Keeping medical billing accurate and efficient is becoming increasingly complex. With constantly changing insurance rules, higher claim rejections, and mounting administrative tasks, healthcare providers need reliable solutions to protect their revenue. Many clinics, hospitals, and medical groups now rely on professional medical billing companies to streamline claims, improve cash flow, and stay compliant.

In this guide, we have highlighted the Top 15 medical billing companies, along with practical tips, and outsourcing alternatives, including how you can build your own dedicated medical billing team through FastLaneRecruit’s Employer of Record (EOR) service.

Content Outline

Key Summary

Medical Billing is Critical for Revenue

Accurate billing connects healthcare providers, insurers, and patients, ensuring timely reimbursements and compliance with regulations.

Understand Billing Metrics

Key performance indicators like first-pass claim acceptance (>95%), denial rate (<5%), and days in A/R (<30) guide billing reliability.

Choose the Right Billing Partner

Evaluate companies based on technology, EHR integration, reporting dashboards, and HIPAA-compliant workflows to safeguard data and efficiency.

Top 15 Billing Companies (2025–2026)

From athenahealth to M&M Claims Care, practices can select vendors based on specialty, tech requirements, practice size, and workflow needs.

Regional Billing Team Advantages

Building a regional medical billing team, such as engaging Malaysian Medical Billing Specialists, provides greater operational stability, extended coverage hours, stronger workflow control, and improved cost efficiency over time.

FastLaneRecruit’s EOR Solution

With FastLaneRecruit, providers can hire and manage dedicated Malaysian billing specialists without establishing a local entity, streamlining payroll, compliance, and workflows.

Strategic Billing Enhances Practice Growth

Whether outsourcing or building an in-house team, efficient billing reduces administrative burdens, accelerates cash flow, and allows providers to focus on patient care.

What Is Medical Billing and Why It Matters

Medical billing is the process that turns the care you provide to patients into payments from insurance companies or patients themselves. Think of it as the bridge that connects healthcare providers, insurance companies, and patients, ensuring that doctors and clinics get paid for the services they deliver.

Even though it sounds straightforward, medical billing involves multiple steps, each of which must be done correctly to prevent delays or mistakes in payment. Let’s break down a typical medical billing workflow and what happens at each stage:

| Stage | What Happens |

| Patient Registration | The clinic collects personal details, insurance information, and any necessary documents from the patient. This ensures that claims can be processed accurately later. |

| Insurance Verification | The billing team confirms that the patient’s insurance is active, what it covers, and any deductibles or co-pays that apply. This step helps avoid rejected claims later. |

| Medical Coding | Healthcare services are translated into standardized codes, like ICD-10 (diagnosis) and CPT (procedures), which insurance companies use to process claims. Accurate coding is critical for fast reimbursement. |

| Claim Submission | The completed claim, with all codes and supporting information, is sent to the insurance company for payment. |

| Payment Posting | Once payment is received, it is recorded in the practice’s financial system to ensure records match what was paid. |

| Denial Management | If a claim is rejected or denied, the billing team identifies the reason, fixes any errors, and resubmits it. Effective denial management ensures the practice recovers all eligible payments. |

According to the Centers for Medicare & Medicaid Services (CMS), accurate medical billing is not just a matter of money, it directly affects how quickly healthcare providers get reimbursed and whether they stay fully compliant with regulations. Mistakes at any step can cause delays, increase administrative work, and even impact a clinic’s financial health.

Medical billing is the backbone of a healthcare practice’s financial stability. When done efficiently, it allows providers to focus on delivering quality patient care rather than worrying about payments or claim rejections.

What to Look for in a Medical Billing Company

Choosing the right medical billing company is more than picking a vendor; it’s about finding a trusted partner who will help your practice get paid accurately and on time. To make the best choice, you need to understand the key metrics that measure billing performance.

Here’s a breakdown of the most important metrics, what they mean, and why they matter:

| Key Metric | Ideal Benchmark | Why It Matters / Example |

| First-Pass Acceptance Rate | 95% or higher | This measures the percentage of claims that are accepted by insurance the first time they are submitted. A high rate means fewer corrections and faster payments. Example: If a practice submits 100 claims in a week and 95 are accepted without any issues, the practice receives payments faster and spends less time fixing rejected claims. |

| Denial Rate | Below 5% | This shows the percentage of claims that are denied by insurers. Lower denial rates reduce lost revenue and administrative work. Example: If a billing company has a 2% denial rate, only 2 out of 100 claims need follow-up, saving staff hours and ensuring predictable cash flow. |

| Days in Accounts Receivable (A/R) | Under 30 days | This is the average time it takes for a claim to be paid after submission. Shorter A/R days mean faster cash flow for the practice. Example: A practice that consistently collects payments within 25 days has more funds available for payroll, supplies, and operations than a practice waiting 60+ days. |

| HIPAA Compliance | Mandatory | Protecting patient data is not optional. Billing companies must follow HIPAA standards to safeguard sensitive medical information and avoid legal penalties. Example: A HIPAA-compliant billing partner uses encrypted data transfer, secure portals, and certified staff to ensure patient health records are never exposed. |

Why these metrics matter:

These benchmarks help you evaluate if a billing company is reliable, efficient, and trustworthy. A partner that consistently meets these targets ensures your practice is financially healthy, reduces administrative stress, and maintains patient trust.

For more on HIPAA compliance and data protection, visit the U.S. Department of Health & Human Services (HHS): https://www.hhs.gov/hipaa

Also Read: How to Build an Offshore HR Administration Team in Malaysia

Top 15 Medical Billing Companies (2025–2026)

This list includes medical billing platforms, revenue cycle management (RCM) providers, and specialized billing firms. Service scope, pricing models, and technology depth vary by provider.

1. athenahealth – Advanced RCM Analytics

Best For: Practices looking for deep revenue cycle management (RCM) insights and EHR integration.

Overview: athenahealth offers a cloud-based platform that combines medical billing, practice management, and patient engagement. Its strength lies in real-time claim scrubbing, automated eligibility checks, and advanced reporting.

Why It Stands Out: Ideal for practices that want data-driven insights to improve cash flow and minimize denied claims.

2. CareCloud – Tech-Driven Practices

Best For: Tech-savvy practices looking for an all-in-one solution.

Overview: CareCloud integrates medical billing with practice management and EHR on a single cloud-based platform. It is known for modern, user-friendly interfaces and advanced analytics dashboards.

Why It Stands Out: Offers automation and performance tracking to reduce administrative workload.

3. AdvancedMD – Growing Multi-Location Clinics

Best For: Practices planning to scale or operate multiple locations.

Overview: AdvancedMD provides AI-powered revenue cycle management tools and modular practice management solutions. It supports both in-house and outsourced billing workflows.

Why It Stands Out: Highly scalable and customizable for large or growing practices.

4. Tebra – Independent Practices

Best For: Small or independent clinics looking for a simple, all-in-one platform.

Overview: Tebra (formerly Kareo) combines practice growth tools with billing services. It streamlines marketing, patient engagement, and claims management in one platform.

Why It Stands Out: User-friendly platform that bridges clinical operations and revenue collection.

Also Read: HR Administrator Salary Guide 2025

5. DrChrono – Mobile-First Clinics

Best For: Clinics that prioritize mobile workflows and Apple devices.

Overview: DrChrono offers an EHR and billing platform optimized for iPads and iPhones. It integrates billing, medical coding, and real-time documentation.

Why It Stands Out: Perfect for mobile-first practices and telemedicine services.

6. eClinicalWorks – Value-Based Care

Best For: Practices focused on population health and value-based care.

Overview: eClinicalWorks combines RCM with population health tools, tracking patient outcomes alongside billing performance.

Why It Stands Out: Connects clinical outcomes with financial performance, supporting value-based reimbursement models.

7. CureMD – Specialty Practices

Best For: Specialty practices that need clean EHR integration.

Overview: CureMD provides end-to-end EHR, practice management, and billing services. It supports multiple specialties, including cardiology, dermatology, and urgent care.

Why It Stands Out: Strong integration between clinical and billing systems.

8. MediBillMD – High-Touch Service

Best For: Practices seeking personalized attention and dedicated support.

Overview: MediBillMD is a boutique billing firm offering one-on-one client management, coding audits, and AR recovery.

Why It Stands Out: Customized solutions for each practice with proactive communication.

9. Invensis – Full Outsourcing

Best For: Practices wanting to fully outsource their billing operations.

Overview: Invensis focuses on end-to-end billing services with multi-tier quality checks and routine compliance training.

Why It Stands Out: Ideal for practices looking to completely delegate revenue cycle management.

10. Promantra – Enterprise RCM

Best For: Large hospitals and enterprise healthcare systems.

Overview: Promantra offers technology-driven revenue cycle management and is focused on operational efficiency.

Why It Stands Out: Suitable for enterprise-level clients needing robust and scalable RCM solutions.

Also Read: Top 15 Business Consulting Firms in Singapore

11. Practolytics – Virtual Billing Teams

Best For: Practices wanting remote billing specialists and ongoing consultation.

Overview: Practolytics combines U.S.-based client management with a global backend for 24/7 billing support.

Why It Stands Out: Flexible model with dedicated support and continuous monitoring of billing performance.

12. CapMinds – Real-Time Dashboards

Best For: Practices needing analytics and workflow transparency.

Overview: CapMinds provides advanced dashboards for revenue tracking, claim management, and denial analytics.

Why It Stands Out: Offers actionable insights with real-time reporting to optimize cash flow.

13. Transcure – A/R Recovery

Best For: Practices focused on recovering unpaid claims and reducing lost revenue.

Overview: Transcure emphasizes high-accuracy billing and aggressive AR recovery through back-office support.

Why It Stands Out: Strong performance in first-pass clean claims and claim recovery.

14. Kareo – Small Practices

Best For: Independent or solo providers with lean operations.

Overview: Kareo offers easy-to-use software and support, helping smaller practices manage billing without a full-time team.

Why It Stands Out: Simple, accessible platform with reliable support for small clinics.

15. M&M Claims Care – Specialty Billing

Best For: Specialty practices needing highly personalized billing support.

Overview: M&M Claims Care provides tailored billing solutions for specialties like neurology, cardiology, mental health, and urgent care.

Why It Stands Out: Focused attention on complex specialties with proven results in improving collections.

Also Read: Why Malaysia Is a Prime Destination for Offshore HR Administrators

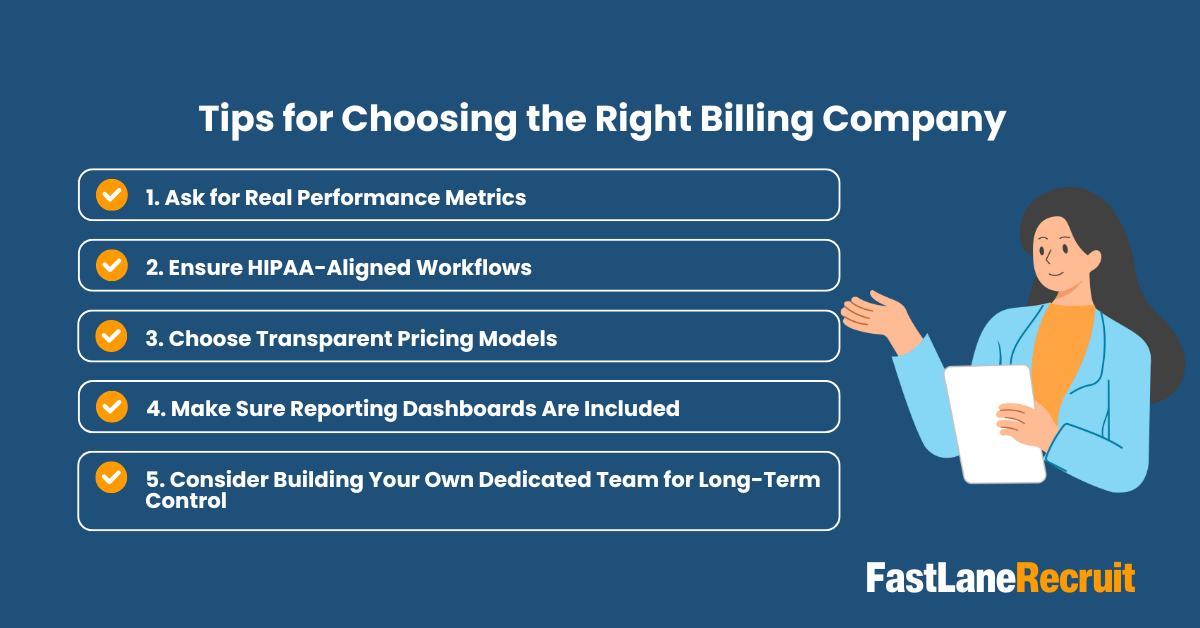

Tips for Choosing the Right Billing Company

Selecting the right medical billing company is crucial for your practice’s financial health. The goal is to maximize reimbursements, reduce claim denials, and minimize administrative overhead. Here are some practical tips to guide your decision:

1. Ask for Real Performance Metrics

Don’t rely on sales pitches alone. Ask potential billing partners for actual performance data, such as:

- First-pass claim acceptance rates

- Denial rates

- Average days in accounts receivable (A/R)

Example: A partner with a 95% first-pass acceptance rate ensures that most claims are paid the first time, reducing the need for follow-ups and speeding up cash flow.

2. Ensure HIPAA-Aligned Workflows

Protecting patient data is non-negotiable. Confirm that your billing partner follows HIPAA-compliant procedures:

- Secure transmission and storage of patient data

- Access controls and encryption

- Regular compliance audits

Example: A HIPAA-certified billing company prevents costly breaches and protects your practice from legal penalties while maintaining patient trust.

3. Choose Transparent Pricing Models

Billing companies often charge either a percentage of collections or a flat monthly/hourly fee. Understand the full pricing structure upfront.

Example:

- A percentage-based model aligns incentives but can become expensive as revenue grows.

- A flat-fee model, such as $9.50/hour for a dedicated specialist, offers predictable costs and long-term savings.

4. Make Sure Reporting Dashboards Are Included

Real-time dashboards provide visibility into your revenue cycle, allowing you to monitor claims, payments, and denials at any time.

Example: With access to a dashboard, you can quickly identify pending claims, track trends, and make informed decisions to improve revenue.

5. Consider Building Your Own Dedicated Team for Long-Term Control

Instead of fully outsourcing to large billing firms, some practices choose to build dedicated regional billing teams, an approach discussed in detail later in this guide.

Example: By hiring Malaysian medical billing specialists through FastLaneRecruit’s EOR service, your practice can:

- Maintain full control over billing processes

- Reduce operational costs

- Access certified, English-proficient professionals who follow international billing standards

- Benefit from extended coverage hours to accelerate claims processing

Bottom Line:

A strong billing strategy balances performance, compliance, transparency, and long-term control. By carefully evaluating these factors, your practice can maximize revenue, reduce administrative burden, and improve overall efficiency.

Also Read: Top 15 Accounting Outsourcing Providers in Singapore

Outsourcing Example: Why Many Providers Build Dedicated Billing Teams

Many healthcare providers are rethinking the traditional approach of paying a percentage of collections, which can become expensive as revenue scales to large billing firms. Instead, they are building their own remote medical billing teams. This approach gives them more control over workflows, reduces long-term costs, and ensures consistent, high-quality billing operations.

Example: Outsourcing Medical Billing Specialists to Malaysia

Malaysia has become a preferred location for building remote healthcare support teams. Malaysian medical billing specialists are engaged under strict HIPAA-aligned workflows, including secure system access controls, encrypted data environments, and role-based permissions defined by the healthcare provider. The country offers several advantages that make it ideal for medical billing outsourcing:

- Strong English proficiency: Teams can communicate easily with international clients and insurers.

- Familiarity with global healthcare workflows: Malaysian specialists are trained to handle ICD, CPT coding, and US-based insurance practices.

- Stable business environment: Policies support long-term remote operations.

- Modern data protection frameworks: Companies comply with international security standards, protecting sensitive patient data.

- High-quality education system: Graduates in healthcare administration and IT bring excellent technical skills.

Source: Malaysia Digital Economy Corporation (MDEC)

Real-World Use Case: Comparing In-House vs. Dedicated Malaysian Team

| Task | In-House (Local Hire) | Dedicated Malaysian Team |

| Medical Coding | Limited availability; difficult to hire certified coders locally | Dedicated, certified coders trained in international billing standards |

| Claim Follow-up | High staff turnover and frequent workflow interruptions | Stable, long-term support with consistent workflow management |

| Billing Costs | High recurring costs (salary, benefits, office space) | Predictable payroll model and lower operational overhead |

| Time Zone Coverage | Limited coverage hours, often overlapping minimally with US/Europe | Extended coverage hours, enabling faster claim processing and follow-up |

By leveraging a dedicated Malaysian medical billing team, clinics can maintain full control of their operations while benefiting from cost efficiency, consistent quality, and time zone flexibility.

Alternative to Traditional Outsourcing: Build Your Own Billing Team with FastLaneRecruit EOR

Instead of outsourcing your revenue to third-party billing vendors, FastLaneRecruit helps healthcare providers build their own dedicated Malaysian Medical Billing Specialists through our Employer of Record (EOR) service. This gives you the benefits of an in-house team, without opening a local entity.

How FastLaneRecruit Can Help

FastLaneRecruit offers an Employer of Record (EOR) service that helps healthcare providers to quickly hire and manage Malaysian medical billing specialists without setting up a local entity. With FastLaneRecruit:

- You can onboard certified, English-proficient billing specialists in Malaysia quickly.

- FastLaneRecruit handles payroll, compliance, and legal requirements, so you can focus on operations.

- Teams can work remotely but fully integrated into your existing systems and workflows.

- It’s a scalable solution, ideal whether you need one specialist or a full dedicated billing team.

Consider building your dedicated Malaysian medical billing team with FastLaneRecruit’s EOR service. Reduce administrative burden, improve claim processing efficiency, and gain a stable, skilled remote team to support your revenue cycle management.

Also Read: Why Malaysia Is a Prime Destination for Offshore HR Administrators

Conclusion

Medical billing is no longer just an administrative function, it is a strategic pillar of healthcare operations. Whether you choose a full-service billing company or build your own offshore billing team, the goal remains the same: faster reimbursements, better compliance, and stronger cash flow.

If you’re looking for a modern, scalable alternative, building a dedicated regional billing team through FastLaneRecruit’s EOR service offers control, transparency, and long-term growth.

Ready to Build Your Dedicated Malaysian Medical Billing Team?

FastLaneRecruit helps healthcare providers hire and manage certified Medical Billing Specialists in Malaysia, fully compliant, fully supported, and tailored to your workflows.

Speak with FastLaneRecruit to explore a compliant EOR setup for medical billing teams.