Malaysia’s dynamic economy, strategic location in Southeast Asia, and growing talent pool make it an attractive destination for businesses expanding internationally. Whether you’re setting up a new office or hiring remotely, understanding Malaysia’s payroll management landscape is essential to ensure compliance and smooth operations. From salary components and statutory contributions to payroll processing and termination laws, this guide covers everything you need to know about managing payroll in Malaysia effectively.

FastLaneRecruit specializes in helping companies hire and pay Malaysian employees with full compliance. Read on to learn how we can simplify your payroll journey.

Also Read: Payroll Process and Compliance Guide in Malaysia for Employer

Content Outline

Key Summary

Salary Structure in Malaysia

Payroll includes basic salary, gross pay, net pay, allowances, overtime, bonuses, and benefits-in-kind. Understanding these components ensures accurate salary calculations.

Statutory Contributions & Deductions

Employers must comply with mandatory contributions, including: HRDF (training fund for companies with >10 employees), EPF (retirement savings), SOCSO (social security protection) and EIS (unemployment insurance).

Income Tax Compliance

Malaysia follows a progressive tax system with Monthly Tax Deduction (MTD). Employers must deduct and remit taxes accurately to the Inland Revenue Board (LHDN).

Payroll Setup Process

To establish payroll in Malaysia, companies must: Decide between in-house payroll or outsourcing, Register with the Companies Commission (SSM), Open a local bank account and Register for EPF, SOCSO, EIS, and tax.

Payroll Processing Cycle

Employers must follow Malaysia’s payroll cycle, which includes timely salary payments (by the 7th of each month), payslip issuance, statutory deductions, and optional year-end bonuses.

Termination & Severance Rules

Employers must follow fair dismissal procedures, provide notice periods, and pay severance based on years of service unless termination is due to gross misconduct.

Payroll Management Options

Companies can manage payroll internally or outsource to a trusted provider like FastLaneRecruit, which ensures compliance, reduces risks, and simplifies operations for international businesses.

How Is Payroll Calculated in Malaysia?

Payroll in Malaysia combines basic salary, allowances, incentives, and mandatory deductions. Understanding these elements is key to accurate payroll processing. Here’s a breakdown:

Salary Components

- Basic Salary: Fixed monthly income based on role and industry, excluding overtime or bonuses.

- Gross Pay: Basic salary plus allowances, bonuses, overtime, and other earnings before deductions.

- Net Pay: Take-home salary after deducting taxes and statutory contributions.

- Incentive Pay: Performance-based bonuses, commissions, profit shares.

- Overtime Pay: Paid at 1.5 times hourly rate on regular days, double or triple rates on rest/public holidays.

- Allowances: Reimbursements like travel, meal, or phone allowances.

- Perquisites & Benefits-in-Kind (BIKs): Non-cash benefits such as company cars, medical coverage, which may be taxable.

Statutory Payroll Contributions and Deductions in Malaysia: Detailed Breakdown

When managing payroll in Malaysia, both employers and employees are required to make statutory contributions. These contributions support social security, retirement savings, and workforce development. Below is a detailed explanation of the main contributions, including rates, descriptions, and practical examples to clarify how they work.

1. Employees Provident Fund (EPF)

Employer Contribution:

- 12% to 13% for employees under 60 years old

- 4% to 6.5% for employees aged 60 and above

Employee Contribution:

- 9% for employees under 60 years old

- 0% to 5.5% for employees aged 60 and above

Description:

The EPF is Malaysia’s mandatory retirement savings scheme designed to help employees save a portion of their salary for retirement. Both employers and employees contribute monthly based on the employee’s monthly salary. The contribution rate varies depending on the employee’s age, with lower rates for senior employees.

Example:

If an employee under 60 earns MYR 3,000 per month:

- Employer contributes 12% → MYR 360

- Employee contributes 9% → MYR 270

Total monthly EPF contribution = MYR 630

This money accumulates in the employee’s EPF account and can be withdrawn upon retirement or under specific circumstances.

2. Social Security Organization (SOCSO)

Employer Contribution: 1.75% of monthly wages

Employee Contribution: 0.5% of monthly wages

Description:

SOCSO provides social security protection to employees in cases of workplace injuries, occupational diseases, invalidity, and pensions. It ensures financial assistance and healthcare benefits in such events.

Example:

For an employee earning MYR 3,000 per month:

- Employer pays 1.75% → MYR 52.50

- Employee pays 0.5% → MYR 15

Total SOCSO contribution = MYR 67.50

This contribution secures employees against work-related risks and disabilities.

Also Read: Advantages of Payroll Outsourcing in Malaysia

3. Employment Insurance Scheme (EIS)

Employer Contribution: 0.2% of monthly wages

Employee Contribution: 0.2% of monthly wages

Description:

The EIS provides temporary financial assistance and re-employment services to employees who lose their jobs. Both parties contribute a small percentage to fund the scheme.

Example:

An employee with a monthly salary of MYR 3,000:

- Employer pays 0.2% → MYR 6

- Employee pays 0.2% → MYR 6

Total EIS contribution = MYR 12

This helps employees during periods of unemployment and supports retraining or job placement.

4. Human Resource Development Fund (HRDF)

Employer Contribution: 1% of monthly wages (applicable only if the company employs more than 10 employees)

Employee Contribution: Not applicable

Description:

The HRDF is a fund dedicated to employee training and skills development to improve the overall competency of Malaysia’s workforce. Only employers contribute to this fund.

Example:

For a company with 20 employees each earning an average of MYR 3,000 per month:

- Monthly HRDF contribution = 1% of total payroll

- Total payroll = 20 employees × MYR 3,000 = MYR 60,000

- HRDF monthly payment = 1% × MYR 60,000 = MYR 600

Employers can claim training grants from the HRDF to upskill their employees.

Summary Table for Employer and Employee Payroll Contributions

| Contribution | Employer Rate | Employee Rate | Description | Example (MYR 3,000 salary) |

| Employees Provident Fund (EPF) | 12-13% (under 60) / 4-6.5% (over 60) | 9% (under 60) / 0-5.5% (over 60) | Mandatory retirement savings | Employer: MYR 360, Employee: MYR 270 |

| Social Security Organization (SOCSO) | 1.75% | 0.5% | Social security for injury and pensions | Employer: MYR 52.50, Employee: MYR 15 |

| Employment Insurance Scheme (EIS) | 0.2% | 0.2% | Unemployment insurance | Employer: MYR 6, Employee: MYR 6 |

| Human Resource Development Fund (HRDF) | 1% (if >10 employees) | N/A | Workforce training and development fund | Employer: MYR 600 (for 20 employees) |

If you’re considering hiring in Malaysia and want to ensure your payroll complies with these statutory requirements, FastLaneRecruit offers expert payroll services tailored to local laws and international standards. Contact us today to get started with hassle-free payroll management.

Source: Employees Provident Fund Malaysia, SOCSO, LHDN Malaysia

Income Tax Rates

Malaysia uses a progressive tax system with monthly tax deductions (MTD) deducted at source:

| Annual Taxable Income (MYR) | Tax Rate on Excess | Tax Payable on First Amount (MYR) |

| 0 – 5,000 | 0% | 0 |

| 5,001 – 20,000 | 1% | 0 |

| 20,001 – 35,000 | 3% | 150 |

| 35,001 – 50,000 | 8% | 600 |

| 50,001 – 70,000 | 13% | 1,800 |

| 70,001 – 100,000 | 21% | 4,400 |

| 100,001 – 250,000 | 24% | 10,700 |

| 250,001 – 400,000 | 24.5% | 46,700 |

| 400,001 – 600,000 | 25% | 83,450 |

| 600,001 – 1,000,000 | 26% | 133,450 |

| 1,000,001 – 2,000,000 | 28% | 237,450 |

| Above 2,000,000 | 30% | 517,450 |

Source: Inland Revenue Board of Malaysia

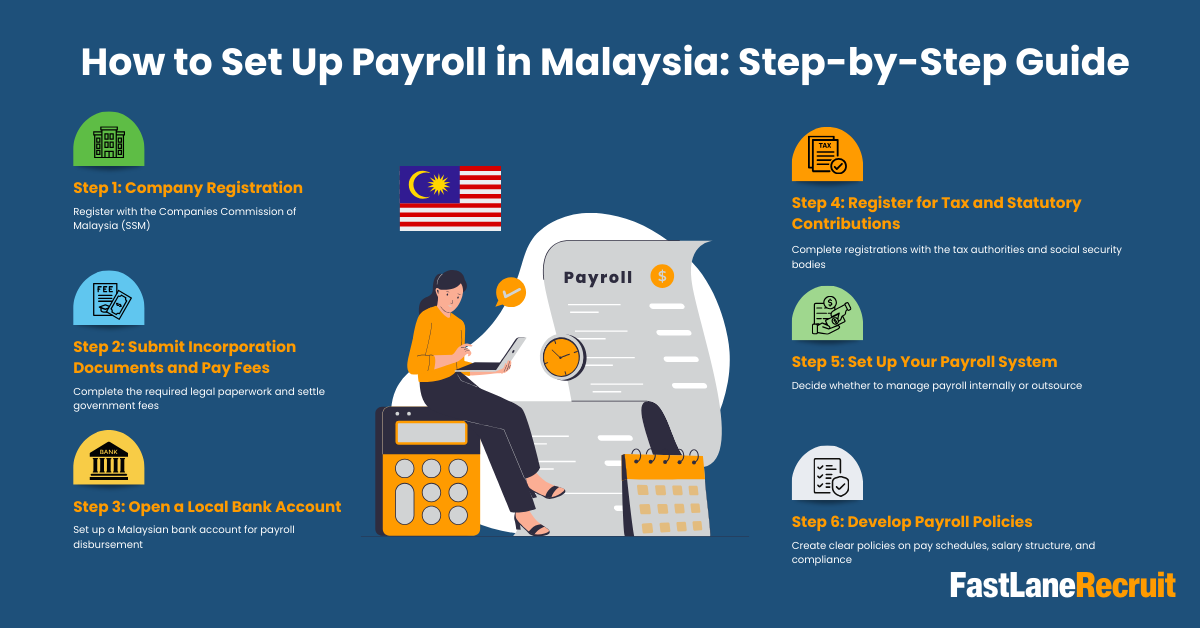

How to Set Up Payroll in Malaysia: Step-by-Step Guide

Setting up payroll in Malaysia can seem complex for international companies unfamiliar with local regulations. Following a structured process will help you stay compliant and avoid costly penalties. Below are the essential steps to get your Malaysian payroll up and running smoothly.

Also Read: Employee Benefits in Malaysia: A Complete Guide for Employers

Step 1: Company Registration

Register with the Companies Commission of Malaysia (SSM)

Before you can hire employees and run payroll in Malaysia, you need to officially register your company with the SSM (Suruhanjaya Syarikat Malaysia), the government agency responsible for company incorporation.

- What to do:

- Choose a company name and check its availability through the SSM online portal.

- Submit the application for incorporation, providing documents such as the Memorandum and Articles of Association.

- Pay the registration fees, which vary depending on the company’s share capital.

Example:

A foreign tech startup wanting to establish a subsidiary in Malaysia registers as a Private Limited Company (Sdn. Bhd.) through SSM. The process takes approximately 1-3 weeks.

Learn more at: SSM Official Portal

Step 2: Submit Incorporation Documents and Pay Fees

Complete the required legal paperwork and settle government fees

After registering the company name, you must submit all required incorporation documents to finalize your company registration.

- Documents typically include:

- Form 9 (Certificate of Incorporation)

- Form 24 (Return of Allotment of Shares)

- Form 49 (Return giving particulars of directors, managers, and secretaries)

- Fees:

- Incorporation fees depend on the authorized share capital.

- Other fees may include post-incorporation services and stamp duties.

Example:

If your company’s authorized share capital is MYR 500,000, your registration fee might be approximately MYR 1,000 to MYR 3,000.

Step 3: Open a Local Bank Account

Set up a Malaysian bank account for payroll disbursement

Once your company is incorporated, you need a local bank account to pay employees their salaries. Malaysian banks require your incorporation documents, company resolution authorizing signatories, and identification documents.

- Why it matters:

- Salary payments must be made to employees’ Malaysian bank accounts by law.

- Having a local account simplifies payroll processing and statutory contributions.

Example:

A manufacturing company opens a corporate account with Maybank, one of Malaysia’s largest banks, to handle monthly salary payments and vendor transactions.

Step 4: Register for Tax and Statutory Contributions

Complete registrations with the tax authorities and social security bodies

To run compliant payroll, register your company with relevant Malaysian government bodies:

- LHDN (Lembaga Hasil Dalam Negeri Malaysia): For income tax and PAYE (Pay-As-You-Earn) system registration.

- EPF (Employees Provident Fund): Mandatory retirement fund contributions.

- SOCSO (Social Security Organization): For employee social security coverage.

- EIS (Employment Insurance Scheme): For unemployment benefits.

Example:

A consulting firm submits company details to LHDN and obtains a tax reference number to start deducting monthly tax (MTD) from employee salaries.

Step 5: Set Up Your Payroll System

Decide whether to manage payroll internally or outsource

Based on your company size and resources, choose the best way to run payroll:

- Internal Payroll: Use payroll software or manual processing within your HR or finance team. Suitable for companies with sufficient local expertise.

- Outsourcing Payroll: Engage a trusted payroll service provider like FastLaneRecruit. Outsourcing helps avoid compliance risks, reduces administrative burden, and ensures timely statutory payments.

Example:

A startup with limited HR capacity partners with FastLaneRecruit to handle all payroll, tax filings, and contributions, allowing them to focus on growth.

Also Read: 4 Types of Employment Contracts in Malaysia Recruitment

Step 6: Develop Payroll Policies

Create clear policies on pay schedules, salary structure, and compliance

To maintain transparency and compliance, define your company’s payroll policies, including:

- Pay Dates: Monthly salary payment deadlines (e.g., by the 7th of each month).

- Salary Components: Clear definition of basic salary, allowances, overtime, bonuses, and deductions.

- Compliance: Outline statutory deductions (EPF, SOCSO, EIS, taxes) and procedures for payroll remittance.

- Termination Pay: Define notice periods and severance pay in line with Malaysian Employment Law.

Example:

An e-commerce company’s payroll policy states employees will be paid monthly by the 5th, with payslips issued electronically showing detailed salary breakdowns and deductions.

Setting up payroll in Malaysia involves a series of legal registrations, banking arrangements, and policy decisions. For international businesses, partnering with experienced providers like FastLaneRecruit can streamline this process and ensure full compliance with Malaysian labor laws and tax regulations.

Summary Table for Setting Up Payroll in Malaysia

| Step | Description |

| 1. Company Registration | Register with the Companies Commission of Malaysia (SSM) |

| 2. Incorporation Documents | Submit required forms, pay registration fees |

| 3. Bank Account Setup | Open a local bank account for salary disbursement |

| 4. Register for Tax & Contributions | Register for Income Tax, EPF, SOCSO, EIS, and PAYE with LHDN and relevant bodies |

| 5. Payroll System Setup | Choose internal payroll or outsource to providers like FastLaneRecruit |

| 6. Payroll Policy Development | Define pay dates, salary structure, deductions, and compliance |

Also Read: Why EPF, SOCSO, and EIS Are Essential for Malaysia Payroll

Payroll Processing Cycle in Malaysia: Key Steps Explained

Most companies in Malaysia follow a monthly payroll cycle that includes several important steps to ensure employees are paid accurately and on time while remaining compliant with local laws. Understanding each step in detail helps streamline payroll operations and avoid penalties.

1. Salary Payment Date

Deadline for Salary Disbursement

In Malaysia, employers are legally required to pay employee salaries promptly. The payment must be made by the 7th of each month and credited directly into employees’ bank accounts.

- Why it matters:

Timely salary payments build trust, ensure employee satisfaction, and comply with the Employment Act 1955. Delays can result in complaints or legal action.

Example:

If the payroll period ends on January 31st, the employer must ensure that all salaries are deposited into employee bank accounts no later than February 7th. Some companies pay earlier as a courtesy or policy decision.

2. Salary Computation

Calculating Gross Salary and Earnings

Payroll teams calculate each employee’s gross salary before deductions. This includes:

- Basic salary

- Overtime pay (at legally mandated rates)

- Allowances (e.g., travel, meals)

- Bonuses and commissions

- Any other earnings such as performance incentives

Considerations:

Overtime pay rates must comply with Malaysian labor laws (e.g., 1.5x for regular days, 2x or 3x for rest/public holidays).

Bonuses can be fixed or variable depending on company policy.

Example:

An employee’s monthly basic salary is MYR 3,000. Last month, they worked 10 hours overtime on a regular workday.

- Overtime rate = 1.5 × hourly wage

- Hourly wage = MYR 3,000 ÷ 26 days ÷ 8 hours = approx. MYR 14.42

- Overtime pay = 10 hours × 1.5 × MYR 14.42 = MYR 216.30

- Gross salary = MYR 3,000 + MYR 216.30 = MYR 3,216.30

3. Payslip Issuance

Providing a Transparent Salary Breakdown

Employers are required to provide employees with payslips, either in hard copy or electronically. Payslips must detail:

- Basic salary

- Allowances and bonuses

- Overtime payments

- Statutory deductions (EPF, SOCSO, EIS, tax)

- Net salary (take-home pay)

Why it’s important:

Payslips increase transparency, help employees verify their earnings and deductions, and are often required for official purposes (e.g., loan applications).

Example:

An employee receives an emailed payslip every month showing:

- Basic salary: MYR 3,000

- Overtime: MYR 216.30

- EPF deduction: MYR 270

- SOCSO deduction: MYR 15

- Tax deduction: MYR 200

- Net pay: MYR 2,731.30

Also Read: Employment Law in Malaysia

4. Statutory Deductions and Remittance

Ensuring Timely Payment of Contributions

Employers must deduct statutory contributions from employees’ salaries and remit both employee and employer shares to the respective authorities on time, including:

- Employees Provident Fund (EPF)

- Social Security Organization (SOCSO)

- Employment Insurance Scheme (EIS)

- Monthly Tax Deduction (MTD) under the Pay-As-You-Earn (PAYE) system for income tax

- Deadlines:

Usually, remittances are due within 15 days after the payroll month ends.

Example:

For January payroll, the employer deducts MYR 270 for EPF (employee share) and contributes an additional MYR 360 (employer share). Both amounts must be paid to EPF by February 15th.

5. Year-End Bonus

Providing Additional Employee Incentives

While not mandatory, it is common practice for Malaysian employers to provide a 13th-month bonus or an annual bonus at the end of the year. This payment usually equals one month’s salary or a pro-rated amount based on tenure.

Purpose:

To reward employees for their contribution and boost morale during the festive season.

Example:

An employee who has worked the full calendar year receives a bonus of MYR 3,000 (equivalent to one month’s salary) in December. If the employee joined mid-year, the bonus may be prorated accordingly.

Also Read: How to Establish an Offshore Company in Malaysia

Summary Table: Monthly Payroll Cycle in Malaysia

| Payroll Step | Key Details | Example |

| Salary Payment Date | By 7th of each month, salary must be credited to employees’ bank accounts | February 7th for January’s salary |

| Salary Computation | Calculate gross pay, including overtime, bonuses, and allowances | MYR 3,000 basic + MYR 216 overtime = MYR 3,216 gross |

| Payslip Issuance | Provide a detailed payslip (hardcopy or electronic) | Payslip shows earnings, deductions, and net pay |

| Statutory Deductions | Deduct & remit EPF, SOCSO, EIS, MTD taxes on time | EPF remitted by 15th February for January payroll |

| Year-End Bonus | An optional 13th-month or annual bonus for employees | MYR 3,000 bonus given in December for full-year work |

Managing payroll correctly ensures smooth business operations and maintains employee satisfaction. If you want to simplify payroll compliance in Malaysia, FastLaneRecruit offers expert payroll outsourcing services designed to keep your business compliant and your employees paid on time.

Termination and Entitlement Laws in Malaysia: What Employers and Employees Need to Know

Malaysia’s employment laws provide protections to employees against unfair dismissal. Employers must adhere to proper procedures and compensate employees fairly upon termination, depending on their length of service. Below is a detailed explanation of termination rules, notice periods, and severance pay entitlements.

1. Protection Against Arbitrary Dismissal

Fair Procedures Must Be Followed

Employers cannot terminate employees arbitrarily or without just cause. Malaysian law requires that dismissals follow a fair and reasonable process. This includes:

- Providing valid reasons for termination (e.g., poor performance, misconduct, redundancy)

- Issuing termination notices or paying in lieu of notice

- Giving the employee an opportunity to respond or improve (in some cases)

Failure to follow these procedures may result in claims of wrongful dismissal.

Example:

If an employee consistently misses deadlines, the employer should first document warnings and performance reviews before terminating employment. Instant dismissal without warning may be legally challenged.

2. Notice Period for Termination

Common Practice vs. Statutory Requirements

While the Malaysian Employment Act 1955 does not specify a mandatory statutory notice period for termination in all cases, the standard practice is to provide a 30-day notice period or payment in lieu of notice.

- Notice period can be shorter or longer if specified in the employment contract.

- Employers and employees can mutually agree on the notice terms in the contract.

Providing notice allows employees time to seek new employment and prepares the company for the transition.

Example:

An employee with a contract specifying a one-month notice must be informed at least 30 days before the last working day, or compensated with one month’s salary instead.

3. Severance Pay Entitlements

Compensation Based on Length of Service

Employees terminated (other than for gross misconduct) are generally entitled to severance pay, which varies according to their duration of employment:

| Length of Service | Severance Pay Entitlement | Description |

| Less than 2 years | 10 days’ wages for each year of service | For example, 1.5 years = 15 days’ wages total |

| 2 to 5 years | 15 days’ wages for each year of service | Reflects increased compensation for longer service |

| More than 5 years | 20 days’ wages for each year of service | Highest entitlement for long-term employees |

Calculation basis:

Severance pay is calculated based on the employee’s last drawn monthly wage, prorated according to their years of service.

Example:

An employee earning MYR 3,000 per month is terminated after 3 years of service. The severance pay is:

- 15 days’ wages per year × 3 years = 45 days’ wages

- Daily wage = MYR 3,000 ÷ 26 working days ≈ MYR 115.38

- Severance pay = 45 × MYR 115.38 = MYR 5,192.10

Also Read: What Is Employee Outsourcing and How Does It Work?

4. Additional Considerations

- Termination due to Misconduct:

If an employee is terminated for serious misconduct (e.g., theft, fraud), severance pay may not be applicable. However, proper investigation and documentation are essential. - Statutory Termination Benefits:

Employers must also ensure that any other statutory benefits (e.g., unpaid salary, unused annual leave, EPF contributions) are settled upon termination. - Contractual Clauses:

Employment contracts may contain additional provisions regarding termination and entitlements, but they cannot contravene the minimum protections under Malaysian law.

Summary Table: Termination Entitlements Based on Service Length

| Length of Service | Severance Pay (Days’ Wages per Year) | Example: MYR 3,000 Monthly Salary |

| Less than 2 years | 10 days | 1 year: 10 × MYR 115.38 = MYR 1,153.80 |

| 2 to 5 years | 15 days | 3 years: 45 × MYR 115.38 = MYR 5,192.10 |

| More than 5 years | 20 days | 6 years: 120 × MYR 115.38 = MYR 13,845.60 |

Understanding Malaysia’s termination and severance laws helps employers act fairly and compliantly while protecting employee rights. Clear communication, fair notice, and proper severance pay calculation reduce disputes and maintain workplace harmony.

For international businesses, navigating these laws can be complex. Partner with FastLaneRecruit to manage payroll, employment contracts, and termination processes with confidence.

Also Read: How to Process Payroll for Global Teams

Malaysia Payroll Management Options

Businesses have two main payroll management options:

1. Internal Payroll

- Suitable for companies with dedicated HR/payroll teams.

- Requires knowledge of Malaysian labor laws and tax regulations.

2. Payroll Outsourcing

- Recommended for foreign companies without local payroll expertise.

- FastLaneRecruit offers end-to-end payroll outsourcing services, ensuring compliance with Malaysia’s complex employment and tax laws, allowing you to focus on growing your business.

Why Choose FastLaneRecruit for Your Malaysian Payroll?

Navigating Malaysia’s complex payroll regulations can be overwhelming, especially for international businesses unfamiliar with local labor laws and compliance requirements. That’s where FastLaneRecruit steps in to simplify the entire hiring and payroll management process for Malaysian employees.

Here’s how we add value to your business:

- Full Compliance with Statutory Requirements:

We ensure your payroll operations fully adhere to Malaysian laws, including timely remittance of Employees Provident Fund (EPF), Social Security Organization (SOCSO), Employment Insurance Scheme (EIS), and accurate Monthly Tax Deduction (MTD) filings to LHDN. This minimizes legal risks and penalties. - Automated Payroll Processing and Payslip Issuance:

Our advanced payroll system automates salary calculations, statutory deductions, bonuses, and allowances. Payslips are generated and delivered electronically or in hard copy, providing transparency and convenience for your employees. - Accurate Tax and Social Security Contributions:

We meticulously calculate employer and employee contributions, ensuring all payments are accurate and submitted within deadlines to avoid any compliance issues. - Timely Salary Payments:

Salaries are credited directly to your employees’ bank accounts by the legally mandated deadline, helping you maintain strong employee satisfaction and trust. - Comprehensive Support for Employee Termination and Benefits Management:

From managing notice periods to calculating severance pay and final settlements, FastLaneRecruit provides end-to-end support, ensuring that terminations and benefits are handled fairly and in line with Malaysian employment laws.

Whether you’re hiring your very first Malaysian employee or expanding an existing local team, FastLaneRecruit’s payroll expertise and local knowledge make managing payroll effortless and worry-free.

Also Read: Guide to Employee Cost: How to Calculate the Cost of an Employee

Conclusion

Payroll management in Malaysia involves careful compliance with local labor laws, tax rules, and social security contributions. For global businesses, understanding these payroll elements is crucial to avoid penalties and maintain good employer-employee relationships. Whether you manage payroll internally or outsource it, partnering with a trusted expert like FastLaneRecruit will help you streamline processes, reduce risks, and focus on business growth in Malaysia’s vibrant market.

Ready to Hire and Pay Malaysian Employees?

Expanding your global team into Malaysia has never been easier. FastLaneRecruit provides expert support to help you navigate Malaysia’s complex payroll regulations and statutory requirements. Our comprehensive payroll solutions ensure that your employees are paid accurately and on time, while keeping your business fully compliant with local laws, saving you time, reducing risk, and letting you focus on what matters most: growing your business.

Don’t let payroll complexities slow down your expansion plans. Partner with FastLaneRecruit today and experience hassle-free Malaysian payroll management tailored for international companies.

Get started now and take the first step towards seamless global hiring!