Expanding your tech team with back-end developers in Malaysia offers access to a skilled, cost-effective workforce in Southeast Asia. However, navigating Malaysia’s payroll and compliance landscape is crucial to ensure smooth operations and avoid legal pitfalls.

In this article, we will provide a comprehensive overview of payroll regulations, statutory contributions, and best practices for hiring back-end developers in Malaysia.

Content Outline

Key Summary

Understand Malaysia’s Payroll Framework

Knowing the statutory authorities—LHDN, EPF/KWSP, SOCSO, EIS, and HRDF, is crucial for compliance. Employers must follow the Employment Act 1955 and the regional Labour Ordinances to ensure correct deductions and benefits for back-end developers.

Structure Payroll Components Effectively

Payroll should include basic salary, allowances, overtime, bonuses, and benefits-in-kind. Clear documentation in contracts and payslips ensures transparency, fairness, and compliance with Malaysian regulations.

Comply with Statutory Contributions and Deductions

Employers are responsible for EPF, SOCSO, EIS, HRDF contributions, and PCB/MTD income tax deductions. Timely and accurate payments prevent penalties and maintain employee trust.

Implement Best Practices for Payroll Management

Register with relevant authorities, maintain accurate records, adhere to payment deadlines, use payroll software, and stay updated with regulatory changes to streamline payroll processes.

Overcome Common Payroll Challenges

Challenges like late statutory payments, incorrect tax calculations, employee misclassification, missing documentation, and mismanaged allowances can be mitigated with automation, regular audits, and clear communication.

Leverage EOR Services for Simplified Compliance

Partnering with an Employer of Record like FastLaneRecruit allows global companies to outsource payroll and compliance for Malaysian developers, ensuring full adherence to local labor laws and reducing administrative burdens.

Enhance Employee Satisfaction and Engagement

Transparent payroll practices, accurate payslips, and timely payments help retain top talent and foster a positive work environment for back-end developers.

Understanding Malaysia’s Payroll Framework

When hiring back-end developers in Malaysia, understanding the payroll framework is essential. This includes understanding the key statutory authorities, legal obligations, and their impact on day-to-day payroll management. Let’s break it down with clear examples.

Also Read: Key Steps to Offshore Hiring in Southeast Asia

Key Authorities

Several statutory bodies oversee payroll and employment compliance in Malaysia. Each plays a specific role, and failing to comply can lead to penalties or legal issues.

1. Inland Revenue Board (LHDN/IRBM)

The LHDN is responsible for administering income tax in Malaysia. Employers must withhold monthly tax from employee salaries through the Potongan Cukai Bulanan (PCB), or Monthly Tax Deduction (MTD), and remit it to LHDN by the 15th of the following month.

Example: If your back-end developer earns RM6,000 per month, you calculate the PCB based on their tax relief eligibility and remit it monthly. Missing this deadline can result in penalties or interest on unpaid tax. LHDN Official Portal

2. Employees Provident Fund (EPF/KWSP)

The EPF is Malaysia’s retirement savings scheme. Employers must contribute a percentage of an employee’s monthly salary (usually 12%–13%) while employees contribute 11%.

Example: For a developer earning RM6,000 monthly, the employer contributes RM720–780, and the employee contributes RM660. Accurate and timely contributions ensure employees receive proper retirement benefits. EPF Official Portal

3. Social Security Organisation (SOCSO/PERKESO)

SOCSO provides social security protection, covering employment injuries and invalidity benefits. Contributions are mandatory for all employees, but calculation is capped at a maximum wage of RM4,000. This means even if a back-end developer earns RM8,000 per month, contributions are still based on RM4,000.

Example: A full-time back-end developer earning RM3,500 would require an employer contribution of 1.75% (RM61.25) and an employee contribution of 0.5% (RM17.50). This ensures coverage in case of workplace accidents or injuries. SOCSO Official Portal

4. Employment Insurance System (EIS)

EIS offers short-term financial assistance and re-employment support to employees who lose their jobs. Both employer and employee contribute 0.2% of the employee’s monthly salary.

Example: For a back-end developer earning RM5,000, both employer and employee contribute RM10 per month to EIS, providing safety nets in case of unemployment. EIS Info

5. Human Resources Development Fund (HRDF)

HRDF supports employee training and skills development. Employers with 10 or more Malaysian employees must contribute 1% of total monthly wages. These funds can then be used to upskill your workforce.

Example: If your company hires 15 back-end developers with total monthly wages of RM90,000, the HRDF contribution would be RM900 per month. This fund can be used to enroll employees in technical or leadership courses. HRDF Official Portal

Legal Framework

The Employment Act 1955 governs employment in Peninsular Malaysia, setting out the rights and obligations of both employers and employees. It covers working hours, overtime, rest days, public holidays, leave entitlements, and termination procedures.

Key points:

- Employees earning RM4,000 or below are fully protected under the Act, including overtime pay, statutory leave, and termination benefits.

- Employees earning above RM4,000 are partially exempt from some provisions, such as certain overtime rates, shift allowances, and layoff or retirement benefits.

Example:

If you hire a senior back-end developer earning RM6,500 per month:

- They are not eligible for statutory overtime under the Employment Act.

- You may still offer overtime or bonuses contractually, but it’s not legally mandated.

Regional Differences:

- Sabah and Sarawak have their own Labour Ordinances, which may differ from Peninsular Malaysia’s Employment Act. Companies operating in these states must comply with local regulations.

Payroll Components for Back-End Developers

When hiring back-end developers in Malaysia, structuring payroll correctly is essential not just for compliance but also for attracting and retaining top talent. A well-defined payroll package balances fixed compensation, statutory contributions, and additional benefits that reflect the value of your employees.

| Component | Description & Recommendations | Example |

| Basic Salary | The fixed monthly remuneration agreed upon in the employment contract. This forms the core of the developer’s compensation and is used to calculate statutory contributions such as EPF, SOCSO, and EIS. Ensure clarity in the contract about payment date and currency (usually MYR). | A junior back-end developer may receive RM4,500 per month, while a senior developer could earn RM8,000 per month. |

| Allowances | Additional payments are provided for housing, transport, meals, or internet expenses. These allowances can be taxable or non-taxable depending on local regulations. Clearly define these in contracts to avoid disputes. | A company may provide a RM500 housing allowance or RM300 internet stipend to support remote development work. |

| Overtime | Compensation for work beyond standard hours (usually 8 hours/day or 48 hours/week under the Employment Act for employees earning ≤ RM4,000). For developers earning above RM4,000, overtime is often discretionary but can be offered as an incentive. | If a developer works 10 hours on a weekday and is eligible for overtime, the extra 2 hours may be paid at 1.5× hourly rate. |

| Bonuses | Performance-based incentives that reward individual or team achievements, project completions, or company performance. Bonuses help retain high performers and encourage productivity. | A back-end team delivering a critical product feature on time may receive a 10% bonus on their monthly salary, or an annual performance bonus of RM5,000. |

| Benefits-in-Kind | Non-monetary perks that enhance job satisfaction and engagement. Common examples include company laptops, software subscriptions, health insurance, or meal vouchers. These are often considered taxable benefits and should be documented. | Providing a company-issued MacBook, cloud software access, or subsidized meals during on-site work. |

Tips for Employers

- Transparent Contracts: Ensure every component is explicitly listed in the employment contract, including eligibility criteria, calculation methods, and payment frequency.

- Payslip Accuracy: Issue detailed payslips showing base salary, allowances, deductions, and bonuses. This builds trust and simplifies compliance.

- Tailored Packages: Consider local market expectations for back-end developers. Tech talent often values flexible benefits, such as remote work stipends or professional development allowances.

- Regular Reviews: Conduct annual salary and benefits reviews to remain competitive and compliant with any statutory changes.

Also Read: How to Hire Employees in Malaysia

Example Payroll Breakdown for a Mid-Level Back-End Developer

| Component | Amount (MYR) | Notes |

| Basic Salary | 6,000 | Fixed monthly pay |

| Housing Allowance | 500 | Non-taxable if used for accommodation |

| Transport Allowance | 300 | Taxable, included in EPF calculations |

| Overtime | 200 | Paid for 5 extra hours in a month |

| Performance Bonus | 500 | Discretionary based on project completion |

| Benefits-in-Kind | Laptop + Software | Valued at RM4,000; recorded for tax purposes |

| Total Compensation | 7,500 + benefits | Actual cash plus in-kind benefits |

By clearly structuring payroll with these components, employers not only stay compliant but also create a compelling compensation package that attracts and retains talented back-end developers.

Statutory Contributions and Deductions

When hiring back-end developers in Malaysia, employers must comply with several statutory contributions and deductions. These are mandatory and apply to most employees, ensuring social protection, retirement savings, and income tax compliance. Understanding each component helps prevent penalties and fosters a transparent employment environment.

Key Statutory Contributions

Income Tax Deduction (PCB/MTD)

Employers are responsible for withholding Monthly Tax Deductions (MTD/PCB) from employees’ salaries and remitting them to the Inland Revenue Board (LHDN/IRBM) by the 15th of the following month. The deduction amount depends on the employee’s monthly salary and tax relief eligibility.

Also Read: Comprehensive Guide to Payroll Management in Malaysia

Example:

A senior back-end developer earns RM8,000/month. After accounting for personal reliefs (e.g., EPF contributions, lifestyle reliefs), the employer calculates RM1,200 as the MTD/PCB and remits it to LHDN monthly. Missing deadlines can result in fines and interest charges. LHDN Portal

Best Practices for Compliance

- Automate Payroll Calculations: Use payroll software to accurately calculate contributions and deductions, ensuring timely submission.

- Document Contributions: Keep digital records of all statutory contributions and remittances for auditing purposes.

- Communicate Clearly with Employees: Show all deductions and contributions in payslips, including EPF, SOCSO, EIS, HRDF, and PCB/MTD, so employees understand their benefits and obligations.

- Stay Updated: Contribution rates and statutory requirements may change annually. Regularly consult official portals or a local payroll expert.

Example Payroll Deduction Breakdown for a Mid-Level Developer (RM6,000/month)

| Component | Employer Contribution | Employee Deduction | Notes |

| EPF | RM720 | RM660 | Retirement savings |

| SOCSO | RM105 | RM30 | Employment injury coverage |

| EIS | RM12 | RM12 | Unemployment insurance |

| PCB/MTD | N/A | RM900 | Income tax withheld |

| Total Monthly Payroll Cost for Employer | RM6,837 | RM1,602 | Includes statutory contributions plus base salary |

This structure ensures both employer and employee contributions are compliant while maintaining transparency.

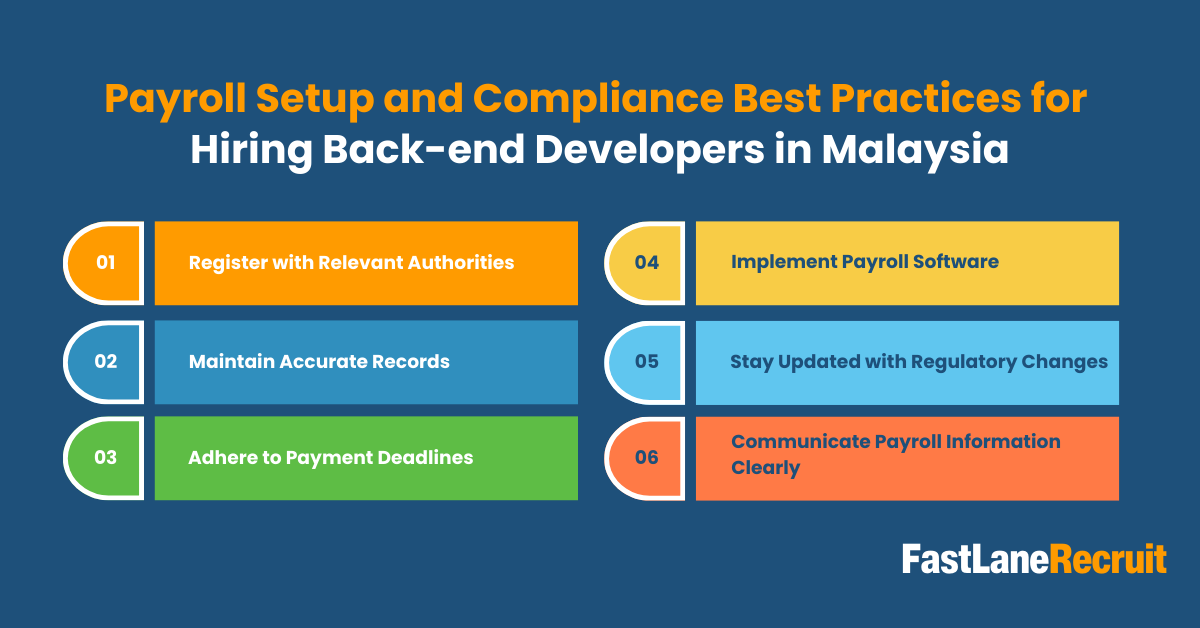

Payroll Setup and Compliance Best Practices for Hiring Back-end Developers in Malaysia

Establishing a compliant payroll system for back-end developers is essential for legal adherence, employee satisfaction, and efficient business operations. Whether managing payroll in-house or outsourcing, following best practices reduces errors and ensures timely payments.

Also Read: Payroll Process and Compliance Guide in Malaysia for Employer

1. Register with Relevant Authorities

Before processing payroll, register your company and employees with statutory bodies:

- EPF (KWSP) for retirement contributions.

- SOCSO (PERKESO) for social security coverage.

- EIS for unemployment protection.

- LHDN for monthly tax deductions (PCB/MTD).

- HRDF if your workforce exceeds 10 employees.

Example: If you hire 10 back-end developers through an outsourcing arrangement in Malaysia, ensure the EOR or your HR team registers all employees with EPF, SOCSO, EIS, and LHDN before the first salary run.

2. Maintain Accurate Records

Proper documentation is crucial to comply with audits and statutory reporting. Keep:

- Employment contracts detailing salary, allowances, and benefits.

- Payslips showing all deductions and contributions.

- Time and attendance records.

- Evidence of statutory contributions submitted to authorities.

Example: A back-end developer working remotely may log hours via a cloud-based system, automatically linking to payroll software for accurate overtime calculations.

3. Adhere to Payment Deadlines

Late payments of salaries or statutory contributions can incur fines or interest. Best practices include:

- Remitting PCB/MTD by the 15th of the following month.

- Submitting EPF, SOCSO, and EIS contributions on time, usually monthly.

- Scheduling payroll runs in advance to accommodate bank processing times.

Example: If your payroll date is the last working day of the month, schedule statutory submissions by the 12th to ensure funds reach EPF, SOCSO, and LHDN on time.

4. Implement Payroll Software

Modern payroll software automates calculations, tracks deductions, generates payslips, and keeps records securely. Benefits include:

- Automatic EPF, SOCSO, EIS, HRDF, and PCB/MTD calculations.

- Integration with time and attendance systems.

- Cloud-based access for employees to view payslips anytime.

Example: Using a payroll system, you can calculate contributions for a team of 15 back-end developers, generate individual payslips, and automatically submit reports to LHDN and EPF.

Recommended Options: FastLaneRecruit’s EOR service handles payroll, statutory contributions, and compliance for outsourced Malaysian employees.

5. Stay Updated with Regulatory Changes

Malaysia periodically updates employment and payroll laws. Regularly:

- Monitor official websites for new EPF, SOCSO, EIS, or tax rates.

- Adjust payroll calculations and contracts accordingly.

- Consult local experts for guidance on complex scenarios like high-salary exemptions or international hires.

Example: If EPF rates increase from 12% to 13% for employer contributions, update payroll software and notify employees to ensure accurate deductions.

6. Communicate Payroll Information Clearly

Transparency builds trust and reduces inquiries:

- Provide detailed payslips listing all components: salary, allowances, deductions, and benefits-in-kind.

- Explain contributions and statutory obligations during onboarding.

- Use cloud portals for real-time access to salary data.

Example: A mid-level back-end developer receives a payslip showing base salary RM6,000, EPF contribution RM720, SOCSO RM105, and EIS RM12, plus performance bonus and benefits-in-kind.

Also Read: Employee Benefits in Malaysia: A Complete Guide for Employers

Recommendation for Outsourcing

For global companies hiring Malaysian back-end developers, using an Employer of Record (EOR) service like FastLaneRecruit can simplify compliance:

- The EOR handles registration, payroll processing, statutory contributions, and tax filings.

- Companies can focus on team productivity while the EOR ensures legal compliance.

- Reduces administrative overhead and risk of penalties.

Example: A European tech company hiring 5 back-end developers in Malaysia can outsource payroll and compliance to FastLaneRecruit, ensuring all statutory contributions and taxes are processed correctly, with employees fully covered under Malaysian labor laws.

Common Payroll Challenges and How to Overcome Them

Even with a structured payroll system, businesses may face challenges when hiring and managing back-end developers in Malaysia. Awareness of these challenges and proactive solutions ensures compliance, employee satisfaction, and operational efficiency.

| Challenge | Description | Practical Solution |

| Late Statutory Payments | Delays in submitting EPF, SOCSO, EIS, or PCB/MTD can incur fines and penalties. | Automate payment schedules through payroll software or EOR services, and set internal reminders for deadlines. |

| Incorrect Tax Calculations | Miscalculating PCB/MTD or failing to account for tax reliefs can lead to penalties and employee dissatisfaction. | Use integrated payroll systems or consult local tax experts to calculate taxes accurately based on updated rates. |

| Employee Classification Errors | Misclassifying employees as contractors or exempting them from certain benefits may violate the Employment Act. | Clearly define employment contracts, and consult legal advisors for high-salary or specialized roles. |

| Missing Payroll Documentation | Paper-based systems can result in lost payslips, incomplete records, and audit risks. | Maintain digital payroll records with cloud-based storage and secure access for employees. |

| Overtime and Allowance Mismanagement | Developers working extra hours may not receive correct compensation if not tracked accurately. | Implement time-tracking software linked to payroll or offer contractual overtime agreements. |

| Cultural Payroll Expectations | International companies may overlook local customs, such as the 13th-month bonus or annual leave entitlements. | Adapt payroll policies to include local customary benefits and clearly communicate them to employees. |

Tips for Employers

- Leverage EOR Services: Outsourcing payroll to a trusted EOR like FastLaneRecruit reduces administrative burden, ensures statutory compliance, and mitigates human error.

- Regular Audits: Conduct monthly or quarterly internal audits to verify accuracy of contributions, tax deductions, and benefits.

- Employee Communication: Keep developers informed about deductions, contributions, and benefits to foster trust and engagement.

- Update Payroll Policies: Reflect changes in Malaysian labor laws, EPF/SOCSO rates, or tax regulations immediately in your payroll system.

Example Scenario:

A global tech company hired 8 back-end developers in Malaysia. Without an EOR, they missed timely EPF contributions for one developer, resulting in penalties. After partnering with FastLaneRecruit, all payroll components, statutory contributions, and taxes were automated and compliant, removing risk and saving administrative time.

Also Read: Advantages of Payroll Outsourcing in Malaysia

Conclusion

Navigating payroll and compliance in Malaysia is essential for businesses hiring back-end developers. By understanding statutory obligations, implementing best practices, and utilizing appropriate tools, employers can ensure legal compliance and foster a positive work environment. For companies seeking to streamline this process, FastLaneRecruit offers comprehensive Employer of Record (EOR) services, managing all payroll and compliance aspects on your behalf.

Streamline Payroll and Compliance with FastLaneRecruit

Hiring back-end developers in Malaysia comes with unique payroll and compliance requirements. From statutory contributions like EPF, SOCSO, and EIS, to income tax deductions and allowances, managing payroll can quickly become complex, especially for international companies.

This is where FastLaneRecruit’s Employer of Record (EOR) service simplifies everything. By partnering with FastLaneRecruit, you can:

- Ensure full compliance with Malaysian labor laws, payroll regulations, and statutory contributions.

- Automate payroll processing, including salary payments, deductions, bonuses, and benefits-in-kind.

- Reduce administrative burden and mitigate risks associated with missed deadlines or miscalculations.

- Provide transparent payslips and clear communication to employees, improving engagement and trust.

- Focus on growth, while we handle HR, payroll, and compliance for your Malaysian team.

Take the Next Step: Streamline your hiring and payroll process today. Hire and Pay your Malaysian back-end developers with FastLaneRecruit and let us handle the complexity of compliance, so you can focus on scaling your business globally.