Accounting firms across Australia, Hong Kong, and Singapore are facing a perfect storm of challenges, including rising labour costs, limited talent availability, and mounting pressure to scale operations without compromising service quality.

Traditional outsourcing models often fall short because they lack the integration, control, and consistency that modern firms demand. While outsourcing was once the default solution, today’s forward-thinking firms are seeking a smarter approach. They want dedicated teams that are aligned with their workflows and standards, not just temporary staff. This is leading many to explore offshore team building in strategic, cost-effective markets like Malaysia.

At FastLaneRecruit, we provide that smarter alternative: helping firms build dedicated, fully operational offshore accounting teams in Malaysia that function as a true extension of their business without the complexity of setting up a local entity.

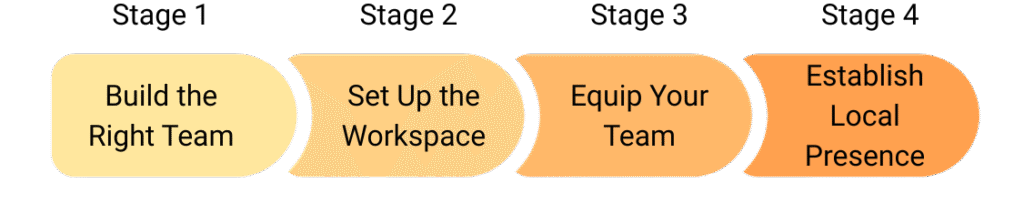

We offer an end-to-end offshore team solution structured around three key pillars:

Stage 1: Build the Right Team

Stage 2: Set Up a Functional Workspace

Stage 3: Equip and Enable Your Team

By partnering with us, firms achieve growth, resilience, and long-term cost efficiency — all while maintaining the service quality their clients expect.

Content Outline

Our Solution: Full Offshore Team Setup in 3 Stages

1. Stage 1: Build the Right Team

1.1 Talent Sourcing

To establish a high-performing offshore team for Australian accounting firm, we began by conducting detailed consultations to understand their staffing requirements and desired workflows. We identified a range of roles essential to their accounting and bookkeeping operations, including junior accountants, intermediate and senior accountants, and an administrative manager to support internal and client communications.

We then leveraged our extensive Malaysian talent pool, built through years of industry partnerships and trusted local recruitment channels. Every candidate was carefully screened to ensure they met the specific needs of Australian accounting firms and were well-suited for remote accounting jobs requiring strong communication skills, attention to detail, and familiarity with Australian compliance standards.

1.1.1 Remote Accounting Jobs

A high-performing offshore team requires the right mix of roles to cover your entire workflow:

Junior Accountants (1–2 years)

Perform transactional data entry, daily bookkeeping, and bank, supplier, and credit card reconciliations in line with Australian firm practices. Maintain accurate general ledgers and cost centre allocations using tools like Xero and MYOB.

Intermediate Accountants (3–5 years)

Prepare trial balances, financial statements, BAS/GST returns, and manage adjusting journal entries. Reconcile intercompany transactions and liaise directly with Australian clients on daily accounting and tax queries.

Senior Accountants (5–7 years)

Review and oversee complex reconciliations, including payroll clearing accounts, multi-entity structures, and tax provisions. Ensure financial statements meet AASB compliance and provide technical leadership on Australian accounting workflows.

Accounting Managers / Team Leads (8+ years)

Direct the offshore team’s performance, ensuring compliance with Australian accounting and ATO standards. Conduct file reviews and technical sign-offs, manage workflow planning, and coordinate with Australian managers to ensure consistent service delivery.

Administrative Managers

Oversee client onboarding documentation and secure data sharing via platforms like Xero Practice Manager, Dropbox, Google Workspace. Manage offshore schedules and ensure documentation aligns with ATO record-keeping guidelines.

1.1.2 Key Evaluation Criteria We Look For When Hiring Remote Accountants for Australian Accounting Firms

To ensure your offshore team in Malaysia can seamlessly integrate with Australian accounting practices, we prioritise candidates with the following competencies and experience:

Proficiency in Australian Accounting Software

We prioritise candidates with hands-on experience using the key accounting software platforms most commonly deployed by Australian accounting firms, including Xero, MYOB, QuickBooks, HandiSoft, and BGL. This includes not only familiarity with basic navigation and data entry, but also demonstrated competence in:

- Setting up and managing the chart of accounts to align with Australian firm standards

- Performing comprehensive bank and credit card reconciliations

- Generating accurate and detailed financial reports, including profit and loss statements, balance sheets, and cash flow statements

- Handling payroll processing where applicable, particularly using integrated features in Xero or MYOB

- Applying software-based GST/BAS coding rules correctly to transactions and understanding how these translate into regulatory reporting

- Configuring and using advanced features such as recurring transactions, tracking categories, and integrated document management modules (e.g., Xero Practice Manager)

BAS and GST Preparation

For Australian accounting practices, the preparation and accurate lodgement of Business Activity Statements (BAS) is a core competency. We ensure that candidates have:

- A practical understanding of how GST is applied within Australian businesses, including standard and simplified GST accounting methods

- Experience in reconciling GST liabilities and preparing BAS reconciliations in Xero or MYOB

- Familiarity with GST coding best practices for expenses and income, including when to apply input tax credits

- An understanding of how to prepare and validate figures for BAS submissions to the Australian Taxation Office (ATO)

- The ability to cross-check BAS reports against underlying accounting records to ensure accuracy and compliance

Financial Statement Preparation and Reconciliation

Australian firms expect offshore team members to produce financial statements that meet local compliance and client expectations. Our screening ensures candidates can:

- Prepare accurate, client-ready financial statements in accordance with Australian accounting standards (AASB)

- Perform bank reconciliations, supplier reconciliations, and debtor reconciliations to ensure the integrity of financial data

- Identify and resolve discrepancies in general ledger balances and subsidiary ledgers

- Collaborate on month-end and year-end closing processes, including journal entries and accrual adjustments

- Provide supporting schedules and detailed working papers for external review or audit, reflecting best practices in Australian accounting environments

Understanding of Australian Tax Regulations

It is essential that offshore accountants supporting Australian firms understand the broader tax compliance environment. We look for candidates with:

- Familiarity with key Australian tax concepts such as PAYG withholding, superannuation, fringe benefits tax (FBT), and small business concessions

- Awareness of compliance deadlines for BAS, GST, income tax, and superannuation guarantee obligations

- A general understanding of the ATO’s compliance framework, including audit readiness and the importance of accurate record-keeping

- For senior candidates, practical experience working with clients who operate across trusts, partnerships, and company structures, and the implications for tax treatment and reporting

- An appreciation of the nuances of Australian tax regulations as they affect both individual and corporate clients, to ensure seamless support for your client-facing team

Technical Agility in Cloud-Based Systems

Australian accounting firms increasingly operate in fully cloud-based environments, which requires offshore team members to be adept with:

- Microsoft Excel for complex reconciliations, data manipulation, and reporting dashboards

- Google Workspace (Sheets, Docs, Drive) for real-time document sharing and collaboration, maintaining data integrity and version control

- Experience with document management platforms (e.g., Dropbox, OneDrive) for secure, accessible storage and sharing of client files

- Familiarity with collaboration tools such as Microsoft Teams, Zoom, or Slack to integrate seamlessly into daily team workflows

- An ability to navigate multiple software platforms confidently, ensuring data security, file consistency, and efficient communication across borders

1.2 Employer of Record (EOR) Services

Once the ideal candidates were selected, we employed them through FastLaneRecruit’s local Employer of Record (EOR) structure. This approach provided a fully compliant employment framework that enabled Australian accounting firms to engage offshore talent in Malaysia without the need to establish a local legal entity.

The EOR model works by making FastLaneRecruit the legal employer of your offshore team members in Malaysia. This means that while Australian accounting firm retains full control over the day-to-day responsibilities, workflows, and performance of its offshore team, FastLaneRecruit takes care of all local HR, compliance, and employment obligations.

Here’s how it works in practice:

- Hiring and Operational Control: BridgePoint defines the roles, selects the candidates, and manages daily work, ensuring offshore staff align with Australian workflows and standards.

- Local Employment Compliance: FastLaneRecruit issues legally compliant Malaysian employment contracts, registers employees with statutory bodies (EPF, SOCSO, EIS), and handles onboarding in accordance with local regulations.

- Payroll and HR Administration: We manage monthly payroll processing, payslip generation, statutory contributions, leave tracking, and annual HR filings — freeing BridgePoint from the complexities of Malaysian employment law.

- Ongoing Local HR Support: As the legal employer, FastLaneRecruit provides continuous HR support, helping to resolve employment-related issues and ensuring consistent compliance with Malaysian labour standards.

- Risk Mitigation: Using an EOR eliminates the need for Australian firms to establish a local entity in Malaysia, significantly reducing operational, legal, and compliance risks.

This model is essential for Australian accounting firms that want to expand their workforce cost-effectively while ensuring every aspect of employment in Malaysia is fully compliant and professionally managed. With our EOR structure, Australian accounting firms was able to launch its offshore team immediately and focus entirely on operational excellence and client delivery, confident that all HR, legal, and regulatory responsibilities were handled by a trusted local partner.

1.3 Payroll & Compliance Management

At FastLaneRecruit, we manage every aspect of payroll and compliance for your offshore team in Malaysia, ensuring accurate, timely, and fully compliant processes that align with local employment laws and best practices.

Payroll and compliance management encompasses the entire administration of employee compensation, statutory deductions, tax obligations, and HR record-keeping. This end-to-end process is critical for safeguarding your firm’s reputation, building trust with your team, and ensuring that every offshore employee receives fair and timely remuneration.

1.3.1 Key Components and How We Execute Them

We begin with monthly payroll calculations, determining each employee’s gross wages, statutory deductions, and net pay. Our team manages this using secure payroll software, incorporating any allowances, overtime, or bonuses in line with Malaysian employment standards. The final payroll is reviewed for accuracy and consistency before moving to the next stage.

We then handle all statutory contributions and deductions, which include:

- EPF (Employees Provident Fund), Malaysia’s retirement savings scheme akin to Australia’s superannuation, with both employer and employee contributions calculated based on monthly wages.

- SOCSO (Social Security Organisation), Malaysia’s equivalent of workers’ compensation insurance, providing protection in case of workplace injury or illness.

- EIS (Employment Insurance System), which offers unemployment support similar to Australian unemployment insurance schemes.

For income tax deductions, we manage the Potongan Cukai Bulanan (PCB)—Malaysia’s monthly tax withholdings—by accurately calculating each employee’s contributions and submitting them to the Inland Revenue Board of Malaysia (LHDN).

A key part of our monthly workflow is the preparation and issuance of individual payslips. Each employee receives a detailed breakdown of their earnings, statutory deductions, and net pay, providing transparency and fostering trust.

Leave tracking is also part of our comprehensive service. We maintain accurate records of annual, medical, and other statutory leave entitlements, ensuring compliance with the Malaysian Employment Act 1955 and providing clear reporting for both employees and management.

Beyond monthly payroll, we handle year-end reporting by preparing and submitting EA Forms—Malaysia’s equivalent to Australia’s PAYG summaries—to meet statutory reporting requirements and ensure your offshore team’s full compliance.

1.3.2 Why This Matters for Your Firm

For Australian accounting firms operating offshore teams in Malaysia, compliance with local employment laws is critical. Effective payroll and HR compliance:

- Protects your firm from fines, legal disputes, and reputational risks

- Builds trust and engagement among your offshore team members

- Ensures your Malaysian operations align with your Australian standards of professionalism and care

By managing these processes in full, FastLaneRecruit allows you to focus on your core accounting services and growth strategies—confident that your offshore team is supported, compliant, and treated fairly.

Stage 2: Set Up the Workspace

2.1 Workspace Sourcing & Office Setup

For many Australian accounting firms building offshore teams in Malaysia, the right workspace is a critical foundation for operational success, employee satisfaction, and data security. A well-chosen environment supports compliance standards, smooth workflows, and client confidence — all while enabling your team to perform at its best.

Through FastLaneRecruit’s network of trusted workspace providers and property agents, firms can focus on spaces that match their team structure, working model, and security priorities — whether that means private offices for confidential work, collaboration rooms for team discussions, or IT infrastructure built for sensitive financial data.

This focused approach removes unnecessary complexity, making it easier to secure a workspace aligned with your offshore strategy and ready to support growth from day one.

Coworking Spaces

Co-working spaces are ideal for smaller teams or firms testing offshore operations for the first time. They offer flexibility, scalability, and access to shared amenities—allowing firms to establish a professional presence without the overhead of long-term leases.

Typical features include:

- High-speed internet and secure network access

- Meeting rooms and collaboration zones for team discussions and client calls

- Ergonomic workstations and breakout areas

- Reception and administrative support services

FastLaneRecruit assists in recommending reputable co-working spaces in Malaysia and can arrange introductions to trusted workspace providers to help you select an environment that supports both flexibility and productivity.

2.2 Virtual Tours and Site Assessments

Through trusted workspace providers, your firm can access a range of virtual and on-site evaluations designed to simplify decision-making without the need for travel. These include:

- Virtual walkthroughs showcasing workspace layouts, facilities, and amenities

- Live video sessions with workspace operators to address specific operational questions

- Optional in-person visits for a hands-on assessment of shortlisted locations

This approach gives your firm clear visibility into each option, making it easier to select a workspace that aligns with operational workflows, security standards, and company culture.

2.3 Why Workspace Setup Matters

A thoughtfully planned and well-equipped workspace goes beyond desks and chairs—it’s a strategic asset that directly impacts your offshore team’s success and your firm’s overall operational efficiency. Here’s why it matters:

- Talent Attraction and Retention:

A comfortable, accessible and professionally equipped workspace enhances the employee experience, making it easier to recruit top-tier accounting professionals and retain them in the long term. It reflects your firm’s commitment to employee well-being and high-quality service standards. - Scalability:

Choosing the right workspace model—whether a coworking environment, private office suite, or self-rented premises—ensures your offshore team can grow without logistical challenges. Flexible lease terms and adaptable layouts allow you to scale seamlessly as your firm’s needs evolve. - Operational Continuity:

A professional workspace ensures uninterrupted access to reliable high-speed internet, secure IT infrastructure, and essential utilities. This creates a productive work environment that supports daily tasks, data security, and smooth collaboration with your Australian office.

2.4 Our End-to-End Support

At FastLaneRecruit, we play an advisory and coordination role in your offshore workspace setup. Our goal is to simplify the process and connect you with trusted partners who can help you achieve operational readiness quickly and efficiently.

Our support includes:

- Local Expertise and Location Insights: Guidance on selecting optimal office locations near business hubs and talent pools.

- Virtual and On-Site Workspace Tours: Coordination of both online and physical visits to evaluate workspace suitability.

- Lease Advisory and Introductions: Guidance on key lease considerations and introductions to local property agents for negotiation and management.

Workspace Fit-Out Recommendations: Advice on functional layouts, security setups, and IT considerations, with referrals to reliable vendors if needed.

3. Stage 3: Equip Your Team

For Australian accounting firms expanding into Malaysia, equipping your offshore team with the right tools and technology is essential to ensuring seamless service delivery and operational continuity. At FastLaneRecruit, we provide end-to-end support to ensure your offshore team has everything they need to work as an integrated extension of your Australian operations from Day 1.

3.1 IT & Equipment Provisioning

We begin by sourcing and configuring IT equipment that meets the high standards and performance demands of Australian accounting workflows. Our focus is on ensuring that every piece of technology supports your offshore team’s daily tasks, collaboration with your Australian office, and adherence to data security and compliance requirements.

This includes:

- Laptops and monitors that are powerful enough to handle accounting software platforms like Xero, MYOB, QuickBooks, and other applications used in preparing complex financial statements, managing reconciliations, and delivering client-facing reports. These devices are selected to offer reliability and speed for multitasking across multiple accounting applications.

- Headsets, docking stations, and ergonomic accessories to create a professional, comfortable workspace that minimises strain during extended work hours. We understand that clear audio and seamless workstation transitions are crucial when communicating with Australian colleagues and clients.

- Printers and document scanners (where required) to support hybrid workflows—particularly for firms that handle both digital records and physical documentation for audits, tax filings, or management reporting. We ensure these devices integrate smoothly with your accounting software and document management systems.

Each piece of equipment is tested and configured locally by our IT specialists to ensure it functions perfectly within your firm’s technology ecosystem. This includes setting up user accounts, ensuring software and security patches are current, and conducting performance tests to verify readiness.

By managing every detail—from device selection to final configuration—we guarantee a plug-and-play experience for your offshore team. Your staff can start work immediately without dealing with technical hurdles, ensuring they’re fully integrated with your Australian workflows and ready to support your client engagements from day one.

3.2 Software Installation & Pre-Onboarding Setup

Before your offshore team’s first day, we manage the installation and full configuration of all essential software to ensure a seamless transition and immediate productivity. This goes beyond simple setup—it’s about creating a secure, fully integrated environment that mirrors your Australian operations and safeguards your clients’ sensitive financial data.

Key areas of focus include:

- Accounting tools: We install and configure your preferred accounting software, such as Xero, MYOB, QuickBooks, HandiSoft, and BGL, tailored to your specific workflows and reporting needs. This includes user account creation, linking with your Australian system (where relevant), and ensuring full functionality for preparing BAS statements, managing payroll, and delivering complex financial reports.

- Secure document management: We set up Google Drive, Dropbox, OneDrive, or other cloud-based platforms, ensuring secure access controls and folder structures that align with your firm’s document management policies. This supports smooth collaboration on financial records, audit files, and client deliverables while maintaining compliance with data retention standards.

- Communication and collaboration tools: We configure Microsoft Teams, Zoom, and Slack for real-time, cross-border communication and project management. This includes setting up user groups for client-specific projects, integrating scheduling tools, and testing video/audio quality to ensure clear communication with your Australian team and clients.

- VPN access and cybersecurity protocols: Recognising the sensitivity of accounting data, we implement VPN connections and advanced security measures to protect client information and ensure compliance with Australian privacy and confidentiality standards. This setup supports secure file sharing, encrypted connections for remote work, and access control based on team roles and client assignments.

Our team validates every aspect of the configuration, ensuring your offshore staff can immediately access the digital tools and data they need without any technical obstacles. By aligning software setups with your Australian workflows, we help your offshore team deliver work that’s accurate, compliant, and fully integrated with your local standards.

This pre-onboarding setup is more than a checklist—it’s your foundation for operational continuity, data integrity, and a seamless client experience.

3.3 Local IT Support

We understand that even the best-equipped offshore team needs ongoing technical support to stay productive and secure. That’s why FastLaneRecruit provides continuous, locally based IT support tailored to the specific needs of Australian accounting firms.

Our services include:

- Troubleshooting and hardware maintenance:

We resolve technical issues rapidly, minimising downtime and ensuring your offshore team can remain focused on their accounting tasks without disruption. From hardware malfunctions to unexpected software glitches, our local IT team is ready to step in and resolve problems efficiently. - System updates and software maintenance:

We ensure that all software platforms and operating systems are regularly updated and maintained. This includes accounting tools, collaboration platforms, and document management systems, reducing vulnerabilities and maintaining system performance to meet Australian standards. - Network security and VPN management:

With client confidentiality and data security being critical in accounting, we provide ongoing management of secure VPN connections and network security protocols. This ensures that sensitive financial data is protected at all times and meets compliance standards set by Australian privacy regulations. - Equipment upgrades and replacements:

We manage lifecycle refreshes for your offshore team’s devices; upgrading or replacing hardware as needed to ensure they always have access to modern, high-performing tools. This proactive approach minimises disruptions and supports the productivity your Australian office expects.

By delivering this comprehensive local IT support, we give your offshore team the confidence and technical reliability they need to deliver high-quality, compliant accounting services—day in and day out.

3.4 Why This Matters

For Australian accounting firms, reliable IT infrastructure is not just a convenience—it’s a critical factor in maintaining client trust and meeting compliance standards. With FastLaneRecruit’s comprehensive support, your offshore team has the tools and security needed to deliver consistent, high-quality accounting services that align with your Australian office’s standards.

4. Outcome & Results

| What We Offer | How It Helps You |

| Full-spectrum accounting talent | From junior staff to senior managers, all aligned with your needs |

| Significant cost savings | Up to 60% more cost-effective than hiring locally |

| Quick deployment | Fully staffed and operational within 30 days |

| Compliance & HR handled | No local entity needed — we manage all payroll, tax, and employment admin |

| Customizable infrastructure | Offices and IT setup matched to your preferred work style and tech stack |

5. Bringing It All Together: Your Offshore Team, Fully Supported

At FastLaneRecruit, we understand that building a high-performing offshore accounting team in Malaysia isn’t just about hiring—it’s about creating a fully integrated, secure, and compliant extension of your Australian operations.

Here’s how we do it:

Stage 1: Build the Right Team

We source and onboard accounting professionals at every level, ensuring technical alignment and cultural fit with your Australian workflows.

Stage 2: Set Up a Functional Workspace

We manage every detail of workspace sourcing and setup, balancing cost-efficiency with your firm’s brand and operational priorities.

Stage 3: Equip and Enable Your Team

We equip your offshore team with modern IT infrastructure, essential accounting software, and robust local support—ensuring they’re fully operational and integrated with your Australian office.

6. Start with a Complimentary Discovery Call

To explore how these stages can support your firm’s unique goals, we offer a complimentary discovery call. This no-obligation conversation is your chance to share your challenges and let us show you how our tailored solutions can deliver real value.

We also welcome you to visit Malaysia where you can:

- Meet with the FastLaneRecruit team, who will serve as your dedicated partner in Malaysia

- Tour potential workspaces to see firsthand the professional environments that will support your offshore team

- Explore our infrastructure and operational processes, giving you full confidence in our ability to support your accounting team with the same standards you maintain in Australia

- See our proven IT support in action, including how we ensure data security, seamless connectivity, and reliable operational performance

Contact us today to book your discovery call and take the first step toward building a smarter, more cost-effective offshore accounting team with FastLaneRecruit.