A Practical Guide for Global Employers

Hiring offshore Payroll Specialists in Malaysia has become an increasingly popular strategy for global companies that want to scale efficiently while maintaining strong compliance standards. Malaysia offers a well-structured payroll system, strong labour protections, and clear statutory requirements that make it one of the best destinations for building an offshore payroll team in Malaysia.

However, to hire and manage payroll specialists smoothly, it is important to understand Malaysia’s payroll rules, contribution systems, and reporting obligations. This guide walks you through what you need to know about payroll and compliance in Malaysia in clear, practical terms so you can hire with confidence and stay compliant.

Content Outline

Key Summary

Understanding Payroll Compliance in Malaysia

Payroll compliance ensures salaries, statutory contributions, tax deductions, and employee records meet Malaysian labour laws, protecting both employer and employee.

Core Statutory Contributions

Employers must manage EPF, SOCSO, EIS, HRD Levy (if applicable), and monthly tax deductions (PCB) to maintain full employee coverage and legal compliance.

Structured Payroll Calendar

Salaries are paid by the 7th, contributions by the 15th, EA forms by February, and employer declaration (Form E) by 31 March. Timely submission is critical.

Payroll Compliance Checklist

Provide itemised payslips, classify employees correctly, register with statutory bodies, maintain records for 7+ years, review payroll regularly, and monitor regulatory updates.

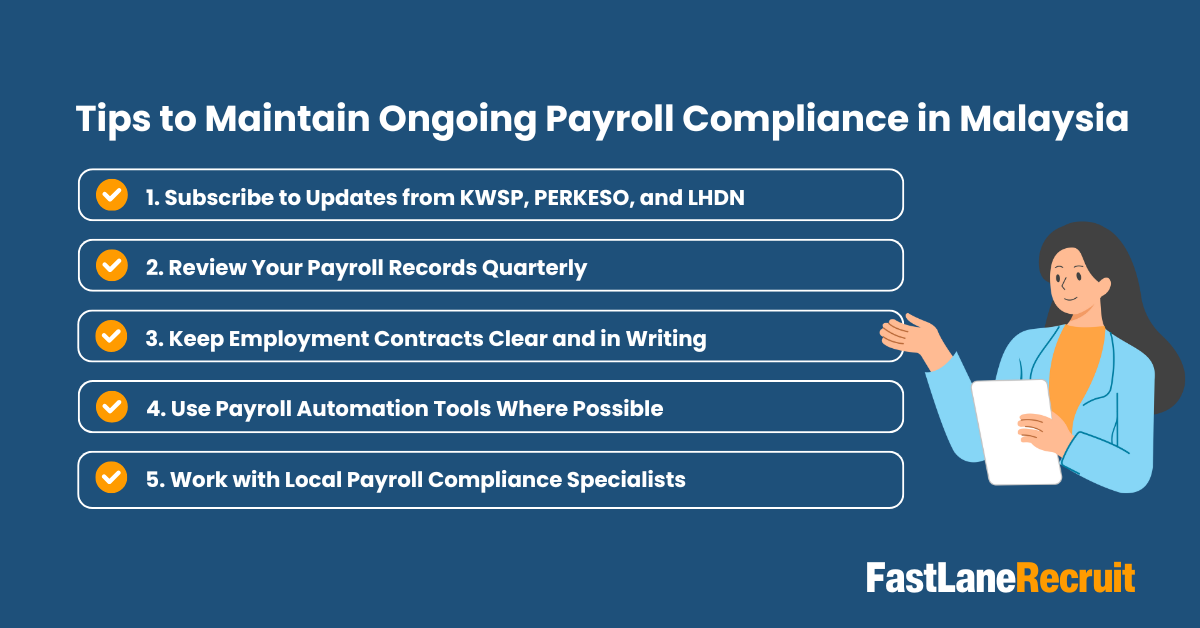

Ongoing Compliance Tips

Subscribe to updates from KWSP, PERKESO, and LHDN, audit payroll quarterly, maintain clear contracts, automate payroll where possible, and work with local compliance specialists.

Practical Example: Offshore Payroll Team

Engaging payroll specialists through an Employer of Record (EOR) allows global companies to quickly launch a compliant Malaysian payroll team without setting up a local entity.

Why FastLaneRecruit’s EOR Is Smart

FastLaneRecruit handles payroll processing, statutory submissions, contracts, and regulatory monitoring, giving global employers peace of mind while scaling offshore payroll operations efficiently.

What Payroll Compliance Means in Malaysia

Payroll compliance in Malaysia simply means following the country’s labour and tax rules when paying employees. It covers everything from how salaries are paid, how deductions are calculated, to how employee records are kept.

For global companies hiring payroll specialists in Malaysia, payroll compliance ensures that your team is paid correctly, contributions are submitted on time, and all reporting obligations are met under Malaysian law.

Malaysia’s payroll rules are guided by several key laws, including:

- Employment Act 1955

This is the main labour law that sets out rules on working hours, salary payments, leave entitlements, overtime, termination, and employee protection. - Minimum Wages Order

This regulation sets the minimum monthly salary that employers must pay eligible employees to ensure fair pay standards nationwide. - Employees Provident Fund Act

This law requires employers and employees to contribute to retirement savings through the Employees Provident Fund (EPF), helping employees build long-term financial security. - Employees’ Social Security Act

This governs SOCSO contributions, which provide protection for workplace injuries, disabilities, and other employment-related risks. - Employment Insurance System Act

This law supports employees who face job loss by providing temporary financial assistance, retraining opportunities, and job placement support.

Together, these laws create a clear framework that protects both employers and employees. For employers, they provide a structured payroll system to follow. For employees, they ensure fair pay, long-term savings, and access to social protection.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Singapore Edition)

Core Statutory Contributions for Payroll Specialists in Malaysia

When you engage payroll specialists in Malaysia, employers are required to manage several mandatory monthly contributions. These statutory contributions are part of Malaysia’s social protection and tax system and are designed to support employee well-being, retirement planning, and financial security.

Below is an overview of the main statutory items that must be handled through your payroll process.

| Contribution | Employer Rate | Employee Rate | What It Covers |

| EPF (Employees Provident Fund) | 12%–13% | 9% | Retirement savings and long-term financial security |

| SOCSO (Social Security Organisation) | 1.75% | 0.5% | Protection for workplace injuries, disabilities, and employment-related risks |

| EIS (Employment Insurance System) | 0.2% | 0.2% | Temporary income support, job search assistance, and retraining programs during retrenchment |

| HRD Levy (Human Resources Development Levy) | 1% | Not applicable | Training and upskilling programs for eligible industries |

| Monthly Tax Deduction (PCB) | Based on tax bracket | Based on tax bracket | Monthly income tax payments to LHDN |

What These Contributions Mean for Employers

- EPF (Employees Provident Fund)

EPF is a mandatory retirement savings program for Malaysian employees and permanent residents. Both employer and employee contribute a percentage of the employee’s monthly salary into a retirement account that the employee can access later in life. - SOCSO (Social Security Organisation)

SOCSO provides coverage if an employee is injured at work, becomes disabled, or faces work-related risks. This ensures employees have access to medical treatment and financial support when needed. - EIS (Employment Insurance System)

EIS supports employees who lose their jobs by offering temporary income assistance, retraining programs, and job placement services to help them return to work. - HRD Levy

The HRD Levy funds national training and upskilling programs. Companies in selected industries must contribute to this levy to support employee development. - Monthly Tax Deduction (PCB)

PCB is the monthly income tax deducted from employee salaries and submitted to the Inland Revenue Board of Malaysia (LHDN) as part of national tax compliance.

Simple Example

Let’s say a global company hires an offshore payroll specialist in Malaysia with a monthly salary of RM 6,000.

Each month, the payroll system will calculate and submit:

- EPF:

- Employer contributes around RM 720–780 (12–13%)

- Employee contributes RM 540 (9%)

- SOCSO:

- Employer contributes about RM 105 (1.75%)

- Employee contributes RM 30 (0.5%)

- EIS:

- Employer contributes RM 12 (0.2%)

- Employee contributes RM 12 (0.2%)

- PCB (Income Tax):

- Deducted based on the employee’s tax bracket and reliefs, then submitted monthly to LHDN

If the company falls under HRD Corp, it will also contribute RM 60 (1%) as HRD Levy.

All these amounts are submitted through the official government systems by the 15th of each month, ensuring the payroll specialist receives full statutory coverage and remains fully compliant under Malaysian payroll laws.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Hong Kong Edition)

Monthly Payroll Calendar in Malaysia

Malaysia follows a structured monthly payroll cycle. Every employer is expected to follow specific payment and reporting timelines to ensure employees are paid correctly and statutory contributions are submitted on time.

Below is the standard payroll calendar that applies when managing an offshore payroll team in Malaysia.

| Payroll Item | Deadline | What This Means |

| Salary payment | By the 7th of the following month | Employees must receive their salaries no later than seven days after the wage period ends. This ensures timely payment and helps maintain trust with your team. |

| EPF, SOCSO, EIS, PCB, HRD Levy | By the 15th of the following month | All statutory contributions and monthly tax deductions must be submitted to the relevant government bodies. This ensures employees remain fully covered under retirement, social security, and employment insurance schemes. |

| EA Form (annual tax form) | By end of February | Employers must provide each employee with an EA Form summarising their yearly income and tax deductions so they can file their personal income tax returns. |

| Employer declaration (Form E) | By 31 March | Employers must submit Form E to declare total employee earnings and confirm all monthly tax deductions have been reported correctly to the tax authority. |

Why This Calendar Matters

Following this payroll calendar keeps your payroll operations smooth and predictable. It ensures:

- Your offshore payroll specialists in Malaysia are paid on time

- Statutory benefits remain active and uninterrupted

- Tax reporting stays accurate

- Your company maintains good standing with Malaysian authorities

Simple Example

If your payroll month ends on 31 July:

- Salaries must be paid by 7 August as a deadline

- EPF, SOCSO, EIS, PCB and HRD Levy must be submitted by 15 August

- Annual tax forms (EA) will be prepared by end of February the following year

- Employer declaration (Form E) must be filed by 31 March the following year

Keeping to these timelines helps avoid disruptions and ensures your offshore payroll team in Malaysia remains fully protected and compliant throughout the year.

Payroll Compliance Checklist for Global Employers

When hiring offshore payroll specialists in Malaysia, following a structured compliance checklist ensures that your payroll operations are accurate, timely, and legally compliant. Here’s a detailed guide to help you manage payroll smoothly:

1. Provide Itemised Payslips for Transparency

Every employee must receive a clear, itemised payslip each month. Payslips should include:

- Base salary

- Allowances

- Overtime pay

- Statutory deductions (EPF, SOCSO, EIS)

- Income tax (PCB)

Why it matters: Transparent payslips help employees understand their earnings and deductions, prevent payroll disputes, and demonstrate your company’s commitment to fair practices.

Tip: Use payroll software to automatically generate accurate payslips each month.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Australia Edition)

2. Classify Employees Correctly

Employees in Malaysia are typically classified as:

- Full-time: Eligible for all statutory contributions and benefits

- Part-time: Contributions are based on earnings and hours worked

- Contract or freelance (contract for service): Generally not subject to employer statutory contributions

Why it matters: Misclassifying employees can result in legal penalties and back payments. Ensure that the classification reflects the actual working relationship, not just what’s written in the contract.

Tip: Review employee contracts and job roles carefully before onboarding to ensure compliance.

3. Register with Statutory Bodies

Employers must register their employees with the following key government agencies:

- EPF (KWSP): For retirement savings

- SOCSO (PERKESO): For workplace injury and disability coverage

- EIS: For employment insurance and retrenchment support

- LHDN: For monthly income tax deductions

Why it matters: Proper registration ensures that employees receive full statutory benefits and protects your company from fines or legal issues.

Tip: Double-check registration numbers and ensure contributions are submitted by the official deadlines.

4. Maintain Payroll Records for at Least Seven Years

Employers must keep detailed payroll records including payslips, tax filings, and contribution statements.

Why it matters: Accurate record-keeping is essential for audits, employee inquiries, and legal compliance. It also helps track historical payroll data for planning and reporting.

Tip: Organise digital copies securely and back them up regularly for easy access.

Also Read: How Outsourcing HR Operations Can Streamline Business Efficiency

5. Review Payroll Data Regularly

Conduct routine checks and audits on your payroll system to ensure:

- Salaries and benefits are calculated correctly

- Contributions are submitted on time

- Employee classifications and leave balances are accurate

Why it matters: Regular reviews prevent errors, identify discrepancies early, and keep your payroll team compliant with changing regulations.

Tip: Schedule quarterly audits and reconcile contributions with government records.

6. Monitor Updates to Minimum Wage and Contribution Rates

Malaysia periodically updates its minimum wage, EPF, SOCSO, and EIS rates. Staying informed ensures:

- Employees are paid fairly and in line with law

- Payroll calculations remain accurate

- The company avoids penalties for late or incorrect submissions

Quick Example: How the Checklist Works in Practice

Imagine you hire an offshore payroll specialist in Malaysia earning RM 5,500 per month:

- Issue a payslip showing salary, allowances, and deductions.

- Confirm they are classified as a full-time employee.

- Ensure they are registered with EPF, SOCSO, EIS, and LHDN.

- Keep payroll records for 7+ years.

- Review payroll monthly to check contribution amounts and tax deductions.

- Update calculations if minimum wage or statutory rates change.

Following this checklist ensures your offshore payroll team is fully compliant, reducing risks and building trust with employees.

Tips to Maintain Ongoing Payroll Compliance in Malaysia

Maintaining payroll compliance is an ongoing process, not a one-time task. Global employers and offshore payroll teams must stay proactive to ensure that employees are paid correctly, statutory contributions are submitted on time, and regulatory changes are implemented promptly. Here are some practical tips:

1. Subscribe to Updates from KWSP, PERKESO, and LHDN

Malaysia’s payroll regulations, including EPF (KWSP), SOCSO (PERKESO), EIS, and tax requirements, can change periodically.

Why it matters: Staying informed ensures your payroll processes reflect the latest rates, deadlines, and compliance requirements.

Tip: Sign up for newsletters or alerts from the official portals:

2. Review Your Payroll Records Quarterly

Conduct regular audits of payroll data at least every three months. This includes checking:

- Salary calculations

- Statutory contributions

- Tax deductions

- Leave balances and overtime payments

Why it matters: Routine reviews help catch errors early, reduce the risk of non-compliance, and give you confidence that your offshore payroll team is being paid correctly.

Tip: Keep audit results documented and address any discrepancies immediately.

Also Read: Why Malaysia Is Emerging as a Hub for HR Operations Analysts

3. Keep Employment Contracts Clear and in Writing

All employment agreements in Malaysia should be written and include:

- Employee and employer details

- Job title and responsibilities

- Salary and allowances

- Working hours and leave entitlements

- Probation, termination, and renewal terms

Why it matters: Clear contracts prevent misunderstandings, ensure compliance with the Employment Act 1955, and protect both parties legally.

Tip: Update contracts whenever there are changes to working hours, pay structure, or benefits.

4. Use Payroll Automation Tools Where Possible

Automated payroll software can calculate salaries, statutory contributions, taxes, and generate payslips quickly and accurately.

Why it matters: Automation reduces human error, saves time, and ensures compliance with deadlines and government regulations.

Tip: Choose payroll systems that integrate with EPF, SOCSO, and LHDN portals for direct submissions. Some advanced solutions even update automatically when contribution rates change.

5. Work with Local Payroll Compliance Specialists

Partnering with Malaysian payroll experts or using an Employer of Record (EOR) service ensures that your payroll is fully compliant without needing in-house expertise.

Why it matters: Local specialists understand current laws, deadlines, and regulatory changes, reducing risk and administrative burden.

Example: A global company hiring an offshore payroll specialist in Malaysia can use an EOR service like FastLaneRecruit. The EOR handles all statutory contributions, tax filings, and payroll updates, allowing your HR team to focus on strategic growth rather than compliance details.

Quick Recap:

By following these tips, staying informed, auditing payroll regularly, maintaining clear contracts, leveraging automation, and working with local experts, your offshore payroll team in Malaysia can be fully compliant, reducing risk and building employee trust.

Also Read: How to Hire HR Operations Analysts in Malaysia

Practical Example: Building an Offshore Payroll Team in Malaysia

Consider a technology company based in Europe that wanted to expand its payroll operations across Asia. Instead of immediately setting up a local entity in Malaysia which can be time-consuming, complex, and costly, they decided to hire payroll specialists in Malaysia through an Employer of Record (EOR) service.

By choosing this approach, the company was able to:

- Stay Compliant with Malaysian Labour Laws

The EOR managed all statutory contributions, payroll regulations, and tax filings, ensuring that the payroll specialists were fully compliant with local requirements like EPF, SOCSO, EIS, and PCB. - Avoid Setting Up a Local Legal Entity

Establishing a company in Malaysia involves legal registration, approvals, and local administrative costs. By engaging an EOR, the company bypassed these hurdles while still hiring locally. - Launch the Payroll Support Team Quickly

Using the EOR, the company onboarded their Malaysian payroll specialists in a matter of weeks instead of months, allowing faster operational rollout across the region. - Scale Their Offshore Payroll Team Smoothly

As business needs grew, the company could expand its Malaysian payroll team easily without worrying about additional compliance or legal complexities.

Why Many Global Companies Choose FastLaneRecruit

Managing payroll compliance across multiple countries can be challenging, particularly when dealing with frequent updates to labour laws, statutory contribution rates, and tax obligations. FastLaneRecruit’s Employer of Record (EOR) service provides a smart solution for companies looking to hire payroll specialists in Malaysia while minimizing administrative burdens.

With FastLaneRecruit, you get:

- Fully Compliant Payroll Processing

Accurate calculation of salaries, allowances, overtime, and statutory deductions in line with Malaysian labour laws. - Timely Statutory Submissions

All EPF, SOCSO, EIS, HRD Levy, and PCB contributions are submitted on schedule, avoiding penalties and ensuring employee coverage. - Employment Contract Management

Written contracts are created and managed in accordance with the Employment Act 1955, covering salary, benefits, leave, probation, and termination clauses. - Ongoing Regulatory Monitoring

FastLaneRecruit keeps track of updates to minimum wage, statutory rates, and employment regulations, ensuring your payroll operations remain compliant over time. - Local HR and Payroll Support

A dedicated local team handles day-to-day payroll, queries, and HR requirements, giving you peace of mind.

Key Benefits for Global Employers

By leveraging FastLaneRecruit’s EOR service, companies can:

- Focus on business growth rather than payroll administration

- Build a skilled offshore payroll team in Malaysia quickly

- Reduce risk of non-compliance and fines

- Enjoy flexible scaling as business needs evolve

Example in Practice:

A global SaaS company hired three offshore payroll specialists in Malaysia via FastLaneRecruit. Within three weeks, the payroll team was fully operational, employees received proper statutory coverage, and monthly contributions were submitted on time. The company avoided entity registration and administrative overhead, enabling faster regional expansion with complete compliance confidence.

This practical approach demonstrates why engaging an EOR like FastLaneRecruit is one of the smartest ways to hire payroll specialists in Malaysia, ensuring compliance, speed, and operational efficiency without the complexities of setting up a local entity.

Also Read: Payroll and Compliance for HR Operations Teams in Malaysia

Conclusion

Malaysia offers a strong and well-regulated environment for hiring offshore payroll specialists. By understanding statutory requirements, payroll deadlines, and reporting obligations, global companies can confidently build an offshore payroll team in Malaysia that is both efficient and compliant.

Build Your Offshore Payroll Team in Malaysia Quickly and Compliantly

Hiring payroll specialists in Malaysia doesn’t have to be complicated. With FastLaneRecruit’s Employer of Record (EOR) service, you can engage skilled payroll professionals while staying fully compliant with local labour laws and statutory requirements.

- Launch your team quickly without setting up a local entity

- Ensure accurate payroll and statutory submissions every month

- Scale your offshore payroll team effortlessly as your business grows