Malaysia vs Global Markets

Payroll Specialists ensure employees are paid accurately and on time. They manage payroll processes, calculate taxes and benefits, maintain compliance, and support HR operations. As companies expand internationally, demand for skilled payroll specialists with knowledge of multi-country payroll, compliance, and reporting continues to rise.

This guide compares 2026 Payroll Specialist salary benchmarks across Malaysia, the US, Singapore, Hong Kong, and Australia to help you make informed hiring decisions.

Content Outline

Key Summary

Cost-Effective Talent in Malaysia

Payroll specialists in Malaysia earn MYR 60k–95k (USD 14k–22k), offering excellent payroll accuracy and compliance efficiency at lower operational costs.

High Salaries in the U.S.

Senior payroll specialists in the US typically earn USD 60k–80k due to complex payroll systems, compliance requirements, and tax regulations.

Competitive Pay in Singapore

Payroll specialists earn SGD 55k–85k (USD 40k–63k), especially in multinational corporations and financial services.

Moderate Salaries in Hong Kong

Payroll specialists earn HKD 280k–420k (USD 35k–54k), reflecting demand in finance, logistics, and compliance-heavy industries.

Experienced Talent in Australia

Salaries range AUD 70k–105k+ (USD 46k–70k+) for professionals skilled in payroll processing, benefits, and compliance.

Outsourcing Maximizes ROI

Hiring in Malaysia provides access to English-speaking payroll talent with expertise in statutory compliance, delivering 50–60% operational efficiency improvement.

Simplified Hiring via EOR

FastLaneRecruit’s EOR solution handles contracts, payroll, and compliance while companies retain operational control.

Payroll Specialist Salary Breakdown by Country (2026)

Malaysia

| Level | Salary (MYR) | Salary (USD) |

| Entry (0–2 yrs) | 60,000–70,000 | 14,000–16,000 |

| Mid (3–5 yrs) | 75,000–90,000 | 17,500–21,000 |

| Senior (6+ yrs) | 90,000–95,000 | 21,000–22,000 |

Market Insight: Malaysia offers cost-efficient payroll talent with strong compliance and reporting expertise.

United States

| Level | Salary (USD) |

| Entry (0–2 yrs) | 45,000–55,000 |

| Mid (3–5 yrs) | 55,000–65,000 |

| Senior (6+ yrs) | 60,000–80,000 |

Market Insight: Complex payroll systems, tax regulations, and compliance drive higher salaries.

Singapore

| Level | Salary (SGD) | Salary (USD) |

| Entry (0–2 yrs) | 55,000–65,000 | 40,000–47,000 |

| Mid (3–5 yrs) | 65,000–75,000 | 47,000–55,000 |

| Senior (6+ yrs) | 85,000+ | 63,000+ |

Market Insight: Multinational companies and financial services pay a premium for experienced payroll specialists.

Hong Kong

| Level | Salary (HKD) | Salary (USD) |

| Entry (0–2 yrs) | 280,000–320,000 | 35,000–40,000 |

| Mid (3–5 yrs) | 340,000–380,000 | 42,000–48,000 |

| Senior (6+ yrs) | 400,000–420,000 | 50,000–54,000 |

Market Insight: Finance and compliance-heavy industries drive payroll specialist salaries.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Singapore Edition)

Australia

| Level | Salary (AUD) | Salary (USD) |

| Entry (0–2 yrs) | 70,000–75,000 | 46,000–49,000 |

| Mid (3–5 yrs) | 85,000–95,000 | 55,000–62,000 |

| Senior (6+ yrs) | 105,000+ | 70,000+ |

Market Insight: Payroll specialists with compliance and multi-country payroll expertise are highly sought after.

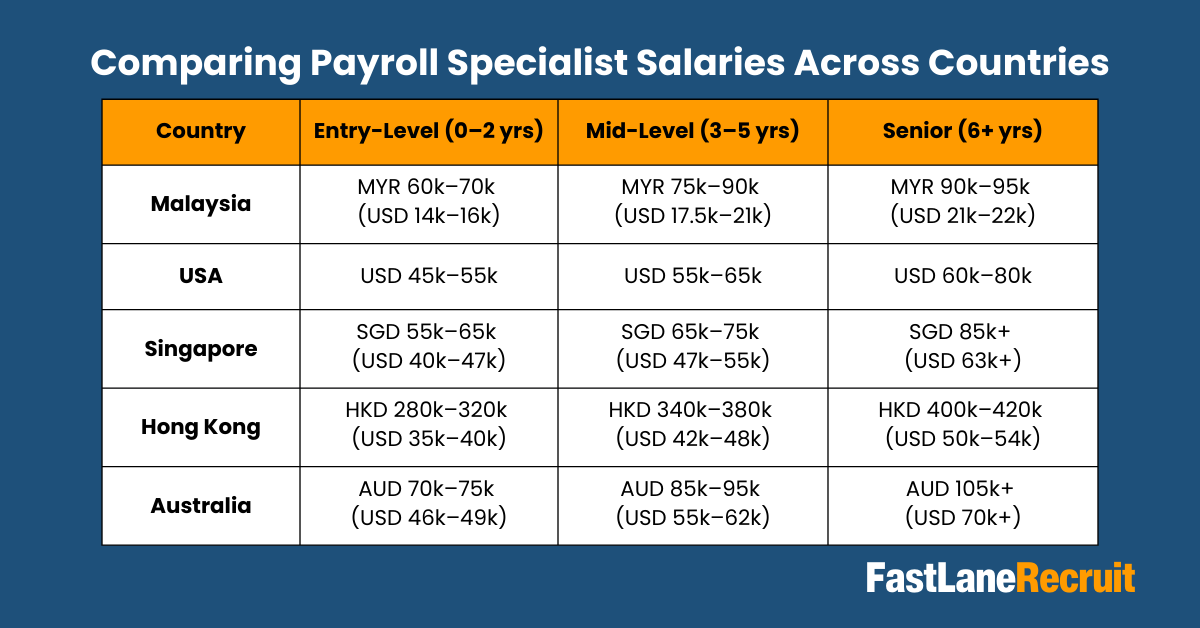

Comparing Payroll Specialist Salaries Across Countries

| Country | Entry-Level (0–2 yrs) | Mid-Level (3–5 yrs) | Senior (6+ yrs) |

| Malaysia | MYR 60k–70k (USD 14k–16k) | MYR 75k–90k (USD 17.5k–21k) | MYR 90k–95k (USD 21k–22k) |

| USA | USD 45k–55k | USD 55k–65k | USD 60k–80k |

| Singapore | SGD 55k–65k (USD 40k–47k) | SGD 65k–75k (USD 47k–55k) | SGD 85k+ (USD 63k+) |

| Hong Kong | HKD 280k–320k (USD 35k–40k) | HKD 340k–380k (USD 42k–48k) | HKD 400k–420k (USD 50k–54k) |

| Australia | AUD 70k–75k (USD 46k–49k) | AUD 85k–95k (USD 55k–62k) | AUD 105k+ (USD 70k+) |

Key Insight: Malaysia remains the most cost-efficient option, while the US, Singapore, and Australia command higher salaries due to complex payroll systems and regulatory requirements.

Why These Salaries Differ

Payroll specialist salaries vary widely across countries, even for roles with similar responsibilities. Several key factors influence these differences, including cost of living, industry demands, specialized skills, and global hiring strategies. Understanding these factors helps companies benchmark salaries accurately and make informed hiring decisions when building regional or global payroll teams.

1. Cost of Living and Local Expenses

Salaries are closely tied to the cost of living in each country. High-cost countries like the United States, Singapore, Hong Kong, and Australia require higher wages to ensure employees can cover housing, transportation, healthcare, education, and daily living expenses.

In contrast, Malaysia has a lower cost of living while still offering a comfortable lifestyle. This allows companies to hire experienced payroll specialists at competitive salaries without compromising on talent quality.

Example: A payroll specialist in Singapore may need a higher salary just to cover rent in central business districts, which can be several times higher than Kuala Lumpur. Meanwhile, a Malaysian professional with equivalent experience can maintain a good standard of living on a fraction of that salary, giving businesses a significant cost advantage.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Hong Kong Edition)

2. Industry Concentration and Regulatory Complexity

Salary differences also reflect the industries in which payroll specialists operate. Financial services, multinational corporations, and tech companies often have highly complex payroll requirements, including multiple pay cycles, benefits programs, tax regulations, and compliance reporting.

Specialists in these sectors are responsible for accurate payroll, statutory filings, and employee benefits management. Mistakes can be costly, involving penalties or legal issues, so companies pay a premium to secure experienced professionals who can navigate these complexities.

Example: A payroll specialist working for a multinational bank in Hong Kong may manage multiple employee benefit schemes, calculate taxes across countries, and ensure compliance with local labor laws. The complexity and responsibility justify higher salaries compared to a similar role in Malaysia serving a regional team.

3. Skill Specialisation and Professional Credentials

Not all payroll specialists are equally skilled. Those with advanced technical knowledge, certifications, and multi-country payroll experience command higher salaries.

Proficiency in payroll platforms like SAP, Workday, or Oracle HCM, along with certifications such as CIPP (Chartered Institute of Payroll Professionals) or CPP (Certified Payroll Professional), signals strong expertise. These skills reduce operational errors, improve efficiency, and ensure compliance across multiple jurisdictions.

Example: A senior payroll specialist in Australia with multi-country payroll experience and SAP SuccessFactors certification can manage complex payroll processing independently, making them significantly more valuable than a generalist without specialized credentials.

4. Remote Work and Global Hiring Strategies

The rise of remote and hybrid work has changed how companies hire payroll specialists. Instead of being limited to high-cost local markets, global companies increasingly outsource payroll operations to countries like Malaysia.

Malaysia offers a strong talent pool of English-speaking payroll specialists experienced in multi-country payroll, statutory compliance, and reporting. Companies can access the same expertise as in high-salary markets but at a fraction of the cost, allowing them to scale efficiently without compromising quality.

Example: A US-based tech company may choose to hire a Malaysian payroll team to manage APAC operations. The team handles payroll, statutory compliance, and reporting accurately and efficiently while the company saves significantly compared to building a similar team in the US or Singapore.

Also Read: Building a High-Performing Offshore HR and Payroll Management Team in Malaysia (Australia Edition)

Summary:

Payroll specialist salaries differ due to living costs, industry-specific demands, skill levels, and global hiring strategies. Countries like the US, Singapore, and Australia offer higher salaries because of higher expenses and complex regulatory environments. Malaysia, meanwhile, provides a cost-efficient alternative without compromising on talent quality, making it an attractive hub for regional payroll operations.

Why Outsource Payroll Operations to Malaysia

Outsourcing payroll operations to Malaysia has become an increasingly popular strategy for global companies. The country offers a combination of cost-efficiency, skilled talent, and operational convenience that makes it an ideal hub for managing payroll across the APAC region and beyond. Here’s why Malaysia stands out:

1. Lower Operational Costs Without Sacrificing Quality

One of the biggest advantages of outsourcing payroll operations to Malaysia is the significant cost savings. Salary levels for payroll specialists are highly competitive compared to high-cost markets like Singapore, the United States, or Australia.

Despite the lower operational costs, Malaysian payroll professionals are highly skilled in statutory compliance, payroll automation, and accurate reporting. Businesses can build efficient payroll teams capable of managing multi-country payroll without compromising quality or compliance standards.

Example: A company that could only afford one payroll specialist in Singapore can hire a full Malaysian team to handle payroll, statutory contributions, and reporting for multiple APAC countries while staying within budget.

2. Certified Talent with Global Payroll Tools

Malaysian payroll specialists are not just affordable, they are well-trained and certified in global payroll standards. Many professionals have experience with payroll platforms such as SAP, Workday, and Oracle HCM, and hold internationally recognized certifications like CIPP (Chartered Institute of Payroll Professionals) or CPP (Certified Payroll Professional).

This expertise allows them to manage multi-country payroll systems, ensure accurate statutory deductions, and maintain compliance with local labor laws and tax regulations. Companies benefit from a highly capable team that can handle complex payroll operations similar to teams in higher-cost markets.

Example: A European company can rely on a Malaysian payroll team to calculate employee taxes, manage EPF/SOCSO contributions, and generate reports for APAC employees with the same accuracy and efficiency as a team based in Singapore or Australia.

Also Read: How Outsourcing HR Operations Can Streamline Business Efficiency

3. Time Zone Overlap for APAC and Europe

Malaysia’s geographic location provides a strategic time zone advantage for global businesses. Its working hours overlap with most APAC countries and partially with Europe, enabling real-time collaboration and faster issue resolution.

Example: A UK-based company can coordinate directly with a Malaysia-based payroll team during overlapping hours. Payroll queries, compliance checks, or report approvals can be completed the same day, reducing delays that would occur if the team were located in a distant time zone.

4. Strong English Proficiency

English is widely spoken in Malaysia’s corporate and business environment, ensuring smooth communication between the payroll team and global headquarters, regional managers, or employees.

Clear communication minimizes errors in payroll processing, statutory filings, and compliance reporting. It also simplifies onboarding, training, and collaboration with other regional teams.

Example: A US company outsourcing payroll operations to Malaysia can easily coordinate system updates, payroll adjustments, and reporting without language barriers, ensuring operations run smoothly and reliably.

5. Simplified Payroll and Compliance with an EOR

For companies without a local entity, managing payroll and statutory compliance can be complicated and time-consuming. Partnering with an Employer of Record (EOR) like FastLaneRecruit simplifies this process.

An EOR acts as the legal employer on the ground, handling employment contracts, payroll processing, statutory contributions (EPF, SOCSO, EIS, PCB), and compliance obligations. Companies can hire skilled payroll specialists quickly, remain fully compliant with Malaysian labor laws, and retain operational control over their team.

Example: A fast-growing SaaS startup can immediately hire a Malaysian payroll team through FastLaneRecruit’s EOR service. Payroll is processed accurately, statutory contributions are filed on time, and employment contracts are compliant, all without the company needing to set up a local legal entity.

Summary:

Outsourcing payroll operations to Malaysia offers a rare combination of cost-efficiency, certified expertise, time-zone advantages, strong English proficiency, and simplified compliance via an EOR. Companies can scale their payroll teams quickly, maintain operational accuracy, and manage multi-country payroll efficiently, all while optimizing costs.

How to Hire Payroll Specialists in Malaysia

Hiring skilled payroll specialists in Malaysia requires careful planning, clear role definition, and an understanding of local compliance requirements. FastLaneRecruit’s expertise, especially through its Employer of Record (EOR) service, makes this process straightforward and efficient. Here’s a step-by-step guide:

Step 1: Define Role Requirements Clearly

Before starting your hiring process, it’s essential to outline the responsibilities and expectations for each level of payroll specialist. Clear role definitions help attract the right candidates and ensure accountability.

| Level | Typical Responsibilities |

| Entry-Level | Support payroll processing, maintain employee records, assist with statutory deductions (EPF, SOCSO, EIS, PCB), prepare basic payroll reports, and respond to employee payroll queries. |

| Mid-Level | Manage full payroll cycles, calculate taxes and benefits, ensure statutory compliance, prepare reports for management, troubleshoot payroll issues, and support junior staff. |

| Senior-Level | Lead payroll operations, handle multi-country payroll, oversee internal and external audits, implement payroll systems, design compliance workflows, mentor junior payroll staff, and coordinate with HR and finance teams. |

Tip: Clearly defining the scope of work also helps determine which hiring model is most suitable for your company whether direct hire, contract hire, or via an EOR.

Also Read: Why Malaysia Is Emerging as a Hub for HR Operations Analysts

Step 2: Choose the Right Hiring Model

Selecting the right hiring model is critical, especially if your company does not have a Malaysian entity. FastLaneRecruit offers solutions for all hiring scenarios:

| Hiring Model | Best For | How FastLaneRecruit Helps |

| Direct Hire | Companies with an established Malaysian entity | FastLaneRecruit manages payroll, statutory filings, and local compliance, allowing your internal HR team to focus on operational management. |

| Contract Hire | Short-term or project-based staffing needs | We provide compliant payroll and reporting for contract staff, ensuring statutory obligations are met while giving flexibility for temporary projects. |

| Employer of Record (EOR) | Companies without a Malaysian entity | FastLaneRecruit becomes the legal employer on the ground. We handle employment contracts, payroll processing, statutory contributions, and local compliance. Your company retains operational control over tasks, performance, and team management without needing to set up a local entity. |

Example: A US-based SaaS company expanding into APAC can immediately onboard Malaysian payroll specialists via FastLaneRecruit’s EOR service. The team can start processing payroll and managing compliance from day one, while the company avoids the legal and administrative complexities of establishing a local office.

Step 3: Set Competitive Salary Benchmarks

Offering competitive salaries is essential to attract and retain top payroll talent. Salary expectations vary by experience, location, and skill specialization.

FastLaneRecruit provides up-to-date local salary benchmarks based on:

- Years of experience (entry, mid, senior)

- City and cost-of-living considerations

- Payroll system expertise (e.g., SAP, Workday, Oracle HCM)

- Certification or professional credentials (e.g., CIPP, CPP)

Tip: Benchmarking salaries accurately prevents underpaying candidates and helps retain high-performing specialists in a competitive market.

Also Read: How to Hire HR Operations Analysts in Malaysia

Step 4: Ensure Payroll Compliance from Day One

Payroll compliance is a critical part of hiring in Malaysia. Mistakes in statutory contributions or reporting can lead to penalties and operational disruptions.

FastLaneRecruit’s EOR service ensures compliance from day one by managing:

- Registration with statutory bodies (EPF, SOCSO, EIS, PCB)

- Monthly payroll processing and accurate payslip issuance

- Timely filing of statutory contributions

- Maintenance of payroll records for audits and reporting

Example: A European company can rely on FastLaneRecruit to automatically calculate EPF and SOCSO contributions for Malaysian employees and submit them accurately to the authorities every month, eliminating the risk of late or incorrect filings.

Step 5: Onboard and Scale Confidently

After hiring, efficient onboarding and the ability to scale teams as business needs change are critical. FastLaneRecruit simplifies this process by providing:

- Compliant employment contracts under Malaysian labor laws

- Structured onboarding programs to integrate new hires smoothly

- Flexible team scaling to add or adjust payroll staff as operations expand

- Ongoing local compliance support and guidance for multi-country payroll

Example: A US-based fintech company expanding across APAC can start with a small payroll team in Malaysia and gradually scale to handle additional countries. FastLaneRecruit ensures all payroll operations remain compliant, accurate, and efficient throughout the growth process.

Summary:

Hiring payroll specialists in Malaysia doesn’t have to be complicated. By defining roles clearly, choosing the right hiring model, setting competitive salaries, ensuring compliance from day one, and onboarding efficiently, global companies can quickly build skilled payroll teams.

FastLaneRecruit’s EOR service is especially valuable for companies without a Malaysian entity, handling contracts, payroll, statutory contributions, and compliance while allowing your business to retain full operational control.

Also Read: Payroll and Compliance for HR Operations Teams in Malaysia

Conclusion

Malaysia is an ideal hub for payroll operations. Payroll specialists are cost-efficient, skilled, fluent in English, and aligned with global compliance standards. FastLaneRecruit’s EOR service simplifies hiring, payroll, and compliance, enabling companies to scale their teams smoothly and efficiently.

Ready to Hire Payroll Specialists in Malaysia?

Expanding your payroll team in Malaysia doesn’t have to be complicated. FastLaneRecruit’s Employer of Record (EOR) service enables global companies to hire skilled, certified payroll specialists quickly and efficiently, fully compliant with local regulations. While we handle the complexities of payroll, statutory contributions, and compliance, your business can stay focused on growth, strategy, and scaling operations.

What FastLaneRecruit Does for You

1. Employment Contracts Made Simple

We draft fully compliant employment contracts under Malaysian labor laws, ensuring clear terms, benefits, and responsibilities for every payroll specialist. This reduces legal risk and provides peace of mind for your company.

2. Payroll & Statutory Contributions

FastLaneRecruit manages accurate, timely payroll processing, including EPF, SOCSO, EIS, and PCB contributions. You never have to worry about errors, late submissions, or penalties.

3. Payroll Compliance & Local Expertise

Our local team ensures all payroll operations meet statutory and regulatory requirements. From multi-country payroll reporting to system setup and audits, your Malaysian team operates efficiently and compliantly.

4. Quick Onboarding & Team Scaling

Hire faster with an Employer of Record (EOR) model. Onboard payroll specialists quickly, scale your team flexibly, and adjust resources as your business expands, all without long setup times or administrative headaches.

5. Operational Control Remains with You

Even though we manage contracts, payroll, and compliance, your company retains full control over daily operations, performance management, and team structure. Maintain your company culture and strategic direction while we handle the local administrative and legal requirements.

Get Started Now

Hiring payroll specialists in Malaysia has never been easier. With FastLaneRecruit’s EOR service, you gain:

- A reliable, skilled payroll team ready to manage multi-country payroll operations

- Peace of mind that all statutory contributions and compliance obligations are handled accurately

- Operational flexibility to scale your team efficiently as business demands grow

- The ability to focus on growth, strategy, and global expansion while we manage the local complexities

Take the Next Step: Build your Malaysian payroll team today with FastLaneRecruit and gain confidence in payroll accuracy, compliance, and operational efficiency. Your business can expand faster, reduce costs, and minimize risk, all without setting up a local entity.