Malaysia vs Global Markets

The global demand for back-end developers continues to rise in 2025, driven by the rapid growth of AI, cloud infrastructure, fintech platforms, and e-commerce ecosystems. As companies race to secure reliable digital infrastructure, salaries for back-end developers are climbing but compensation still varies widely by country.

In this salary guide, we’ll compare back-end developer salaries across Malaysia, the United States, the United Kingdom, Singapore, India, China, and Vietnam. We’ll also explore why these differences exist and how FastLaneRecruit’s Employer of Record (EOR) service can help businesses hire top talent affordably and compliantly.

Also Read: Average Salary in Malaysia 2025

Content Outline

Key Summary

Malaysia Offers a Competitive Cost-to-Talent Ratio

Back-end developers earn between USD 1,200–1,900/month, making Malaysia a cost-effective destination for global companies building offshore teams.

United States Leads Global Salaries

Salaries range from USD 7,500–9,660/month, reflecting its status as the world’s leading tech hub.

United Kingdom Offers Strong Pay but Faces a Talent Shortage

Average salaries sit at USD 7,000–8,300/month, with demand outpacing supply.

Singapore is Competitive but Expensive

Salaries of USD 5,000–7,000/month are offset by high living costs and tight competition.

India and Vietnam Provide Affordable Talent Pools

With salaries between USD 690–2,870/month, these countries are popular outsourcing destinations for cost-conscious firms.

China Balances Affordability with Scale

Developers earn USD 3,868–5,112/month, with strong talent supply in major tech hubs.

FastLaneRecruit’s EOR Service Simplifies Offshore Hiring

Businesses can quickly and compliantly hire Malaysian developers without setting up a local entity.

Back-End Developer Salary Breakdown by Country (2025)

Malaysia

Malaysia has emerged as a leading outsourcing hub thanks to government support under the Malaysia Digital Economy Blueprint (MyDIGITAL) (MDEC). Salaries for back-end developers vary by experience:

- Entry Level (0–2 years): USD 1,200–1,400/month

- Mid Level (3–5 years): USD 1,500–1,650/month

- Senior (6+ years): USD 1,800–1,900/month

Market Insight: Lower costs, English proficiency, and a growing fintech and e-commerce sector make Malaysia highly attractive for offshore hiring.

United States

Back-end developer salaries remain the highest globally:

- Entry Level (0–2 years): USD 7,500/month

- Mid Level (3–5 years): USD 8,410/month

- Senior (6+ years): USD 9,660/month

Market Insight: Tech hubs like Silicon Valley and New York push salaries upward, but rising costs are encouraging businesses to explore offshore hiring. (Bureau of Labor Statistics)

United Kingdom

The U.K. faces a developer shortage, driving high salaries:

- Entry Level: USD 7,000/month

- Mid Level: USD 7,400/month

- Senior: USD 8,300/month

Market Insight: Strong fintech demand boosts salaries, especially in London. (Office for National Statistics)

Singapore

Singapore remains one of Asia’s most expensive markets:

- Entry Level: USD 5,000/month

- Mid Level: USD 6,600/month

- Senior: USD 7,000/month

Market Insight: Government-led Smart Nation initiatives create high demand, but costs are steep. (MOM Singapore)

India

India remains a cost-efficient market:

- Entry Level: USD 830/month

- Mid Level: USD 1,400/month

- Senior: USD 2,870/month

Market Insight: Salaries are low, but competition for top-tier developers is intensifying. (NASSCOM)

China

China offers a vast developer base at mid-level salaries:

- Entry Level: USD 3,868/month

- Mid Level: USD 4,835/month

- Senior: USD 5,112/month

Market Insight: Innovation hubs like Beijing and Shenzhen drive demand, but affordability is decreasing compared to ASEAN markets.

Also Read: Hiring App Developers in Malaysia

Vietnam

Vietnam’s competitive costs continue to attract global companies:

- Entry Level: USD 690/month

- Mid Level: USD 1,410/month

- Senior: USD 1,690/month

Market Insight: Salaries are among the lowest, but English proficiency and developer availability are steadily improving.

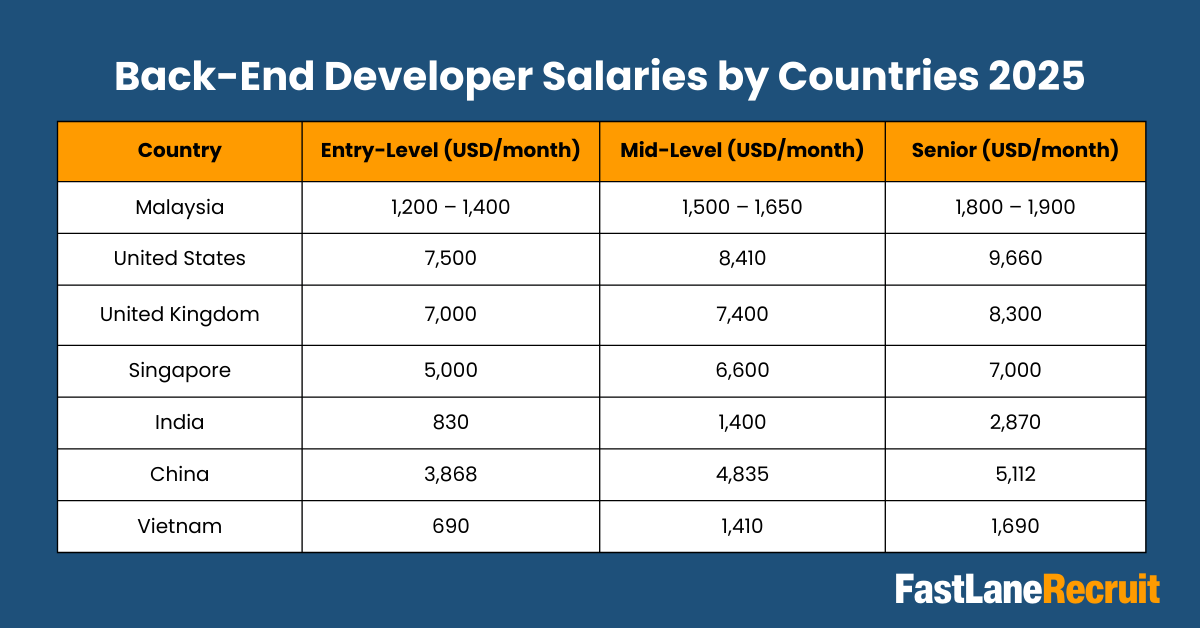

Salary Table – Back-End Developer Salaries by Country (2025)

| Country | Entry-Level (USD/month) | Mid-Level (USD/month) | Senior (USD/month) |

| Malaysia | 1,200 – 1,400 | 1,500 – 1,650 | 1,800 – 1,900 |

| United States | 7,500 | 8,410 | 9,660 |

| United Kingdom | 7,000 | 7,400 | 8,300 |

| Singapore | 5,000 | 6,600 | 7,000 |

| India | 830 | 1,400 | 2,870 |

| China | 3,868 | 4,835 | 5,112 |

| Vietnam | 690 | 1,410 | 1,690 |

Comparing Back-End Developer Salaries Across Countries

When choosing where to hire back-end developers, salary is just one piece of the puzzle. Cost of living, skill availability, government support, and industry specializations all shape the value employers get from each market. Let’s break it down:

Malaysia: Best Cost-to-Talent Ratio with Strong Government Support

Malaysia offers one of the most attractive cost-to-talent ratios in the region. With salaries averaging USD 1,200–1,900/month, businesses can hire skilled developers at a fraction of the cost compared to the U.S. or U.K. The Malaysia Digital Economy Blueprint (MyDIGITAL) (MDEC) continues to expand the local tech ecosystem, ensuring a steady pipeline of developers.

Strengths: Affordable, English-proficient workforce, strong fintech and e-commerce growth, and government tax incentives for tech firms.

Challenges: While costs are low, niche specializations such as AI or blockchain are less prevalent than in Western hubs.

Also Read: How to Outsource App Development in 2025

United States: Highest Global Salaries, But Costly for Employers

Back-end developers in the U.S. command salaries of USD 7,500–9,660/month, making it the most expensive market globally. These figures are driven by high demand in innovation hubs like Silicon Valley, New York, and Seattle, where venture capital and tech investments are abundant.

Strengths: Access to top-tier developers with cutting-edge expertise in AI, cloud, and cybersecurity.

Challenges: High payroll costs, competition for talent, and rising living expenses in major cities. For many employers, this makes offshore hiring a strategic necessity.

United Kingdom: Strong Demand in Fintech, Limited Local Supply

The U.K. market, with salaries ranging USD 7,000–8,300/month, faces a severe developer shortage. This shortage is especially acute in London’s booming fintech sector, where banks and startups compete heavily for technical talent.

Strengths: Strong industry focus in finance, global connectivity, and demand for skilled developers.

Challenges: Limited supply of developers inflates salaries, and Brexit has also restricted the inflow of international tech workers.

Singapore: Attractive Salaries but Offset by High Living Costs

In Singapore, back-end developers earn USD 5,000–7,000/month, reflecting its status as a leading Asian financial and technology hub. However, the high cost of living, particularly in housing and transport, diminishes the attractiveness of these salaries from a business perspective.

Strengths: Government-backed Smart Nation initiative, strong digital infrastructure, and availability of high-skilled developers in fintech and cybersecurity.

Challenges: Small local talent pool, high cost of living, and reliance on foreign professionals. Offshore hiring often becomes the practical alternative.

India: Large, Affordable Talent Pool, But Skill Levels Vary

India remains a global outsourcing leader with salaries between USD 830–2,870/month. The country produces thousands of IT graduates each year, giving employers access to a vast developer base.

Strengths: Cost-efficient, large pool of developers, long-standing reputation for offshore IT outsourcing.

Challenges: Quality can vary widely; top-tier developers now command much higher salaries. Employers often need strong vetting processes to secure reliable talent.

Also Read: Why Malaysia Is the Ideal Country to Hire Offshore App Developer

China: Mid-Range Costs with Strong Innovation Hubs

Back-end developers in China earn USD 3,868–5,112/month, making it more expensive than India or Vietnam but still cheaper than Western countries. Innovation hubs like Shenzhen, Shanghai, and Beijing are home to global tech giants and a thriving startup culture.

Strengths: Large talent base, strong focus on R&D and emerging technologies like AI and IoT.

Challenges: Language and regulatory barriers for foreign firms, rising salary expectations in tier-1 cities, and stricter government policies around data and compliance.

Vietnam: Among the Lowest Salaries, Attractive for Startups and SMEs

Vietnam offers some of the lowest developer salaries globally, around USD 690–1,690/month, making it an attractive choice for startups and SMEs scaling their teams. The local government actively promotes digital growth, and the talent pool continues to expand.

Strengths: Affordable salaries, improving English proficiency, and a fast-growing developer ecosystem.

Challenges: Talent pool is smaller compared to India or China, and highly specialized developers (e.g., AI engineers) remain limited.

Bottom Line:

- If cost savings are the priority, Malaysia and Vietnam lead the pack, offering skilled developers at a fraction of Western costs.

- If cutting-edge specialization is needed, the U.S. and U.K. remain top choices but at premium salaries.

- For companies seeking a balance of quality and affordability, Malaysia stands out with its English-speaking workforce, government-backed tech initiatives, and competitive salary structure.

Why These Regional Salaries Are Different?

Malaysia

Economic Context:

Salaries for back-end developers in Malaysia are lower compared to Singapore or the United States, largely due to the country’s favorable cost of living and developing economic scale. Kuala Lumpur is emerging as a digital hub, supported by initiatives such as the Malaysia Digital Economy Blueprint (MyDIGITAL), but it still lacks the concentration of global tech headquarters that push salaries higher in other markets.

Talent Dynamics:

Demand for skilled developers is increasing, particularly in fintech, e-commerce, and cloud-based services. The local talent pool is expanding steadily, supported by English proficiency and government investment in digital skills. Employers often attract talent by offering not just salary, but also flexible work arrangements and upskilling opportunities.

Market Outlook:

As more multinational companies establish regional operations in Malaysia, back-end developers, particularly at the mid-to-senior level, are expected to see gradual salary growth. Malaysia is positioning itself as a cost-effective alternative to Singapore for global businesses.

United States

Economic Context:

The United States remains the global leader in tech investment, with hubs like Silicon Valley and New York driving innovation in AI, cloud computing, and software engineering. Salaries are pushed upwards by a combination of high demand, a deep funding ecosystem, and high living costs in tech-heavy cities.

Talent Dynamics:

Back-end developers are among the most sought-after roles, especially in sectors like fintech, AI, and SaaS. With talent demand exceeding supply in many regions, companies compete aggressively by offering higher salaries, equity, and bonuses.

Market Outlook:

U.S. salaries will likely continue to grow, particularly for specialized skills such as DevOps, cybersecurity, and cloud architecture. However, rising payroll costs are encouraging many firms to expand offshore hiring in cost-competitive markets.

Also Read: App Developer Salary Guide 2025

United Kingdom

Economic Context:

The U.K. faces a severe shortage of developers, particularly in fintech and enterprise software. London’s status as a global financial hub drives high demand for secure, scalable back-end systems. At the same time, post-Brexit restrictions have tightened access to EU tech workers, further inflating salaries.

Talent Dynamics:

Competition for back-end developers is strong, with employers often offering higher base pay and benefits to attract scarce talent. Remote and hybrid work policies are also used to appeal to candidates.

Market Outlook:

Salaries will likely continue rising, especially in fintech and regulated industries. Without a significant increase in domestic training pipelines or immigration reform, the talent gap will persist, keeping pay high for the foreseeable future.

Singapore

Economic Context:

Singapore’s reputation as a regional tech hub comes with a very high cost of living, which directly raises salary benchmarks. The government’s Smart Nation initiative and its role as a hub for multinational corporations have further driven up demand for skilled back-end developers.

Talent Dynamics:

The local talent pool is relatively small, and many employers rely on foreign workers to fill critical roles. Developers with multi-disciplinary skills in cloud, AI, and cybersecurity are particularly valued.

Market Outlook:

Back-end developer salaries in Singapore will remain high as demand continues to outpace supply. Employers may increasingly look to nearby markets such as Malaysia or Vietnam to complement their tech teams.

India

Economic Context:

India has long been known for its large-scale IT outsourcing industry. The massive talent supply keeps entry-level salaries low, but experienced back-end developers or those with niche expertise can command significantly higher pay.

Talent Dynamics:

While India produces a vast number of engineering graduates each year, skill levels can vary widely. Top-tier developers are often concentrated in metropolitan hubs like Bangalore and Hyderabad, where global tech firms maintain large operations.

Market Outlook:

India will remain a cost-effective talent hub, but wages are expected to climb steadily in specialized areas such as cloud-native development, big data, and security engineering.

Also Read: How to Build a High-Performing Offshore App Developer Team in Malaysia

China

Economic Context:

China’s tech sector is maturing rapidly, with major hubs in Beijing, Shanghai, and Shenzhen fueling demand for back-end developers. Salaries are rising in these tier-1 cities, though they remain lower than Western levels. Government investment in AI, IoT, and cloud further drives demand.

Talent Dynamics:

China has a large and competitive talent base, but language barriers and regulatory complexities make it less accessible for foreign companies. Developers working in strategic industries often see accelerated career growth and higher pay.

Market Outlook:

Back-end developer salaries will continue to rise as China strengthens its innovation economy. However, foreign firms may face regulatory hurdles, making countries like Malaysia or Vietnam more accessible alternatives.

Vietnam

Economic Context:

Vietnam is quickly establishing itself as an affordable outsourcing destination, supported by its low cost of living and government-led digital transformation programs. Salaries remain among the lowest in the region, attracting global companies seeking cost savings.

Talent Dynamics:

The talent pool is growing, with a young workforce eager to enter the tech industry. English proficiency is improving, though the pool of highly specialized back-end developers is still smaller compared to India or China.

Market Outlook:

Vietnam’s salaries will rise gradually as the economy grows and foreign investment increases. However, the country is likely to remain a cost-efficient option for startups and SMEs well beyond 2025.

Also Read: Best Countries to Outsource Web Development Services

Are Back-End Developer Salaries Expected to Rise?

Yes and here’s why. The demand for back-end developers is not slowing down. Global businesses are rapidly investing in AI, cloud computing, cybersecurity, and scalable software systems, all of which depend heavily on back-end expertise.

- Western Markets: Salaries in the U.S. and U.K. are projected to climb even higher due to talent shortages and heavy investment in AI-driven industries.

- Asia-Pacific: Countries like Malaysia and Vietnam, though cost-effective today, are already experiencing salary inflation as more foreign companies enter the market.

- India and China: While still affordable, niche expertise in areas like big data, blockchain, and machine learning is commanding premium pay.

For companies looking to expand, the message is clear:

- Act early to secure affordable developer talent in growth markets like Malaysia before salary gaps widen.

- Partner with Employer of Record (EOR) providers such as FastLaneRecruit to ensure compliant, streamlined hiring without the overhead of setting up local entities.

Outlook for 2025 and Beyond: Back-end developer salaries are expected to see a steady year-on-year increase worldwide, with emerging markets catching up faster than before. Employers who adopt a proactive hiring strategy now will lock in cost advantages and reduce the risk of talent shortages later.

Also Read: RPO vs. In-House Recruitment: Which Hiring Strategy Works Best?

Choosing the Best Country to Hire Back-End Developers

When businesses look beyond their borders to hire back-end developers, salary alone shouldn’t be the deciding factor. A successful outsourcing strategy depends on balancing cost with quality, scalability, and long-term stability. Here are the key considerations:

Talent Availability

Access to skilled developers is just as important as affordability. Countries like Malaysia and Vietnam are producing a steady supply of developers thanks to strong government focus on digital skills development. Malaysia stands out because of its higher English proficiency, making communication smoother with global teams. By comparison, India and China have vast talent pools but often require additional vetting to ensure alignment with international work standards.

Time Zone Compatibility

Time zone alignment can have a big impact on productivity. ASEAN markets such as Malaysia, Vietnam, and Singapore offer overlapping hours with both Asian and Western time zones, making them convenient for real-time collaboration. For companies in the U.S. and Europe, this means faster turnaround times compared to hiring in far-off time zones.

Business Environment

A country’s regulatory and business climate also shapes outsourcing decisions. Malaysia, for example, provides a business-friendly environment backed by the Malaysia Digital Economy Corporation (MDEC). Incentives under the MyDIGITAL initiative encourage foreign companies to establish operations or partner with local talent providers. This makes Malaysia one of the most stable and supportive outsourcing destinations in Southeast Asia.

Cost-to-Quality Balance

While India and Vietnam offer the lowest costs, Malaysia offers one of the best balances between affordability and quality. Developers are not only cost-effective but also highly adaptable to global standards, making the country a sweet spot for companies that want to optimize payroll without compromising quality.

Bottom Line: Companies seeking cost efficiency, scalability, and smooth collaboration should strongly consider Malaysia as their outsourcing hub, with Vietnam as a close alternative for startups and SMEs.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

Decision Matrix: Best Countries to Hire Back-End Developers (2025)

| Country | Talent Availability | Cost of Hiring | Business Environment | Time Zone Compatibility |

| Malaysia | Growing pool, strong English proficiency; skilled in fintech & e-commerce | Low–Moderate (USD 1,200–1,900/month) | Stable, government-backed incentives (MDEC, MyDIGITAL) | Excellent overlap with Asia, partial with Europe/US |

| United States | Large, highly skilled, cutting-edge expertise | Very High (USD 7,500–9,660/month) | Strong innovation hubs, but high cost of living | Aligned for North America; difficult for Asia/Europe |

| United Kingdom | Shortage of developers; strong demand in fintech | High (USD 7,000–8,300/month) | Advanced market, but limited post-Brexit workforce | Overlaps well with US mornings and Asia evenings |

| Singapore | Small but high-quality pool; expertise in finance & cybersecurity | High (USD 5,000–7,000/month) | Highly developed, Smart Nation support, but costly | Good overlap with Asia & partial US/Europe |

| India | Vast IT workforce, but skill levels vary | Low (USD 830–2,870/month) | Mature outsourcing market, but competitive | Overlaps well with Europe; partial US alignment |

| China | Large pool in tier-1 cities; strong in AI & IoT | Moderate (USD 3,868–5,112/month) | Strong innovation hubs, but regulatory barriers for foreign firms | Good overlap with Asia; limited for US/Europe |

| Vietnam | Expanding pool, improving English proficiency | Very Low (USD 690–1,690/month) | Emerging market, growing digital economy | Strong overlap with Asia & partial Europe/US |

Quick Insights:

- Malaysia offers the best cost-to-talent balance with supportive government programs.

- Vietnam is the most affordable but still developing its specialist pool.

- U.S. and U.K. provide world-class expertise but at a premium cost.

- Singapore is highly skilled but faces salary inflation due to living costs.

- India and China are attractive for scale, but employers must navigate quality control and compliance challenges.

Also Read: Why Do Companies Choose to Outsource?

Why Malaysia Should Be Your First Choice

Looking at the decision matrix, Malaysia offers the strongest cost-to-talent ratio, a business-friendly environment, and time zone flexibility that fits both Asian and Western markets. For global companies, it’s one of the smartest places to build and scale back-end development teams.

That’s where FastLaneRecruit’s Employer of Record (EOR) service comes in. With our support, you can:

- Hire Malaysian developers quickly and compliantly without setting up a local entity.

- Manage payroll, benefits, and taxes seamlessly, so you stay focused on growth.

- Scale your team affordably, tapping into Malaysia’s growing pool of skilled back-end talent.

Partner with FastLaneRecruit today and start building your offshore back-end development team in Malaysia efficiently, compliantly, and at a fraction of Western costs.

Conclusion

Back-end developer salaries vary widely across global markets. While the U.S. and U.K. lead with top pay, they also come with higher costs and competition. Malaysia offers one of the strongest value propositions, combining affordable salaries, English-speaking talent, and government-backed digital growth.

Ready to Hire Back-End Developer from Malaysia?

With FastLaneRecruit’s Employer of Record (EOR) Service, you can hire and manage Malaysian back-end developers without setting up a local entity.

Here’s how we help:

- Full Compliance: Stay aligned with Malaysian labor laws and payroll requirements.

- Payroll & Benefits Management: We handle everything from statutory filings to salary processing.

- Faster Hiring: Onboard skilled talent quickly and compliantly.

- Cost Efficiency: Scale your development team strategically while saving on costs.

Contact FastLaneRecruit today to build your high-performing back-end development team in Malaysia.