When hiring or managing foreign employees in Singapore, employers must comply with a key regulation known as tax clearance, which involves filing Form IR21. Failure to do so can result in fines or delays in your employee’s departure. This guide will walk you through every essential detail about IR21 so that you can fulfil your obligations accurately and efficiently.

Content Outline

Key Summary

Form IR21 is mandatory for non-citizen employees leaving Singapore or ending employment.

It must be filed at least one month in advance of departure or termination.

Employers must withhold final payments until tax clearance is granted.

There are specific exemptions and common pitfalls to be aware of.

Electronic submission via myTax Portal is the fastest and most reliable method.

Partnering with experts like FastLaneRecruit ensures peace of mind in the filing process.

What is Form IR21?

Form IR21 is a tax clearance form submitted by employers to the Inland Revenue Authority of Singapore (IRAS) when a non-citizen employee ceases employment, plans to leave Singapore for more than three months, or is posted overseas. The purpose is to ensure all outstanding taxes are settled before the employee’s departure.

Learn more directly from IRAS’ official website.

Why Employers Need to File Form IR21

The IR21 form ensures the employee’s tax liabilities are settled before they exit the country. As an employer, you play a crucial role in initiating this process and are legally obligated to:

- Withhold all monies due to the employee (e.g., salary, bonuses, etc.) from the day you are aware of their departure.

- File the IR21 form promptly so that IRAS can compute the final tax payable.

Also Read: Benefit of Outsourcing Accounting to Malaysia

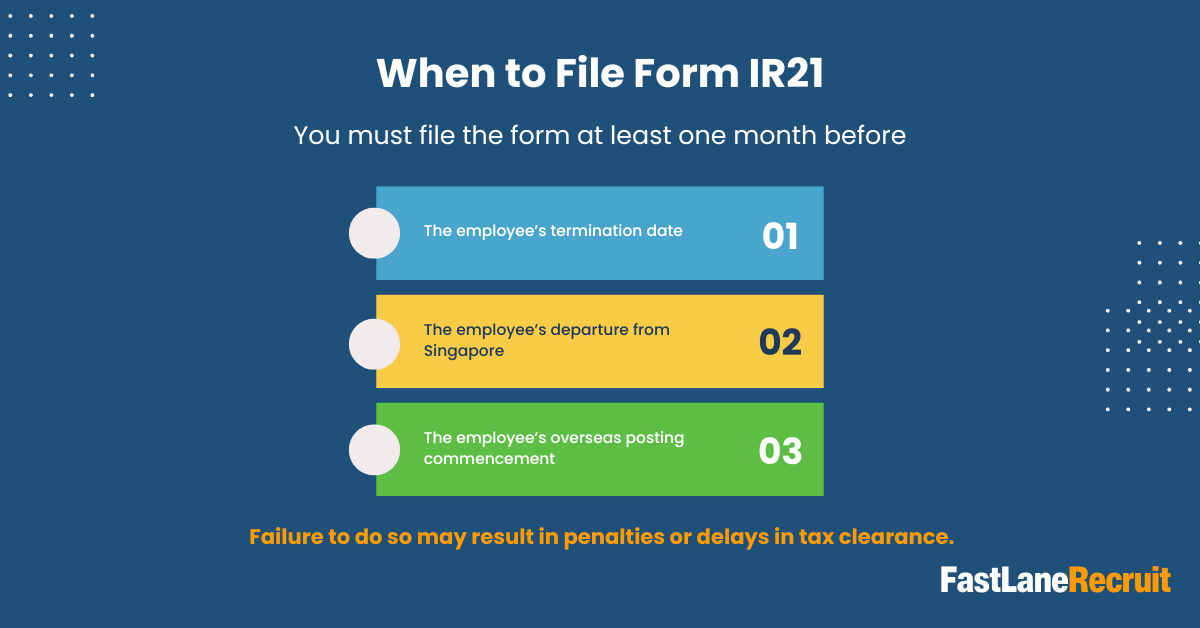

When to File Form IR21

You must file the form at least one month before:

- The employee’s termination date;

- The employee’s departure from Singapore;

- The employee’s overseas posting commencement.

Failure to do so may result in penalties or delays in tax clearance.

Key Information Required for Form IR21

To file Form IR21, you’ll need:

- Employee’s personal details (Full name, FIN, NRIC if applicable)

- Employment period and total income earned

- Bonuses, stock options, benefits-in-kind

- CPF contributions, if any

- Tax residency status

Be prepared with supporting documentation such as employment contracts or relocation notices.

Also Read: The Ultimate Guide to Offshore Accounting

How to Submit Form IR21

Employers can submit IR21:

- Electronically via myTax Portal (preferred and faster processing)

- Paper filing (only under exceptional circumstances)

For e-submission, access the portal here: IRAS myTax Portal.

Understanding Tax Clearance in Singapore

Tax clearance is the process of settling all income tax liabilities before a non-citizen employee leaves Singapore. IRAS will issue a Directive to Pay Tax if taxes are owed or a Tax Clearance Certificate if everything is in order. You can release any withheld funds only after receiving this clearance.

Common Scenarios Requiring Form IR21 Filing

You need to file Form IR21 when:

- A non-citizen employee is terminating employment

- The employee is leaving Singapore permanently or for >3 months

- The employee is transferred to an overseas office

- The employment contract ends and will not be renewed

Exemptions from Filing Form IR21

You are not required to file Form IR21 if:

- The employee is a Singapore Citizen or Permanent Resident (SPR) staying in Singapore

- The non-citizen employee worked less than 60 days in a year

- The employee is posted overseas but remains employed and paid from Singapore with no intention to leave permanently

Refer to IRAS’ exemption conditions for a full list.

Also Read: How Remote Accounting Services Can Improve Your Business

Potential Challenges in Filing Form IR21

Employers often encounter the following difficulties:

- Late notification of employee resignation or travel plans

- Incomplete or inaccurate income records

- Misunderstanding of employee’s tax residency

- Delays in compiling required documents

Avoiding Penalties for Late or Incorrect Filing

To prevent penalties:

- Always monitor employment end dates

- Set internal reminders to file IR21 one month in advance

- Withhold final payments until you receive clearance

- Use IRAS’ online calculators for accurate tax computation

Late filing may incur fines up to S$1,000, or even prosecution in severe cases.

Best Practices for Filing Form IR21

- Centralise HR and finance coordination

- Use the IRAS online submission platform for quicker processing

- Maintain detailed payroll and benefits records

- Engage a tax agent or HR outsourcing partner for complex cases

FAQs on IR21 Filing Process

Q: Can I amend IR21 after submission?

Yes, by submitting an amended form via myTax Portal.

Q: How long does IRAS take to process?

Typically 7–21 working days if all info is correct and submitted electronically.

Q: Do I need to file IR21 for interns or short-term contractors?

Only if their work period exceeds 60 days and they are non-citizens.

Conclusion

Filing Form IR21 is a legal responsibility that ensures foreign employees fulfill their tax obligations before leaving Singapore. Understanding the timeline, knowing when exemptions apply, and ensuring submission through the correct channel are all key to smooth and penalty-free processing. By adopting best practices and staying informed, employers can manage tax clearance efficiently and compliantly.

How FastLaneRecruit Can Help

FastLaneRecruit empowers employers to navigate the complexities of IR21 filing with confidence and ease. Our team of experts ensures accurate preparation, timely submission, and full compliance with IRAS requirements, minimizing the risk of penalties and delays. Whether you’re handling employee terminations, overseas postings, or end-of-contract scenarios, we streamline the tax clearance process so you can focus on running your business effectively.

Let FastLaneRecruit be your trusted partner in HR and payroll. Contact Us Now!