Hiring someone full-time isn’t just about the monthly salary. Whether you’re a startup founder, CFO, or HR exec, understanding the true cost of hiring an employee, including hidden fees and compliance costs, can be a game-changer for your business strategy.

In this guide, we’ll break down the real cost of an employee, compare in-house vs. offshore hiring, and explore how companies are saving up to 60% by hiring Malaysian employees through FastLaneRecruit’s Employer of Record (EOR) service.

Content Outline

Key Summary

Total Employee Cost Exceeds Base Salary

The true cost of hiring includes not only the employee’s salary but also benefits, payroll taxes, insurance, overhead, and turnover-related expenses. Employers should budget approximately 1.25 to 1.4 times the base salary to cover all costs.

Location Significantly Influences Hiring Costs

Employee costs vary widely depending on geographic location due to differences in labor laws, statutory contributions, and cost of living. Hiring in lower-cost countries like Malaysia can offer substantial savings compared to the U.S. or Australia.

Hidden Costs Impact Your Bottom Line

Recruitment fees, onboarding, training, and employee turnover are often overlooked but can add significant expenses. Understanding and planning for these hidden costs improves budgeting accuracy.

Employer of Record (EOR) Solutions Simplify Global Hiring

Using an EOR like FastLaneRecruit enables businesses to hire internationally without establishing local entities, reducing compliance risks, administrative burdens, and overall hiring costs.

Industry, Company Size, and Role Complexity Affect Compensation

Labor costs differ by industry standards, organizational scale, and job level, with specialized or senior roles generally commanding higher salaries and benefits.

Employee Turnover is Costly

High turnover increases recruitment and training costs while reducing productivity. Investing in employee retention strategies can lead to significant savings over time.

Automate HR Processes to Reduce Costs and Errors

Implementing HR technology for payroll, onboarding, and compliance reduces manual errors, speeds up processes, and lowers operational costs.

Accurate Cost Calculation Leads to Smarter Hiring Decisions

A clear understanding of all cost components enables better workforce planning and supports sustainable business growth.

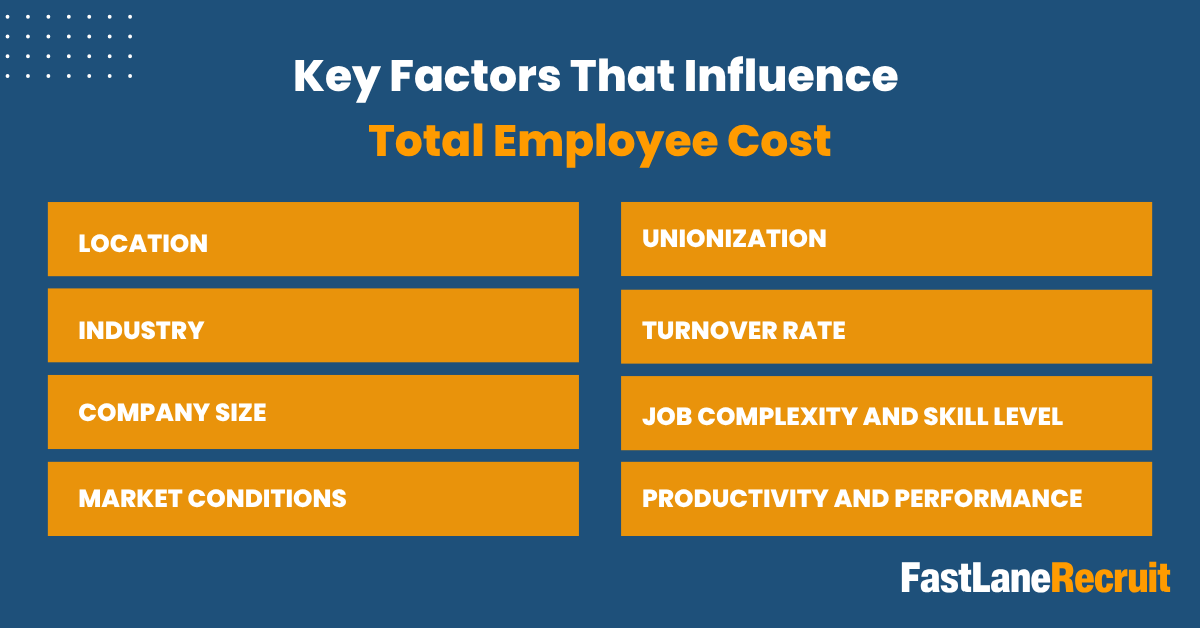

Key Factors That Influence Total Employee Cost

Understanding how much employees cost goes far beyond base salaries. Employers must consider a range of variables that can significantly affect total workforce expenses. From statutory contributions and benefits to location-specific factors and turnover rates, these elements all contribute to the true cost of hiring. Below are eight key factors that employers, particularly those expanding internationally, should evaluate when budgeting and developing workforce strategies.

Also Read: Employer of Record vs. Staffing Agency

1. Location

Geographic location plays a critical role in determining employee costs due to variations in statutory contributions, minimum wage standards, and cost of living. Labor laws, such as pension or social insurance contributions, differ by jurisdiction. For example, Canadian employers in Quebec face a higher pension plan contribution rate than those in other provinces.

Similarly, the cost of living impacts expected salary ranges. A junior marketing executive in Kuala Lumpur may require significantly less compensation than a peer in London or San Francisco, due to differences in housing, transportation, and healthcare costs.

How to estimate the cost of living?

Employers often rely on cost-of-living indices (like those from Numbeo) to benchmark wages against the relative expenses in the employee’s location, covering necessities such as rent, food, education, and healthcare.

2. Industry

Certain industries come with unique payroll taxes, compliance requirements, and workforce costs. For instance, the unemployment insurance rate for new construction businesses may be higher than for service-based companies in the same region. Specialized sectors such as tech, finance, or legal services may also command premium salaries to attract high-skilled talent.

3. Company Size

Small businesses and startups may operate under tighter budget constraints, affecting how much they can offer employees. Larger organizations, on the other hand, often benefit from economies of scale in HR and payroll administration, enabling more efficient onboarding and benefits management.

However, bigger companies may also incur additional costs related to infrastructure, internal compliance, and employee engagement, areas that smaller firms may outsource or manage more flexibly.

4. Market Conditions

The labor market’s competitiveness directly affects hiring costs. In an employee-driven market, where demand exceeds supply, companies must increase compensation and offer enhanced benefits to attract top candidates. Conversely, during economic downturns or in employer-favored markets, hiring costs may stabilize or decrease.

5. Unionization

Unionized workforces typically involve structured wage scales, collective bargaining agreements, and specific benefit entitlements. These agreements may result in higher wages and more comprehensive employee benefits than in non-unionized environments.

Even for non-union firms, operating within a highly unionized industry often pressures employers to offer competitive wages to attract talent, indirectly increasing labor costs.

Also Read: Managing Remote Teams Best Practices

6. Turnover Rate

High turnover can drain company resources quickly. Costs associated with recruitment advertising, interview processes, training, and onboarding can accumulate with each replacement hire. A high attrition rate often indicates issues with compensation, job satisfaction, or work culture, each of which can raise employee-related costs in the long run.

Reducing turnover through better talent matching, employee engagement strategies, and competitive compensation can significantly cut costs over time.

7. Job Complexity and Skill Level

Roles that require rare or highly technical skills generally command higher compensation. For example, a certified cybersecurity analyst or experienced legal counsel will require a more substantial compensation package than an entry-level administrative assistant.

In addition, long-tenured employees or those in leadership roles may receive more generous health insurance, retirement contributions, or stock options—adding to total labor costs.

8. Productivity and Performance

Highly productive employees often offset their higher salaries by delivering greater output and reducing the need for additional hires. On the other hand, underperformance can result in hidden costs, such as missed deadlines, project delays, and wasted resources.

To boost productivity, many companies invest in incentive programs, like performance bonuses, learning and development budgets, or flexible work arrangements, which, while adding cost, can drive long-term gains in engagement and retention.

Also Read: Examples of Outsourcing

The True Cost of Hiring an Employee

Many employers make the common mistake of focusing solely on an employee’s base salary when calculating labor costs. However, the actual expense of hiring and retaining an employee goes well beyond just wages. Understanding the true cost is essential for effective budgeting, workforce planning, and long-term business success.

When you consider recruitment, onboarding, payroll taxes, employee benefits, insurance, workplace overhead, and turnover costs, the total expenditure typically ranges from 1.25 to 1.4 times the employee’s base salary. This multiplier can vary depending on your industry, location, and company-specific policies, but it offers a useful rule of thumb to ensure you don’t underestimate labor expenses.

Breaking Down the Key Cost Components

1. Base Salary:

This is the fixed annual or hourly wage agreed upon with your employee. It forms the foundation of your employee cost calculation.

2. Benefits:

Benefits can include health insurance, retirement contributions, paid time off, disability insurance, and other perks. For many employers, benefits add approximately 15% to 30% on top of base salary, depending on the level of coverage and employee participation rates.

3. Payroll Taxes:

In many jurisdictions, employers are responsible for payroll taxes such as Social Security and Medicare in the U.S., or contributions to the Central Provident Fund (CPF) in Singapore, or superannuation in Australia. These taxes are legally mandated and vary by region. For example, U.S. employers pay 7.65% for FICA taxes, which includes Social Security and Medicare contributions.

4. Insurance and Compliance Costs:

Employers often cover costs related to workers’ compensation insurance, unemployment insurance, and other regulatory compliance fees. These expenses protect both the company and the employee but add to the overall cost.

5. Overhead Expenses:

Overhead includes the indirect costs of employing someone, such as office space, utilities, technology (computers, software licenses), office supplies, and equipment. These costs can be significant, especially if you provide a fully equipped workstation or remote working technology.

6. Turnover Costs:

Replacing an employee is expensive. It includes recruitment advertising, background checks, interviewing time, onboarding, and lost productivity during the vacancy period. Research shows that turnover costs can equal between 20% to 50% of an employee’s annual salary, depending on the role’s seniority and specialization.

Also Read: How to Switch Your EOR Provider

Example Employee Cost Calculation

Let’s say you hire an employee with a base salary of USD $60,000 annually. Here’s an example breakdown of other costs you might incur:

| Cost Component | Amount | Percentage of Base Salary |

| Base Salary | $60,000 | 100% |

| Benefits | $9,000 | 15% |

| Payroll Taxes | $4,590 | 7.65% (U.S. FICA) |

| Insurance | $3,000 | 5% |

| Overhead | $5,000 | 8.3% |

| Turnover Costs | $5,000 | 8.3% |

| Total Employee Cost | $86,590 | 144.3% (1.44x salary) |

This example illustrates how the true cost to the employer is nearly one and a half times the employee’s base salary. Overlooking these additional expenses can lead to significant budgeting shortfalls and impact your business’s profitability.

Essential Resources for Employer Obligations

To comply with tax and employment regulations, it’s important to stay updated on employer obligations in your region. Here are some authoritative resources:

- IRS Employer Tax Guide (U.S.) – Details on federal employer tax responsibilities including Social Security, Medicare, and unemployment taxes.

- Ministry of Manpower (Singapore) – Employer Obligations – Guidance on CPF contributions, employment laws, and mandatory benefits.

- Fair Work Ombudsman (Australia) – Hiring Employees – Comprehensive information on workplace laws, payroll taxes, and employment conditions.

Understanding and accurately calculating the true cost of hiring is vital for financial planning, setting competitive compensation packages, and maintaining healthy business operations. With a clear view of your total labor costs, you can make smarter hiring decisions and sustain long-term growth.

Global Cost Comparison: In-House vs. Offshore Hiring

When evaluating the total cost of hiring employees, businesses must consider more than just base salaries. Payroll taxes, statutory contributions, benefits, and overhead can significantly affect overall expenses. This is especially important for companies deciding between hiring locally (in-house) or offshore through Employer of Record (EOR) services like FastLaneRecruit. Below is a detailed comparison of the average annual costs for a mid-level full-time employee in several key markets:

| Country | Average Base Salary | Estimated Total Cost (1.4x multiplier) | Typical Payroll Tax Rate | Cost Ranking |

| United States | $70,000 USD | $98,000 USD | 7.65% (FICA employer share) | High |

| Australia | AUD 80,000 | AUD 112,000 | 9.5% (Superannuation) | High |

| Singapore | SGD 60,000 | SGD 84,000 | 17% (Central Provident Fund, shared employer-employee) | Medium |

| Malaysia | MYR 50,000 | MYR 65,000 | 13% (Employee Provident Fund) | Low |

| Philippines | PHP 500,000 | PHP 700,000 | Approximately 10% payroll-related contributions | Low |

Understanding the Numbers

1. United States

The U.S. has relatively high base salaries and mandatory payroll taxes, such as Social Security and Medicare (FICA), contributing approximately 7.65% in employer payroll taxes. Additionally, companies often provide extensive benefits, further increasing total costs. Regulatory compliance and employee protections also add indirect costs.

Also Read: Best Practices for Remote Work Performance Management

2. Australia

In Australia, the base salary is often higher due to the cost of living and labor market conditions. Employers must contribute to superannuation, a retirement fund equivalent to 9.5% of wages. Benefits and strict employment laws also contribute to higher labor costs, making it a costly market for employers.

3. Singapore

Singapore’s Central Provident Fund (CPF) is a mandatory savings scheme funded by both employer and employee contributions, totaling about 17%. Despite relatively high payroll taxes, Singapore remains attractive for regional headquarters and high-skill talent due to its robust infrastructure and business environment.

4. Malaysia

Malaysia offers a competitive labor market with lower average salaries and mandatory contributions like the Employee Provident Fund (EPF) at 13%. The cost advantage is significant, especially for companies looking to hire skilled professionals at a fraction of the cost of Western markets. This makes Malaysia an increasingly popular offshore destination for businesses.

5. Philippines

The Philippines provides a large pool of English-speaking talent with moderate base salaries and payroll-related taxes around 10%. Many companies use the Philippines for offshore support functions due to the favorable cost structure and talent availability.

Cost Savings Through Offshore Hiring with EOR Services

For companies considering global expansion or cost reduction, hiring offshore through an EOR provider like FastLaneRecruit can offer substantial savings. By managing all statutory compliance, payroll administration, and HR functions locally, EORs enable businesses to tap into Malaysia’s cost-effective talent market without the need to establish a local entity.

Also Read: The Pros and Cons of Employers of Record

Key benefits include:

- Up to 60% Cost Reduction: Compared to hiring an employee in the U.S. or Australia, businesses can reduce total labor expenses by as much as 60% by hiring in Malaysia via an EOR.

- Elimination of Local Setup Costs: No need to navigate complex local registration or compliance processes, saving both time and money.

- Simplified Payroll and Compliance: The EOR handles all mandatory contributions (EPF, SOCSO, EIS), tax filings, and employment law compliance.

- Access to Skilled Talent: Malaysia offers a growing pool of qualified professionals across industries, including technology, finance, and customer support.

The Hidden Costs Most Employers Miss

When budgeting for a new hire, many companies focus only on salary and major benefits but the real picture includes several hidden and indirect costs. Ignoring these can throw off your budgeting and profitability forecasts. Below are the often-overlooked components that contribute to the true cost of employment:

Recruitment Costs

The hiring process doesn’t come free. Whether you’re using internal recruiters or external agencies, the process of sourcing, screening, and interviewing candidates consumes time and money:

- Job board postings and advertising

- Recruitment agency fees (typically 15–25% of annual salary)

- Time spent by internal staff reviewing resumes and conducting interviews

- Pre-employment assessments and background checks

Onboarding and Training

Getting a new hire up to speed has its own set of expenses:

- Setting up IT equipment, email accounts, and internal tools

- Allocating time from supervisors or team members to provide training and shadowing

- Temporary dips in productivity as the new hire adjusts

- Cost of training materials or learning management systems

Benefits and Perks

These may vary based on geography but are essential to attract and retain talent:

- Health, dental, and vision insurance

- Retirement plans or pensions

- Performance bonuses or profit-sharing

- Paid time off, holidays, and sick leave

Payroll Tax and Statutory Contributions

Mandatory government contributions differ by country and are a critical component of total employment cost:

- United States: FICA (Social Security and Medicare) at 7.65%

- Singapore: Central Provident Fund (CPF) contributions up to 17%

- Australia: Superannuation at 9.5%

- Malaysia: Employees Provident Fund (EPF) around 13%

- Other: State insurance, unemployment contributions, and workers’ compensation

Employee Turnover

The cost of losing and replacing a team member is substantial. According to the U.S. Department of Labor, replacing a bad hire can cost up to 30% of that employee’s annual salary.

- Exit interviews and administrative processing

- Time and money spent hiring a replacement

- Loss of institutional knowledge

- Temporary productivity dips

These hidden costs add up quickly, which is why understanding the full cost of employment is critical, especially for startups and growing companies. Reducing these expenses is one reason many firms turn to offshore hiring and Employer of Record (EOR) services.

Also Read: Why Do Companies Choose to Outsource?

In-House vs. FastLaneRecruit EOR Model

Hiring talent internationally often comes with a choice: build your own legal presence or partner with an Employer of Record (EOR) like FastLaneRecruit. While in-house hiring gives you direct control, it comes with a significant administrative and financial burden. The EOR model, on the other hand, offers a faster, simpler, and more cost-effective solution, especially for businesses scaling into new markets.

Here’s a side-by-side comparison:

| Feature | In-House Hiring | FastLaneRecruit (EOR) |

| Legal Entity Required | Yes – Must register a local entity | No – FastLaneRecruit becomes the legal employer |

| HR & Payroll Admin | Yes – Managed internally | Fully handled by FastLaneRecruit |

| Hiring Timeline | 4–12 weeks – Includes incorporation & setup | 1–8 weeks – Quick onboarding via EOR |

| Employment Compliance | Your team must stay up to date | FastLaneRecruit ensures full local compliance |

| Employee Benefits & Taxes | Must manage contributions & calculations | FastLaneRecruit handles statutory benefits |

| Cost Savings | Higher – Overhead, tax setup, local consultants | Save up to 60% on total employment costs |

| Scalability | Slower – Requires more setup per country | Seamless – Scale to new countries without entity setup |

Bottom Line:

FastLaneRecruit’s EOR service takes the heavy lifting off your plate. You get access to global talent, especially from high-potential markets like Malaysia, without the need to build costly infrastructure or navigate complex regulations.

Smart Cost-Saving Strategies for Employers

Whether you’re a startup founder, CFO, or HR executive, keeping your hiring costs under control is essential to long-term growth. Here are proven strategies that modern businesses use to stretch their HR budget without sacrificing talent quality:

1. Leverage an Employer of Record (EOR)

An EOR allows you to legally hire in countries without setting up a local entity. This significantly reduces upfront costs, ongoing compliance management, and local payroll complications. You also avoid the delays associated with company registration, banking setup, and unfamiliar labor laws.

2. Outsource Non-Core Functions

Consider outsourcing functions like legal documentation, data entry, administrative support, and customer service. This frees up your core team to focus on revenue-driving roles while reducing operational expenses. FastLaneRecruit specializes in placing top-tier outsourced professionals at cost-effective rates.

3. Hire in Emerging Talent Markets

Countries like Malaysia offer highly skilled professionals at a fraction of the cost compared to the U.S., Australia, or Singapore. With a growing English-speaking workforce and strong business infrastructure, Malaysia is fast becoming a preferred hiring destination for global employers.

4. Automate HR and Payroll Workflows

Reduce manual effort by using modern HR tech platforms. Automate onboarding paperwork, e-signatures, timesheets, and payroll reporting. FastLaneRecruit integrates these processes into its EOR model, so you stay efficient and compliant.

Also Read: Outsourced Accounting – Frequently Asked Questions (FAQ)

5. Adopt a Remote-First Workforce

Shifting to remote work can drastically cut costs associated with office space, utilities, equipment, and commuter subsidies. By offering flexible work setups and remote-friendly benefits, you attract a wider talent pool while keeping overhead low.

Why Hire With FastLaneRecruit?

FastLaneRecruit helps global companies hire and pay Malaysian employees legally and efficiently through our EOR service.

- Legally employ talent in Malaysia without opening a local office

- Handle payroll, tax, statutory filings, benefits, and compliance

- Rapid hiring and onboarding (3–8 weeks)

- Transparent pricing, no hidden fees

Book a free consultation!

The True Cost of Hiring an Employee in Malaysia with FastLaneRecruit’s EOR Service

Many Malaysian businesses underestimate the full cost of hiring by focusing only on the employee’s monthly salary. However, when you factor in statutory contributions, mandatory benefits, compliance costs, and overheads, the actual cost can be significantly higher. For companies seeking to streamline hiring and payroll management, FastLaneRecruit’s Employer of Record (EOR) service provides a smart solution to simplify compliance and control costs while efficiently expanding your Malaysian workforce.

What Makes Up the True Cost of an Employee in Malaysia?

When hiring directly or through an EOR like FastLaneRecruit, employers need to consider multiple components beyond just wages. Here’s what to include for a comprehensive understanding:

1. Base Salary

This is the agreed gross monthly or annual salary for your employee. It serves as the starting point for your employee cost calculation.

2. Statutory Contributions and Payroll Taxes

Malaysian employers are required to contribute to key statutory bodies, which include:

- Employee Provident Fund (EPF): Employers contribute 12% (up to 13% for some sectors) of the employee’s monthly salary.

- Social Security Organization (SOCSO): Employer contributions vary depending on the employee’s salary bracket, typically between 1.75% to 1.95%.

- Employment Insurance System (EIS): A mandatory contribution of 0.2% paid by the employer.

- Income Tax Withholding: Employers are responsible for deducting monthly tax from employees’ salaries and submitting to the Inland Revenue Board (LHDN).

These contributions are legally mandated and non-negotiable, significantly adding to the total labor cost.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

3. Employee Benefits

While Malaysia does not mandate extensive employee benefits beyond statutory minimums, many companies offer additional perks such as:

- Medical insurance or outpatient coverage

- Annual bonuses or performance incentives

- Paid annual leave beyond statutory minimums

- Training and professional development allowances

Providing competitive benefits enhances talent attraction and retention but also increases labor costs.

4. Insurance and Compliance Costs

Employers must maintain proper employment contracts, comply with the Employment Act, and pay for worker protection insurance, such as SOCSO. Non-compliance can lead to hefty penalties, so factoring these administrative and legal expenses into your budget is essential.

5. Overhead Costs

Overhead includes office space, equipment, utilities, internet, software licenses, and other resources needed for employees to perform their work. For companies using FastLaneRecruit’s EOR, much of the administrative burden is managed for you, but indirect costs still apply.

6. Turnover and Recruitment Costs

Hiring costs are not limited to salaries and benefits. They also include expenses related to recruitment advertising, interview time, background checks, onboarding, and lost productivity during vacancies. Malaysian businesses often face high turnover in certain sectors, making this an important cost to monitor.

Also Read: Building Offshore Project Team in Malaysia For Australian Companies

How FastLaneRecruit’s EOR Service Helps Optimize Employee Costs in Malaysia

FastLaneRecruit’s EOR solution allows you to hire Malaysian employees quickly without the complexities of local labor laws, payroll tax filing, and statutory compliance. Here’s how using an EOR benefits your cost management:

- Simplified Compliance: FastLaneRecruit handles EPF, SOCSO, EIS, and tax filings on your behalf, reducing the risk of non-compliance fines.

- Cost Transparency: The EOR service packages all statutory and administrative costs into a clear monthly fee, helping you forecast total labor expenses accurately.

- Scalability: Easily scale your team up or down without long-term employment contracts or severance liabilities on your books.

- Reduced Overhead: No need to set up local entities, offices, or HR departments; FastLaneRecruit manages employment logistics and infrastructure.

Example: Calculating the True Cost of a Malaysian Employee

Let’s assume that you are an employer from Malaysia and you want to hire a Malaysian employee with a monthly gross salary of MYR 5,000. Here’s an estimated breakdown of the additional employer costs:

| Cost Component | Amount (MYR) | Percentage of Base Salary |

| Base Salary | 5,000 | 100% |

| EPF Employer Contribution | 600 (12%) | 12% |

| SOCSO Employer Contribution | 75 (approx.) | 1.5% |

| EIS Employer Contribution | 10 (0.2%) | 0.2% |

| Employee Benefits | 300 (medical, etc.) | 6% |

| Overhead | 400 (workspace, tech) | 8% |

| Recruitment & Turnover | 400 (annualized) | 8% |

| Total Monthly Cost | 6,785 | 135.7% of salary |

In this example, your total monthly employment cost is approximately 1.36 times the base salary, reflecting mandatory contributions plus other indirect costs. Using FastLaneRecruit’s EOR service, these elements are consolidated for simplicity and compliance.

Also Read: Build Your Offshore HR and Payroll Management Team in Malaysia

Authoritative Malaysian Resources for Employer Obligations

To stay compliant and informed, review official Malaysian regulatory sources:

- Employees Provident Fund (EPF) – Details on employer and employee contribution rates and compliance.

- Social Security Organization (SOCSO) – Information on workplace insurance and contributions.

- Employment Insurance System (EIS) – Coverage and contribution details.

- Malaysian Employment Act – Legal framework for employment terms and employer responsibilities.

Calculating the true cost of hiring an employee in Malaysia involves more than just their salary. By understanding statutory contributions, benefits, overhead, and turnover costs, you can budget accurately and avoid unexpected financial burdens. FastLaneRecruit’s Employer of Record service simplifies this complex landscape by managing compliance, payroll, and statutory filings for you, making it easier to expand your Malaysian team while controlling costs.

If you’re ready to hire and pay Malaysian employees seamlessly, FastLaneRecruit’s EOR service offers a reliable, cost-effective solution that ensures full legal compliance and transparent cost management.

Also Read: Guide for Australian Companies to Hire Malaysian Employees

Conclusion

Hiring globally can save you money, but only if you truly understand the costs involved. Don’t let hidden taxes, legal risks, or miscalculated benefits catch you off guard.

With FastLaneRecruit’s EOR solution, you can hire smarter, scale faster, and stay compliant without breaking the bank. It’s time to rethink your hiring strategy. Book a free 30-min Discovery call with FastLaneRecruit!

FAQs

What is the Employer Cost Multiplier?

It’s the total cost of hiring an employee as a multiple of base salary. Typically ranges from 1.25x to 1.4x due to taxes, benefits, and overhead.

What does FastLaneRecruit’s EOR service include?

Everything from employment contracts, payroll processing, benefits administration, to compliance filings in Malaysia.

Can I hire Malaysian employees without setting up a local office?

Yes. FastLaneRecruit lets you hire legally without needing to register a local company.

How quickly can I onboard talent with FastLaneRecruit?

Most clients onboard their first hire in 1–2 weeks.

Is EOR legal?

Absolutely. EOR is a fully legal model backed by local labor laws and trusted by thousands of global companies.

Why hire from Malaysia?

Malaysia offers a skilled, English-speaking workforce, lower employment costs, and strong cultural compatibility with Western markets.

Need help calculating the true cost of your next hire? Let FastLaneRecruit guide you.