As businesses increasingly expand their footprints across international borders, managing global payroll has evolved from a complex administrative burden into a strategic necessity. The growing demand for remote teams, cross-border operations, and distributed workforces means that accurate, compliant, and scalable payroll systems are more essential than ever. In 2025, businesses are seeking payroll providers who can seamlessly integrate HR, tax compliance, and global payments, while offering real-time visibility and data-driven insights.

Choosing the right international payroll provider can enhance operational efficiency, mitigate compliance risks, and elevate employee satisfaction worldwide. This guide explores the best international payroll providers of 2025, their standout features, and how to select the right one for your organization.

Also Read: Best Practices for Remote Work Performance Management

Content Outline

Key Summary

International payroll solutions enable international companies to compliantly hire, pay, and manage employees across multiple countries without establishing local entities.

Oyster, Rippling, Papaya Global, ADP GlobalView, Remote, Gusto, and FastLaneRecruit stand out as leading payroll providers in 2025, each offering unique features and regional strengths.

Choosing the right provider involves evaluating key factors such as service availability, pricing transparency, industry expertise, ease of use, and compliance capabilities.

Essential payroll processing features include automated tax compliance, multi-currency payments, EOR support, benefits administration, and real-time reporting.

FastLaneRecruit offers tailored payroll and EOR services for international businesses hiring in Malaysia, combining compliance expertise with streamlined onboarding and payment solutions.

Leveraging the right payroll partner can reduce risk, improve efficiency, and support the growth of global and remote teams in a legally sound manner.

What Are International Payroll Solutions?

International payroll solutions are platforms or service providers that manage salary disbursement, tax compliance, social security contributions, benefits administration, and regulatory reporting for employees across multiple countries. These solutions are designed to ensure businesses remain compliant with local labor laws, tax authorities, and statutory obligations, regardless of where their workforce resides.

Global payroll providers often offer Employer of Record (EOR) services, enabling global businesses to hire in countries where they do not have a legal entity. This solution supports both compliance and agility, two pillars of successful international employment.

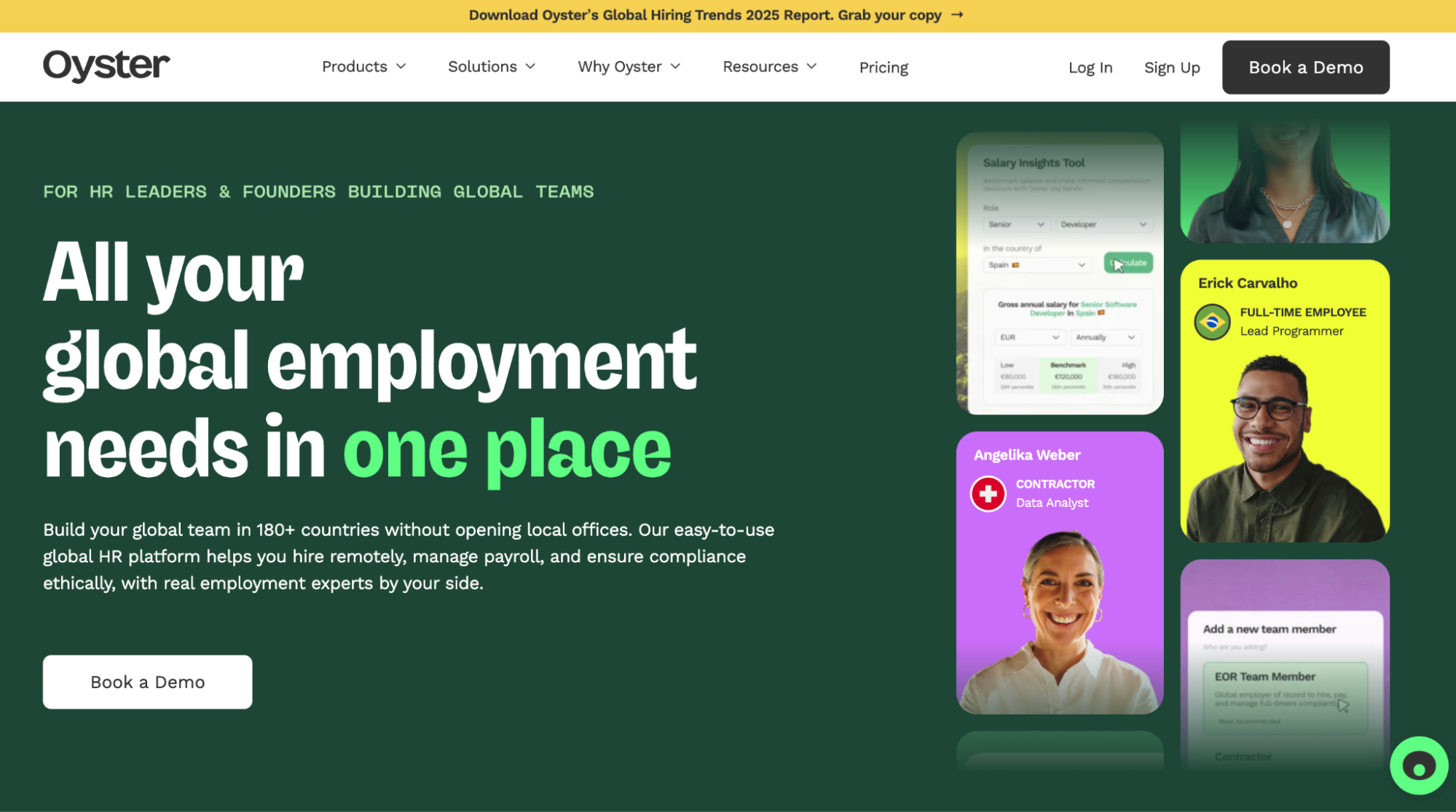

1. Oyster

Oyster has emerged as a frontrunner in the global payroll space, particularly for companies prioritizing ethical hiring and equitable compensation. It provides end-to-end payroll management, EOR services, and automated compliance for more than 180 countries.

Oyster’s standout feature is its commitment to salary intelligence and transparency. Employers can benchmark compensation globally while complying with local tax and labor laws. This data-driven approach is especially valuable for businesses seeking to maintain fairness in global pay structures.

Additionally, Oyster’s digital onboarding, benefits management, and support for intellectual property protection make it a robust choice for startups and scale-ups expanding globally.

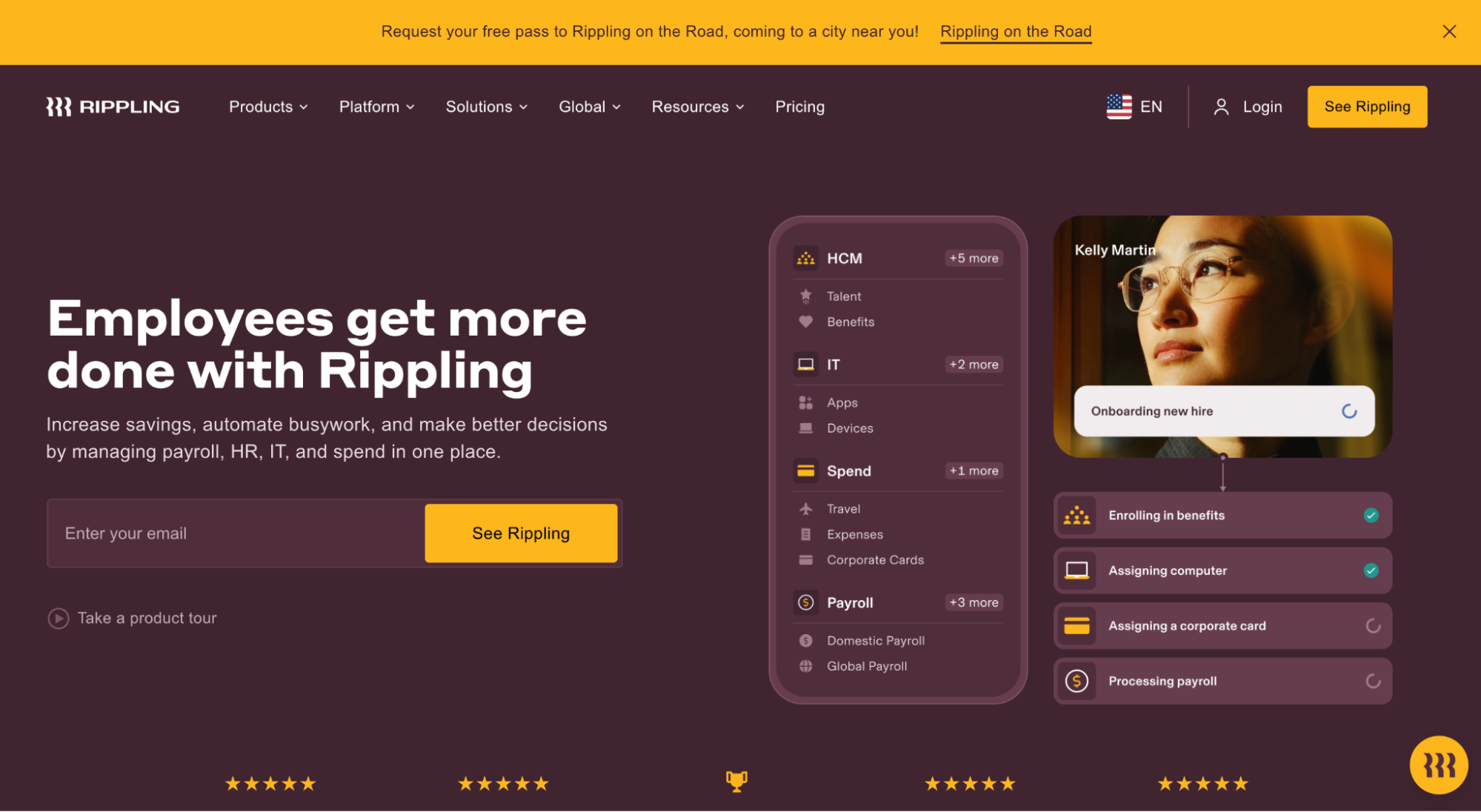

2. Rippling

Rippling bridges the gap between HR, IT, and finance by offering a unified platform that automates everything from device management to international payroll. For global businesses operating abroad, Rippling’s Global Payroll system delivers remarkable efficiency by syncing employee data across all functions.

One of Rippling’s core strengths lies in its automation capabilities. From tax filings to currency conversions and benefits enrollments, the system reduces manual overhead and minimizes errors. Moreover, its customizable dashboards provide CFOs and HR leaders with real-time insights into workforce costs across jurisdictions.

For companies seeking a platform that scales with their tech stack, Rippling’s integrations and modular pricing make it a compelling contender.

3. Papaya Global

Papaya Global focuses on combining compliance assurance with tech innovation. Its global payroll platform supports direct payments, tax filing, and multi-currency salary distribution in over 160 countries. Papaya’s automated classification system reduces misclassification risks, an essential feature when hiring international contractors or freelancers. The platform also offers workforce cost breakdowns and regulatory insights, helping finance teams budget more accurately and stay ahead of global tax changes.

Security and compliance are built into Papaya’s DNA, making it ideal for highly regulated industries like finance and healthcare.

Also Read: The Pros and Cons of Employers of Record

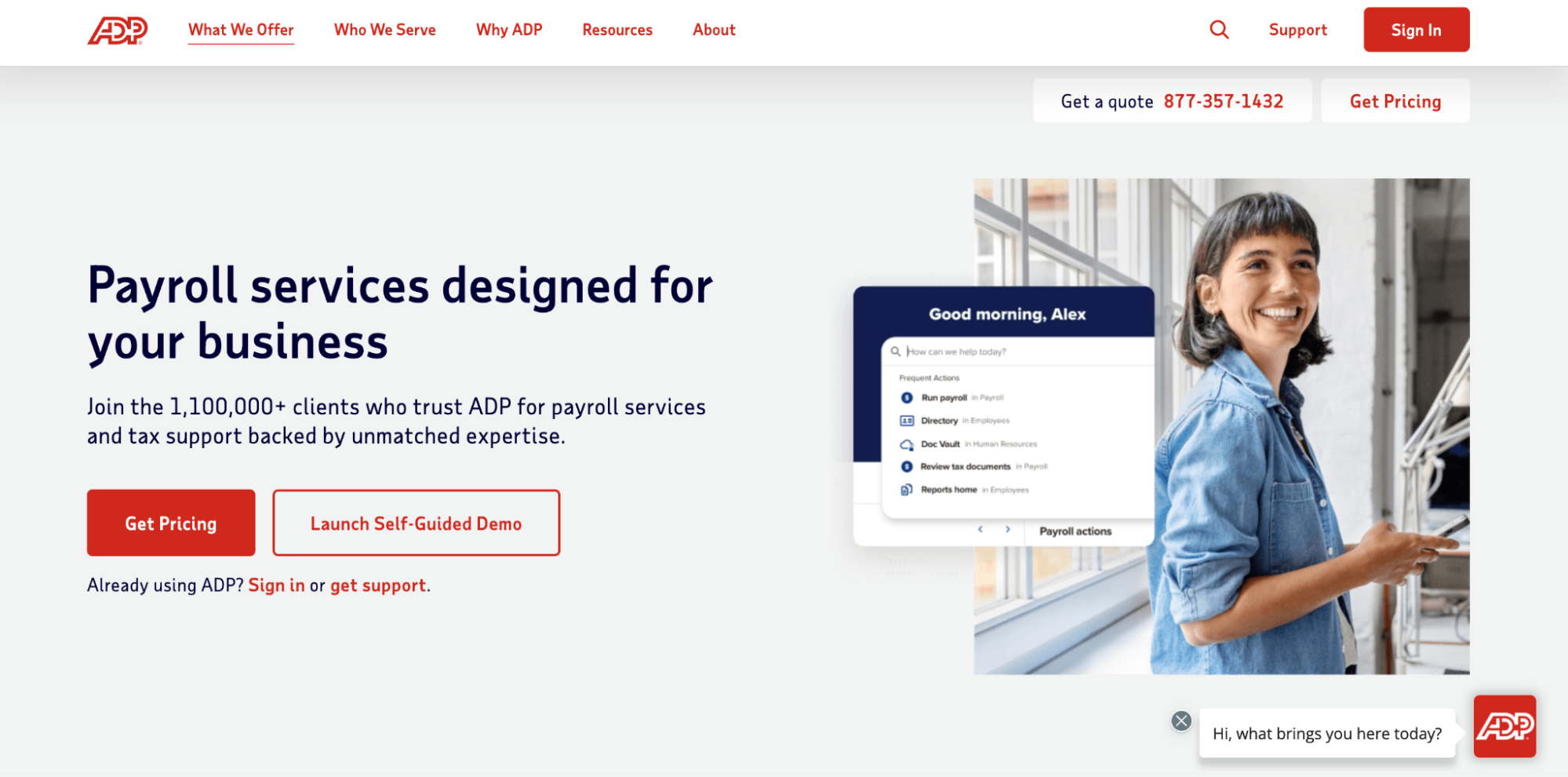

4. ADP GlobalView Payroll

A legacy provider with unmatched scale, ADP GlobalView Payroll is engineered for large global enterprises with international subsidiaries. Backed by decades of experience, ADP offers comprehensive payroll compliance, tax filing, benefits administration, and multi-language support.

GlobalView integrates seamlessly with SAP and other major ERP systems, providing a centralized platform for HR and payroll data management. Its local expertise in over 100 countries ensures businesses adhere to country-specific regulations, from China’s IIT to Brazil’s INSS.

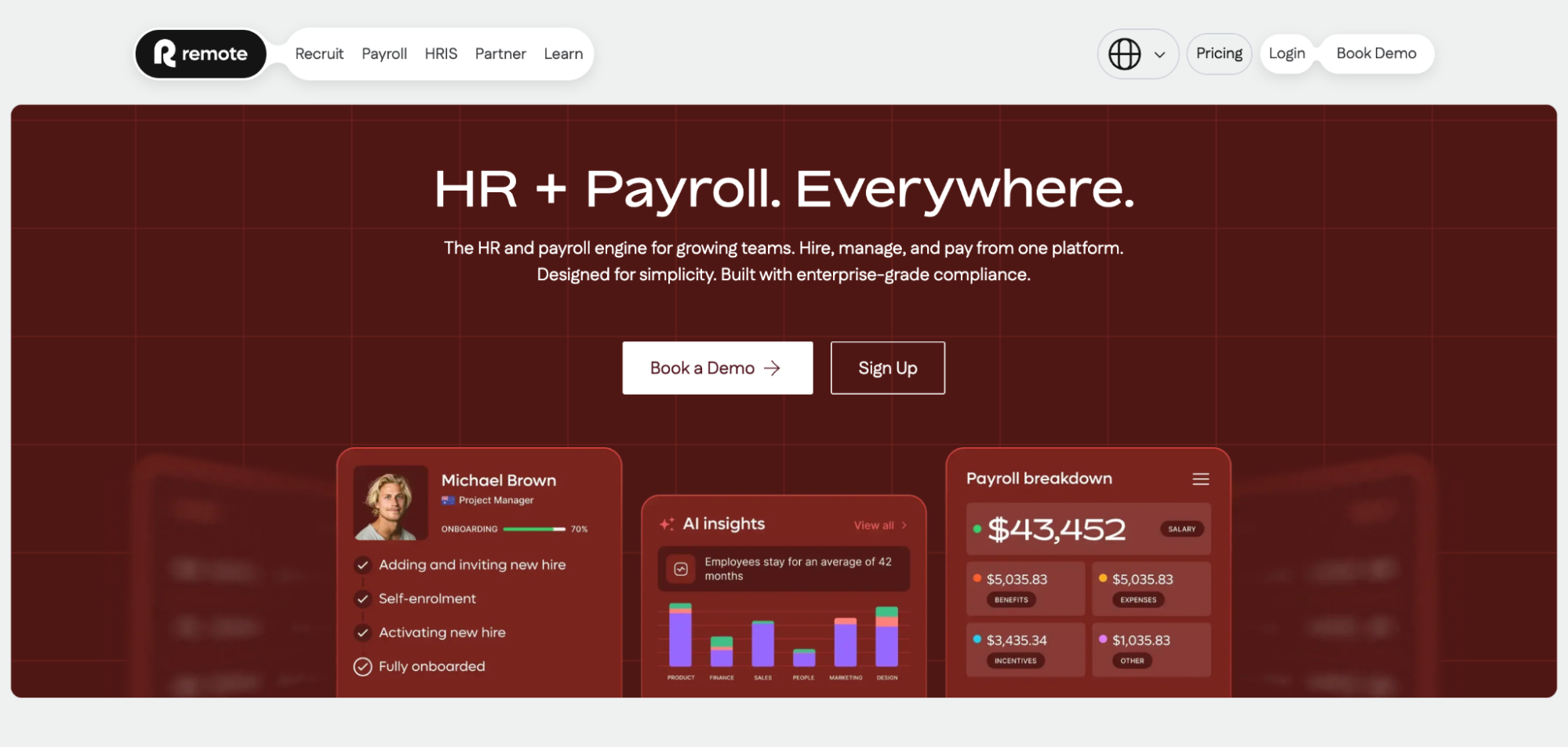

5. Remote

Remote has become synonymous with frictionless global employment. Its EOR and payroll services are available in more than 75 countries, offering legally compliant hiring without requiring a local entity.

Remote’s legal infrastructure allows for secure IP transfer, contractor compliance, and equity management, which appeals to tech startups and creative firms. It supports globa; businesses with transparent pricing, localized contracts, and full HR support.

In addition, Remote’s platform includes an intuitive UI, instant onboarding tools, and a robust knowledge base for global labor laws, making it an ideal choice for fast-growing teams.

6. Gusto

Though traditionally focused on domestic payroll, Gusto has expanded its global reach through partnerships and integrations. International businesses benefit from Gusto’s simple interface, tax filing automation, and employee self-service portals.

Its new Global Contractor Payroll feature supports payments in over 80 countries, with clear visibility into costs and timelines. While not a full-fledged EOR like others on this list, Gusto remains a great starting point for small businesses testing international hiring waters.

Also Read: Why Do Companies Choose to Outsource?

7. FastLaneRecruit: Your Gateway to Compliant Hiring and Payroll in Malaysia

FastLaneRecruit empowers international companies to seamlessly tap into Malaysia’s skilled workforce without the need to establish a local entity. Specializing in remote hiring and payroll for Malaysian talent, FastLaneRecruit delivers fully compliant Employer of Record (EOR) and payroll solutions that align with the nation’s labor, tax, and social security regulations.

With localized expertise in Malaysian employment law, including EPF, SOCSO, and EIS contributions, FastLaneRecruit offers end-to-end support from onboarding to salary disbursement. The platform simplifies cross-border employment by ensuring accurate tax withholding, statutory benefit compliance, and streamlined documentation.

In addition to payroll services, FastLaneRecruit provides strategic talent sourcing. Its intuitive workflow and expert-led service model make it an ideal partner for global businesses seeking to scale remote teams in Malaysia with confidence and control.

8 International Payroll Processing Features to Consider

| Feature | Description |

| Automated Tax Compliance | Ensures local tax rules, withholding, and filings are followed. |

| Multi-Currency Payments | Supports salary payments in local currencies with real-time FX rates. |

| Global Time Tracking | Tracks hours and attendance across time zones and labor regulations. |

| Contractor & Employee Support | Facilitates classification, onboarding, and payments for both types. |

| Integrated Benefits Admin | Offers access to local healthcare, pensions, and statutory benefits. |

| Data Localization | Adheres to local data protection laws like GDPR or PDPA. |

| Real-Time Reporting | Provides dashboards with payroll summaries, costs, and compliance insights. |

| EOR Capabilities | Allows employment without a local entity via a legal Employer of Record. |

A reliable international payroll provider must handle far more than just pay slips. Comprehensive features ensure not only compliance but also a seamless employee experience.

Also Read: How to Pay International Employees

How to Choose an International Payroll Service

Service Availability

Ensure the provider operates in the specific countries you intend to hire. Regional limitations can hinder expansion and create compliance blind spots. Opt for providers with in-house entities or vetted local partners.

Industry Experience

Not all payroll providers serve all sectors equally. Look for those with experience in your industry, be it tech, logistics, or manufacturing. Regulatory environments vary, and industry-specific expertise reduces risk.

Pricing

International payroll pricing models vary: per employee, per country, or flat monthly fees. Ensure transparency, particularly around currency exchange, onboarding fees, and early termination clauses.

| Provider | Pricing Model | Transparency Level |

| Oyster | Per employee | High |

| Rippling | Modular pricing | Medium |

| Papaya Global | Tiered pricing | High |

| ADP GlobalView | Custom quote | Medium |

| Remote | Flat fee | High |

| Gusto | Per contractor | High |

Core Global Payroll Services

Evaluate if the provider supports payroll taxes, social security, statutory benefits, and compliance audits. Robust support across these pillars ensures smooth operations globally.

Ease of Use

A user-friendly interface accelerates onboarding and reduces the learning curve. Features like mobile access, document e-signatures, and self-service portals can significantly streamline HR operations.

Customer Reviews

Review third-party sources like G2, Trustpilot, or Capterra for candid feedback. Pay close attention to support responsiveness, ease of integration, and reliability during local tax filing seasons.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

Conclusion

The global workforce is no longer a trend; it is the new reality. Selecting the best international payroll provider requires balancing technology, compliance, and human support. Whether your business is scaling into Southeast Asia, Latin America, or Europe, aligning with the right partner ensures both legal adherence and financial predictability.

The providers listed above represent the gold standard for 2025. Each offers distinct strengths tailored to different business sizes, sectors, and hiring models.

Hire and Pay Malaysian Employees with Confidence Through FastLaneRecruit

At FastLaneRecruit, we specialize in helping international companies seamlessly pay and manage employees in Malaysia. Our platform simplifies payroll processing while ensuring full compliance with Malaysia’s tax regulations and labor laws, including EPF, SOCSO, and EIS.

Whether you’re hiring full-time staff or remote freelancers in Malaysia, we provide tailored EOR solutions, payroll execution, and HR support. Let us help you build a thriving remote team, compliant, cost-effective, and stress-free. Contact Us!