance obligations.

How an EOR Supports Your Finance Team

- Local Employment Compliance

The EOR helps ensure alignment with local labor regulations and statutory requirements. This reduces legal risk and ensures proper adherence to Malaysian employment laws and payroll regulations. - Payroll and Tax Contributions

The EOR handles all salary payments, tax filings, and statutory contributions such as EPF and SOCSO in Malaysia. This saves your company time and reduces the risk of errors or penalties. - Onboarding and Employment Contracts

From drafting legally compliant contracts to managing onboarding processes, the EOR ensures that your hires are ready to contribute effectively from day one. - HR and Workforce Support

The EOR provides ongoing human resource support, including employee relations, benefits management, and workplace compliance, acting as a trusted local partner for your team.

FastLaneRecruit EOR: Expand Your Finance Team Strategically

FastLaneRecruit empowers companies to hire accounting and finance professionals in Malaysia without setting up a legal entity. This solution is ideal for businesses that want to access cost-effective talent while maintaining operational control and integration.

Also Read: Help Desk Technician Salary Guide 2025

Ideal Use Cases:

- Cost-Efficient Finance Talent – Hire skilled accountants and finance specialists at a fraction of local hiring costs.

- Scale Remote Teams Quickly – Expand your finance department during peak periods or for new projects without administrative hurdles.

- Bilingual Professionals Familiar with Australian Accounting Tools – Ensure seamless reporting, compliance, and communication across borders.

Conclusion

For companies exploring cost-efficient talent acquisition without traditional outsourcing, FastLaneRecruit’s EOR solution provides a flexible pathway to build dedicated accounting teams in Malaysia while maintaining full operational control.

Contact FastLaneRecruit to build your accounting and finance team efficiently while letting the EOR handle all local compliance, payroll, and HR responsibilities.

Frequently Asked Questions (FAQ)

What is Accounting BPO?

Accounting BPO (Business Process Outsourcing) refers to the practice of delegating financial and accounting functions such as bookkeeping, payroll, accounts payable/receivable, BAS & GST submissions, and reporting to an external specialist provider. It helps businesses reduce operating costs, improve reporting accuracy, and remain compliant with financial regulations.

Why do businesses in Australia use Accounting BPO services?

Many Australian companies outsource finance functions due to rising labour costs, accountant shortages, complex ATO compliance requirements, and the need for digital transformation. Partnering with a BPO provider enables businesses to access expert support and scale capacity without hiring large internal teams. Reference: Australian Taxation Office https://www.ato.gov.au

How do I choose the best Accounting BPO provider for my business?

Evaluate firms based on:

- Certifications (ISO 27001, SOC2)

- Experience in your industry sector

- Technology capability (Xero, MYOB, QuickBooks, NetSuite)

- Transparent pricing and clear service SLAs

- Security and data protection standards

- Request case studies or client testimonials before signing.

What are the benefits of outsourcing accounting vs hiring an in-house team?

Outsourced accounting services typically reduce labour costs, speed up recruitment time, provide access to senior expertise, enable 24/7 workflow coverage and improve regulatory compliance. For example, hiring an accountant remotely through Malaysia via EOR can cost significantly less than hiring in Australia while maintaining quality.

Is Accounting BPO suitable for small businesses and startups?

Yes. Many small businesses use outsourced bookkeeping and payroll services to manage financial tasks they can’t justify hiring full-time internal staff for. This helps improve cash flow visibility and ensures compliance without significant overhead.

What industries commonly use outsourced accounting in Australia?

Common industries include e-commerce, technology, SaaS, professional services, manufacturing, healthcare, hospitality, and construction. Providers often offer tailored reporting formats based on industry requirements.

Is outsourcing accounting legal in Australia?

Yes, outsourcing accounting is fully legal as long as companies maintain compliance with Australian accounting standards (AASB) and ATO reporting requirements. Reference: Financial compliance rules via Business.gov.au https://business.gov.au

What is the difference between Outsourcing and Employer of Record (EOR)?

Outsourcing delegates processes to an external company that executes tasks independently. An Employer of Record (EOR) legally hires talent in another country on your behalf, handles payroll, HR, and compliance, while the employee works directly for your organisation. This model is ideal for building dedicated internal teams without opening a foreign entity.

How much does Accounting BPO cost in Australia?

Costs depend on service type, complexity, and team size. Some providers charge hourly or project-based pricing, while others offer dedicated full-time accountants. Many companies combine Australian oversight with remote talent in Malaysia or the Philippines to optimise budget.

Can I hire overseas accountants without outsourcing to a BPO provider?

Yes. Through an EOR service such as FastLaneRecruit, businesses can legally hire and manage remote accountants in Malaysia without setting up a company locally. This provides affordability and global talent access while maintaining direct control of work.

Have More Questions?

FastLaneRecruit assists global businesses in building accounting teams efficiently through an Employer of Record solution in Malaysia. Book a free consultation to explore whether EOR or accounting BPO is the best fit for your goals.