In today’s fast-paced business environment, companies are constantly seeking ways to optimize their operations, reduce costs, and stay competitive. One strategy that has gained significant traction is employee outsourcing. But what exactly is employee outsourcing, and how does it work?

Employee outsourcing, also known as staff outsourcing, is the practice of hiring external professionals or teams to handle specific tasks or roles within a company. This approach allows businesses to access specialized skills, reduce overhead costs, and focus on their core competencies. With globalization and remote work becoming the norm, outsourcing is no longer confined to IT or customer service roles. From accounting and payroll to marketing and data analysis, businesses can now outsource a wide array of tasks to skilled professionals across the globe.

In this article, we’ll explore how employee outsourcing works, its benefits, the different models available, and how FastLaneRecruit can help you streamline your outsourcing process.

Content Outline

Key Takeaways

What Is Employee Outsourcing?

Employee outsourcing involves hiring external professionals or teams to handle specific tasks or roles within a company, allowing businesses to focus on their core competencies.

Types of Outsourcing Models:

- Onshoring: Within the same country, e.g., an Australian company outsourcing payroll to a local HR provider.

- Offshoring: To distant countries for cost savings, e.g., an Australian company outsourcing customer service to Malaysia.

- Nearshoring: To nearby countries for better communication and cultural similarities, e.g., outsourcing marketing from Australia to New Zealand.

Benefits of Employee Outsourcing:

- Increased efficiency and access to specialized skills

- Cost savings and flexible scalability

- Strategic focus and risk mitigation

Common Outsourced Tasks:

IT services, customer support, HR, accounting, digital marketing, and administrative tasks are commonly outsourced functions that boost operational efficiency.

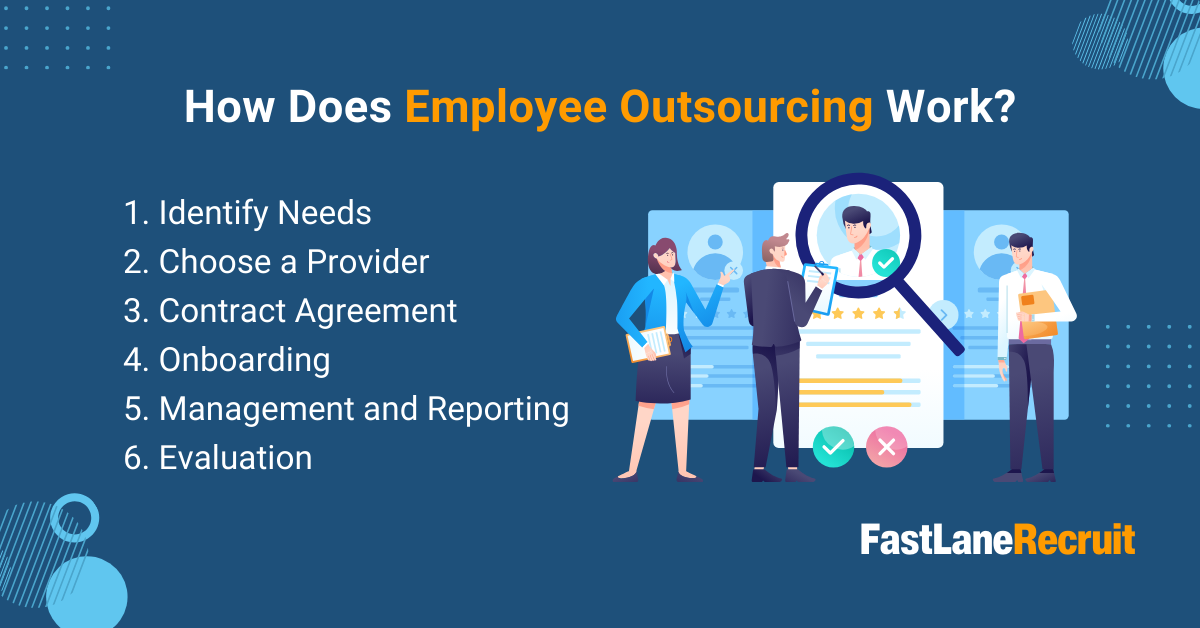

How Does Employee Outsourcing Work?

Businesses partner with third-party agencies, Professional Employer Organizations (PEOs), or Employer of Record (EOR) platforms to hire outsourced employees. These agencies manage payroll, compliance, and HR administration, allowing businesses to focus on growth and efficiency. Here’s a step-by-step breakdown of how it works:

- Identify Needs: The company identifies tasks or roles that can be outsourced, such as accounting, IT support, payroll processing, or customer service.

- Choose a Provider: The company selects a reputable outsourcing provider, like FastLaneRecruit, that specializes in the required services.

- Contract Agreement: Both parties agree on the scope of work, timelines, costs, and performance metrics.

- Onboarding: The outsourced employees are integrated into the company’s workflow, often with the help of the provider.

- Management and Reporting: The outsourcing provider manages the employees, ensuring they meet the agreed-upon standards, while the company retains oversight.

- Evaluation: Regular performance reviews are conducted to ensure the arrangement meets the company’s goals.

This process allows businesses to delegate non-core activities while maintaining control over critical operations.

Why Do Companies Outsource Their Workforce?

Employee outsourcing has become an increasingly popular strategy for businesses looking to optimize costs, access global talent, and improve operational efficiency. Companies of all sizes, from startups to multinational corporations, leverage outsourcing to stay competitive in today’s fast-paced business environment. But why do companies outsource their workforce? Below, we explore the key reasons driving this decision.

1. Cost Savings and Budget Optimization

One of the primary reasons businesses outsource is to reduce operational costs. Hiring and maintaining an in-house workforce can be expensive, especially in regions with high wages, taxes, and compliance costs. Outsourcing allows businesses to tap into global talent at a fraction of the cost.

- Lower Labor Costs: Many companies outsource to countries with lower living costs, allowing them to hire skilled professionals at more affordable rates.

- Reduced Overhead Costs: Businesses save on office space, equipment, and other administrative expenses by hiring remote teams.

- Tax and Compliance Savings: Employer of Record (EOR) services and Professional Employer Organizations (PEOs) help businesses navigate tax regulations and legal compliance more efficiently.

2. Access to a Wider Talent Pool

Outsourcing enables businesses to hire highly skilled professionals regardless of their geographic location. In today’s digital economy, talent is no longer confined to a company’s physical headquarters.

- Specialized Skills: Companies can access niche expertise in areas such as IT, accounting, marketing, and customer service without the need for local recruitment.

- Scalability and Flexibility: Businesses can quickly expand their workforce based on project demands without going through lengthy hiring processes.

- Diverse Perspectives: Hiring a global workforce can bring fresh ideas, innovation, and cultural diversity to the company.

3. Focus on Core Business Functions

Outsourcing allows companies to delegate non-core tasks to external experts, enabling their in-house team to focus on more strategic areas.

- Operational Efficiency: Routine and time-consuming tasks such as payroll processing, IT support, and customer service can be outsourced to free up internal resources.

- Increased Productivity: Companies can dedicate more time and energy to revenue-generating activities like product development, sales, and business growth.

- Better Resource Allocation: Businesses can optimize their workforce by assigning specialized tasks to outsourced employees while keeping critical decision-making roles in-house.

4. Flexibility and Business Scalability

Many companies choose outsourcing as a strategy for rapid expansion, allowing them to scale operations quickly in response to business demands.

- Quick Market Entry: Outsourcing helps companies establish a presence in new markets without the need to set up a physical office.

- Adaptability to Demand: Businesses can scale their workforce up or down based on project requirements or seasonal demand.

- Reduced Risk: Instead of hiring full-time employees, companies can use outsourced teams for short-term or project-based work, minimizing financial risk.

Types of Employee Outsourcing Models

There are several outsourcing models to choose from, depending on your business needs and goals. Here are the three most common types, with examples using Hong Kong and Malaysia:

1. Onshoring

Definition: Onshoring refers to outsourcing to service providers within Australia. This model ensures compliance with Australian labor laws, minimizes communication challenges, and allows for easier collaboration.

Example: An Australian accounting firm outsourcing bookkeeping and payroll processing tasks to a third-party provider in Sydney instead of handling it in-house.

Key Benefits:

- No language or cultural differences, making communication seamless.

- Full compliance with Australian employment laws and tax regulations.

- Stronger quality control, with the ability to meet in person if needed.

Challenges:

- Higher costs compared to outsourcing overseas.

- Limited cost savings, as Australian labor remains relatively expensive.

Best for: Businesses that require local compliance and close collaboration.

2. Offshoring

Definition: Offshoring involves outsourcing business processes to distant countries, usually to reduce costs and access a larger talent pool.

Example: An Australian accounting firm outsourcing full set accounting tasks to an accounting service provider in the Malaysia to lower operational costs and increase service capacity.

Key Benefits:

- Significant cost savings, as wages in offshore countries are lower than in Australia.

- Access to accountants experienced in bookkeeping, payroll, tax compliance, and financial reporting.

Challenges:

- Time zone differences may cause slight delays in real-time communication.

Best for: Companies focused on cost savings, business scalability, and global workforce expansion.

3. Nearshoring

Definition: Nearshoring refers to outsourcing to nearby countries that offer cost advantages while maintaining some cultural and time zone similarities.

Example: An Australian software company outsourcing IT development to a team in New Zealand to maintain strong collaboration with lower costs.

Key Benefits:

- Lower costs than onshoring but without the major challenges of offshoring.

- Fewer communication and cultural challenges, as Australia and New Zealand have similar business cultures.

- Time zone compatibility, making real-time collaboration easier.

Challenges:

- Higher costs than offshoring, as labor expenses in nearshore countries are still significant.

- Smaller talent pool compared to offshore hubs like Malaysia or Philippines.

Best for: Businesses that want cost efficiency while maintaining easier collaboration and oversight.

| Model | Location | Key Benefits | Best For |

| Onshoring | Same country | Easy communication, cultural alignment | Local partnerships |

| Offshoring | Different country | Cost savings, global talent pool | Reducing operational expenses |

| Nearshoring | Nearby countries | Similar time zones, cost savings | Balancing cost and convenience |

Legal Considerations for Employee Outsourcing

Outsourcing employees can be a cost-effective and strategic way for businesses to access talent globally. However, companies must navigate legal complexities to ensure compliance with international labor laws. This section covers how Australian laws apply to overseas workers, local labor law considerations, Employer of Record (EOR) solutions, and a real-world case study on legal challenges in employee outsourcing.

Do Australian Laws Apply to Overseas Workers?

The short answer is yes, in some cases. Australian businesses that outsource employees internationally may still have legal obligations depending on the nature of the work and the contractual agreement. Some key factors that determine legal responsibility include:

- Employment Contracts: If an outsourced employee signs a contract governed by Australian law, certain obligations (such as minimum wage and benefits) may still apply.

- Management and Control: If the Australian company exercises significant control over the outsourced employee’s daily tasks, work hours, and reporting structure, they may be classified as an employer under Australian law.

- Payroll & Tax Obligations: Even if employees work overseas, tax and social security obligations may still be applicable, especially if the company does not use an EOR.

Risks of Non-Compliance

Failing to comply with Australian labor laws when outsourcing can lead to:

- Legal Disputes – Employees may claim benefits and protections under Australian law.

- Financial Penalties – Companies could face fines for tax evasion or unfair labor practices.

- Reputational Damage – Non-compliance can affect business credibility and partnerships.

Understanding Local Labor Laws

Every country has unique employment laws, taxation systems, and compliance requirements. Businesses must understand and adhere to the regulations in the country where they are outsourcing.

Key Legal Considerations for Global Hiring

- Minimum Wage Requirements: Some countries have strict labor laws on minimum wages and overtime pay, which must be followed. See Malaysia Salary Guide 2025.

- Employee Benefits: Countries like Malaysia, Singapore, and the Philippines mandate social security contributions, health insurance, and leave entitlements.

- Data Protection & Privacy Laws: The General Data Protection Regulation (GDPR) in Europe and other local regulations impact how businesses handle employee data.

- Termination & Severance Pay: Each country has different laws on employee termination, notice periods, and severance pay, which companies must factor into their outsourcing agreements.

Failure to comply with local labor laws can lead to lawsuits, employee disputes, and business shutdowns in those regions.

Employer of Record (EOR) & Compliance Solutions

One of the best ways to navigate global compliance challenges is to partner with an Employer of Record (EOR).

What Does an EOR Do?

An EOR is a third-party organization that legally employs outsourced workers on behalf of a company. They handle:

- Employment Contracts: Ensuring contracts align with local labor laws.

Payroll & Tax Compliance: Managing salary payments, benefits, and tax obligations for outsourced employees. - Legal & Regulatory Compliance: Ensuring businesses follow the employment laws of the employee’s country.

Benefits of Using an EOR

- Reduces Compliance Risks: Businesses don’t have to worry about misclassification or labor law violations.

- Faster Market Entry: Companies can quickly expand into new markets without setting up a local entity.

- Cost-Effective Operations: Avoids legal fees, fines, and administrative overheads.

By leveraging an EOR, businesses can outsource employees in a legally compliant manner, reducing risks and streamlining global hiring.

What Tasks Can You Delegate to Outsourced Employees?

Outsourcing is a versatile strategy that can be applied to a wide range of tasks. Here are some common functions businesses delegate to outsourced employees:

- Accounting and Finance: Bookkeeping, payroll processing, tax preparation.

- IT Services: Software development, technical support, cybersecurity.

- Customer Support: Call centers, live chat, email support.

- Human Resources: Recruitment, employee onboarding, benefits administration.

- Digital Marketing: Social media management, content creation, SEO.

- Administrative Tasks: Data entry, scheduling, virtual assistance.

By outsourcing these tasks, businesses can focus on their core operations while ensuring all other functions run smoothly.

Conclusion

Employee outsourcing is a powerful tool for businesses looking to enhance efficiency, reduce costs, and stay competitive in a dynamic market. By leveraging the expertise of external professionals, companies can focus on their strategic goals while leaving specialized tasks in capable hands.

Ready to take your business to the next level?

At FastLaneRecruit, we specialize in helping businesses streamline their operations by providing tailored employee outsourcing solutions. Whether you need skilled professionals for short-term projects or a dedicated team for long-term goals, we can connect you with the right talent. Contact FastLaneRecruit today and discover how we can help you optimize your operations through employee outsourcing!

FAQs

What is an example of employee outsourcing?

An example of employee outsourcing is an Australian-based accounting firm hiring a team of accountants from Malaysia to handle its accounting job. This allows the company to access specialized skills at a lower cost while focusing on client servicing.

What legal factors should you consider when outsourcing employees on a global scale?

When outsourcing globally, consider:

- Labour Laws: Ensure compliance with the labor laws of the outsourcing country.

- Data Privacy: Adhere to data protection regulations like GDPR or CCPA.

- Contractual Agreements: Clearly define roles, responsibilities, and dispute resolution mechanisms in the contract.

- Tax Implications: Understand the tax obligations in both your country and the outsourcing destination.

How can you effectively onboard outsourced employees?

To onboard outsourced employees effectively:

- Provide clear documentation and guidelines.

- Use collaboration tools like Slack or Microsoft Teams for seamless communication.

- Assign a point of contact for queries and support.

- Conduct regular check-ins to ensure alignment with company goals.