Outsourced accounting is more than a staffing solution, it’s a strategy to build financial resilience, increase operational efficiency, and access specialized talent across borders. Whether you’re augmenting your internal team during a busy season or scaling a lean finance department, the onboarding process is where success begins.

A well-structured onboarding approach ensures your outsourced accountants are aligned with your expectations, systems, and compliance standards. It eliminates ambiguity, fosters collaboration, and lays the foundation for accurate reporting, timely deliverables, and long-term trust.

When done right, onboarding transforms external accountants into integrated partners; equipped not just to execute tasks, but to contribute meaningfully to your finance function.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

Content Outline

Key Summary

Define Your Goals Clearly

Outlining expectations and deliverables ensures alignment from day one.

Conduct Thorough Partner Evaluations

Don’t skip reference checks and interviews. They reveal the true reliability of your partner.

Use SLAs and Clear Communication Channels

Service agreements and structured communication prevent delays and confusion.

Provide Tools and Documentation

Proper access and guidance help outsourced professionals integrate seamlessly.

Choose a Trusted Partner Like FastLaneRecruit

For outsourcing Malaysian accountants, smooth onboarding and seamless integration, FastLaneRecruit is your trusted partner.

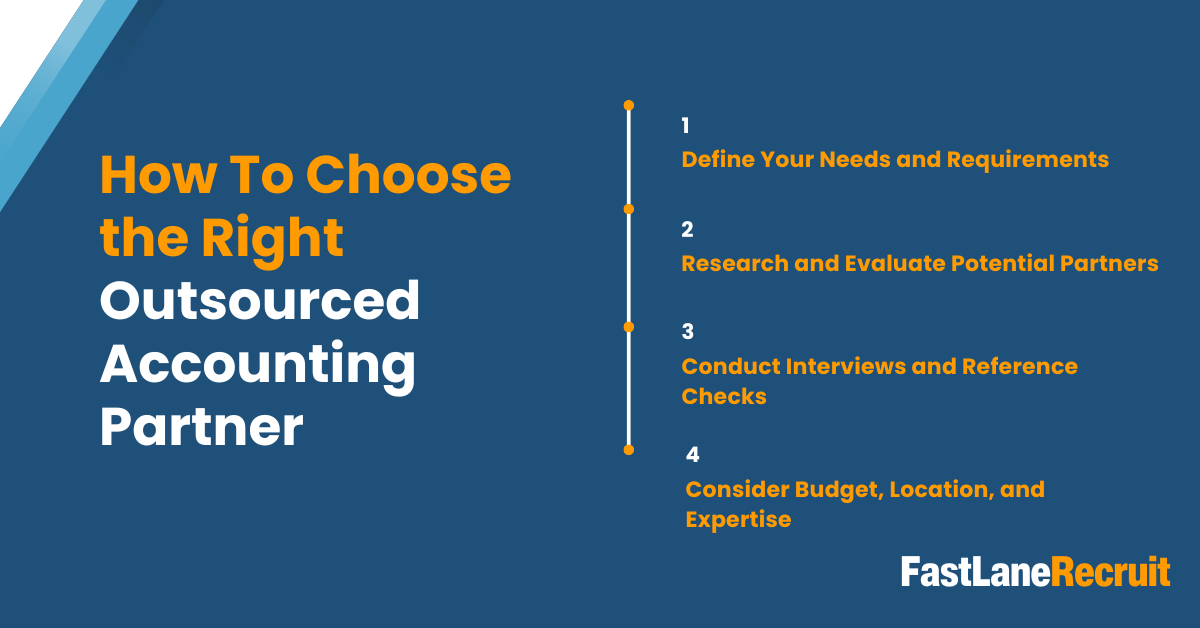

How To Choose the Right Outsourced Accounting Partner

Define Your Needs and Requirements

Before engaging with any external partner, businesses must clearly articulate their accounting needs. Are you outsourcing payroll, accounts payable, tax preparation, or end-to-end financial management? Understanding the precise tasks helps define roles, responsibilities, and KPIs.

Create a checklist that outlines your current challenges, growth trajectory, compliance obligations in your jurisdiction, and the accounting software you’re using. This clarity enables you to select a partner with the right functional and technical expertise.

Also Read: Outsourced Accounting – Frequently Asked Questions (FAQ)

Research and Evaluate Potential Partners

Not all outsourcing providers are created equal. Evaluate each candidate’s experience, industry specialization, certifications, and the strength of their internal controls. Look for signs of credibility, such as ISO certifications, affiliation with reputable accounting bodies, or government-recognized partnerships.

Check reviews, testimonials, and case studies. A reliable partner should demonstrate a track record of delivering consistent, accurate, and timely financial outputs. Platforms like Accounting and Corporate Regulatory Authority (ACRA) Singapore and the Companies Registry Hong Kong can be referenced to verify registered firms in their respective countries.

Conduct Interviews and Reference Checks

Engage in video interviews with potential vendors. This allows you to assess their communication style, professionalism, and cultural fit. Ask specific questions related to data handling, crisis management, and their methodology for managing deadlines.

Additionally, ask for client references. Speak directly to previous or current clients about their experience, responsiveness, accuracy of deliverables, and how issues were handled.

Consider Budget, Location, and Expertise

While cost is important, the cheapest option isn’t always the most cost-effective. Consider partners in regions like Malaysia or the Philippines, where highly qualified professionals offer competitive rates due to lower cost-of-living indexes. Malaysian accountants, for example, often hold ACCA, CPA, or ICAEW certifications and are fluent in English, making them an ideal choice for global companies.

Also Read: Build Your Offshore HR and Payroll Management Team in Malaysia

Comparison Table: Key Considerations When Choosing a Partner

| Factor | Consideration Example |

| Expertise | Industry-specific knowledge (e.g., eCommerce, manufacturing) |

| Certifications | ACCA, CPA, ICAEW, etc. |

| Communication | Time zone alignment, English proficiency |

| Budget | Cost vs. quality balance |

| Data Security | GDPR, ISO 27001 compliance |

Why Is It Important to Onboard Outsourced Accounting Professionals?

A thorough onboarding process transforms external contractors into valuable collaborators. It’s the bridge between hiring talent and achieving results.

Ensures a Seamless Transition and Integration into the Team

By clearly defining workflows, access permissions, and decision-making hierarchies during onboarding, companies prevent delays and missteps. This alignment sets the pace for productive collaboration from day one.

Also Read: Why Do Companies Choose to Outsource?

Reduces Misunderstandings and Communication Barriers

Accounting is a detail-driven function, and small miscommunications can lead to costly mistakes. Onboarding allows time to align terminology, reporting formats, and expectations, reducing the risk of misunderstandings.

Establishes Clear Expectations

A comprehensive onboarding process defines SLAs, reporting standards, timelines, and escalation procedures. This clarity empowers outsourced accountants to perform without second-guessing your requirements.

Builds Trust and Stronger Collaboration

When you invest time in onboarding, outsourced professionals feel valued and included. This fosters loyalty, improves morale, and lays the groundwork for a longer-term working relationship.

What To Do Before the Onboarding Process

Preparing your internal operations before onboarding outsourced accounting professionals is critical to laying a strong foundation for success. This phase helps eliminate ambiguity, align expectations, and ensure compliance with regulatory requirements. By taking a strategic and structured approach, companies can drastically reduce the risk of delays, errors, and miscommunication once the engagement begins.

Also Read: Benefits Of Offshoring Accounting In Malaysia

Define the Scope of Work and Deliverables

Begin by outlining the precise nature and extent of the accounting services you’re outsourcing. This should include a detailed list of functions such as:

- Bookkeeping and ledger maintenance

- Payroll processing

- Bank reconciliations

- Financial statement preparation

- Cash flow forecasting and budgeting

- Tax filing and compliance reports

Each task must be paired with well-defined deliverables and specific deadlines. Vague statements like “handle bookkeeping” should be replaced with concrete expectations, for instance:

“Reconcile all bank accounts and credit card statements by the 3rd working day of each month.”

Include key performance indicators (KPIs) such as error rates, timeliness, and completeness of reporting. This not only sets the standard but also provides a benchmark for review and evaluation. Consider using a Statement of Work (SOW) document to formalize these commitments before the actual onboarding begins.

Also Read: How to Pay International Employees

Agree on Communication Channels and Frequency

Smooth collaboration depends heavily on effective communication. Before onboarding starts, agree on the platforms to be used for different types of communication:

| Type of Communication | Preferred Platform Example |

| Instant Messaging | Slack, Microsoft Teams |

| Meetings & Screen Shares | Zoom, Google Meet |

| Task & Project Tracking | Trello, Asana, Monday.com |

| Document Collaboration | Google Drive, Dropbox, SharePoint |

Establish the cadence for updates, such as:

- Weekly sync meetings for bookkeeping updates

- Bi-weekly reviews for financial analysis

- Monthly strategy meetings for CFO-level insights

Time zone differences should also be factored in when scheduling meetings or expecting responses. It’s best practice to document these communication protocols in an onboarding playbook to avoid confusion down the line.

Set Service-Level Agreements (SLAs)

Service-Level Agreements act as the operational contract between your business and the outsourced team. They create structure, consistency, and accountability, ensuring that performance standards are measurable and enforceable.

Also Read: Offshore Accounting: Top 10 Offshore Roles For Accounting

Examples of effective SLAs include:

| SLA Category | Example Metric |

| Report Turnaround | Monthly reports submitted within 3 business days |

| Response Time | Emails responded to within 24 hours |

| Error Resolution | Discrepancies resolved within 48 hours |

| Uptime & Availability | System access guaranteed 99.5% during business hours |

SLAs should include escalation procedures for missed benchmarks and clear definitions of acceptable performance. They protect both parties by making expectations transparent and trackable. Consider including penalty clauses or performance bonuses based on SLA adherence.

Clarify Data Security and Confidentiality

Outsourced accounting professionals often handle sensitive financial data, including payroll records, tax information, and bank details. As such, it is essential to establish a robust framework for data security and confidentiality even before onboarding begins.

Also Read: Best Practices for Remote Work Performance Management

Key considerations include:

- Non-Disclosure Agreements (NDAs): Ensure that all parties sign legally binding confidentiality agreements.

- Role-based Access: Grant access to systems and files based on the principle of least privilege.

- Encryption: Use end-to-end encryption for data transfers and cloud storage solutions.

- Compliance: Align with data protection regulations such as the General Data Protection Regulation (GDPR) for EU companies, or PDPA in Singapore if operating in Southeast Asia.

- Audit Trails: Implement logs to track changes and access to financial records.

Additionally, it’s important to conduct a data security audit of your outsourced partner’s infrastructure to assess risk and ensure safeguards are in place. Cybersecurity policies should be mutually understood and documented in advance.

Preparing these key elements ahead of onboarding empowers your team to operate smoothly and confidently, creating a solid foundation for a productive and secure working relationship with your outsourced accounting professionals.

Also Read: The Pros and Cons of Employers of Record

How To Successfully Manage the Onboarding Process

Create a Detailed Project Plan and Timeline

Use Gantt charts or onboarding tools to outline week-by-week expectations. Break down the onboarding into manageable milestones: system setup, workflow alignment, test reporting, and go-live.

Provide Access to Systems and Documents

Give timely access to accounting software (Xero, QuickBooks, NetSuite), cloud storage, SOPs, and historical reports. Set user roles to limit access to sensitive data where necessary.

Establish Regular Check-Ins and Progress Updates

Regular touchpoints keep the process on track. Use weekly calls to address roadblocks, answer questions, and realign goals if needed.

Resolve Communication Challenges Proactively

Be proactive in identifying and mitigating language or cultural nuances. Use written summaries after calls, provide training on internal jargon, and encourage open dialogue.

Also Read: The Ultimate Playbook for Building and Integrating Offshore Teams

Assign Dedicated Team Members to Oversee the Process

Designate a point-of-contact (POC) from your internal team to handle communication, feedback, and task allocation. This creates a single source of truth and improves accountability.

Document Workflows and Processes

All standard procedures, such as month-end close, invoicing, or expense reconciliation, should be documented in a centralized knowledge base. This ensures continuity even if personnel changes on either side.

Conclusion

Onboarding outsourced accounting professionals is far more than a transactional process; it’s the strategic foundation for operational efficiency, financial compliance, and scalable growth. When executed thoughtfully, it transforms outsourced talent into integral team members who drive real value across your organization.

From choosing the right partner to aligning on expectations, tools, and timelines, each step in the onboarding journey demands precision and clarity. Businesses that invest in structured onboarding avoid costly missteps, enhance collaboration, and lay the groundwork for long-term success.

In today’s competitive landscape, working with experienced, reliable, and cost-effective professionals, especially from talent-rich regions like Malaysia, gives global companies an edge. With FastLaneRecruit, you don’t just hire accounting talent, you gain a partner committed to your success from day one.

Hire and Pay Malaysian Accountants with FastLaneRecruit

FastLaneRecruit specializes in helping global companies hire and onboard skilled accounting professionals from Malaysia. With access to a talent pool, a deep understanding of international financial regulations, and seamless integration with platforms like Xero and Talenox, FastLaneRecruit ensures that your outsourced accounting professionals hit the ground running.

Whether you’re looking for a virtual bookkeeper, payroll officer, or a full finance and accounting team, FastLaneRecruit handles recruitment, onboarding, payroll, and ongoing support, so you can focus on growing your business.

Ready to scale your finance team? Partner with FastLaneRecruit today.

Frequently Asked Questions

Why is payroll a commonly outsourced accounting function?

Payroll is time-sensitive, repetitive, and compliance-heavy. By outsourcing, businesses minimize errors, stay updated with ever-changing tax laws, and free up internal resources for strategic tasks. Payroll providers also offer specialized software and integration that enhances efficiency.

When is outsourcing accounting professionals not a good idea?

Outsourcing may not be suitable for companies with highly confidential financial data and no capacity to implement strict access controls. It’s also not ideal if frequent in-person collaboration is essential, or if internal SOPs are poorly documented.

How much does it cost to outsource a bookkeeper?

Costs vary based on location, expertise, and scope of services. In Malaysia, outsourced bookkeepers typically range from SGD 1000 to SGD 1,500 per month, depending on experience and workload complexity, substantially more cost-effective than hiring in-house in developed economies.