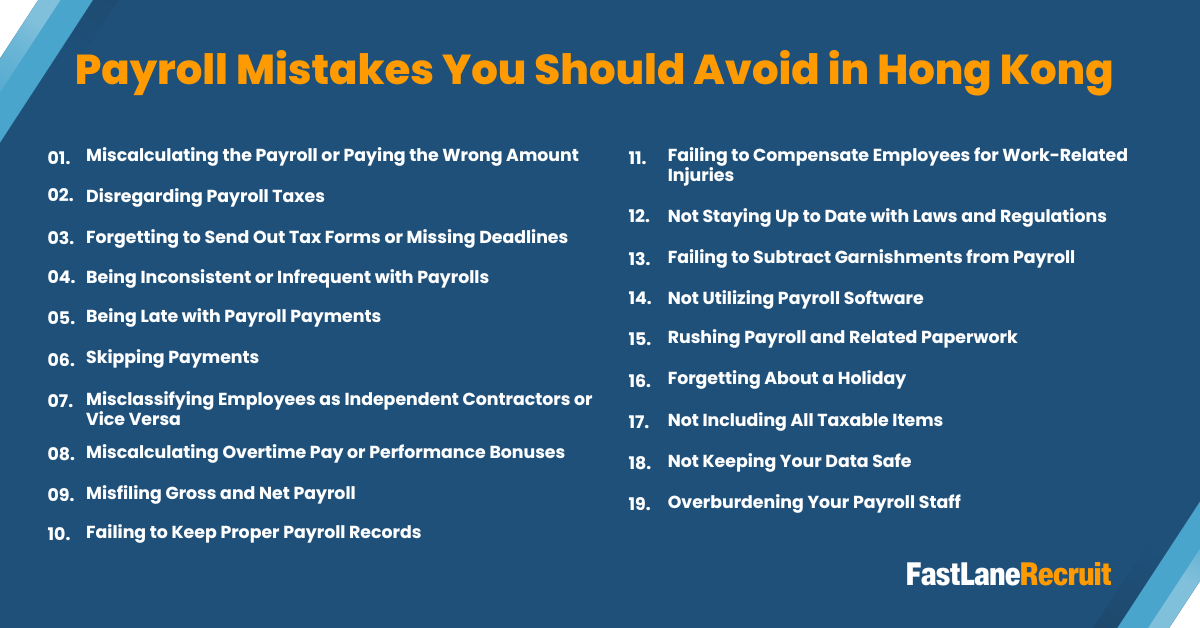

Payroll mistakes are more than administrative errors; they can lead to fines, strained employee relationships, or even legal consequences. For businesses operating in or hiring for Hong Kong, accurate payroll management is critical, given the territory’s unique combination of low taxes, mandatory MPF contributions, and strict employment law enforcement.

Whether you’re a growing startup, an SME, or managing remote talent, here’s a comprehensive guide to the payroll mistakes you should avoid, especially if you’re expanding into Hong Kong.

Content Outline

Key Summary

OutsourcingAccurate payroll calculations are essential to avoid disputes and comply with the Employment Ordinance. and Offshoring Are Distinct Strategies

Timely tax filings and form submissions (IR56 series) prevent penalties and legal issues.

Maintain consistent and punctual payroll schedules aligned with contracts and statutory requirements.

Correctly classify employees vs contractors to ensure proper MPF contributions and tax treatment.

Use automated payroll software to reduce human error, improve compliance, and simplify reporting.

Keep comprehensive payroll records for at least 7 years to meet IRD requirements and audits.

Stay updated on legal changes such as MPF caps, minimum wage, and statutory holidays.

Include all taxable benefits and deductions in payroll and tax filings.

Protect employee data privacy in compliance with Hong Kong’s Personal Data (Privacy) Ordinance.

Avoid overloading internal payroll teams, consider outsourcing to experts like FastLaneRecruit for reliable, compliant payroll support.

1. Miscalculating the Payroll or Paying the Wrong Amount

Payroll miscalculations are among the most common and costly HR mistakes. Even small errors can damage employee trust, lead to labour disputes, or result in fines for violating the Employment Ordinance. Common errors include:

- Incorrect pro-rata salary during new joiners’ first month or when handling resignations

- Missing unpaid leave deductions, especially for staff with irregular attendance

- Overlooking allowances, bonuses, or commissions stated in the employment contract

- Inaccurate rounding or bonus calculations, especially when calculated manually

- Applying incorrect MPF contribution thresholds or salary caps

In Hong Kong, employees can report discrepancies to the Labour Department, and employers may be ordered to repay underpaid wages with penalties or interest.

Tip:

- Build a checklist-based payroll approval workflow that involves both HR and finance to ensure salary components are fully accounted for before disbursement.

- Conduct a monthly audit of payroll elements, including unpaid leave, new commissions, and overtime claims.

- Use payroll software tailored for Hong Kong (e.g., Talenox or Xero), which includes built-in MPF and tax compliance calculations.

Also Read: The Ultimate Playbook for Building and Integrating Offshore Teams

FastLane Solution:

Through FastLaneRecruit, you can onboard qualified outsourced payroll professionals, including Malaysian-based staff, to verify payroll inputs and minimize the risk of errors due to lean internal HR teams.

FastLane Group provides end-to-end payroll management tailored to Hong Kong’s Employment Ordinance, including accurate calculation of pro-rata salaries, bonuses, and allowances.

More Info: Labour Department – Guide on Wages

2. Disregarding Payroll Taxes

In Hong Kong, employers must deduct, report, and submit payroll-related tax documents for each employee to the Inland Revenue Department (IRD). Neglecting this obligation can result in:

- Under-reporting of taxable income

- Penalties for late or missing tax forms

- Legal action in cases of tax evasion or non-disclosure

Employers are required to submit different IR56 forms based on the employee’s situation:

- IR56E – for new hires

- IR56B – for annual reporting

- IR56F – for resignations

- IR56G – for employees leaving Hong Kong

Failure to handle these correctly can trigger audits or put employees at risk of double taxation or delayed tax returns.

Tip:

- Create a dedicated payroll tax filing calendar that includes key tax form deadlines and employee lifecycle events (e.g., start date, termination date, departure from HK).

- Use automated payroll platforms such as Xero, QuickBooks Online, or Talenox to generate and file tax forms, minimizing manual entry errors.

- Keep a copy of every IR56 form submitted, and log submission dates to maintain audit trails.

FastLane Solution:

Need extra support? FastLaneRecruit connects you with experienced payroll administration professionals who can manage tax cycles, prepare e-filing drafts, and ensure your payroll taxes are filed on time, every time.

FastLane Group handles payroll tax reporting and compliance for Hong Kong-based companies, including preparing and filing all required IR56 forms.

More Info: IRD – Employer’s Return

3. Forgetting to Send Out Tax Forms or Missing Deadlines

In Hong Kong, employers are legally required to submit tax forms such as IR56B, IR56E, IR56F, and IR56G to the Inland Revenue Department (IRD). Missing submission deadlines or filing incorrect forms can lead to:

- Penalties for non-compliance

- Increased scrutiny or audits

- Prosecution for repeated offences

Late or inaccurate filing can also negatively impact employees’ tax filing experience, especially during job changes or relocation.

Also Read: Build Your Offshore HR and Payroll Management Team in Malaysia

Tip:

- Assign a dedicated payroll compliance officer or administrator responsible for tracking tax deadlines and managing employer returns.

- For companies with frequent new hires or resignations, implement a bi-weekly check-in process to identify joiners and leavers early, ensuring IR56E (new employees) and IR56F (resigned employees) are submitted promptly.

- Automate form generation with payroll software that integrates directly with IRD e-filing systems.

More Info: IRD – Filing Employer’s Return Guide

FastLane Solution:

If you lack in-house bandwidth, FastLaneRecruit can connect you with reliable outsourced payroll professionals who are trained to manage tax documentation on your behalf, ensuring no deadline is missed.

FastLane Group offers end-to-end support for Hong Kong payroll compliance, including automated IR56 form preparation, submission tracking, and tax season reporting.

4. Being Inconsistent or Infrequent with Payrolls

Irregular pay cycles, even when employees are eventually paid, can violate employment contracts and breach Hong Kong’s Employment Ordinance, which mandates timely and predictable wage payments.

Such inconsistencies can also lead to:

- Low employee trust and morale

- Increased labour disputes

- Cash flow confusion for employees relying on regular income

Tip:

- Clearly define pay cycles in both employment contracts and employee handbooks (e.g., “Salary is payable on the last working day of each month”).

- Use payroll software with automated scheduling to ensure that salaries are calculated and disbursed on a consistent monthly or bi-weekly basis.

- Send out automated payroll reminders and confirmation notices to management and employees to reinforce transparency and expectations.

FastLane Solution:

Through FastLaneRecruit, you can hire outsourced payroll staff in Malaysia who manage Hong Kong payroll calendars with consistency and accuracy, even during busy or transition periods.

With FastLane Group, you gain access to cloud-based payroll solutions that allow for automated pay cycle setup, reducing the risk of human error or missed dates.

More Info: Labour Department – Payment of Wages

5. Being Late with Payroll Payments

In Hong Kong, wages must be paid within 7 days after the end of each wage period. Missing this deadline, even unintentionally, can result in:

- Labour Tribunal claims

- Court-ordered interest or compensation

- Negative employer branding or media exposure

Late payments are a violation of the Employment Ordinance and may also lead to internal friction, especially if salaries are delayed around holidays or rent due dates.

Tip:

- Maintain a payroll reserve fund that covers at least two full pay cycles to cushion against unexpected cash flow disruptions.

- Process payroll 5–7 business days before payday to leave enough time for senior management approvals, bank processing, or correction of errors.

- Incorporate automatic bank file uploads through integrated software to streamline the disbursement process.

FastLane Solution:

For additional support, FastLaneRecruit provides trained offshore payroll assistants who can manage processing schedules and payment verifications, ensuring 100% timely payouts.

FastLane Group’s payroll services help you run on-time, automated payrolls while offering bank file preparation, approval workflows, and direct integration with local banks.

Also Read: Guide to Payroll in Hong Kong

6. Skipping Payments

Whether caused by cash flow issues, manual payroll errors, or administrative oversight, skipping payroll runs or delaying salary payments—intentionally or otherwise—is a serious legal offence under Hong Kong’s Employment Ordinance. Employees are entitled to lodge complaints with the Labour Department, which may result in an order for up to 24 months of back wages, along with penalties for the employer.

Failure to pay wages on time also impacts employee morale, increases turnover, and may trigger internal grievances or labour disputes.

Tip:

- Reconcile bank statements and payroll journals monthly to catch missed or partial payments early. Use automated flags in your payroll software to alert you to anomalies.

- Cross-reference every payment with a signed payslip report to confirm employee acknowledgment.

- For startups or SMEs with lean HR teams, eliminate the risk of missed payrolls by outsourcing payroll operations to professionals.

FastLane Solution:

FastLaneRecruit provides qualified outsourced Malaysian payroll support staff who can manage regular payroll runs and bank reconciliations for your Hong Kong operations with speed and precision.

Alternatively, FastLane Group’s payroll services ensure timely, compliant disbursements and reporting, eliminating the risks of skipped payments entirely. We also manage year-end submissions, MPF, and tax clearances with full accountability.

7. Misclassifying Employees as Independent Contractors or Vice Versa

Incorrect classification between an employee and an independent contractor is a common compliance risk in Hong Kong. Misclassification can lead to violations related to:

- MPF contributions (mandatory for employees but not most self-employed persons)

- Tax reporting under IR56 forms

- Labour protections such as annual leave, rest days, and compensation

Under audit, the Inland Revenue Department (IRD) and Labour Department evaluate employment status based on the “control, integration, and economic reality” tests, not just the signed contract.

Tip:

- Assess your worker status based on criteria such as: who sets the hours, who provides the tools, and how integrated the worker is into the business.

- When in doubt, err on the side of classifying individuals as employees and comply with MPF and tax obligations accordingly.

- Conduct classification audits at least annually, especially when hiring freelancers, gig workers, or international contractors.

Also Read: Guide to PEO vs EOR

FastLane Solution:

Through FastLaneRecruit, you can also hire Malaysian payroll and HR professionals who understand the nuances of cross-border compliance and avoid costly reclassification mistakes.

FastLane Group assists companies in structuring employment contracts that align with Hong Kong law and MPF rules. We conduct employee classification reviews to ensure proper documentation and compliance with labour, tax, and pension regulations.

8. Miscalculating Overtime Pay or Performance Bonuses

While overtime pay is not strictly mandated under the law in Hong Kong, it is enforceable if stated in the employment contract or company policy. Failure to pay agreed-upon overtime or undercalculate performance bonuses can result in breach of contract, employee disputes, and reputational harm.

Even small rounding errors or delays in bonus disbursements may violate internal policies and affect employee satisfaction.

Tip:

- Configure your payroll software to auto-calculate overtime based on actual timesheets, rosters, or swipe-in/out logs.

- Document bonus schemes in writing, clearly outlining KPIs, calculation methods, payment timelines, and dispute resolution procedures.

- Run simulations or “what-if” bonus forecasts in advance to align your budgets and avoid overpromising.

FastLane Solution:

Through FastLaneRecruit, you can access experienced payroll professionals who can manage and automate overtime calculations and bonus accruals using cloud-based platforms like Xero or Talenox.

FastLane Group’s HR and payroll specialists help you design transparent and enforceable performance bonus frameworks that align with your business model and labour laws.

9. Misfiling Gross and Net Payroll

Accurate payroll reporting requires a clear distinction between gross income and net pay. Gross income includes not only the base salary but also allowances, bonuses, reimbursements, and other taxable benefits. Net pay is what the employee takes home after deductions such as taxes, MPF contributions, and garnishments.

Misreporting occurs when employers confuse gross income with net pay figures in tax filings or employee payslips, leading to inaccurate IR56 submissions and potential underpayment or overpayment of tax liabilities. This can trigger audits by the Inland Revenue Department (IRD) and result in penalties or enforcement actions.

Furthermore, inconsistent or unclear payslip formats can confuse employees and complicate payroll audits.

Tip:

- Standardize your payslip format with clearly separated sections for gross income, itemized allowances, deductions, and net pay.

- Conduct quarterly audits of payroll tax submissions to ensure figures match supporting documents.

- Refer to the IRD’s sample forms and guidelines to maintain compliance in reporting.

- Use payroll software that enforces these standards and generates compliant payslips automatically.

10. Failing to Keep Proper Payroll Records

The Inland Revenue Department (IRD) mandates that all employers retain comprehensive payroll records for at least 7 years. These records include:

- Employment contracts

- Payslips and salary payment records

- Tax forms (e.g., IR56B, IR56F)

- MPF contribution statements

- Records of leave, overtime, and bonuses

Failure to maintain these documents can result in penalties during tax audits and difficulties in resolving employee disputes or government investigations.

With the complexity of Hong Kong’s tax and employment laws, maintaining well-organized, secure, and accessible payroll records is critical for compliance and operational efficiency.

Also Read: Why Do Companies in Hong Kong Choose to Hire Offshore?

Tip:

- Digitize payroll files by scanning physical documents and storing them securely on encrypted cloud platforms such as Microsoft OneDrive, Google Drive (with proper security settings), or industry-specific payroll software.

- Implement role-based access controls to limit data access to authorized payroll and HR personnel only.

- Establish a Standard Operating Procedure (SOP) for record archiving and retention that includes regular backups, periodic reviews, and compliance checks.

- Ensure your payroll system supports easy retrieval of records for audits or employee inquiries.

More Info: IRD – Business Record Keeping

FastLane Solution

FastLane Group offers digital payroll services that include the secure creation, retention, and management of all payroll-related records in compliance with IRD and MPF requirements. Their cloud-based solutions ensure your documents are organized, encrypted, and audit-ready.

Need additional manpower to ensure timely payroll record upkeep?

FastLaneRecruit can help you source outsourced payroll administration professionals (from Malaysia) who are trained in best practices for digital archiving, statutory filing, and regulatory documentation in line with Hong Kong law.

11. Failing to Compensate Employees for Work-Related Injuries

Under Hong Kong’s Employees’ Compensation Ordinance (Cap. 282), employers are legally required to compensate employees who suffer injuries or illnesses arising out of and in the course of employment. Failure to do so, especially without valid employee compensation insurance, can lead to:

- Criminal prosecution of the employer

- Financial liabilities for medical and wage compensation

- Reputational damage and potential lawsuits

Ensuring timely reporting and compensation for workplace injuries is essential not only for legal compliance but also for maintaining a safe and trustworthy workplace culture.

More Info: Employees’ Compensation Ordinance – Labour Department

Tip:

- Maintain a workplace incident logbook to record details of all work-related injuries or illnesses. This logbook should be accessible to HR and safety officers for review and reporting.

- Train team leaders and supervisors to report any workplace injury or illness within 24 hours to the HR and safety department. Prompt reporting helps ensure timely claims and investigation.

- Renew your employee compensation insurance annually and keep a copy of the valid insurance certificate on file, ready for inspection by authorities.

- Collaborate with insurance providers who specialize in Hong Kong’s employees’ compensation requirements to get appropriate coverage and claims support.

FastLane Solution

Outsource your HR and payroll compliance to FastLane Group (our group company), which offers expert management of employee compensation insurance and claims processes. The team ensures that all statutory insurance policies are up to date and assists with timely claims handling, minimizing your legal exposure and administrative burden. With FastLane, you can focus on business growth while we manage your workplace injury compliance efficiently and professionally.

12. Not Staying Up to Date with Laws and Regulations

Hong Kong’s employment laws, tax policies, and mandatory contributions are subject to periodic updates. For instance, minimum wage rates, Mandatory Provident Fund (MPF) contribution caps, and tax filing requirements evolve in response to economic conditions and government policy changes. Failure to stay current with these changes can expose your business to severe penalties, legal disputes, and reputational damage.

For example, the minimum hourly wage in Hong Kong was last revised in May 2023, and MPF contribution limits have been periodically adjusted to reflect wage growth. Companies that continue applying outdated rates or contribution thresholds risk underpaying employees or underreporting deductions, which can trigger investigations by the Labour Department, Mandatory Provident Fund Schemes Authority (MPFA), or Inland Revenue Department (IRD).

More Info:

- Labour Department – News & Updates

- MPFA Announcements

- IRD News and Updates

Tip:

- Subscribe to official email bulletins from the Labour Department, MPFA, and IRD to receive timely alerts about regulatory changes.

- Schedule quarterly internal audits to review payroll processes against the latest legal requirements.

- Engage a payroll or compliance expert annually for a comprehensive review and update of your payroll policies, minimizing the risk of non-compliance.

FastLane Solution:

- FastLane Group provides fully outsourced payroll and compliance services, including proactive monitoring of regulatory changes. Their team ensures your payroll policies, contribution rates, and filing processes are always up to date with the latest IRD, MPFA, and Labour Department standards.

- FastLaneRecruit helps businesses hire outsourced payroll compliance staff from Hong Kong or Malaysia. These professionals are trained to implement policy updates in real time, maintain legal documentation, and ensure payroll accuracy under evolving regulations.

13. Failing to Subtract Garnishments from Payroll

Under Hong Kong law, employers are obligated to comply with court-issued garnishment orders (known as wage attachments), which require deducting specified amounts from an employee’s wages to satisfy outstanding debts or judgments. Ignoring or delaying these deductions can result in the employer being held liable for the unpaid debt.

Wage garnishments must be handled carefully to ensure compliance without breaching minimum wage protections or employment contract terms. Failure to process garnishments correctly may expose the employer to legal action and fines.

Tip:

- Upon receipt of a garnishment order, immediately create a deduction profile in your payroll software to automate the withholding process.

- Regularly verify that the employee’s net salary after garnishments remains above statutory minimum wage levels to avoid contravening employment regulations.

- Maintain clear documentation and communication with affected employees regarding deductions and balances.

FastLane Solution

- FastLane Group offers end-to-end payroll outsourcing services that include garnishment handling, compliance monitoring, and automated deduction configuration. Their team ensures that all wage attachments are processed accurately while maintaining compliance with minimum wage laws and employment contract obligations.

- FastLaneRecruit can help you hire dedicated payroll professionals or compliance specialists who are trained in Hong Kong labour law and familiar with court-ordered deduction procedures. These professionals can manage garnishment processing, employee communication, and record-keeping on your behalf.

14. Not Utilizing Payroll Software

Relying on manual payroll systems, such as spreadsheets or paper records, significantly increases the risk of calculation errors, missed tax filings, and data breaches. Manual processing is time-consuming, difficult to audit, and prone to human mistakes—especially in a complex regulatory environment like Hong Kong’s.

In contrast, cloud-based payroll software offers automation of salary calculations, tax and MPF deductions, and submission of statutory forms (e.g., IR56B). These platforms provide secure data storage with encryption, user access controls, and often feature automatic updates aligned with regulatory changes.

Switching to a payroll platform improves efficiency, reduces compliance risks, and facilitates timely reporting to government agencies.

Tip:

- Evaluate and implement payroll platforms popular in Hong Kong such as Talenox, Xero, or QuickBooks Online, which support local statutory requirements.

- FastLane Group provides integration assistance and training support for Xero, ensuring your payroll team can leverage the full benefits while maintaining compliance.

- Regularly back up payroll data and restrict software access to authorized personnel only.

FastLane Solution:

- FastLane Group provides end-to-end support for payroll software integration, employee training, and ongoing compliance monitoring. They specialize in Xero setup and can ensure your payroll systems are optimized and compliant.

- FastLaneRecruit can help you hire experienced payroll specialists or HR tech professionals who are already proficient in using Hong Kong-compliant payroll software. This ensures a smoother transition and long-term reliability.

15. Rushing Payroll and Related Paperwork

Rushing through payroll processing, whether due to poor planning, staffing constraints, or last-minute approvals, can lead to a cascade of errors that jeopardize both compliance and employee trust. In Hong Kong, timely and accurate payroll is not only a legal obligation under the Employment Ordinance (Cap. 57) but also a fundamental part of maintaining employee satisfaction and operational efficiency.

When payroll is handled hastily, companies commonly encounter:

- Incorrect salary payments, including overpayments or underpayments

- Omitted or incorrect deductions (e.g. MPF, tax withholding, loan repayments)

- Failure to submit IR56 forms accurately or on time

- Late salary deposits, which can breach employment contracts

- Inconsistent payment cycles, causing confusion among employees

Moreover, a disorganised payroll process reflects poorly on company management. Employees rely on accurate and punctual pay as a basic expectation—delays or errors can diminish morale, damage your company’s reputation, and potentially expose you to complaints filed with the Labour Department or other regulatory bodies.

In Hong Kong’s fast-paced business environment, especially with monthly tax and MPF obligations, rushing payroll isn’t just risky, it’s unsustainable.

Tip:

Introduce a structured payroll processing schedule and enforce internal deadlines. Here’s how:

1: Implement a structured payroll preparation calendar.

Design a timeline that covers each stage of payroll—from timesheet submission and leave approvals, to payroll calculations, tax and MPF deductions, and final management sign-off. Allocate 3–4 business days solely for reviewing, verifying, and approving payroll. Set firm internal cut-off dates and automate timesheet collection where possible.

2. Outsource Your Payroll to FastLane Group.

Leverage the expertise of payroll professionals with deep knowledge of Hong Kong labor laws and tax requirements. FastLane Group (our parent company) offers comprehensive payroll services that ensure accuracy, timely payments, and full compliance, freeing your internal teams from rushed processing and reducing costly mistakes.

3. Hire Malaysian Outsourced Payroll Staff for Cost-Effective Support.

Outsource payroll operations to experienced Malaysian professionals trained in Hong Kong payroll compliance via FastLaneRecruit. This model offers flexible, scalable support at a competitive cost, helping you manage workload peaks without compromising accuracy or compliance.

By adopting these strategies, your business can move away from last-minute payroll scrambles toward a smooth, compliant, and stress-free payroll cycle, benefiting both your workforce and overall operations.

Rushing payroll is like skipping pre-flight checks, it might save a few minutes, but the potential cost of errors is far greater. A well-paced, structured payroll process ensures regulatory compliance, builds employee trust, and gives your finance and HR teams the time they need to do the job right.

16. Forgetting About a Holiday

In Hong Kong, all employers are legally required to observe 12 statutory holidays under the Employment Ordinance (Cap. 57). These holidays must be granted to eligible employees, either as paid leave or compensatory time off if the employee is required to work on the holiday. Overlooking one or more of these dates, intentionally or not, can lead to non-compliance, underpayment, or even labor disputes.

Common issues that arise from neglecting statutory holidays include:

- Unintentional scheduling of work on holidays without compensating employees

- Incorrect payroll calculations that exclude statutory holiday pay

- Failure to offer substitute days when employees work on public holidays

This mistake not only breaches legal obligations but can also damage employee morale and lead to complaints filed with the Labour Department. It’s especially problematic for companies operating across multiple regions or managing part-time, shift-based, or remote workers, where holiday tracking may fall through the cracks.

Hong Kong’s public holiday schedule is not fixed, some holidays follow the Lunar Calendar, which changes annually. For example, the dates for the Lunar New Year, Ching Ming Festival, and Mid-Autumn Festival vary each year, making manual tracking risky and prone to error.

Check Out Our Hong Kong Public Holiday 2025

Tip:

To prevent costly holiday oversights, implement a proactive system for holiday tracking:

- Use a Payroll or HR System with Holiday Integration:

Modern payroll software platforms can sync with Hong Kong’s statutory and general holidays. This ensures holidays are automatically factored into work schedules and payroll calculations. Look for systems with built-in alerts for holiday-related compliance reminders. - Subscribe to the GovHK iCal Feed:

Add the GovHK iCalendar Public Holiday Feed to your digital calendar system (Google Calendar, Outlook, or Apple Calendar). This updates automatically every year, reducing the risk of missing a holiday when planning shifts or payroll cycles. - Establish an Internal Holiday Compliance Checklist:

Ensure your payroll and HR teams conduct monthly compliance checks, especially before major holidays. Review work rosters and confirm whether compensatory rest days or extra pay (double pay) is due based on each employee’s contract and duty roster. - Communicate Holiday Schedules in Advance:

Share the annual holiday calendar with employees early in the year. Transparency helps avoid miscommunication and ensures everyone is aware of their entitlements.

By staying on top of Hong Kong’s evolving public holiday schedule, you ensure compliance with local labor laws and demonstrate respect for your employees’ rights—a win-win for both employer and staff morale.

17. Not Including All Taxable Items

One of the most common mistakes when preparing Form IR56B is failing to include all taxable items. Employers often overlook or omit non-standard remuneration components such as bonuses, car allowances, meal vouchers, accommodation, and stock options. These fringe benefits may not be part of regular salary payments but are still considered assessable income under the Inland Revenue Department (IRD) guidelines. Missing these items can lead to under-reporting of income, potential penalties, and extra administrative work to correct errors post-submission.

Failure to report all taxable items may also raise red flags during an IRD audit, especially if discrepancies are noticed between employee declarations and employer filings.

Tip:

To avoid this oversight, implement a Taxable Benefit Register, a centralized document that tracks all monetary and non-monetary compensation given to employees. Update this register on a quarterly basis to ensure nothing is missed during year-end reporting.

Additionally, regularly cross-reference each benefit with the IRD’s list of assessable income categories, which includes items like:

- End-of-year bonuses

- Education allowances

- Holiday travel benefits

- Company-provided housing

- Share-based compensation

Set up a checklist or internal policy that requires HR or payroll to verify each employee’s full compensation package—both cash and non-cash—before submitting Form IR56B. Consider consulting a tax professional annually to review your fringe benefit reporting process for compliance accuracy.

18. Not Keeping Your Data Safe

In the digital age, payroll processing involves the collection and management of sensitive personal data, including employees’ Hong Kong Identity Card numbers, bank account details, salaries, MPF contributions, tax information, and residential addresses. Mishandling this data can lead to serious consequences under Hong Kong’s Personal Data (Privacy) Ordinance (PDPO), enforced by the Office of the Privacy Commissioner for Personal Data (PCPD).

A data breach, whether due to negligence, system vulnerabilities, or malicious attacks, can result in significant penalties, reputational damage, and loss of trust among employees. In some cases, the PCPD may launch investigations or issue enforcement notices, and affected individuals may be entitled to compensation.

Employers are responsible for ensuring that any third-party payroll provider or software they use also complies with data protection laws. This is especially important when using cloud-based payroll platforms or outsourcing payroll functions to external vendors.

Tip:

Protecting payroll data should be a top priority. Here are several actionable measures to enhance your data security:

- Enable Two-Factor Authentication (2FA): Add an extra layer of security beyond passwords for access to payroll systems. 2FA helps prevent unauthorized access, even if login credentials are compromised.

- Audit User Access and Permissions Regularly: Review who has access to sensitive payroll data and ensure that only authorized personnel can view or edit employee records. Remove access for former employees immediately.

- Encrypt Payroll Data: Choose payroll software and storage systems that use end-to-end encryption both at rest and in transit to protect data from breaches and interception.

- Use Secure, GDPR-Compliant Cloud Storage: Even though GDPR is an EU regulation, aligning your systems with GDPR standards ensures robust data protection. Look for vendors that are certified under international security standards such as ISO/IEC 27001.

- Back Up Data Regularly: Maintain encrypted, automated backups in multiple secure locations to ensure that you can recover quickly in the event of a ransomware attack or system failure.

- Train Staff on Data Privacy Protocols: Your payroll team should be trained on confidentiality, safe handling of personal data, and recognizing phishing attempts or other cybersecurity threats.

For more guidance on data privacy in the workplace, refer to the PCPD’s official guidance for human resources management.

Implementing these data protection practices is not only a legal necessity in Hong Kong but also a best practice to maintain operational integrity and employee trust.

19. Overburdening Your Payroll Staff

As businesses scale, payroll becomes increasingly complex, particularly in a jurisdiction like Hong Kong, where strict statutory requirements must be met for tax filings, MPF contributions, sick leave payments, and annual leave calculations. When the responsibility for payroll is placed on a small or overwhelmed HR team without the proper systems, tools, or training, mistakes become almost inevitable.

Overworked payroll staff may face unrealistic deadlines, manual data entry overload, or fragmented software systems that lead to errors such as:

- Missed MPF deadlines

- Incorrect IR56B form submissions

- Omission of taxable benefits

- Late salary payments

Even minor slip-ups can attract penalties from authorities like the Inland Revenue Department (IRD) or the Mandatory Provident Fund Schemes Authority (MPFA). In worst-case scenarios, persistent non-compliance can result in audits, legal actions, or even damage to employer branding and employee trust.

Additionally, if your team lacks sufficient training or is forced to multitask between payroll, HR admin, and talent management, quality will inevitably suffer. This not only increases risk but also affects operational efficiency and employee satisfaction.

Tip:

Lighten the load on your in-house HR and payroll staff by outsourcing to experienced professionals. Here’s how you can achieve this:

Partner with Payroll Specialists Like FastLane Group:

FastLane Group, our parent company, offers fully managed payroll services in Hong Kong, including salary calculations, tax compliance, MPF submissions, leave tracking, and employee payslips. Our services are tailored to local legislation and updated regularly to remain compliant with evolving regulatory frameworks.

By outsourcing to specialists, your internal team can focus on strategic HR functions, talent retention, and business development, not compliance paperwork.

Cost-Effective Offshore Support with Malaysian Talent via FastLaneRecruit:

Alternatively, you can outsource payroll tasks to skilled Malaysian staff who are trained in Hong Kong payroll compliance. This hybrid solution offers cost-efficiency without compromising on accuracy. Our FastLaneRecruit service can help you hire vetted Malaysian payroll professionals who operate remotely as part of your extended team. This allows for scalability, reduced payroll overhead, and seamless coordination with your Hong Kong operations.

Ensure Ongoing Training

Whether in-house or outsourced, make sure your payroll personnel receive ongoing training on Hong Kong’s Employment Ordinance, MPF schemes, and IRD filing procedures. This reduces the likelihood of misinterpretation or error in payroll execution.

Payroll should not be a bottleneck in your operations. Offloading it to qualified experts ensures compliance, efficiency, and peace of mind, all while empowering your internal team to deliver higher strategic value.

Conclusion

Getting payroll right in Hong Kong is more than an HR task, it’s a legal and operational necessity. Avoiding the mistakes outlined above will protect your business from penalties, litigation, and reputational damage, and ensure your employees feel valued and paid fairly.

Need Cost-Effective Hong Kong Payroll Support?

Hire Skilled Malaysian Payroll Professionals with FastLaneRecruit

Managing payroll in Hong Kong is complex, from MPF contributions and tax filings to ever-changing employment laws. Hiring in-house talent can be costly and time-consuming. That’s where FastLaneRecruit comes in.

We help you hire experienced Malaysian payroll employees who are trained to handle:

- IR56 tax form preparation and submission

- MPF administration and statutory compliance

- Payroll software operation (Xero, Talenox, QuickBooks)

- Monthly salary processing and reporting

Let FastLaneRecruit build your offshore payroll team, so you can focus on growing your business in Hong Kong.