Thinking of hiring talent in Malaysia? Navigating payroll compliance is not just a formality, it’s a legal necessity and a key driver of employee satisfaction and business continuity. With its stable economy, strategic Southeast Asian location, and a digitally skilled, multilingual workforce, Malaysia is an attractive destination for global businesses. However, understanding and executing payroll correctly is crucial, especially for foreign companies unfamiliar with local regulations.

This guide will walk you through every critical aspect of Malaysia’s payroll system, from calculating wages and handling deductions to statutory filings and best practices. Whether you’re setting up a local team or expanding operations, this guide ensures you stay compliant with Malaysia’s Employment Act 1955 and related payroll legislation.

Tip: Missteps in payroll compliance can result in legal penalties, loss of employee trust, and reputational damage. Ensuring accurate and timely payroll is essential for operational success.

Also Read: Advantages of Payroll Outsourcing in Malaysia

Content Outline

Key Summary

Understanding Malaysia’s Payroll Process Is Crucial

Accurate payroll processing involves calculating gross salary, applying statutory deductions (EPF, SOCSO, EIS), issuing payslips, disbursing net pay by the 7th, and submitting monthly filings to authorities.

Payroll Components Cover More Than Just Basic Salary

Payroll includes basic salary, allowances, overtime pay, incentives, perquisites, and benefits-in-kind — all of which must be clearly detailed in employment contracts and payslips.

Statutory Contributions Are Mandatory for Employers and Employees

Employers and employees must contribute to EPF, SOCSO, EIS, and sometimes HRDF. These contributions fund retirement, social security, unemployment insurance, and skill development programs.

Income Tax Must Be Withheld and Remitted Monthly

Employers deduct Monthly Tax Deductions (MTD) based on progressive tax brackets and remit these to the Inland Revenue Board by the 15th of each month to comply with tax regulations.

Payroll Setup Requires Registration and Proper Documentation

Companies must register with the Companies Commission of Malaysia, statutory bodies (EPF, SOCSO, LHDN), open local bank accounts, maintain payroll records for 7 years, and draft clear employment contracts.

Best Practices Ensure Compliance and Employee Trust

Timely payments, comprehensive payslips, regular regulatory updates, correct employee classification, payroll automation, and data privacy are essential for smooth payroll operations.

Foreign and Local Employees Have Different Payroll Rules

Foreign workers may have different EPF eligibility, social security coverage, tax rates, and documentation requirements that employers must understand to avoid penalties.

Common Payroll Challenges Can Be Avoided With Proactive Measures

Late filings, incorrect tax deductions, missing benefits, incomplete documentation, and ignoring cultural norms like the 13th-month bonus are common pitfalls employers should prevent.

Outsourcing Payroll Can Simplify Compliance and Save Costs

Partnering with experienced payroll providers like FastLaneRecruit ensures accurate, timely payroll processing, compliance with Malaysian laws, and frees up your resources for business growth.

Overview of the Payroll Process in Malaysia

Payroll processing in Malaysia consists of several key steps, each governed by labor laws and tax regulations set by agencies like the Inland Revenue Board (LHDN), Employees Provident Fund (EPF), Social Security Organisation (SOCSO/Perkeso), and Employment Insurance System (EIS).

Here’s a step-by-step breakdown of a standard payroll cycle in Malaysia:

| Step | Description |

| 1. Calculate Gross Salary | Gross pay includes basic salary, allowances (e.g., transport, meal), commissions, and any overtime. Employers must also comply with Malaysia’s minimum wage law, currently set at RM1,500/month. [Source] |

| 2. Apply Statutory Contributions and Income Tax | Deduct EPF (usually 11% employee + 13% employer for locals), SOCSO, EIS, and Monthly Tax Deductions (MTD/PCB). Contributions depend on salary bands and employee nationality. [EPF Guide] |

| 3. Issue Payslips | Payslips must show breakdowns of gross pay, deductions, and net salary. This is not only best practice—it also supports transparency and PDPA (Personal Data Protection Act) compliance. |

| 4. Disburse Net Salary to Employees | Salaries must be paid no later than the 7th of the following month as per the Employment Act. Late salary payment can result in legal penalties. [Employment Act] |

| 5. Submit Monthly Statutory Filings | Employers must remit contributions and submit reports to EPF, SOCSO, EIS, and LHDN monthly, usually by the 15th of each month. Late submissions may incur fines or legal action. [LHDN e-Submission] |

Key Payroll Authorities in Malaysia

- EPF (KWSP) – https://www.kwsp.gov.my

- SOCSO / PERKESO – https://www.perkeso.gov.my

- EIS (under SOCSO) – https://www.perkeso.gov.my/en/our-services/protection/employment-insurance.html

- Inland Revenue Board (LHDN) – https://www.hasil.gov.my

- Ministry of Human Resources (MOHR) – https://www.mohr.gov.my

Why It Matters

Staying compliant with Malaysia’s payroll laws isn’t just about avoiding penalties. It ensures employee trust, supports long-term workforce retention, and protects your company’s reputation. Whether you manage payroll in-house or through a local provider, understanding these fundamentals is a must.

Also Read: Fixed-Term Employment Contracts: Pros and Cons for Employers

Components of Malaysian Payroll: What Employers Must Know

A thorough understanding of each component of Malaysian payroll is essential for ensuring accurate employee compensation and full legal compliance. Whether you’re a local employer or a foreign business expanding into Malaysia, overlooking even a single payroll element can lead to administrative errors or regulatory issues.

Below is a detailed breakdown of the common elements involved in the Malaysian payroll system, followed by the required statutory contributions and income tax obligations.

Payroll Elements in Malaysia

| Payroll Element | Description |

| Basic Salary | Fixed monthly compensation agreed upon in the employment contract. Excludes bonuses, incentives, or overtime. |

| Gross Pay | Sum of basic salary, overtime, commissions, and all allowances before deductions. |

| Net Pay | Gross pay minus all statutory deductions (e.g., EPF, SOCSO, EIS) and monthly tax. This is the actual take-home pay. |

| Overtime | Compensation for hours worked beyond normal hours. Governed by the Employment Act 1955 (EA 1955). Rates: • 1.5× on normal workdays • 2× on rest days • 3× on public holidays |

| Perquisites | Benefits convertible into cash, such as travel allowances, gift vouchers, or meal cards. These are taxable under LHDN rules. |

| Benefits-in-Kind (BIKs) | Non-cash benefits (e.g., company car, subsidised housing, or private healthcare). Subject to specific valuation methods by LHDN. |

| Allowances | Fixed monthly reimbursements for transport, meals, phone bills, etc. May be fully or partially taxable. |

| Incentives | Performance-based payments such as bonuses, sales commissions, and profit-sharing schemes. |

Best Practice: Employers should detail all remuneration components clearly in employment contracts and payslips for transparency and audit readiness.

Statutory Contributions in Malaysia

Statutory deductions are mandatory contributions that employers must make on behalf of employees to Malaysian government bodies. These ensure employees are covered for retirement, social protection, and unemployment support.

Here’s a comprehensive overview:

| Scheme | Employer Contribution Rate | Employee Contribution Rate | Administered By | Purpose |

| EPF (Employees Provident Fund) | 12% or 13% for employees under 60 | 9% under age 60; reduced for 60+ | KWSP | Retirement savings |

| SOCSO (Social Security Organisation) | 1.75% | 0.5% | PERKESO | Work injury & disability protection |

| EIS (Employment Insurance System) | 0.2% | 0.2% | SOCSO EIS | Income replacement during unemployment |

| HRDF (Human Resources Development Fund) | 1% (if ≥10 Malaysian employees) | 0% | HRD Corp | Skills training & upskilling |

These contributions must be calculated and submitted monthly, typically along with the payroll cycle. Non-compliance can result in fines or audits.

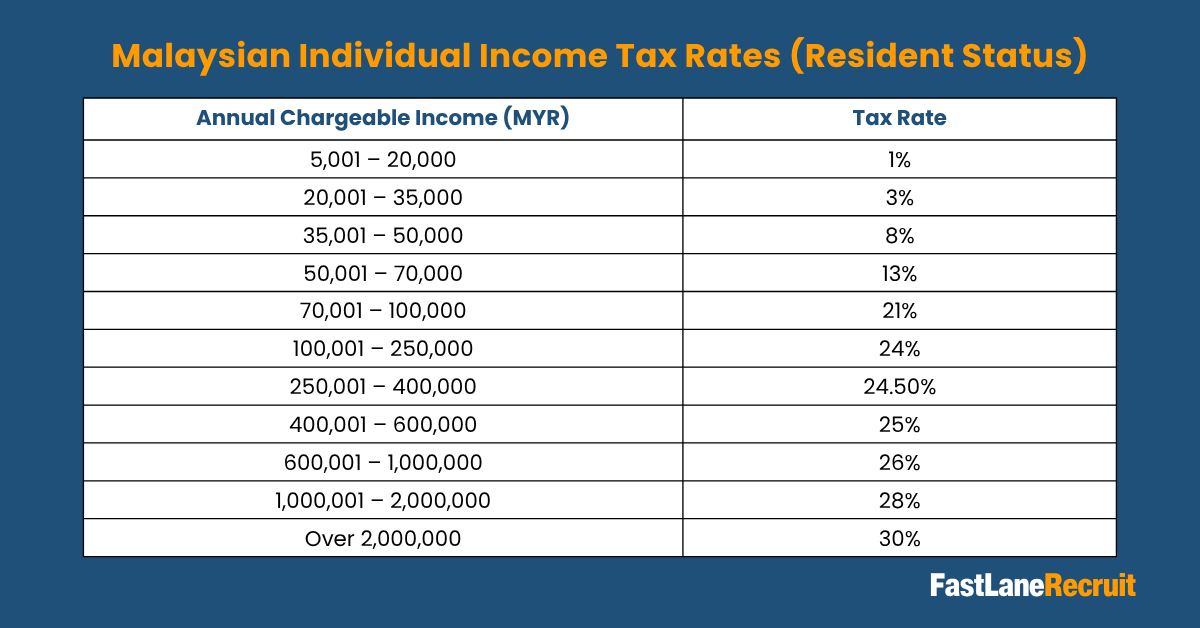

Monthly Tax Deduction (MTD/PCB) & Withholding Tax

Employers are responsible for deducting income tax at source through the Monthly Tax Deduction (MTD), also referred to as Potongan Cukai Bulanan (PCB), and submitting it to the Inland Revenue Board of Malaysia (LHDN) by the 15th of the following month.

Malaysian Individual Income Tax Rates (Resident Status)

Withholding Tax (WHT) may also apply when Malaysian companies pay non-resident individuals or businesses for services rendered. Different rates apply based on the service type and double tax agreements.

Also Read: What Is Global Employment Outsourcing?

Payroll Setup Requirements in Malaysia

Setting up payroll in Malaysia involves more than just processing salaries. Employers, especially foreign companies entering the Malaysian market, must adhere to strict registration, documentation, and compliance steps to ensure smooth operations.

Key Steps to Establish Payroll in Malaysia:

- Company Registration

To legally employ staff and run payroll, your business must be registered with the Companies Commission of Malaysia (SSM). This involves:- Reserving your company name

- Submitting incorporation documents

- Paying registration and stamp duties

[SSM Official Site]

- Registration with Statutory Bodies

Once registered, you must enrol your company and employees with key regulatory agencies:- Employees Provident Fund (EPF/KWSP) for retirement benefits

- Social Security Organisation (SOCSO/Perkeso) for workplace injury and social protection

- Employment Insurance System (EIS) for unemployment protection

- Inland Revenue Board (LHDN) for income tax withholding and filings

Registration ensures your company’s ability to deduct and remit contributions on time.

- Open a Local Bank Account

Salary payments must be made into employees’ bank accounts. Opening a Malaysian bank account is necessary for smooth monthly payroll disbursements. - Maintain Employee Records

Under Malaysia’s Employment Act 1955 and Personal Data Protection Act (PDPA), employers must keep detailed payroll records and employee contracts securely for at least 7 years. This includes:- Payslips

- Attendance and overtime logs

- Tax and social security contribution proofs

- Draft Clear Employment Contracts

Contracts must specify salary components, pay frequency, benefits, termination terms, and any allowances or incentives. Clear contracts reduce disputes and support regulatory compliance.

Also Read: Hiring an Offshore Development Team in 2025

Best Practices for Payroll Compliance in Malaysia

Successful payroll management balances accuracy, compliance, and employee trust. Below are industry best practices based on legal requirements and practical experience.

1. Timely Payroll Processing and Payments

- Pay employees by the 7th of each month as mandated by the Employment Act.

- Submit statutory contributions and MTD payments to EPF, SOCSO, EIS, and LHDN by the 15th of each month to avoid penalties.

2. Comprehensive Payslips

- Issue payslips monthly, detailing basic salary, allowances, overtime, statutory deductions, income tax, and net pay.

- Maintain electronic or hardcopy copies for audits and employee records.

3. Stay Updated with Regulatory Changes

- Payroll laws, contribution rates, and tax brackets can change annually. Follow official portals such as LHDN and PERKESO for updates.

- Consider subscribing to newsletters or working with payroll specialists to remain compliant.

4. Correct Classification of Employees

- Differentiate between local, foreign, resident, and non-resident employees for tax and social security purposes.

- Ensure foreign workers are registered with SOCSO’s Employment Injury Insurance Scheme as required.

5. Automate Payroll Where Possible

- Use reliable payroll software or trusted payroll outsourcing partners to reduce errors, improve efficiency, and ensure compliance with deadlines.

- Automation helps manage complex calculations for allowances, overtime, and statutory contributions seamlessly.

6. Ensure Data Privacy and Security

- Comply with Malaysia’s PDPA by safeguarding employee personal data, especially payroll details.

- Limit access to payroll information and implement secure storage solutions.

7. Provide Employee Education and Transparency

- Educate employees on their payslips, statutory deductions, and benefits. Transparency builds trust and reduces payroll-related disputes.

Also Read: 4 Types of Employment Contracts in Malaysia Recruitment

Payroll Processing for Foreign Employees vs. Local Employees in Malaysia

When managing payroll in Malaysia, it’s important to understand the distinctions between foreign and local employees. Different statutory requirements and tax rules apply, which can affect payroll calculations and compliance.

Key Differences:

| Aspect | Local Employees | Foreign Employees |

| Social Security (SOCSO) | Registered under both Employment Injury Insurance Scheme (EIIS) and Invalidity Pension Scheme (IPS). | Only covered under EIIS, as IPS applies only to locals. |

| EPF Contributions | Mandatory contributions by employer and employee. | Foreign employees are eligible for EPF only if from countries with agreements with Malaysia; otherwise exempt. |

| Income Tax Treatment | Taxed as residents if working >183 days/year, with progressive tax rates (up to 30%). | Taxed as non-residents with flat 30% tax on employment income, regardless of duration over 60 days. |

| Work Permits & Documentation | No special work permit required. | Employers must maintain valid work permits and include passport/work permit details in payroll records. |

| Overtime & Benefits | Overtime and benefits governed strictly by Employment Act 1955. | Can be subject to contract terms; however, best practice is to comply similarly to locals for consistency. |

Employers must ensure accurate classification and apply the appropriate contribution rates and tax treatment for each employee category to avoid penalties.

Also Read: Why EPF, SOCSO, and EIS Are Essential for Malaysia Payroll

Common Payroll Compliance Challenges in Malaysia and How to Avoid Them

Many companies, especially those new to Malaysia or managing international teams, face common payroll pitfalls. Here’s how to recognize and prevent them:

1. Late Submission of Statutory Payments

- Issue: Missing deadlines for EPF, SOCSO, EIS, or MTD payments leads to penalties, fines, and interest.

- Solution: Set up automated reminders and plan payments well before the 15th of each month. Consider outsourcing to payroll specialists who guarantee timely remittance.

2. Incorrect Tax Calculations or Employee Classification

- Issue: Misclassifying foreign workers as residents or vice versa causes incorrect tax deductions and may result in audit penalties.

- Solution: Maintain up-to-date records of employees’ residency status, work permit durations, and consult official IRB guidelines regularly.

3. Failure to Include Benefits and Perquisites in Payroll Reporting

- Issue: Excluding taxable benefits-in-kind or cash allowances from payroll calculations may trigger tax audits.

- Solution: Use comprehensive payroll systems that account for all remuneration elements and consult LHDN’s valuation rules for BIKs.

4. Incomplete or Missing Payroll Documentation

- Issue: Payroll records, contracts, payslips, and statutory filings must be retained for at least 7 years as per PDPA and Employment Act requirements. Missing documentation risks non-compliance.

- Solution: Implement a centralized and secure payroll record-keeping system with regular audits.

5. Ignoring Cultural Payroll Practices (e.g., 13th Month Pay)

- Issue: Although not legally mandatory, many Malaysian employees expect the culturally accepted 13th-month bonus. Not offering it could impact employee morale and retention.

- Solution: Consider including the 13th-month payment as part of your benefits package to align with local norms.

6. Lack of Awareness of Regulatory Changes

- Issue: Malaysia’s payroll regulations evolve frequently, including contribution rates and tax policies. Lack of updates can cause inadvertent non-compliance.

- Solution: Subscribe to updates from official sites such as LHDN, KWSP, and PERKESO. Engage professional advisors or payroll service providers.

How Payroll Outsourcing Can Simplify Your Malaysia Expansion

Expanding into Malaysia’s vibrant market is exciting but navigating its complex payroll landscape can be challenging, especially for foreign companies unfamiliar with local regulations. This is where payroll outsourcing becomes a strategic advantage.

Also Read: Employment Law in Malaysia

Benefits of Outsourcing Payroll in Malaysia:

1. Compliance Assurance

Malaysian payroll involves multiple statutory bodies, EPF, SOCSO, EIS, and LHDN, each with their own rules and deadlines. Payroll specialists ensure that all contributions and tax withholdings are accurate and submitted on time, minimizing risks of fines and audits.

2. Time and Cost Efficiency

Setting up internal payroll processes requires dedicated HR and finance resources, plus investment in software and training. Outsourcing reduces overheads, automates calculations, and streamlines reporting, allowing you to focus on core business activities.

3. Expertise on Local Labor Laws

Experienced payroll providers keep up-to-date with regulatory changes and best practices in Malaysia. They help you navigate complexities such as employee classification, benefits administration, and compliance with the Employment Act.

4. Payroll Technology Integration

Outsourcing partners often provide cloud-based payroll platforms offering secure employee self-service portals, real-time reporting, and integration with accounting systems — enhancing transparency and data security.

5. Support for Multinational Workforce

For companies employing both local and foreign talent, payroll providers offer tailored solutions to handle tax differences, work permits, and social security schemes efficiently.

Conclusion

Managing payroll in Malaysia involves navigating a complex web of statutory obligations, tax requirements, and cultural expectations. For employers, especially foreign businesses, getting payroll right from the start is critical to avoid costly penalties, maintain workforce satisfaction, and ensure legal compliance.

By understanding Malaysia’s payroll components, statutory contributions, tax regulations, and best practices, your company will be well-positioned for smooth operations and sustainable growth in this dynamic market. Leveraging expert guidance or outsourcing your payroll process can further safeguard your compliance and free up your resources to focus on expanding your business.

Why Choose FastLaneRecruit?

FastLaneRecruit is your trusted partner for payroll outsourcing in Malaysia. With in-depth knowledge of local regulations and a client-centric approach, we help you:

- Avoid costly compliance errors

- Simplify payroll administration

- Provide a seamless employee experience

- Scale your operations confidently in Malaysia

Our expert team is ready to guide your business from setup to ongoing payroll management, ensuring legal compliance and operational excellence.

Ready to Simplify Your Payroll in Malaysia?

FastLaneRecruit offers comprehensive payroll solutions tailored for businesses expanding into Malaysia. Our experienced team helps you stay compliant, reduce administrative burden, and deliver timely, accurate payroll services to your employees.

- Ensure full compliance with Malaysian labour laws and tax regulations

- Benefit from expert local knowledge and trusted government insights

- Access scalable, cost-effective payroll management tailored to your business needs

Get in touch with FastLaneRecruit today and take the first step towards hassle-free payroll management in Malaysia.

Frequently Asked Questions (FAQs) about Payroll in Malaysia

Q1: When must I pay my employees in Malaysia?

A: Salaries must be paid no later than the 7th of each month, either by bank transfer, cheque, or cash.

Q2: What are the mandatory payroll contributions in Malaysia?

A: Employers and employees must contribute to the Employees Provident Fund (EPF), Social Security Organisation (SOCSO), and Employment Insurance Scheme (EIS). Some employers also contribute to the Human Resources Development Fund (HRDF).

Q3: How is income tax handled in Malaysian payroll?

A: Employers deduct monthly tax from employees’ salaries via the Monthly Tax Deduction (MTD) system and remit these to the Inland Revenue Board (LHDN) by the 15th of each month.

Q4: Are foreign employees treated differently in payroll?

A: Yes, foreign employees generally pay a flat 30% tax rate as non-residents and have different social security coverage requirements.

Q5: What records must I keep as an employer?

A: Employers must keep payroll records, payslips, contracts, and tax filings securely for a minimum of 7 years to comply with Malaysian law.

Q6: Is the 13th-month bonus mandatory?

A: No, it is not legally required but widely practiced as part of Malaysian corporate culture.