Hire Payroll Specialist from Malaysia with FastLaneRecruit

Need a smarter, more scalable way to manage your company’s payroll? With FastLaneRecruit, you don’t just outsource payroll tasks, you build a dedicated offshore payroll team in Malaysia. From CPF contributions to IR8A forms and monthly payroll runs, we help Singaporean businesses hire experienced payroll specialists who function as a seamless extension of your internal HR or finance team. Our offshore payroll solutions are ideal for SMEs, startups, and enterprises seeking affordable, compliant, and expert payroll services.

Why Malaysian Payroll Specialists Stand Out

Build a Cost-Efficient Offshore Payroll Team in Malaysia

Malaysia offers a deep talent pool of payroll professionals trained in regional labour laws, tax compliance, and HR best practices. With FastLaneRecruit, you’re not just outsourcing tasks — you’re building a dedicated payroll team aligned with Singapore’s Employment Act, CPF regulations, and IRAS standards.

English Proficiency & Singapore Payroll Familiarity

Malaysian payroll experts are fluent in English and experienced with Singapore’s regulatory requirements, including CPF, Skills Development Levy (SDL), Foreign Worker Levy (FWL), and IRAS filings like IR8A and IR21.

End-to-End Payroll Talent

Our outsourced payroll specialists handle all core functions: Monthly payroll processing, CPF, SDL & FWL computation and submissions, Payroll software management (e.g., Talenox, JustLogin, Payboy), IRAS compliance including IR8A, IR21, and Appendix 8A preparation.

Accurate, Timely, and Compliant

Your offshore payroll team ensures accurate calculations, timely salary payments, and full compliance with MOM, CPF Board, and IRAS regulations — helping you avoid fines, late submissions, and payroll errors.

Trusted by Singapore-Based Businesses

Malaysian payroll teams support HR departments, accounting firms, and fast-growing companies across Singapore and Southeast Asia. With high-quality execution and data confidentiality, they streamline payroll while reducing costs.

Fast Setup. Local Compliance. Zero Bureaucracy.

With FastLaneRecruit, you can hire a compliant, cost-effective offshore payroll team in Malaysia without needing to set up an entity. We manage recruitment, onboarding, and HR support under a trusted Employer of Record (EOR) structure.

Outsourced Payroll Specialists Can Manage All Aspects of Singapore Payroll

By outsourcing payroll to Malaysia, you get access to professionals who understand Singapore’s labour and tax environment — helping you stay compliant while keeping payroll operations efficient

Monthly Payroll Runs & Salary Processing

Calculate gross-to-net salary, manage employee payroll cycles, generate payslips, and ensure accurate salary disbursements.

CPF, SDL & FWL Contributions

Compute and submit statutory contributions accurately to the CPF Board, avoiding late payment penalties.

IRAS Reporting – IR8A, IR21 & Appendix 8A

Prepare and submit annual income tax filings for employees, including required forms like IR8A, IR21 (for foreign employees), and Appendix 8A (benefits-in-kind).

Employee Self-Service Support

Manage leave, claims, benefits, and payslip access through payroll software or custom dashboards.

Onboarding & Offboarding Payroll Management

Handle payroll components related to new hires, resignations, and terminations in compliance with MOM guidelines.

Software Expertise Across Platforms

Skilled in using Singapore payroll software including Talenox, Payboy, JustLogin, HReasily, and more.

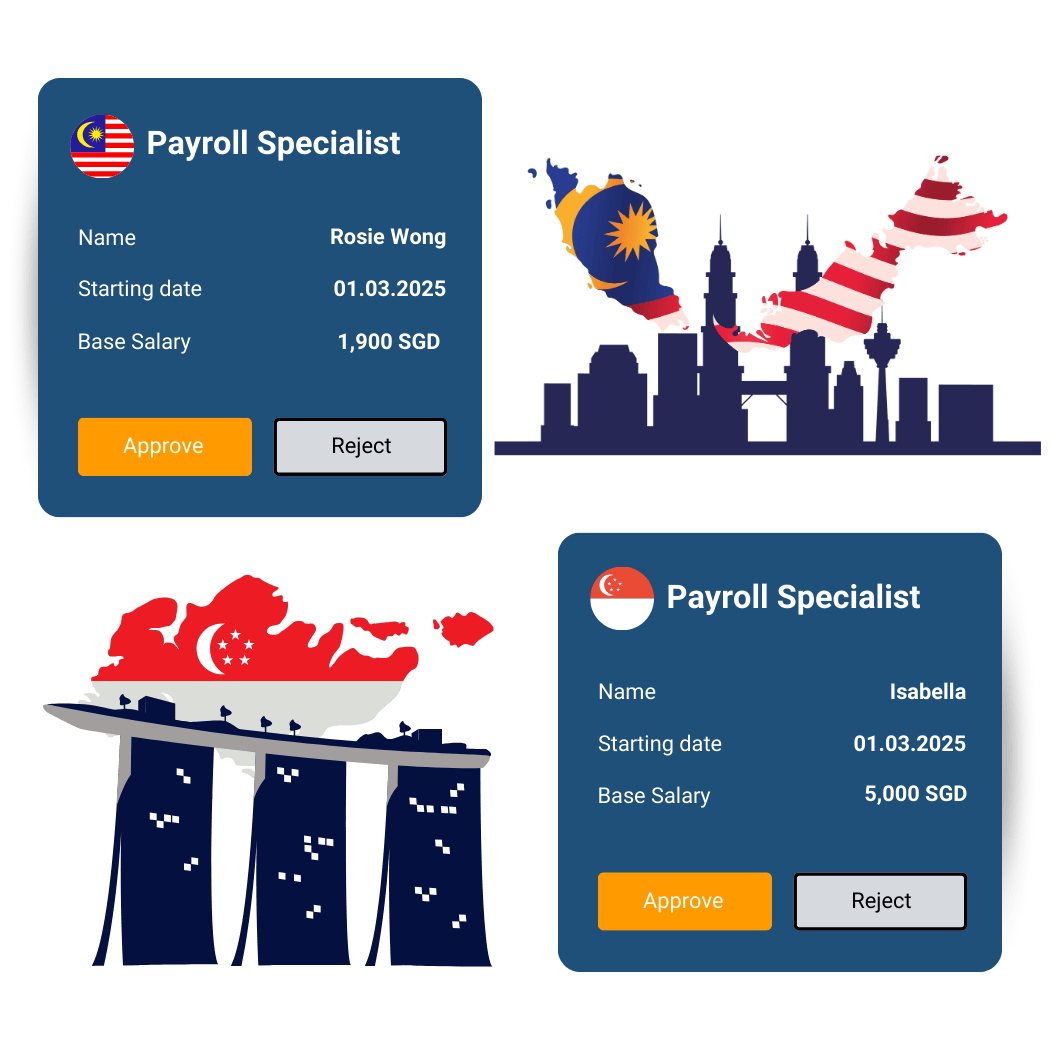

Salary Comparison: Hiring in Singapore vs. Malaysia

| Role | Singapore | Malaysia |

| Payroll Specialist | SGD $45,000 – $65,000/year | MYR 60,000 – 84,000/year (~SGD $17,000 – $24,000) |

| Senior Payroll Executive | SGD $60,000 – $80,000/year | MYR 84,000 – 108,000/year (~SGD $24,000 – $31,000) |

| Payroll & HR Manager | SGD $75,000 – $100,000/year | MYR 108,000 – 132,000/year (~SGD $31,000 – $38,000) |

2025 Salary Guide

FastLaneRecruit’s 2025 Salary Guide equips Singapore businesses with key salary benchmarks in Malaysia, offering insights into workforce cost efficiencies and headcount optimization. By comparing compensation structures between Singapore and Malaysia, this guide provides data-driven insights to help companies establish competitive salary packages while effectively managing their manpower budget and operational costs.

Download 2025 Singapore Salary Guide Download 2025 Malaysia Salary GuideHiring a Payroll Specialist in Singapore vs. Malaysia

Hiring a full-time payroll specialist in Singapore may cost your business approximately SGD $60,000 – $80,000 per year. In contrast, hiring a similarly qualified payroll professional in Malaysia typically costs around SGD $17,000 – $24,000 annually. With expertise in Singapore payroll regulations, CPF submissions, and tax filings, Malaysian professionals offer exceptional value without compromising compliance or quality.

Total Savings: Over 65%

With FastLaneRecruit as your offshore recruitment and EOR partner, you gain access to reliable, cost-effective payroll teams that support your Singapore operations with local expertise — at a fraction of the cost.

Book A Free 30 mins Discovery Call

Why FastLaneRecruit is the Best Partner

FastLaneRecruit is part of the FastLane Group, a trusted CPA firm with a proven track record in providing professional accounting services. With years of operating history and experience working with offshore accounting teams in Malaysia, we know accounting inside out. Our expertise ensures we can identify, recruit, and manage top-tier accounting talent tailored to your business needs. As accountants hiring accountants, we offer unmatched insight into the skills and qualifications required for success in the field.

Xero Platinum Partner

We embarked on our Xero journey in 2013, becoming a trusted Xero Platinum partner. Our team of Xero experts is dedicated to unleashing the power of Xero for your business, revolutionizing your bookkeeping, credit control, and payroll processes.

We offer flexible involvement tailored to your needs. With Xero’s cloud-based platform, collaboration happens seamlessly from any device with an internet connection. Say goodbye to wasted time and unnecessary expenses of downloading or transferring data to your accountant.

Global and Singaporean Companies Using Offshore Payroll Talent in Malaysia

Forward-thinking Singapore companies are using Malaysian talent to strengthen their corporate compliance and governance functions:

Diverse Industries

Real Examples:

Accounting Firms Delegating Payroll Ops

A mid-sized accounting firm in Singapore offshored payroll processing for over 80 clients to a Malaysian team. Result: reduced overhead by 60%, zero late CPF submissions, and faster turnaround times.

SMEs Handling Monthly Payroll & CPF

A Singapore-based logistics SME partnered with FastLaneRecruit to manage monthly payroll, leave tracking, and CPF filings for 50+ employees via Talenox — saving over SGD 50,000 annually.

Startups Scaling with HR-Payroll Combo Roles

A SaaS startup based in Singapore hired a dual-role HR & Payroll Executive in Malaysia to support employee onboarding, claims processing, and monthly salary disbursements — ensuring compliance during rapid team expansion.

Benefits of

Offshore and Remote Payroll Teams

Cost-Effective Payroll Operations

- Reduce your annual payroll operations cost by over 65% without sacrificing accuracy or compliance.

Access to Skilled & Certified Talent

- Our Malaysian talent pool includes payroll professionals experienced in Singapore’s tax codes, CPF contributions, and MOM compliance.

Faster Hiring, On-Demand Scaling

- Launch your team in as little as 2–8 weeks. Scale up or down without long-term commitments or HR burdens.

More Time for Strategic HR

- Outsource administrative tasks so your Singapore-based HR team can focus on strategic workforce planning and employee engagement.

Seamless Integration & Full Oversight

- Your offshore payroll team works under your reporting structure. FastLaneRecruit handles employment, HR, and compliance in Malaysia.

Talent Sourcing Process Overview

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Talent Sourcing Process Overview

Total Turnaround Time – 3~8 weeks (subject to role complexity and candidate availability)

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Build Your Offshore Payroll Team for Singapore Today

Ready to scale your payroll function and stay compliant — while cutting costs? FastLaneRecruit helps you build a dedicated offshore payroll team in Malaysia that delivers efficiency, accuracy, and cost savings to your Singapore operations.

Book Your Free 30-Min Strategy Call