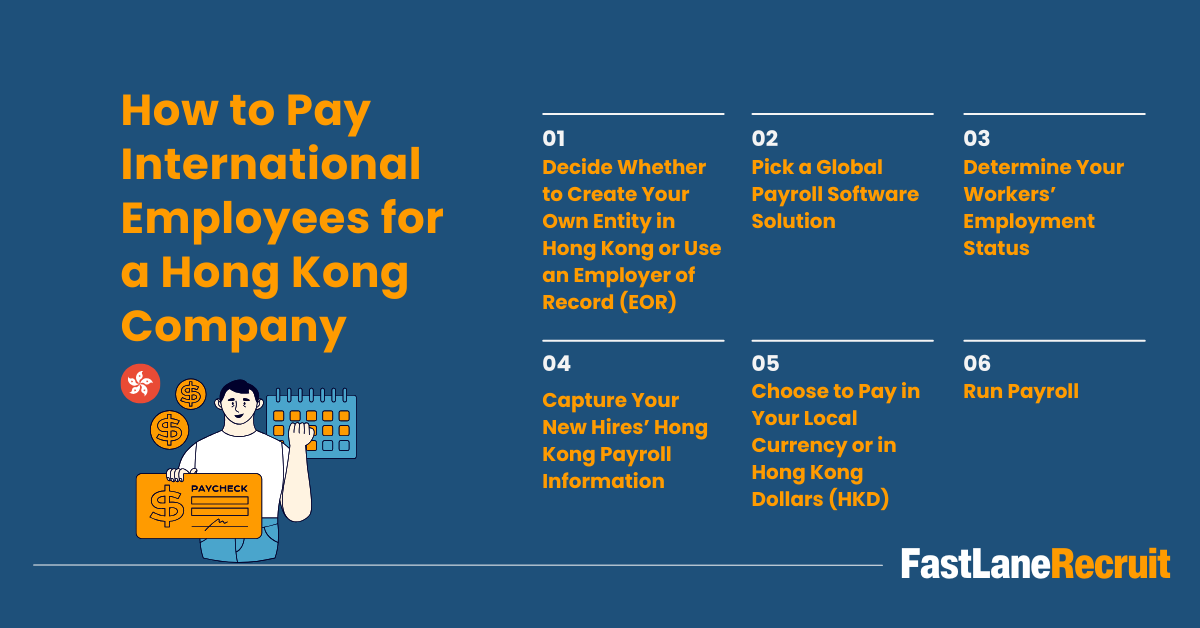

Paying international employees as a Hong Kong company involves a series of careful legal, administrative, and financial steps. Whether you’re scaling globally or onboarding top-tier talent from Malaysia, Vietnam, or the Philippines, the right payroll strategy ensures compliance, accuracy, and seamless employee experiences.

Content Outline

Key Summary

Choose Between Entity Setup and EOR

Hong Kong companies can either establish a local entity abroad or partner with an Employer of Record (EOR) to hire and pay international employees legally and efficiently.

Invest in Global Payroll Software

Using a global payroll solution helps automate payments, tax filings, and compliance tracking for distributed teams across multiple countries.

Classify Workers Correctly

Accurate classification of employees vs. independent contractors is essential to comply with Hong Kong labor laws and avoid costly penalties.

Collect Payroll Data in Line with Local Laws

Gather necessary employee details while adhering to Hong Kong’s data privacy and labor regulations, including MPF enrolment and tax documentation.

Choose the Right Payment Currency

Pay employees in Hong Kong Dollars (HKD) or their local currency to optimize financial operations and enhance employee satisfaction.

Run Compliant Payroll Cycles

Ensure timely disbursement of salaries, proper tax deductions, and filing of required forms such as IR56B, in line with Hong Kong’s payroll rules.

Partner with FastLane for Expert Payroll Support

FastLane Group offers full-service payroll solutions for Hong Kong companies managing global teams, ensuring accuracy, compliance, and peace of mind.

Hire and Pay Malaysian Employees with Ease

FastLaneRecruit provides end-to-end recruitment and payroll services via EOR so you can legally hire and pay top Malaysian talent without setting up a local entity.

Step 1: Decide Whether to Create Your Own Entity in Hong Kong or Use an Employer of Record (EOR)

Before anything else, determine if your company will establish a legal entity in the employees’ country of residence or work through an Employer of Record (EOR). Setting up your own entity can offer full control but comes with high setup and maintenance costs, tax obligations, and compliance risks.

An EOR, on the other hand, serves as the legal employer on your behalf, handling payroll, taxes, statutory benefits, and local compliance. This approach allows you to hire internationally without setting up a branch or subsidiary.

For companies just testing overseas markets or hiring a few employees, an EOR is often the most cost-effective and compliant option. Visit the Hong Kong Labour Department for employer guidelines and labor compliance requirements.

Also Read: Build Your Offshore HR and Payroll Management Team in Malaysia

Step 2: Pick a Global Payroll Software Solution

A robust global payroll solution automates complex tasks like tax withholding, payslip generation, and statutory filings. Look for platforms that integrate with Hong Kong’s MPF (Mandatory Provident Fund) system, offer multi-currency support, and provide localized compliance features.

Popular options include Deel, Papaya Global, and Remote. These tools reduce the burden of manual calculations and reporting errors, especially for hybrid teams split between Hong Kong and other countries. Ensure the payroll platform can handle region-specific nuances, such as public holiday calculations and wage subsidies.

A streamlined payroll system ensures transparency and enhances employee satisfaction, critical for retention in a distributed team.

Step 3: Determine Your Workers’ Employment Status

Understanding whether your overseas workers are employees or independent contractors affects everything from tax obligations to benefit entitlements. Misclassification can lead to penalties, back payments, and reputational harm.

In Hong Kong, employment status is governed by factors such as control, integration into the business, and the nature of remuneration. Refer to the Inland Revenue Department’s guidance to understand classification and employer responsibilities.

Correct classification ensures you’re meeting the right legal standards, particularly regarding severance pay, leave entitlements, and tax deductions.

Also Read: The Ultimate Playbook for Building and Integrating Offshore Teams

Step 4: Capture Your New Hires’ Hong Kong Payroll Information

Once an employee is onboarded, collect the necessary payroll data. This includes:

| Required Information | Description |

| Full Name & ID/Passport Number | For legal employment documentation |

| Bank Account Details | For salary disbursement |

| Tax File Number / IR56 Forms | For local income tax declaration |

| MPF Enrolment (if applicable) | Mandatory for qualifying employees under the MPF Scheme |

| Employment Start Date | Required for accurate leave accruals and termination pay |

Ensure that sensitive data is securely stored and aligned with Hong Kong’s Personal Data (Privacy) Ordinance.

Step 5: Choose to Pay in Your Local Currency or in Hong Kong Dollars (HKD)

Paying employees in HKD may simplify compliance with local regulations and bank requirements, especially if your payroll system is headquartered in Hong Kong. However, paying in the employee’s local currency enhances satisfaction by avoiding foreign exchange losses on their end.

Multi-currency payment platforms like Wise Business or Airwallex offer real-time FX conversions and low transfer fees, making it feasible to pay employees in their preferred currencies while maintaining accounting clarity in HKD.

A dual-currency payroll system may also allow better financial reporting and tax reconciliation, particularly during year-end audits.

Also Read: Building Offshore IT Team in Malaysia for Hong Kong Companies

Step 6: Run Payroll

After data is captured and currency preferences are set, run your payroll. This includes calculating:

- Gross wages

- Statutory contributions (e.g., MPF)

- Allowances or bonuses

- Tax withholdings

- Net pay

Timely payroll cycles, typically monthly in Hong Kong, are critical to compliance. Also, file required tax forms such as IR56B or IR56M, depending on the worker’s classification. Visit IRD’s Employer’s Guide for more info on deadlines and documentation.

Make sure pay slips are issued and records retained for at least 7 years, per the Inland Revenue Ordinance.

Conclusion

Hiring international talent is a powerful growth strategy, but it comes with administrative and legal complexities. By leveraging an EOR, investing in reliable global payroll software, understanding employment classification, and adhering to Hong Kong’s statutory obligations, companies can manage cross-border payroll with confidence.

Whether you’re scaling into Southeast Asia or hiring remote developers from abroad, a compliant and well-managed payroll process builds trust with your workforce and protects your business.

Hire and Pay Remote Malaysian Employees with FastLaneRecruit

Expanding your Hong Kong company’s talent pool to include skilled Malaysian professionals has never been easier. FastLaneRecruit specializes in seamlessly connecting Hong Kong businesses with top-tier Malaysian talent across industries such as technology, finance, marketing, and more. Leveraging our deep expertise and extensive network, we simplify every step of the remote hiring process, so you can focus on your core business growth.

One of the most significant challenges companies face when hiring overseas is navigating local labor laws, tax regulations, and payroll complexities. FastLaneRecruit offers a comprehensive Employer of Record (EOR) service that acts as your legal employer in Malaysia. This means you can onboard Malaysian employees quickly and compliantly, without the need to establish a costly and time-consuming local legal entity. Through this EOR model, we assume full responsibility for statutory compliance, tax filing, and labor law adherence, shielding your company from potential legal and financial risks.

Our integrated hiring and payroll platform supports multi-currency payment options, allowing you to pay your Malaysian remote workforce either in Malaysian Ringgit (MYR) or Hong Kong Dollars (HKD), depending on your business preferences and employee needs. With FastLaneRecruit, you receive complete transparency through detailed payroll reports, timely salary disbursements, and customized benefits administration. Whether you require standard employment contracts, local statutory benefits like Employees Provident Fund (EPF) contributions, or tailored remuneration packages, our team ensures everything is handled efficiently and accurately.

FastLaneRecruit’s end-to-end solution is designed to align with your specific industry standards and employment models, from full-time staff to contractors. We provide ongoing compliance updates and support, minimizing your administrative burden and maximizing operational agility. By partnering with us, your Hong Kong company can confidently expand its workforce in Malaysia, accessing the best talent without borders, while maintaining full compliance and operational efficiency. Contact us for a free discvovery call!

Frequently Asked Questions About Running Payroll in Hong Kong

How do you calculate the severance payment for an employee in Hong Kong?

Severance is calculated based on two-thirds of the last full month’s wages or HKD 22,500 (whichever is lower) per year of service. Labour Department Guide

How does maternity leave work in Hong Kong?

Employees are entitled to 14 weeks of paid maternity leave if they’ve been employed under a continuous contract for at least 40 weeks.

How are income taxes handled for employees in Hong Kong?

Employers must report income using Form IR56B for regular employees or IR56M for freelancers. Salaries tax is paid directly by the employee. Inland Revenue Department

What is a long service payment in Hong Kong and how is it calculated?

Similar to severance, it applies after 5 years of continuous service. The formula is identical to severance pay.

How is overtime pay calculated in Hong Kong?

There is no statutory requirement for overtime pay unless stipulated in the employment contract.

What are the regulations for paternity leave in Hong Kong?

Fathers are entitled to 5 days of paid paternity leave at 80% of average daily wages.

What employee benefits are common in Hong Kong?

Benefits include MPF contributions, annual leave, sick leave, and discretionary bonuses.

How do you hire employees in Hong Kong?

Through a valid employment contract, registration with the MPF scheme, and compliance with local labor ordinances.

How is retirement scheme contribution calculated in Hong Kong?

The MPF contribution is typically 5% of relevant income from both employer and employee, capped at HKD 1,500/month each.

What provisions does the Hong Kong Labour Department have in place for young persons in employment?

Youth under 18 have work hour limitations and are restricted from hazardous jobs. Labour Department Youth Guidelines

How are daily wages calculated in Hong Kong?

Average daily wages are calculated over a 12-month period, factoring in all wages and benefits.

What social security measures are in place for employees in Hong Kong?

MPF is the primary social security measure, along with protection under the Employment Ordinance.

What is the wage period in Hong Kong?

Wages must be paid at least once per month, no later than 7 days after the end of the wage period.

What is included in an employment contract in Hong Kong?

Basic terms include job title, wage rate, payment frequency, working hours, leave, and notice period.

What is a “lieu of notice” in Hong Kong?

Employers or employees can pay wages in lieu of notice to terminate a contract immediately.

How is an employee’s salary determined in Hong Kong?

By mutual agreement in the employment contract, subject to minimum wage regulations.

What does the tax year look like in Hong Kong?

It runs from April 1 to March 31. Tax returns are issued in May and are due within one month unless extended.