Malaysia has become a thriving hub for global technology and IT support talent. With its strong digital infrastructure, English proficiency, and competitive hiring costs, more international companies are turning to Malaysia to build remote or hybrid IT teams.

However, understanding Malaysia’s labour laws is critical to ensure fair employment practices and full legal compliance, especially when hiring IT support specialists. From EPF and SOCSO contributions to employment contracts and work permits, employers must follow specific regulations set by Malaysian authorities.

In this guide, we’ll cover:

- The key employment laws and legal requirements for hiring in Malaysia

- How EPF, SOCSO, and EIS contributions work and what employers must do to stay compliant

- Tips and best practices for onboarding IT support specialists

- How an Employer of Record (EOR) like FastLaneRecruit can simplify compliance and payroll for global companies

By the end, you’ll have a clear understanding of Malaysia’s employment framework and how to hire confidently with direct, trusted references from official sources such as KWSP (EPF), PERKESO, and the Ministry of Human Resources (MOHR).

Content Outline

Key Summary

Employment Landscape

Malaysia follows the Employment Act 1955, with full-time, part-time, contract, and freelance arrangements, each with specific benefits.

Legal Requirements

Employers must register employees with EPF, SOCSO, EIS, submit Form CP22, issue valid contracts, and secure work visas for foreigners.

EPF Contributions

Mandatory retirement savings scheme: Employer 12–13% | Employee 11%. From October 2025 onwards, contributions are also compulsory for eligible non-Malaysian employees. Timely registration and contributions are crucial to avoid penalties.

SOCSO & EIS

Provides protection for workplace injuries, disability, and retrenchment benefits. For most employees, the employer contributes a total of 1.75% to SOCSO plus 0.2% to EIS, calculated up to the current wage ceiling (RM6,000 per month).

Employment Contracts

Must include job role, salary, hours, leave, benefits, and termination clauses. Avoid mistakes like underpaying or late statutory contributions.

Hiring with EOR

FastLaneRecruit manages payroll, statutory contributions, HR, and compliance, allowing global companies to hire Malaysian IT talent without a local entity.

Understanding Malaysia’s Employment Landscape

Before hiring IT support specialists or any other professionals in Malaysia, it’s essential to understand the country’s employment framework and the laws that govern the relationship between employers and employees.

Malaysia’s workforce operates primarily under the Employment Act 1955, which defines the minimum standards for working conditions, employee entitlements, and employer responsibilities. This Act applies to most private-sector employees in Peninsular Malaysia and the Federal Territory of Labuan. For companies operating in Sabah and Sarawak, the relevant laws are the Sabah Labour Ordinance and the Sarawak Labour Ordinance, respectively.

The Act covers essential aspects such as:

- Working hours and rest days

- Leave entitlements (annual, sick, maternity, and paternity leave)

- Wages and overtime rules

- Termination procedures and notice periods

- Employee protections under statutory bodies like EPF and SOCSO

Also Read: Top 15 Software Outsourcing Companies in Australia

To help employers and HR professionals differentiate between the main types of employment arrangements in Malaysia, here’s a breakdown of the most common categories:

| Type of Employment | Description | Key Notes |

| Full-Time | Employees work the standard 45 hours per week as defined under the Employment Act. | Eligible for all statutory benefits, including EPF, SOCSO, and EIS contributions, paid leave, and public holidays. |

| Part-Time | Employees work up to 70% of the normal full-time hours, which means 33 hours or less per week. | Entitled to pro-rated benefits such as annual leave and sick leave. The Employment (Part-Time Employees) Regulations 2010 govern their entitlements. |

| Contract-Based | Hired for a fixed duration — such as 6 months, 1 year, or project-specific terms. | Must include a clearly written contract specifying duration, compensation, benefits, and renewal or termination clauses. |

| Freelance / Project-Based | Independent professionals hired to perform specific tasks or projects without being part of the company’s workforce. | Not covered under the Employment Act; no statutory deductions (EPF, SOCSO) required unless voluntarily contributed. However, ensure compliance with the Personal Data Protection Act (PDPA) 2010 when handling their information. |

Tip for Global Employers:

When hiring IT specialists in Malaysia, whether on a full-time, contract, or freelance basis, make sure the employment type matches the working arrangement. Misclassifying employees (for example, treating a full-time worker as a freelancer) can lead to legal and tax non-compliance issues.

For reference, you can read the full Employment Act 1955 on the Official Portal of the Department of Labour Peninsular Malaysia (JTKSM).

Key Legal Requirements for Employers in Malaysia

Before hiring employees whether local or foreign, every employer in Malaysia must meet specific statutory obligations to stay compliant with the country’s labour and tax laws. These requirements ensure employees receive proper protection, benefits, and fair treatment under the law.

Below is a breakdown of the key legal requirements and the relevant authorities involved:

| Requirement | Authority | Description |

| Form CP22 Submission | Inland Revenue Board of Malaysia (LHDN / IRBM) | Employers must notify the Inland Revenue Board within 30 days of hiring a new employee by submitting Form CP22 (Notification of New Employee). This ensures the employee’s income tax records are properly established and the Monthly Tax Deduction (MTD / PCB) process can begin. Employers who fail to submit CP22 within the deadline may face fines. |

| EPF Registration (Employees Provident Fund) | Kumpulan Wang Simpanan Pekerja (KWSP / EPF) | Employers are required to register with the EPF within 7 days of hiring their first employee by submitting Form KWSP 1. All eligible employees must be registered within 7 days of employment using Form EPF 3. Monthly contributions — shared between employer and employee — must then be remitted by the 15th of the following month. These contributions secure employees’ retirement savings and long-term financial stability. |

| SOCSO & EIS Registration | Social Security Organisation (PERKESO) | Employers must register their business and all eligible employees with PERKESO to provide social security coverage under the Employees’ Social Security Act 1969 and Employment Insurance System (EIS) Act 2017. SOCSO covers work-related injuries, disabilities, or death, while EIS provides financial support and job search assistance for retrenched employees. Registration should be completed within 30 days of hiring. |

| Work Visa / Employment Pass (for Foreign Workers) | Immigration Department of Malaysia | Non-Malaysian employees must hold a valid work visa or employment pass to legally work in Malaysia. Employers are responsible for sponsoring the visa and ensuring it aligns with the employee’s role and salary level. The main types of work passes include the Employment Pass, Professional Visit Pass, and Temporary Employment Pass. Applications are typically processed through the Expatriate Services Division (ESD). |

| Employment Contract | Ministry of Human Resources (MOHR) | Every employee must receive a written employment contract outlining the terms and conditions of employment including job title, salary, working hours, leave entitlements, termination clauses, and statutory contributions. Contracts must comply with the Employment Act 1955 and be signed by both parties before work begins. A clear and detailed contract helps avoid future disputes and ensures compliance with Malaysian labour law. |

Compliance Tip for Employers:

- Always retain copies of all employment-related submissions (Form CP22, EPF registration, SOCSO forms, etc.) for at least seven years, as required by law.

- Late or missed submissions can lead to penalties or prosecution under Malaysian labour regulations.

- Employers can complete most registrations and submissions through official online portals:

- LHDN e-Daftar – for tax registration

- KWSP i-Akaun – for EPF employer registration

- PERKESO ASSIST Portal – for SOCSO and EIS registration

By ensuring compliance from the very beginning, employers can establish a solid legal foundation for their workforce, protecting both the company and its employees.

Also Read: Top 15 IT Consulting Companies in the Philippines

EPF: Employees Provident Fund

The Employees Provident Fund (EPF) or Kumpulan Wang Simpanan Pekerja (KWSP) is Malaysia’s mandatory retirement savings scheme designed to ensure employees have financial security after retirement. Both employers and employees are legally required to contribute a portion of the employee’s monthly wages to this fund.

The EPF operates under the Employees Provident Fund Act 1991 and applies to all Malaysian citizens and permanent residents working under a contract of service.

Contribution Rates

The contribution rate is determined by the employee’s monthly salary level:

| Category | Employer Contribution | Employee Contribution |

| Employee earning ≤ RM5,000 | 13% | 11% |

| Employee earning > RM5,000 | 12% | 11% |

Note:

Employers may voluntarily contribute more than the statutory rate if stated in the employment contract or company policy. For foreign employees (non-Malaysians), EPF participation used to be optional. From October 2025 wages onward, employers are required to register and contribute for eligible non-Malaysian employees in line with the updated EPF Act and KWSP policies.

Registration & Compliance Steps

To comply with Malaysian labour laws, employers must follow specific steps to register and maintain their EPF contributions properly:

- Employer Registration:

- Register your business with the EPF via the KWSP i-Akaun portal or by submitting Form KWSP 1.

- Registration must be completed within 7 days of hiring your first employee.

- Register your business with the EPF via the KWSP i-Akaun portal or by submitting Form KWSP 1.

- Employee Registration:

- Each new employee must be registered with the EPF within 7 days of employment using Form KWSP 3.

- You’ll receive an EPF account number for each registered employee.

- Each new employee must be registered with the EPF within 7 days of employment using Form KWSP 3.

- Monthly Contributions:

- EPF contributions must be remitted by the 15th of the following month after salary payment.

- Payments can be made online via the KWSP i-Akaun (Employer) portal or through authorised banks.

- EPF contributions must be remitted by the 15th of the following month after salary payment.

- Record Keeping:

- Employers must retain all EPF payment records and related forms for at least seven years, as required under EPF regulations.

Penalties for Non-Compliance

Failure to register employees or remit EPF contributions on time is considered an offence under the EPF Act 1991.

Penalties include:

- Fines up to RM10,000, or

- Imprisonment up to 3 years, or both.

In addition, employers may be charged late payment interest and required to settle the full arrears, including administrative fees.

Pro Tip for Global Employers

If your company is based outside Malaysia, managing EPF compliance can be complex due to local submission timelines and system integrations.

- Ensure your payroll system integrates with the KWSP’s auto-submission portal to avoid delays or calculation errors.

- Partnering with a local Employer of Record (EOR) such as FastLaneRecruit can simplify the entire process from employee registration and monthly submissions to maintaining full statutory compliance on your behalf.

Also Read: Game Designer Salary Guide 2025

SOCSO: Social Security Organization

The Social Security Organization (SOCSO), known locally as Pertubuhan Keselamatan Sosial (PERKESO), is a government agency under Malaysia’s Ministry of Human Resources (MOHR). SOCSO provides financial protection and social security coverage to employees in cases of workplace injuries, occupational diseases, disability, or death.

Employers are required to register their companies and employees with SOCSO and contribute monthly according to the Employees’ Social Security Act 1969.

Types of SOCSO Coverage

SOCSO provides two main protection schemes, each serving a specific purpose:

| Coverage Type | Employer Contribution | Employee Contribution | Purpose |

| Employment Injury Scheme | 1.25% | – | Protects employees against work-related accidents, occupational diseases, or injuries occurring during work travel. |

| Invalidity Scheme | 0.5% | 0.5% | Provides coverage for non-work-related disabilities, invalidity, or death before reaching the age of 60. |

| Total (Regular Employee) | 1.75% | 0.5% | Combined contribution for comprehensive protection. |

Note:

SOCSO coverage generally applies to employees under the Employees’ Social Security Act, with contributions calculated up to the current wage ceiling of RM6,000 per month. For employees earning above this amount, contributions are still made but capped at the RM6,000 wage level to maintain continuous protection.

Additional Coverage: Employment Insurance System (EIS)

In addition to SOCSO, Malaysia introduced the Employment Insurance System (EIS) in 2018 to help employees who lose their jobs involuntarily (such as through retrenchment or downsizing).

| Scheme | Employer Contribution | Employee Contribution | Purpose |

| Employment Insurance System (EIS) | 0.2% | 0.2% | Provides financial assistance, re-employment programs, and career counseling for retrenched employees. |

The EIS is governed under the Employment Insurance System Act 2017, administered by PERKESO.

Registration and Compliance

Employers must:

- Register with PERKESO within 30 days of hiring their first employee.

- Submit monthly contributions through the ASSIST Portal (PERKESO’s online system).

- Ensure accurate salary reporting for each employee to calculate the correct contribution rate.

- Maintain contribution records for at least seven years for audit and verification purposes.

Failure to register or contribute may result in legal penalties, including fines up to RM10,000 or imprisonment.

Example Calculation

If you hire an IT Support Specialist earning RM6,000 per month, here’s how the statutory contributions may look:

- EPF (Employer + Employee): ~24% combined

- SOCSO (Employer + Employee): 2.25% combined (1.75% + 0.5%)

- EIS (Employer + Employee): 0.4% combined

Total Approximate Statutory Contribution: ~26% of the employee’s monthly salary (combining EPF, SOCSO, and EIS), shared between employer and employee.

Also Read: Why Companies Outsource Game Design Talents

Pro Tip for Global Employers

When hiring remotely or setting up an offshore team in Malaysia, compliance with SOCSO and EIS can be challenging due to local reporting requirements and payment cycles.

- Automate submissions through payroll systems linked to the PERKESO ASSIST Portal.

- Consider partnering with a local Employer of Record (EOR) like FastLaneRecruit, which can handle SOCSO registration, contribution filings, and compliance monitoring on your behalf, ensuring your employees are fully protected under Malaysian labour laws.

Employment Contracts and Compliance Tips

Under Malaysia’s Employment Act 1955, every employee, whether full-time, part-time, or contract-based, must be employed under a written contract that clearly defines the terms and conditions of employment. This ensures transparency, legal protection, and compliance for both employer and employee.

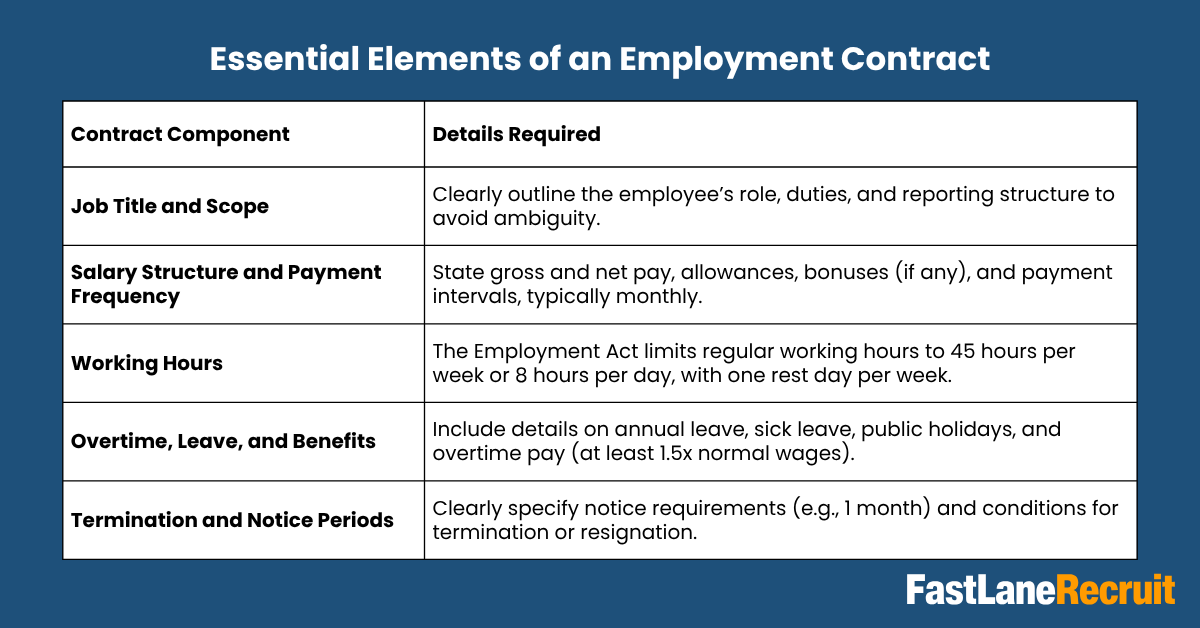

Essential Elements of an Employment Contract

An employment contract in Malaysia must be in writing and provided to the employee before employment begins. At a minimum, it should include:

Tip:

Digital employment contracts are legally accepted in Malaysia. Employers may use e-signature platforms such as DocuSign or Adobe Sign. However, ensure that signed copies are stored securely, ideally in encrypted HR management systems and that all terms comply with the Employment Act 1955 and related amendments.

Also Read: Malaysia as a Strategic Talent Hub for Global Game Design & Development

Compliance Best Practices for Employers

To maintain a compliant and professional hiring process, companies should implement the following best practices:

- Align contracts with the Employment Act:

Regularly review employment templates to ensure they reflect the latest amendments to Malaysian labour laws, such as the 2022 Employment (Amendment) Act which expanded coverage to all employees, regardless of income. - Provide clear documentation:

Issue offer letters and employment contracts in both English and Bahasa Malaysia when hiring local staff, ensuring all employees fully understand their terms. - Include statutory benefits:

Ensure all contracts reflect mandatory contributions, EPF, SOCSO, and EIS and provide details on other benefits like medical coverage, allowances, or performance bonuses. - Adopt transparent salary practices:

Clearly state the gross salary, deductions, and any variable components (commissions, incentives). Avoid informal or cash-based payments that may complicate tax reporting. - Update contracts for foreign employees:

Include clauses regarding work permit validity, visa sponsorship, and compliance with the Immigration Department of Malaysia for non-citizens.

Common Mistakes to Avoid

| Mistake | Why It’s a Problem | How to Avoid It |

| Paying below the statutory minimum wage | Paying below the statutory minimum wage As of 2025, Malaysia’s national minimum wage has been increased to RM1,700 per month under the latest Minimum Wages Order, fully implemented from 1 August 2025. Violations can result in fines and penalties. | Always verify current wage rates from the Ministry of Human Resources (MOHR). |

| Delaying or missing EPF/SOCSO contributions | Non-compliance can lead to penalties or imprisonment under the EPF Act and Employees’ Social Security Act. | Automate contributions through KWSP and PERKESO portals or delegate payroll management to an EOR. |

| Hiring foreigners without valid work permits | This violates Malaysia’s Immigration Act 1959/63 and may result in heavy fines or deportation. | Always secure work permits through the Immigration Department of Malaysia. |

| Improper or undocumented terminations | Terminating employees without due notice or valid reason can result in unfair dismissal claims. | Follow Section 14 of the Employment Act and issue written notice with justification. |

Pro Tip for Global Employers

When hiring IT support specialists or remote teams in Malaysia, navigating employment laws, benefits, and contract structures can be complex.

- Partnering with a local Employer of Record (EOR) like FastLaneRecruit allows your company to legally employ Malaysian professionals without establishing a local entity.

- FastLaneRecruit manages employment contracts, payroll, statutory deductions, and compliance so you can focus on scaling your IT operations confidently and compliantly.

Hiring IT Support Specialists in Malaysia

Malaysia’s growing digital economy makes it an attractive destination for remote and offshore IT hiring. Here’s why many global companies choose to expand their IT operations here:

| Advantage | Description |

| Cost Efficiency | Competitive salaries compared to Western markets |

| English Proficiency | Widely spoken, especially among IT professionals |

| Strong Infrastructure | High-speed connectivity and digital tools availability |

| Government Support | Initiatives like Malaysia Digital (MD) encourage tech talent development |

Example:

An Australian company hiring a Level 2 IT Support Specialist in Kuala Lumpur can expect monthly salaries between RM6,000–8,000, with statutory contributions handled through FastLaneRecruit’s compliant EOR service.

Best Practices for Global Employers

Here are key steps to ensure compliance and smooth operations when hiring IT staff in Malaysia:

- Register with all statutory bodies (EPF, SOCSO, EIS, and LHDN).

- Issue a compliant employment contract within 30 days.

- Pay statutory contributions by the 15th of each month.

- Retain payroll and employee records for at least 7 years.

- Consult with local HR or an EOR provider for ongoing compliance updates.

Also Read: How to Build Offshore Game Design Teams in Malaysia

Simplify Hiring with FastLaneRecruit’s EOR Services

For international companies looking to hire Malaysian IT professionals without the need to establish a local entity, FastLaneRecruit’s Employer of Record (EOR) service provides a seamless, fully compliant alternative. Our EOR service allows you to legally employ local talent while we manage all the administrative, legal, and payroll obligations on your behalf.

What FastLaneRecruit Handles for You:

| Service | Details |

| EPF, SOCSO, and EIS Registration & Payments | We ensure timely registration of your employees with KWSP (EPF) and PERKESO (SOCSO/EIS), and manage monthly contributions automatically, avoiding penalties and compliance issues. |

| Payroll Processing & Tax Reporting | FastLaneRecruit calculates salaries, deductions, and statutory contributions accurately. We handle Potongan Cukai Bulanan (PCB/MTD) submissions to the Inland Revenue Board of Malaysia (LHDN) on your behalf. |

| Employment Contracts | Drafting, issuing, and managing contracts compliant with Malaysian labour laws, covering working hours, leave entitlements, termination clauses, and statutory benefits. |

| Local HR Support & Employee Onboarding | From onboarding to ongoing HR support, we help your employees settle in and remain engaged, including managing workplace policies, leave management, and compliance guidance. |

By partnering with FastLaneRecruit, your business can:

- Scale your tech team faster without the administrative burden.

- Stay fully compliant with Malaysian labour laws and statutory requirements.

- Focus on core business operations while we take care of local HR, payroll, and legal obligations.

Pro Tip: Using an EOR like FastLaneRecruit is particularly effective for global companies exploring remote or hybrid IT teams in Malaysia, ensuring smooth operations without the complexity of registering a local entity.

Take the hassle out of hiring in Malaysia, let FastLaneRecruit manage compliance while you build your team.

Conclusion

Hiring IT Support Specialists in Malaysia is an excellent way to access skilled, affordable talent in Southeast Asia. But understanding and complying with Malaysia’s labour laws, EPF, SOCSO, and EIS requirements is essential for sustainable operations.

With the right partner like FastLaneRecruit, you can confidently build your Malaysian workforce while ensuring legal, tax, and HR compliance without the administrative burden.

Ready to Hire Top Malaysian IT Professionals?

Building a skilled IT team in Malaysia can be a game-changer for your business but navigating local labour laws, statutory contributions, and work permits can be complex and time-consuming. That’s where FastLaneRecruit comes in.

With FastLaneRecruit’s Employer of Record (EOR) solutions, you can:

- Hire Malaysian talent compliantly without setting up a local entity.

- Manage payroll, EPF, SOCSO, and EIS contributions automatically.

- Handle employment contracts, statutory deductions, and work visas seamlessly.

- Ensure full compliance with Malaysian labour laws, reducing risk and administrative burden.

Focus on growing your IT operations, onboarding talent, and delivering results, while FastLaneRecruit takes care of all the local HR and compliance requirements.

Explore FastLaneRecruit’s EOR Solutions today and start building your Malaysian IT team the smart, compliant way. Book A Free Call!