Why Payroll Outsourcing Matters More Than Ever

Managing payroll in Malaysia requires a sharp eye for detail, deep familiarity with regulatory updates, and robust systems to ensure accuracy and timeliness. As businesses scale or expand across borders, payroll complexities multiply. From adhering to EPF (Employees Provident Fund) contributions to understanding the nuances of SOCSO, EIS, and income tax deductions, Malaysian payroll processing is not only time-consuming but also fraught with regulatory pitfalls.

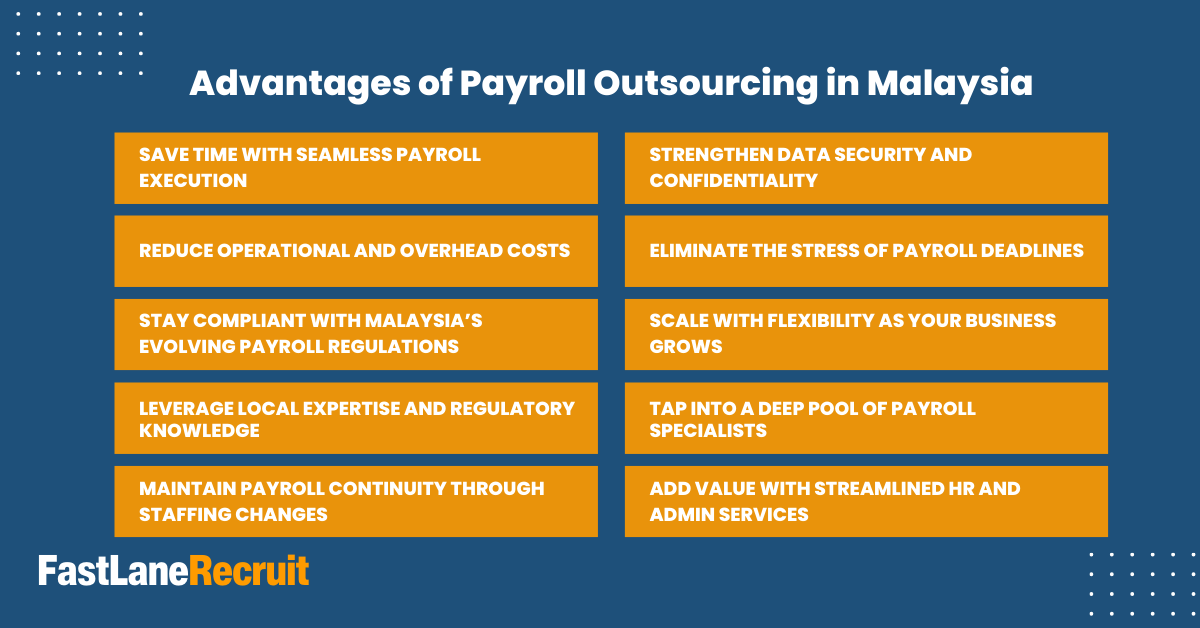

Outsourcing payroll isn’t just about handing over administrative burdens; it’s a strategic move that empowers businesses to focus on their core strengths. Whether you’re a fast-growing startup or an established international enterprise with a Malaysian presence, engaging a reliable payroll and hiring partner like FastLaneRecruit ensures compliance, cost-efficiency, and peace of mind.

Content Outline

Key Summary

Save Time and Resources

Outsourcing eliminates time-consuming payroll tasks, allowing your HR and finance teams to focus on strategic growth initiatives instead of monthly admin work.

Lower Operational Costs

Reduce expenses tied to in-house payroll staff, software, and compliance risks by partnering with a payroll provider that offers predictable, scalable pricing.

Stay Fully Compliant

Avoid costly penalties and regulatory errors. Outsourcing ensures timely and accurate statutory filings in line with Malaysian labour laws and tax regulations.

Access Local Expertise

Partnering with a Malaysia-based payroll provider gives you access to professionals who understand local tax laws, EPF, SOCSO, EIS, and LHDN requirements.

Ensure Payroll Continuity

Payroll operations stay consistent regardless of staff turnover or absences, protecting your business from disruptions and delays.

Improve Data Security

Outsourcing providers use encrypted, cloud-based systems that enhance data protection and align with Malaysia’s Personal Data Protection Act (PDPA).

Increase Flexibility and Scalability

Whether you’re hiring five or fifty employees, outsourced payroll services can easily adapt to your workforce needs and growth trajectory.

Tap into Payroll Specialists

Gain a dedicated team of payroll experts with cross-functional knowledge of HR, accounting, and local compliance without increasing headcount.

Benefit from Value-Added Services

Modern payroll providers offer additional HR tools like leave tracking, digital payslips, and reporting dashboards, improving operational efficiency.

Simplify Malaysian Hiring

FastLaneRecruit enables international companies to hire and pay Malaysian employees without establishing a local entity, ensuring smooth and compliant cross-border operations.

Save Time with Seamless Payroll Execution

In-house payroll processing demands countless hours every month, collating time sheets, calculating statutory deductions, issuing payslips, filing tax documents, and resolving queries. These repetitive administrative tasks sap your HR and finance teams’ productivity.

Outsourcing liberates your internal teams from the monthly grind. A dedicated payroll partner ensures your employees are paid accurately and on time, while you reclaim those hours for strategic HR initiatives, talent development, or business growth.

Also Read: Detailed Guide to IT Outsourcing

Time Savings at a Glance

| Task | In-House Time Requirement | With Outsourced Payroll |

| Monthly payroll run | 10–20 hours | 1–2 hours (review only) |

| Statutory filings | 5–8 hours | Handled by provider |

| End-of-year reporting | 15+ hours | Fully managed |

Reduce Operational and Overhead Costs

Running payroll in-house might seem cost-effective until you consider the hidden expenses: salaries for HR/payroll staff, software licenses, training, error correction, and potential penalties from misfilings.

Outsourcing eliminates the need to invest in expensive payroll infrastructure or software upgrades. More importantly, it mitigates the financial risk of late or incorrect submissions to statutory bodies such as:

- Lembaga Hasil Dalam Negeri (LHDN) – https://www.hasil.gov.my/

- KWSP/EPF – https://www.kwsp.gov.my/

- PERKESO (SOCSO) – https://www.perkeso.gov.my/

With a fixed monthly fee, you can budget predictably while eliminating HR staffing concerns or system breakdowns.

Also Read: Guide to Efficient Payroll Processing in Malaysia

Stay Compliant with Malaysia’s Evolving Payroll Regulations

Malaysia’s payroll regulations are complex, and non-compliance can result in fines, audits, or reputational damage. Legislation such as the Employment Act 1955, Income Tax Act 1967, and contributions to EPF, SOCSO, and EIS demand accurate calculations and timely submissions.

An experienced payroll provider stays updated on all legislative changes, ensuring your payroll processes align with the latest legal requirements. Whether it’s CP39 forms, Borang EA, or PCB deductions, errors in payroll compliance are one risk you can eliminate with the right partner. Explore payroll compliance regulations at the Official LHDN website.

Leverage Local Expertise and Regulatory Knowledge

A payroll provider deeply rooted in Malaysia understands the local labour market, statutory frameworks, and even subtle cultural expectations around payroll timelines and benefits. This ensures not only compliance but also alignment with local employee expectations.

Moreover, navigating state-specific payroll requirements or industry-related incentives (such as tax exemptions for SMEs) becomes easier with an expert partner. From Bahasa Malaysia payslip formats to statutory portals, a localised service model ensures your operations remain frictionless.

Maintain Payroll Continuity Through Staffing Changes

Employee turnover can disrupt payroll operations significantly. An absent payroll officer or a sudden resignation can throw your payroll schedule into chaos, delaying salaries and creating compliance breaches.

Outsourcing creates a stable operational foundation. Your payroll will not be held hostage by individual staff changes. The provider maintains institutional knowledge, documentation, and continuity even when key personnel exit, ensuring a seamless and uninterrupted payroll cycle.

Also Read: 7 Strategic Benefits of Using an EOR for Talent Acquisition

Strengthen Data Security and Confidentiality

Payroll involves sensitive employee data, identification numbers, salary details, tax records, and bank account information. Mishandling or leaks can lead to identity theft, reputational harm, or legal consequences.

Outsourcing providers implement bank-grade encryption, two-factor authentication, and role-based access control to ensure your payroll data remains secure. Their infrastructure is designed to comply with the PDPA (Personal Data Protection Act) in Malaysia, reducing your liability and reinforcing employee trust.

Eliminate the Stress of Payroll Deadlines

Missed deadlines for monthly PCB (Potongan Cukai Bulanan), EPF, or SOCSO payments can result in late payment penalties and employee dissatisfaction. In-house teams, already stretched thin, may struggle to stay ahead of deadlines, especially during peak periods like financial year-end.

A dedicated payroll provider operates with pre-set calendars, automated reminders, and workflow tools to prevent delays. Their proactive approach ensures every document is filed and every payment made on time, every time.

Scale with Flexibility as Your Business Grows

As your workforce expands, whether in Kuala Lumpur, Penang, or across ASEAN, payroll complexity scales in tandem. Managing multiple pay grades, allowances, bonuses, and varying contract types becomes increasingly challenging.

Outsourced payroll services are inherently scalable. Whether you’re onboarding five employees or fifty, a provider can adapt swiftly without requiring you to upgrade systems or retrain staff. You gain agility, freeing your internal teams to support your business expansion initiatives.

Also Read: 4 Types of Employment Contracts in Malaysia Recruitment

Tap into a Deep Pool of Payroll Specialists

Payroll processing is more than just number crunching. It requires legal knowledge, system fluency, tax interpretation, and an understanding of HR policies. Outsourcing connects you with experts who bring cross-functional payroll mastery, accountants, tax consultants, HR specialists, and system analysts.

At FastLaneRecruit, your Malaysian payroll is managed by certified professionals with a thorough understanding of Malaysian employment law and regulatory updates. You no longer rely on a single point of failure but rather gain access to a well-rounded payroll team.

Add Value with Streamlined HR and Admin Services

Modern payroll outsourcing isn’t limited to salary processing. Payroll providers offer value-added services such as:

- Leave and claims management

- Time-tracking integrations

- Employee self-service portals

- Digital payslip issuance

- Automated statutory reports

These services reduce manual HR tasks and bring a unified, tech-driven approach to employee administration.

Also Read: Average Salary in Malaysia 2025

Value-Add Capabilities Table

| Feature | Benefit |

| ESS Portals | Empower employees to access payslips and submit leave/claims |

| Auto Tax Filing | Ensure timely CP39 and EA form submissions |

| Integration with Talenox & Xero | Real-time syncing with HR and accounting tools |

Simplify Your Payroll with FastLane Group’s Outsourced Payroll Services

Managing payroll can be overwhelming, especially when you’re navigating Malaysia’s complex statutory landscape. That’s where FastLane Group, our group of company, steps in to simplify the entire payroll process from end to end. Whether you’re a small business, a scaling startup, or a multinational organisation with a presence in Malaysia, our payroll outsourcing services are designed to give you complete peace of mind.

We combine deep local expertise with world-class technology through our strategic partnerships with Xero and Talenox. These integrations enable fully compliant, cloud-based payroll solutions that ensure automation, accuracy, and real-time access to payroll data. You can generate payroll reports, issue digital payslips, calculate statutory contributions, and file monthly returns, all from a single, unified platform. With our systems aligned to local laws and updated in accordance with regulatory changes, you eliminate the risk of non-compliance.

Also Read: How to Hire Using EOR in Malaysia

FastLane Group supports a wide range of clients, from SMEs to international firms and remote teams, by offering tailored payroll workflows that accommodate diverse business models. Whether you pay employees monthly, bi-weekly, or on a project basis, our platform is flexible enough to meet your needs. We go beyond basic payroll functions by offering:

- Multi-currency payroll for cross-border operations

- Automated tax and statutory filings, including PCB, EPF, SOCSO, and EIS

Confidentiality and data protection are top priorities. Our systems are built with bank-grade security protocols and strict internal controls, ensuring that your employee data remains safe and your business is fully compliant with Malaysia’s Personal Data Protection Act (PDPA).

By outsourcing your payroll to FastLane Group, you’re not just handing over a task; you’re gaining a trusted partner. Our local payroll specialists manage everything with meticulous attention to detail, from processing to compliance to reporting. You stay in control, without the burden of daily payroll administration.

Let FastLane Group take care of the heavy lifting, so you can focus on growing your team and scaling your business in Malaysia, without missing a beat.

Also Read: What is Outsourcing?

Conclusion: Payroll Outsourcing Is a Strategic Advantage

Outsourcing payroll is no longer a luxury; it’s a necessity for businesses that value efficiency, accuracy, and strategic growth. From regulatory compliance and cost savings to stress reduction and access to expert support, the advantages are undeniable.

In Malaysia’s fast-evolving labour and compliance environment, payroll outsourcing allows companies to stay nimble, reduce operational risk, and focus on what matters most: growing their business and supporting their people.

Hire and Pay Malaysian Employees for Your Global Team with FastLaneRecruit

Thinking about hiring Malaysian talent but unsure how to manage payroll and compliance? FastLaneRecruit offers employer of record (EOR) and payroll outsourcing solutions tailored for international firms.

We help you onboard Malaysian employees without establishing a local entity, while managing payroll, tax, statutory contributions, and compliance all under one roof. Whether you’re building a remote team or expanding your regional presence, we make hiring and paying staff in Malaysia frictionless.

Get in touch with our payroll experts today and streamline your expansion into Malaysia with confidence.