Outsource Malaysia with Confidence

Looking to expand your business with cost-effective and highly skilled talent? Malaysia stands out as a prime outsourcing destination for Singaporean companies. With a dynamic workforce, competitive wages, and a business-friendly environment, FastLaneRecruit helps you hire and manage Malaysian employees seamlessly, ensuring compliance and operational efficiency.

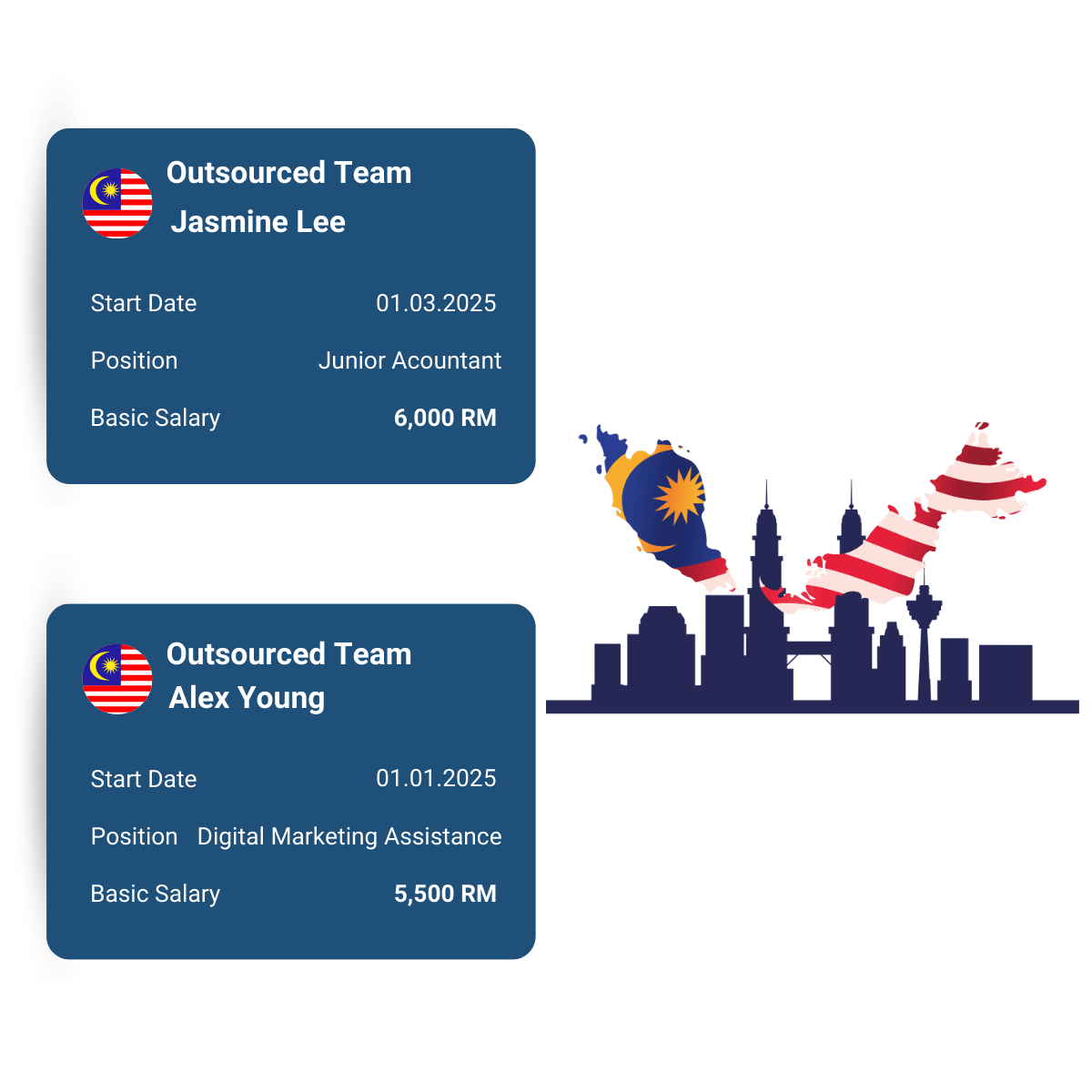

Popular Roles Outsourced to Malaysia

Whether you need financial experts, administrative support, or HR solutions, Malaysia offers skilled professionals to enhance your operations.

Outsource Accountants from Southeast Asia for Australian Companies

FastLaneRecruit connects Australian businesses with highly skilled accountants from Malaysia and Southeast Asia, delivering reliable and cost-effective solutions tailored to your needs. Whether you’re an accounting firm, audit firm, CFO or an established company, our outsourcing services help you stay competitive in today’s dynamic market.

Why Malaysian Talent is the Ideal Choice for Singaporean Employers

Highly Skilled and Globally Competitive Workforce

Malaysia boasts a strong talent pool across key industries such as accounting, finance, technology and engineering, with professionals who are well-educated, adaptable, and internationally competitive.

Strategic Cost Efficiency Without Compromising Quality

Hiring Malaysian professionals allows Singaporean companies to optimize costs while maintaining high standards of expertise and productivity, ensuring business growth without sacrificing talent quality.

Cultural and Language Synergy

Malaysia and Singapore share similar business practices, languages, and cultural values, fostering seamless workplace integration, effective communication, and enhanced collaboration.

Digital Literacy

Malaysia ranks second highest in digital literacy in Southeast Asia, making it a prime source of tech-savvy professionals. With strong expertise in digital tools, automation, and innovation, Malaysian talent can drive digital transformation and enhance business efficiency, making them a valuable asset for companies seeking a future-ready workforce.

Outsource, Onboard, and Manage Malaysian Employees with FastLaneRecruit

FastLaneRecruit simplifies cross-border hiring by handling everything from recruitment to payroll and compliance. Our comprehensive services ensure a smooth hiring experience, allowing you to focus on scaling your business. Outsource Malaysia with FastLaneRecruit!

Book A Free 30 mins Discovery Call

Key Facts & Statistics About Malaysia

Capital City

Kuala Lumpur

Languages

English, Chinese & Malay

Currency

Malaysian Ringgit (RM)

GDP per Capita

$11,371

Ease of Doing Business

Ranked 12th globally

Minimum Wage

RM1,700/month

Average Wage

RM4,000/month

Paid Leave

8 days

Tailored Hiring Strategies

Every business has unique hiring needs, and we ensure a personalized approach to recruitment. Whether you’re looking for full-time employees, contract workers, or remote talent, we design a hiring strategy that aligns with your business goals and industry requirements.

Why Choose FastLaneRecruit for Outsourcing to Malaysia?

Efficient and Cost-Optimized Recruitment Solutions

Outsourcing to Malaysia with FastLaneRecruit ensures significant cost savings on hiring and operational expenses. Our streamlined process reduces recruitment time and costs, making hiring easier and more affordable for Singapore businesses.

Local Expertise, Global Standards

Our deep understanding of both the Malaysian job market and Singapore’s hiring requirements enables us to match the right talent with your company’s needs, ensuring cultural alignment and seamless integration.

Faster Hiring Process & Extensive Talent Network

With access to an extensive database of skilled professionals across various industries, we help Singaporean businesses fill roles quickly and efficiently, reducing downtime and improving productivity.

Comprehensive Recruitment & HR Solutions

From sourcing and interviewing to onboarding and payroll management, FastLaneRecruit provides end-to-end outsourcing solutions. We handle all the complexities of compliance, taxation, and employment laws, allowing your business to focus on growth.

Additional Benefits of Outsourcing to Malaysia

Enhanced Business Scalability & Flexibility

Outsourcing to Malaysia allows Singaporean companies to scale their workforce quickly and efficiently. Whether you need short-term project-based hires or long-term employees, Malaysia provides a flexible talent pool that adapts to business demands.

Access to Industry-Specific Expertise

From IT and finance to customer service and engineering, Malaysia boasts a diverse range of industry professionals. FastLaneRecruit connects you with top-tier talent tailored to your business sector, ensuring you get specialized expertise without the high costs.

Book A Free 30 mins Discovery Call

Employment and Labor Laws in Malaysia

Malaysia’s employment laws are governed by the Employment Act 1955, which outlines employee rights, employer obligations, and workplace regulations. Additional labor laws cover taxation, social security, and workplace safety, ensuring fair employment practices across industries.

Employment contracts must include essential details such as job scope, salary, benefits, working hours, termination clauses, and probation terms. Contracts can be either fixed-term or permanent and must comply with local labor laws.

A structured onboarding process ensures new hires integrate smoothly. It includes contract signing, orientation, compliance training, payroll setup, and any visa or work permit arrangements for foreign employees.

Under the Employment Act, employees can work up to 45 hours per week (effective from 2023), typically 9 hours per day with a maximum of 6 working days per week. The standard working week in Malaysia is Monday to Friday or Monday to Saturday, depending on industry norms. Employees are entitled to one rest day per week and must not exceed 45 hours of work weekly (excluding overtime).

Employees working beyond standard hours are entitled to overtime pay, calculated at 1.5 times the hourly wage on weekdays, 2 times on rest days, and 3 times on public holidays.

The probation period usually lasts 3 to 6 months, depending on company policies. During this period, either party can terminate the contract with a shorter notice period.

Payroll Management in Malaysia

Payroll management includes salary disbursement, tax deductions, EPF (Employees Provident Fund), SOCSO (Social Security Organization) contributions, and compliance with employment laws. Employers must ensure accurate payroll processing to meet regulatory requirements and avoid penalties.

1

Fiscal Year in Malaysia

The fiscal year in Malaysia follows the calendar year, running from January 1 to December 31.

2

Payroll Cycle in Malaysia

Salaries must be paid at least once a month, typically on the last working day of the month.

3

Minimum Wage in Malaysia

Effective February 1, 2025, Malaysia’s minimum wage has been raised to RM1,700 per month nationwide, covering Peninsular Malaysia, Sabah, Sarawak, and the Federal Territory of Labuan.

4

Bonus Payments in Malaysia

While not mandatory, many employers offer performance-based or contractual bonuses, commonly known as the 13th-month salary.

Employment Taxes in Malaysia

Employers and employees must contribute to various tax and social security schemes, including income tax, EPF, SOCSO, and EIS.

Employer Contributions

Employers contribute to:

Employees Provident Fund (EPF): 12%–13% of salary

Social Security (SOCSO): 1.75%

Employment Insurance Scheme (EIS): 0.2%

Employee Payroll Contributions

Employees contribute to:

EPF: 11% of salary

SOCSO: 0.5%

EIS: 0.2%

Individual Income Tax Contributions

Employees earning above RM34,000 annually must pay progressive income tax, ranging from 0% to 30% based on income brackets.

Pension in Malaysia

The Employees Provident Fund (EPF) serves as Malaysia’s pension scheme, providing retirement benefits for private-sector employees.

Annual Leave & Company Policies in Malaysia

Employers must provide annual leave, public holidays, and additional leave entitlements as per Malaysian labor laws.

Mandatory Leave Entitlement in Malaysia

Employees are entitled to 8 to 16 days of paid annual leave, depending on years of service.

Public Holidays in Malaysia

Malaysia has 11 nationwide public holidays, with additional state-specific holidays depending on location.

Paid Time Off in Malaysia

Apart from annual leave, employees may receive paid leave for personal matters, emergencies, or family-related needs.

Maternity Leave in Malaysia

Female employees are entitled to 98 days of paid maternity leave, funded by the employer.

Paternity Leave in Malaysia

Fathers in the private sector receive 7 days of paternity leave (effective 2023), while public sector employees receive 14 days.

Sick Leave in Malaysia

Employees are entitled to 14–22 days of paid sick leave, depending on tenure. If hospitalization is required, they may receive up to 60 days per year.

Start Outsourcing to Malaysia Today with FastLaneRecruit

Expand your business with confidence by leveraging Malaysia’s cost-effective, skilled workforce. FastLaneRecruit ensures a seamless hiring process, from talent acquisition to payroll management, helping you optimize operations and maximize business growth. Contact FastLaneRecruit today to explore customized outsourcing solutions that fit your business needs.

FastLaneRecruit – Building Teams, Powering Growth!

Book A Free 30 mins Discovery Call