Processing payroll accurately and on time is not just about paying employees; it’s about showing respect, ensuring legal compliance, and building trust within your workforce. Whether you’re hiring remote professionals or managing in-market talent in Malaysia and beyond, payroll can be complex, but it doesn’t have to be.

In this article, we’ll walk you through how to process payroll efficiently and compliantly, wherever your talent is located. You’ll also learn tips for streamlining global payroll and why FastLaneRecruit is your trusted partner for processing Malaysian payroll and hiring top talent in Malaysia.

Content Outline

Key Summary

What Is Employee Outsourcing

Employee outsourcing is a hiring strategy where a third-party provider, such as an Employer of Record (EOR), manages recruitment, payroll, and compliance on behalf of a company.

Why Businesses Outsource Employees

Outsourcing allows businesses to reduce operational overhead, access skilled talent quickly, maintain legal compliance, and expand without establishing a local entity.

Who Should Consider Employee Outsourcing

Startups, foreign companies entering Malaysia, and SMEs looking to scale or test new markets without long-term commitment can benefit from outsourcing.

How FastLaneRecruit Supports Outsourcing

FastLaneRecruit serves as an EOR, managing the complete outsourcing process including recruitment, onboarding, payroll, contributions, and regulatory compliance.

Ensures Full Legal Compliance in Malaysia

Outsourced employees are registered under Malaysia’s employment system, ensuring compliance with EPF, SOCSO, EIS, and PCB tax requirements.

Roles Commonly Outsourced

Popular functions for outsourcing in Malaysia include customer service, IT, marketing, HR, finance, and administrative support, thanks to the country’s skilled and multilingual workforce.

Flexible Outsourcing Models

Businesses can choose from onshoring, offshoring, or nearshoring based on their operational needs, budget constraints, and regional focus.

Key Advantages of Outsourcing

Outsourcing reduces fixed employment costs, accelerates hiring, lowers compliance risks, and provides greater flexibility for project-based or temporary roles.

Why Choose FastLaneRecruit

FastLaneRecruit delivers tailored, end-to-end employee outsourcing solutions that help businesses remain compliant, hire efficiently, and scale operations in Malaysia.

What is Payroll Processing?

Payroll processing is the end-to-end workflow involved in compensating employees accurately, compliantly, and on time. It goes beyond simply issuing salaries; it’s a legally mandated business function that involves:

- Calculating gross pay (based on time worked, salaries, or performance)

- Applying statutory deductions like income tax, retirement contributions, and social security levies

- Administering employee benefits, such as health insurance or housing allowances

- Issuing payslips that break down gross pay, deductions, and net pay

- Filing reports and making payments to government agencies on behalf of both the employer and the employee

Proper payroll processing ensures both employee satisfaction and legal compliance, which reduces risk and supports long-term organizational integrity.

Example:

Imagine you’re running a tech startup in Kuala Lumpur with 15 employees. Each month, you must:

- Calculate individual salaries based on fixed monthly rates and overtime for engineers.

- Deduct EPF (Employee Provident Fund) contributions as per KWSP/EPF regulations, SOCSO for social security (PERKESO), and income tax via PCB based on Malaysia’s LHDN tax brackets.

- Issue a digital payslip showing gross pay, deductions, and net salary.

- File and remit these deductions to the respective authorities before the statutory deadlines.

For multinational companies or remote-first teams, payroll becomes more complex due to varying regulations, currencies, and tax rules across borders. For example, while Malaysia mandates EPF contributions, Hong Kong uses MPF (Mandatory Provident Fund), and Singapore applies CPF (Central Provident Fund), each with different rates and employer responsibilities.

Maintaining compliance across these jurisdictions is critical, and often calls for local payroll experts or global payroll providers like FastLaneRecruit, especially when operating without a legal entity.

Also Read: Best International Payroll Providers of 2025

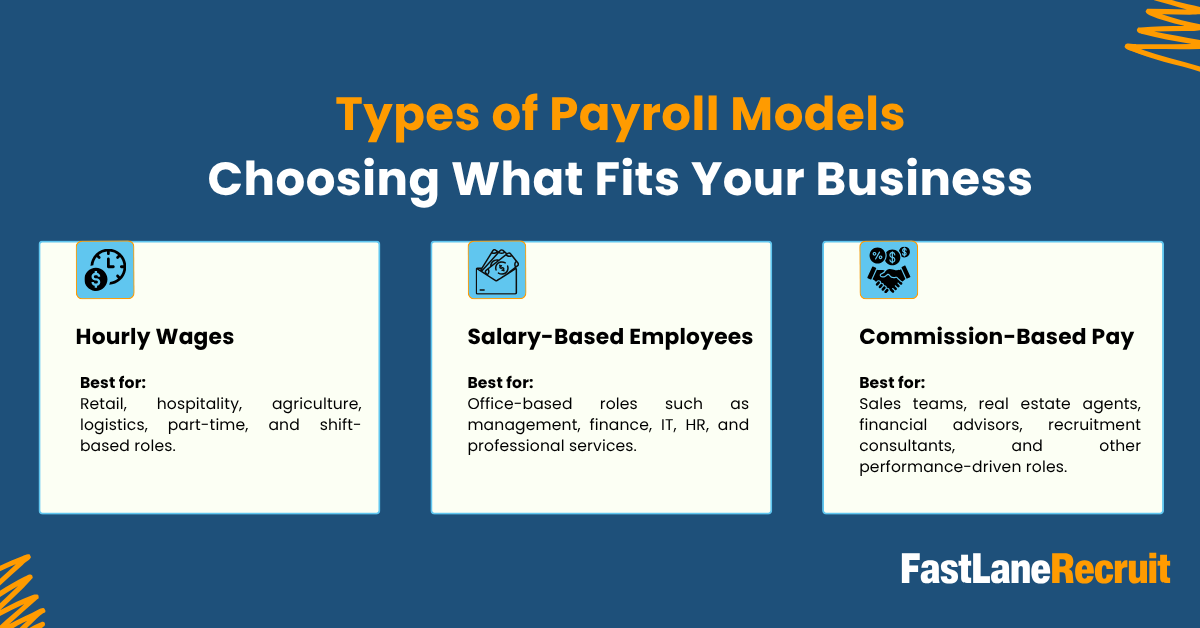

Types of Payroll Models: Choosing What Fits Your Business

When setting up your payroll system, understanding the different payroll models is key to aligning compensation strategies with your operational needs. Whether you’re managing a local team in Malaysia or a global workforce, selecting the right payroll model impacts budgeting, compliance, and employee motivation. Below are the three most common payroll types, each suited for different roles and industries.

Hourly Wages

Best for: Retail, hospitality, agriculture, logistics, part-time, and shift-based roles.

In an hourly wage model, employees are paid based on the number of hours they work. This model is commonly used in industries where working hours vary from week to week, and where overtime, night shifts, or public holiday work is frequent.

This type of payroll includes provisions for:

- Overtime pay (usually 1.5x or 2x the hourly rate)

- Holiday or weekend differentials

- Flexible scheduling and shift changes

Example:

A restaurant in Kuala Lumpur pays its waitstaff RM10 per hour. On national holidays, employees receive double pay. If one waiter works 10 hours on a public holiday, they earn RM200 (RM10 × 2 × 10 hours).

This model offers flexibility for both employer and employee, but requires accurate time-tracking systems to avoid disputes or compliance risks.

Also Read: How to Pay International Employees

Salary-Based Employees

Best for: Office-based roles such as management, finance, IT, HR, and professional services.

Salaried employees receive a fixed monthly amount regardless of the number of working days or hours in a month. This model provides income stability and simplifies payroll calculations. It also allows easier automation in payroll systems since payments are predictable.

This type of payroll usually does not include overtime unless it is stated in the employment contract. However, salaried roles often come with additional perks such as paid leave, health insurance, or performance bonuses.

Example:

A software engineer is hired by a Malaysian tech company with a fixed salary of RM6,000 per month. Even if the month has fewer working days (due to public holidays), the employee still receives the full RM6,000. Overtime is only considered if approved and documented as part of the employment agreement.

This model is efficient and cost-effective for companies seeking predictability and low administrative overhead.

Commission-Based Pay

Best for: Sales teams, real estate agents, financial advisors, recruitment consultants, and other performance-driven roles.

In a commission-based model, employee compensation is directly tied to their performance, usually through sales volume, deals closed, or targets achieved. This model often includes a base salary plus a percentage of revenue generated, though in some cases, employees may be fully commission-based.

This type of payroll encourages productivity and accountability but can lead to income variability, which may not suit all employees.

Example:

A car salesperson earns a base salary of RM2,000 per month and receives a 3% commission on sales. If the salesperson closes RM100,000 worth of deals in one month, their total income would be RM5,000 (RM2,000 base salary + RM3,000 commission).

This model is ideal for roles where performance is quantifiable and directly contributes to business growth.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

Why Understanding Payroll Models Matters

Understanding payroll models is more than just choosing how to pay employees; it directly impacts your company’s operational efficiency, financial planning, regulatory compliance, and employee satisfaction.

From a financial standpoint, selecting the right model helps manage payroll costs more effectively. For example, businesses in seasonal industries might prefer hourly wages to scale workforce costs up or down, while companies aiming for stable overheads may choose fixed monthly salaries.

From a compliance perspective, misclassifying employees or choosing the wrong model can lead to legal issues. For instance, failing to pay overtime for hourly staff or misreporting commissions may result in penalties under labor laws such as Malaysia’s Employment Act 1955.

Operationally, different roles demand different levels of pay flexibility. Commission-based models, for instance, motivate sales-driven employees, while fixed salaries help retain skilled professionals looking for income stability.

Ultimately, a clear understanding of payroll models allows you to:

- Align compensation with business goals

- Attract and retain the right talent

- Ensure smooth integration with payroll systems

- Maintain trust with your employees through transparent, fair pay practices

Choosing the right model and applying it correctly is a foundational step in building a compliant, efficient, and people-first payroll process.

Businesses with a diverse workforce comprising hourly staff for logistics, salaried professionals in the back office, and commission-based salespeople often benefit from a hybrid approach tailored to each role.

Need help managing multiple payroll types in one system? FastLaneRecruit can support end-to-end payroll setup and automation in Malaysia.

Also Read: How to Pay International Employees for a Hong Kong Company

7 Steps to Process Payroll Efficiently

Processing payroll accurately is critical for any organization, whether you’re managing a small business in Malaysia or running a multinational company with employees across Asia. Each step in the payroll process must be handled with precision to ensure timely compensation, maintain compliance with local laws, and build trust with your team.

Here’s a step-by-step guide to processing payroll efficiently, especially for businesses operating in or hiring from Malaysia.

1. Choose a Payroll System

The first step is to decide how you’ll run payroll. Businesses typically choose from one of three approaches:

- Manual processing: Done in-house using spreadsheets or accounting tools. Suitable for small teams but prone to human error.

- Payroll software: Cloud-based solutions like Talenox, Xero Payroll, or QuickBooks that automate calculations, tax filings, and payslips.

- Outsourcing: Partnering with a third-party payroll provider or using a PEO (Professional Employer Organization) or Employer of Record (EOR), like FastLaneRecruit, is ideal for companies managing teams in multiple countries without setting up local entities.

Pro Tip: For companies hiring in Malaysia, ensure your payroll system supports automated calculations for:

- EPF (KWSP/EPF): Retirement savings

- SOCSO (PERKESO): Social security protection

- EIS (SOCSO EIS): Employment insurance

- PCB (Potongan Cukai Berjadual) (LHDN): Monthly income tax deductions

2. Develop a Payroll Policy

A payroll policy is a formal document outlining your company’s approach to employee compensation. It sets expectations and ensures compliance with labor laws and internal processes.

Key areas to cover include:

- Pay frequency: Monthly, biweekly, or semimonthly

- Working hours, overtime, and public holiday compensation

- Deductions: Statutory and voluntary

- Bonus, allowance, and severance pay policies

- Leave entitlements (e.g., annual, medical, parental)

Example: A Malaysian company may define that staff are paid on the last working day of each month, receive 1.5x pay for overtime, and bonuses are issued annually based on performance reviews.

Having a written policy helps ensure fairness, consistency, and transparency, especially important when managing teams in multiple jurisdictions with different legal requirements.

Also Read: What Is Payroll Service And Why You Need It

3. Collect and Verify Employee Details

Accurate employee information is the foundation of payroll accuracy. Collect the necessary data during onboarding and verify it before the first pay cycle.

Information to gather includes:

- Full legal name and MyKad (Malaysian ID) or passport number

- Tax Identification Number (TIN) or Income Tax Number

- Bank account details for salary disbursement

- Employment contract: Position, start date, salary, benefits, working hours

Malaysia-specific Note: Employers must file tax forms such as Form IR56B for departing employees or year-end tax reporting to LHDN.

Global Tip: For remote hires, ensure bank and tax details match the employee’s country of residence to avoid payroll errors or remittance issues.

4. Calculate Gross Pay

Gross pay includes the full compensation an employee is entitled to before any deductions.

Components of gross pay typically include:

- Base salary (fixed monthly wage)

- Overtime pay (e.g., 1.5x or 2x hourly rate)

- Bonuses (e.g., annual, performance-based)

- Commissions (for sales or performance-driven roles)

- Allowances (e.g., housing, transport, meals)

Example:

A marketing manager in Kuala Lumpur earns RM7,000/month. This month, they received an RM500 performance bonus and RM300 transport allowance.

Gross Pay = RM7,000 + RM500 + RM300 = RM7,800

Maintaining detailed documentation (e.g., timesheets, bonus justifications) ensures calculations are traceable and meet audit standards.

Also Read: Payroll Mistakes You Should Avoid in Hong Kong

5. Deduct Statutory and Voluntary Contributions

Once gross pay is determined, apply the required deductions to calculate net pay. Statutory deductions vary by country and employee status.

Here’s a breakdown for Malaysian employees:

| Deduction | Authority | Purpose |

| EPF | KWSP/EPF | Retirement savings |

| SOCSO | PERKESO | Social security insurance |

| EIS | SOCSO EIS | Employment insurance coverage |

| PCB | LHDN | Monthly income tax deduction |

Voluntary deductions may include:

- Employee contributions to private insurance

- Union dues

- Loan repayments

- Charitable donations

Always obtain written employee consent for voluntary deductions and ensure they are in accordance with employment law.

6. Disburse Net Pay

After deductions, the resulting net pay is the amount transferred to the employee’s bank account.

Payment methods include:

- Direct bank deposit (most common and preferred)

- Mobile wallet (in fintech-driven regions)

- Cheques (used in limited or legacy systems)

Be sure to issue a payslip that includes:

- Gross pay

- Each deduction itemized

- Net pay

- Pay date and pay period

For cross-border teams: Use systems that support multi-currency payroll and comply with local banking regulations. Partnering with a provider like FastLaneRecruit or using global payroll software can help you avoid foreign exchange errors and banking delays.

Also Read: Guide to Payroll in Hong Kong

7. Maintain Secure and Compliant Records

Payroll records must be securely stored and accessible for audits, internal reviews, or labor disputes. They also form the basis of statutory reporting.

Documents to keep:

- Monthly payslips

- Deduction reports

- EPF/SOCSO/PCB submission records

- Annual tax forms (e.g., EA Form in Malaysia)

- Bank transfer confirmations

Retention Period Tip:

In Malaysia, payroll records should be kept for at least 7 years, as required by the Income Tax Act 1967.

Compliance Note: Use GDPR-compliant and PDPA-compliant payroll platforms that offer encryption, access control, and secure cloud backups to protect sensitive employee data.

Tips to Streamline Payroll for Global Teams

Managing payroll across multiple countries can quickly become complex due to varying labor laws, currencies, tax systems, and employee expectations. Below are proven strategies to enhance accuracy, improve efficiency, and ensure full compliance, critical aspects when building trust and demonstrating professional credibility in global payroll management.

1. Invest in Global Payroll Technology

Choosing the right payroll software or service provider can significantly reduce administrative burden and human error. Cloud-based solutions centralize payroll data, automate calculations, and ensure timely disbursement across borders.

Features to look for:

- Multi-currency support

- Country-specific compliance templates

- Integration with HRMS and accounting software

- Automated tax filings and payslip generation

Example: A Hong Kong-based company with staff in Malaysia and Singapore uses a cloud payroll solution like Talenox. This allows HR to manage local compliance (e.g., EPF in Malaysia, CPF in Singapore) while streamlining pay cycles across both regions.

Also Read: Salary Insights: How to Determine Fair Compensation For Global Talent

2. Integrate with HR and Accounting Systems

Integration between payroll, HR, and finance tools enables a seamless flow of employee and financial data, which reduces errors and improves reporting accuracy. This also ensures that any changes in employee records (e.g., promotions, bonuses, or terminations) are immediately reflected in payroll.

Key integrations include:

- HRMS: Leave tracking, onboarding, offboarding

- Accounting platforms: Reconciliation, payslip cost allocation

- Time-tracking tools: Shift and attendance syncing

Example Table:

| System | Integration Purpose | Benefit |

| BambooHR (HRMS) | Sync employee info | Accurate payroll inputs |

| Xero (Accounting) | Auto-record payroll journals | Faster reporting & auditing |

| TSheets (Time tracking) | Pull attendance data | Accurate hourly wage calculation |

3. Stay Compliant with Local Laws

Each country has its own set of labor, tax, and social security requirements that evolve regularly. Global employers must monitor these changes to avoid non-compliance penalties and employee dissatisfaction.

Malaysia Example:

- The national minimum wage was recently updated. Refer to the official portal of Jabatan Tenaga Kerja (JTK) for regional wage differences (e.g., urban vs. non-urban areas).

- EPF (KWSP) contribution rates can vary depending on government mandates and employee elections.

- Employers must comply with monthly PCB (Potongan Cukai Bulanan) tax withholding as guided by LHDN Malaysia.

Pro Tip: Assign a dedicated compliance officer or partner with a Professional Employer Organization (PEO) like FastLaneRecruit that monitors legal updates across jurisdictions and implements them promptly.

Also Read: How to Build Your Own Remote Team

4. Standardize Payroll Processes Across Countries

Create a unified payroll workflow while accommodating country-specific legal nuances. Standardization improves visibility, reduces confusion, and facilitates cross-country payroll audits.

Elements to Standardize:

- Payroll cycle (monthly, biweekly)

- Payslip format and contents

- Payroll cut-off dates

- Reporting and documentation templates

Example: FastLane manages payroll in Malaysia using a single SOP for salary approvals and processing timelines, with adjustments made for local statutory contributions and holidays.

5. Conduct Regular Payroll Audits

Payroll audits ensure your internal processes align with legal requirements and internal policies. Regular reviews help detect discrepancies early, prevent fraud, and reinforce your company’s credibility during external audits or due diligence.

What to review:

- Payslip accuracy

- Tax filing records

- Social security contribution receipts

- Employee master data vs. payroll outputs

Pro Tip: Schedule quarterly audits and document findings. Use tools like audit trails in your payroll software for traceability and transparency.

6. Offer Multilingual and Localized Support

Global teams operate across languages and cultural contexts. Ensuring payslips, helpdesk support, and HR communications are localized helps build employee trust and improves query resolution.

Example: Employees in Thailand receive payslips and tax guides in Thai, while those in the Philippines get updates in English or Tagalog.

Also Read: Why Malaysia Is Becoming The Top Destination For Global Talent

7. Centralized Document Management

Store payroll-related documents, like contracts, payslips, tax forms, and compliance certificates, in a secure, centralized platform that supports role-based access and version control.

Data Compliance: Ensure the platform complies with GDPR, Malaysia’s PDPA, or other relevant data protection laws in each operating country.

Documents to centralize:

- Employment contracts

- Monthly payslips

- Annual tax summaries

- Contribution records (EPF, SOCSO, CPF, etc.)

By adopting these best practices, companies can ensure efficient, secure, and compliant payroll operations across all markets, enhancing employee satisfaction and protecting their global reputation.

Why Use FastLaneRecruit for Payroll Processing in Malaysia?

Managing payroll across borders, especially in a regulatory environment like Malaysia, requires more than just salary calculations. It demands deep local expertise, accurate statutory compliance, and seamless technology integration. This is where FastLaneRecruit stands out.

FastLaneRecruit combines in-depth knowledge of Malaysian employment laws with advanced automation tools to deliver a secure, accurate, and efficient payroll experience for both local and international businesses.

Key Benefits of Using FastLaneRecruit:

- Automated Calculations of Statutory Contributions

FastLaneRecruit ensures automatic and accurate computation of EPF, SOCSO, EIS, and PCB (monthly tax deductions), minimizing the risk of non-compliance or underpayment.

Example: For a gross monthly salary of RM5,000, the system will automatically deduct 11% EPF from the employee and match the employer’s 13%, in line with KWSP rules. - Up-to-Date Compliance with Malaysian Labor Laws

With continuous monitoring of labor regulations and contribution rate changes, FastLaneRecruit ensures your payroll complies with the latest updates from LHDN, Jabatan Tenaga Kerja, and PERKESO.

Example: The recent changes to Malaysia’s minimum wage or SOCSO’s revised contribution limits are immediately applied to payroll settings. - Integrated HR & Payroll Management via Talenox

FastLaneRecruit partners with Talenox, a leading HR and payroll platform, to provide a centralized dashboard for HR records, leave tracking, and payroll operations, saving hours on manual reconciliation. - Support for Employer of Record (EOR) & Hiring Across Asia

Need to hire employees in Malaysia without incorporating locally? FastLaneRecruit acts as your EOR, handling all employment contracts, payroll, and benefits administration while you focus on operations.

Expert Tip: FastLaneRecruit is ideal for startups, SMEs, or global companies expanding into Malaysia or Southeast Asia, as it simplifies compliance and provides local hiring support without entity setup.

Also Read: Top 5 Reasons to Hire Remote Talents in Malaysia

Sample Malaysian Payroll Workflow with FastLaneRecruit

Here’s how FastLaneRecruit supports the end-to-end payroll process in a streamlined, transparent way:

| Step | Task | System/Support |

| Onboarding | Collect employee legal documents, bank details, signed contract, tax file number | Digital onboarding via Talenox HR module |

| Calculation | Compute gross salary, overtime, bonuses | Automated salary engine with local logic |

| Deductions | Apply EPF, SOCSO, EIS, and PCB | Built-in compliance with Malaysia tax rules |

| Payment | Disburse net pay in Malaysian Ringgit | FastLaneRecruit payroll system with local bank integration |

| Payslip Issuance | Email payslips with a full breakdown | Auto-generated via Talenox |

| Statutory Filing | Submit forms (e.g., Form E, EA, CP39) to LHDN and other authorities | FastLane + Talenox support ensures on-time submissions |

| Recordkeeping | Store payroll reports securely | Cloud-based, PDPA-compliant data storage |

Example Scenario: Tech Startup Expanding to Malaysia

A Singapore-based tech startup wants to hire five Malaysian software engineers but doesn’t have a local entity. Using FastLaneRecruit’s EOR + Payroll service, they can:

- Onboard employees legally via Talenox

- Pay them in MYR with proper EPF/SOCSO deductions

- File monthly PCB tax and annual Form EA

- Ensure all records are audit-ready for investor reviews or future expansion

By partnering with FastLaneRecruit, you’re not just outsourcing payroll; you’re gaining a trusted regional partner that understands the nuances of employment compliance, supports modern HR operations, and scales with your business.

Let FastLaneRecruit handle the complexities of payroll, so you can focus on hiring the right talent and growing your business in Malaysia and beyond.

Ready to Process Payroll in Malaysia?

Looking to hire Malaysian employees and pay them accurately and compliantly? Let FastLaneRecruit handle it for you from onboarding to monthly payslips.

- Process Malaysian Payroll

- Hire Malaysian Employees Without a Local Entity

- Ensure Full Compliance with Malaysian Labor Laws

Get Started with FastLaneRecruit or contact us to learn how we can simplify your payroll today!