In Malaysia, payroll compliance goes beyond just calculating salaries and disbursing wages. It encompasses statutory contributions that safeguard the financial and social well-being of employees. Among these are the Employees Provident Fund (EPF), Social Security Organization (SOCSO), and the Employment Insurance System (EIS), three cornerstones of Malaysia’s social security landscape.

These statutory obligations not only ensure regulatory compliance for employers but also provide crucial protection and benefits for employees. Understanding their roles is vital for both employers and employees to navigate Malaysia’s payroll system efficiently and responsibly.

Content Outline

Key Summary

EPF, SOCSO, and EIS are essential pillars of Malaysia’s social security system.

Each scheme provides unique and critical benefits for employees.

Employers are legally required to contribute and register for all three.

Financial security and employee welfare depend on these contributions.

FastLaneRecruit can help businesses stay compliant with Malaysia payroll laws.

Employees Provident Fund (EPF)

What is EPF?

The Employees Provident Fund (EPF) is a retirement savings scheme managed by the Employees Provident Fund Board under the purview of the Ministry of Finance Malaysia. It is a mandatory savings plan that ensures long-term financial security for employees in the private sector and non-pensionable public sector employees.

How Does EPF Work?

Both employees and employers contribute to the EPF fund monthly. Contributions are based on a percentage of the employee’s monthly salary.

- Employees contribute 11%

- Employers contribute 12%–13% (depending on monthly wages)

These contributions are invested by EPF to generate returns, and employees can access their savings upon retirement, or under specific conditions, like buying a house or medical expenses.

Benefits of Contributing to EPF

- Guaranteed retirement savings with yearly dividends

- Early withdrawal options for housing, education, or healthcare

- Tax relief for EPF contributions

- Security during retirement or permanent disability

Social Security Organization (SOCSO)

What is SOCSO?

SOCSO, also known as Pertubuhan Keselamatan Sosial (PERKESO), is a social security scheme managed by the Social Security Organization. It offers protection to employees through two main schemes:

- Employment Injury Scheme

- Invalidity Scheme

Who Benefits from SOCSO?

Employees earning less than RM5,000/month (compulsory) and optionally for those earning above that threshold. Benefits extend to:

- Medical expenses from workplace injuries

- Temporary and permanent disablement benefits

- Survivor benefits in the event of death

- Physical or vocational rehabilitation services

How to Register for SOCSO?

Employers must register themselves and their employees through the PERKESO ASSIST Portal. Once registered, monthly contributions are made based on the SOCSO rate table.

Also Read: Benefit of Outsourcing Accounting to Malaysia

Employment Insurance System (EIS)

Understanding EIS

The Employment Insurance System (EIS) is designed to provide financial assistance and employment services to employees who have lost their jobs. It is governed by PERKESO and funded by contributions from both employers and employees. Learn more on EIS here.

Eligibility for EIS Benefits

- Malaysian citizens aged 18–60

- Private-sector employees (excluding domestic workers, self-employed, and retirees)

- Individuals who have made at least 12 months of contributions in the 24 months prior to unemployment

How to Make an EIS Claim?

- Register at EIS Portal

- Submit the application within 60 days from the last date of employment

- Provide necessary documents: termination letter, payslips, and proof of contributions

EPF vs. SOCSO vs. EIS: What Sets Them Apart?

| Feature | EPF | SOCSO | EIS |

| Main Purpose | Retirement savings | Employment injury & invalidity | Unemployment support |

| Mandatory Contribution | Yes | Yes | Yes |

| Contribution By | Employer & Employee | Employer & Employee | Employer & Employee |

| Benefits Provided | Retirement, housing, medical | Medical, disability, death | Unemployment allowance, training |

| Managing Body | EPF Board | PERKESO | PERKESO |

| Website | kwsp.gov.my | perkeso.gov.my | eis.perkeso.gov.my |

Which One Should You Prioritize?

In short—all three. Each serves a unique purpose in an employee’s financial and welfare framework. Neglecting one could mean loss of critical benefits in times of need or retirement.

Also Read: Benefits Of Offshoring Accounting In Malaysia

The Importance of Financial Security

Why Does Financial Security Matter?

Financial security ensures peace of mind, reduces stress, and enables individuals to handle emergencies, plan for the future, and maintain a stable lifestyle.

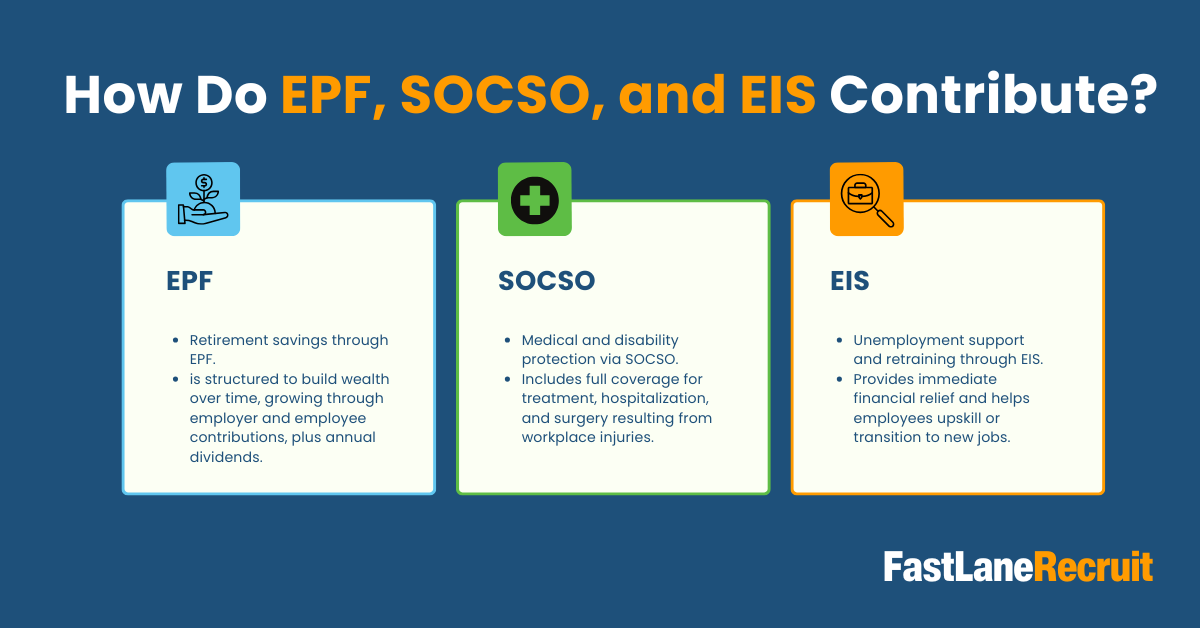

How Do EPF, SOCSO, and EIS Contribute?

Together, they form a safety net that covers:

- Retirement savings through EPF

- Medical and disability protection via SOCSO

- Unemployment support and retraining through EIS

Planning for Retirement with EPF

Building Your Retirement Nest Egg

The EPF is structured to build wealth over time, growing through employer and employee contributions, plus annual dividends.

Withdrawal Options and Conditions

Employees can partially withdraw funds for:

- Home purchases

- Education

- Medical treatments

Full withdrawal is permitted at age 55 or under certain conditions such as disability or migration.

EPF’s Role in Long-Term Financial Stability

With structured savings, investment growth, and flexibility in withdrawals, EPF offers Malaysians a reliable foundation for retirement.

Also Read: Guide to Payroll Outsourcing in Singapore

Supporting Employees in Times of Need: SOCSO at Work

Medical Benefits and Coverage

Includes full coverage for treatment, hospitalization, and surgery resulting from workplace injuries.

Employment Injury and Invalidity Benefits

Employees receive compensation for temporary or permanent disabilities and even dependents’ benefits in case of death.

Rehabilitation Programs

SOCSO offers vocational and physical rehab programs to help injured employees return to work.

Unforeseen Circumstances: EIS Comes to the Rescue

Types of Benefits Provided

- Job search allowance

- Training allowance

- Reduced income allowance

- Re-employment placement programs

EIS During Layoffs and Retrenchment

Provides immediate financial relief and helps employees upskill or transition to new jobs.

Re-employment Programs

EIS includes job matching, career counselling, and placement services for affected individuals.

Contributing to EPF, SOCSO, and EIS

How Contributions Are Calculated?

| Contribution Type | Employer (%) | Employee (%) | Total (%) |

| EPF | 12–13% | 11% | 23–24% |

| SOCSO | 1.75% | 0.5% | 2.25% |

| EIS | 0.2% | 0.2% | 0.4% |

Employee and Employer Responsibilities

- Employers: Must register and contribute on time, maintain accurate records, and issue pay slips.

- Employees: Should understand their benefits and monitor monthly contributions.

The Impact of Regular Contributions

Regular contributions not only ensure compliance but also significantly impact employees’ well-being in the short and long term.

Conclusion

Compliance with EPF, SOCSO, and EIS is not just a legal obligation, it’s a commitment to the financial security and social welfare of your employees. For businesses, this also means building trust, retaining talent, and demonstrating a culture of care.

How FastLaneRecruit Can Help

At FastLaneRecruit, we understand the complexities of payroll compliance in Malaysia. Our experts can help your business:

- Accurately calculate and manage EPF, SOCSO, and EIS contributions

- Register and submit filings through relevant portals

- Stay updated on changes to statutory rates and deadlines

- Streamline your HR and payroll operations

Stay compliant, avoid penalties, and empower your workforce with professional payroll management. Contact FastLaneRecruit today to learn more about our Malaysia payroll solutions.