Managing payroll in-house can be a complex and time-consuming task, especially for businesses navigating Singapore’s strict employment regulations. Payroll outsourcing offers a strategic solution, allowing companies to streamline operations, ensure compliance, and focus on core business growth. Whether you’re a startup, SME, or multinational corporation, understanding payroll outsourcing can help you stay focused on what matters most, growing your business. In this blog, we’ll explore payroll outsourcing in Singapore, its benefits, how it works, and why FastLaneRecruit is the ideal partner for your payroll needs.

Content Outline

Key Summary

Payroll Outsourcing Defined

Payroll outsourcing is the process of engaging a third-party provider to manage essential payroll tasks, such as salary processing, tax filings, CPF contributions, and employee payslip generation.

Ensure Compliance with Singapore’s Regulations

Outsourcing helps businesses stay compliant with Singapore’s strict employment and tax regulations, including the Employment Act, Central Provident Fund (CPF), IRAS filings, and Skills Development Levy (SDL).

Key benefits

Key benefits include streamlined operations, improved accuracy, stronger data security, enhanced employee satisfaction, and operational scalability.

Ideal for Various Business Types

Outsourcing suits a wide range of businesses including startups, SMEs, multinational corporations (MNCs), and industries with complex pay structures.

Know When to Outsource

You should consider outsourcing payroll if you’re experiencing frequent errors, regulatory confusion, or want to redirect your HR focus toward business development.

FastLaneRecruit is Your Trusted Payroll Partner

FastLaneRecruit offers end-to-end payroll services tailored for Singapore-based businesses, combining expert support with cloud-based technology for compliance, efficiency, and growth.

What is payroll outsourcing?

Payroll outsourcing refers to the process of hiring a third-party provider to handle all aspects of your payroll functions, including salary disbursement, statutory contributions, tax filing, leave management, and employee payslip generation. This approach helps companies ensure accuracy, compliance, and timely payroll processing while reducing administrative workload.

In Singapore, According to Singapore’s Ministry of Manpower (MOM), payroll service providers must comply with regulations such as the Employment Act, Central Provident Fund (CPF) contributions, IRAS income tax filings, and Skills Development Levy (SDL) requirements. These regulations are updated periodically, making it vital to stay informed or partner with a professional who is.

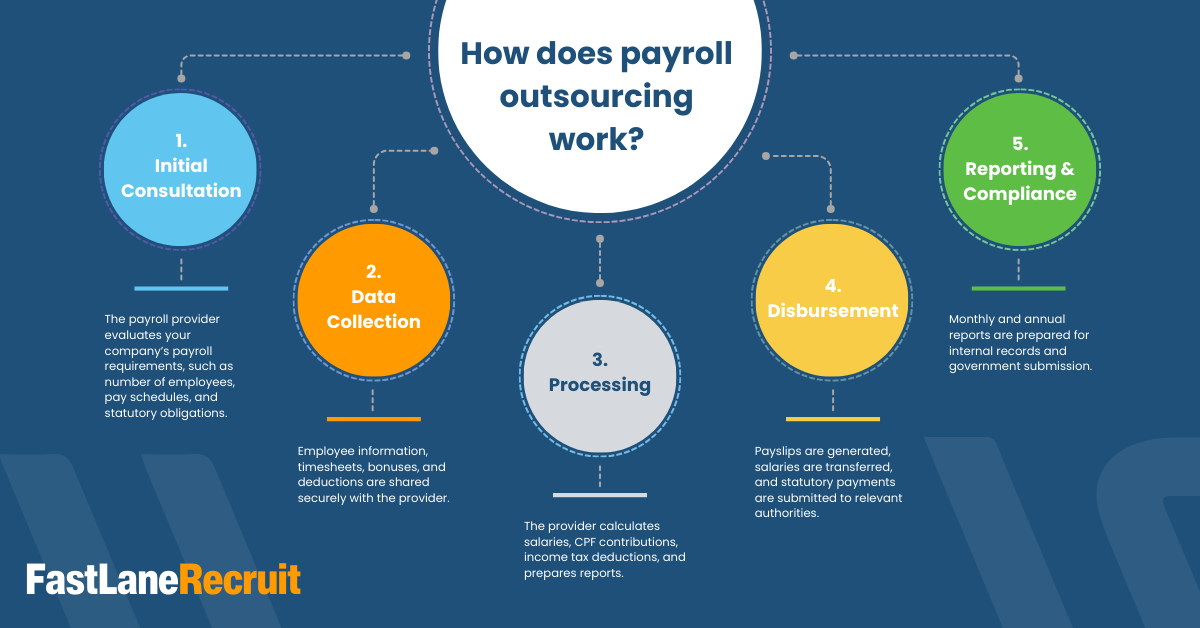

How does payroll outsourcing work?

Outsourcing payroll in Singapore typically involves a structured process:

- Initial Consultation: The payroll provider evaluates your company’s payroll requirements, such as number of employees, pay schedules, and statutory obligations.

- Data Collection: Employee information, timesheets, bonuses, and deductions are shared securely with the provider.

- Processing: The provider calculates salaries, CPF contributions, income tax deductions, and prepares reports.

- Disbursement: Payslips are generated, salaries are transferred, and statutory payments are submitted to relevant authorities.

- Reporting & Compliance: Monthly and annual reports are prepared for internal records and government submission.

The entire process is typically handled using secure cloud-based platforms that ensure confidentiality, accuracy, and accessibility.

Benefits of Outsourcing Your Payroll Process

Streamline operations

Outsourcing payroll enables businesses to centralize and automate processes, reducing manual intervention and administrative burden. With a reliable provider, you eliminate the risk of late payments or calculation errors that can result in penalties.

Help increase employee satisfaction

A professionally managed payroll process ensures employees are paid accurately and on time. It also offers self-service portals for payslips, leave balances, and tax forms, which enhances transparency and trust.

Strengthen security & compliance

Payroll involves handling sensitive employee data and complex regulatory requirements. Outsourcing to a reputable provider with robust data security and compliance frameworks (such as ISO-certified platforms) minimizes the risk of breaches or non-compliance.

Freedom to focus on the growth of your organization

By entrusting payroll functions to specialists, internal teams can concentrate on strategic HR initiatives, talent acquisition, and business expansion rather than getting caught up in administrative tasks.

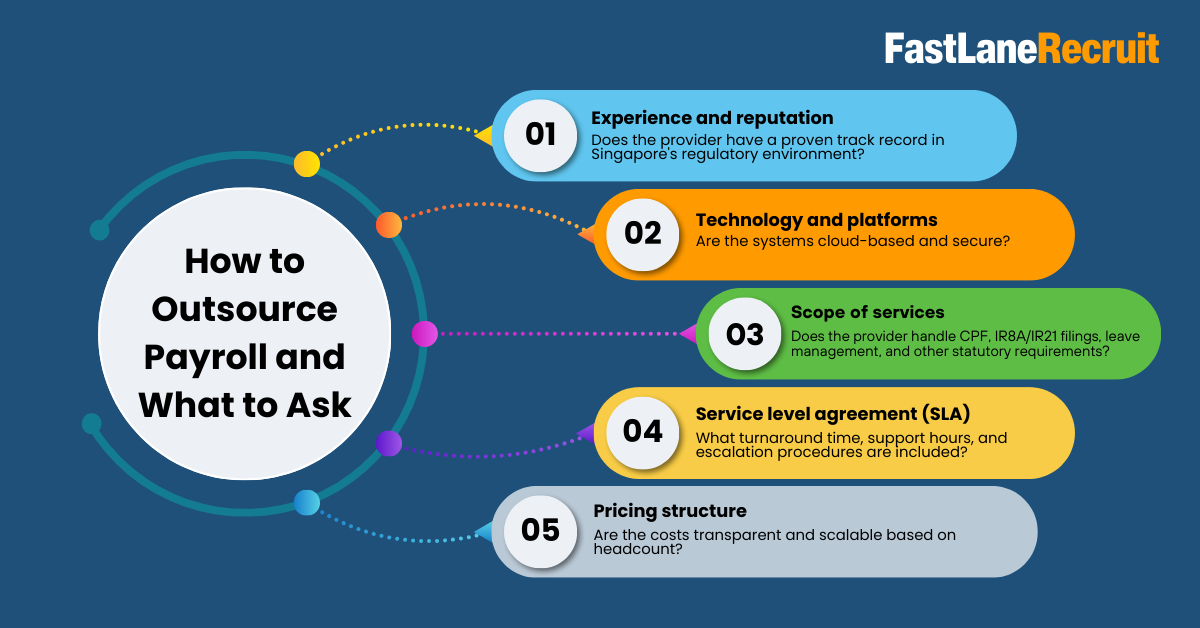

How to Outsource Payroll and What to Ask

Before choosing a payroll service provider in Singapore, it’s important to evaluate the following:

- Experience and reputation: Does the provider have a proven track record in Singapore’s regulatory environment?

- Technology and platforms: Are the systems cloud-based and secure?

- Scope of services: Does the provider handle CPF, IR8A/IR21 filings, leave management, and other statutory requirements?

- Service level agreement (SLA): What turnaround time, support hours, and escalation procedures are included?

- Pricing structure: Are the costs transparent and scalable based on headcount?

Asking these questions ensures you select a provider aligned with your business needs and compliant with local legislation.

Who Should Consider Payroll Outsourcing Singapore?

Small and Medium Enterprises (SMEs)

With limited internal HR capacity, SMEs benefit significantly from outsourcing payroll. It helps them avoid costly compliance mistakes while keeping operations lean and efficient.

Startups

Startups need agility and speed. Outsourcing payroll allows founders to focus on scaling the business while ensuring accurate and timely salary payments.

Multinational Corporations (MNCs)

MNCs operating in Singapore need local payroll expertise to ensure alignment with national tax laws and employment regulations. Outsourcing simplifies cross-border payroll compliance.

Industries with complex payroll processes

Sectors such as manufacturing, logistics, or hospitality often deal with shift work, overtime, and variable pay structures. A payroll provider helps manage this complexity with precision.

New market players

Companies entering Singapore for the first time benefit from outsourcing payroll as it helps them comply with local employment laws without setting up a full HR department.

Rapidly expanding organizations

As businesses grow and onboard employees rapidly, a scalable payroll solution ensures accuracy and consistency without straining internal resources.

When Does Your Business Need to Outsource Payroll?

You may need to consider outsourcing your payroll when:

- Payroll errors or late salary disbursements become frequent.

- Your HR team spends more time on payroll than on strategic initiatives.

- You expand your workforce or enter new markets.

- There are changes in regulatory requirements that you’re struggling to keep up with.

- You want to reduce the cost of maintaining in-house payroll infrastructure and personnel.

What payroll functions can be outsourced?

A comprehensive payroll outsourcing service in Singapore can include:

- Monthly payroll calculation and salary disbursement

- CPF, SDL, and other statutory contributions

- IR8A and IR21 income tax reporting to IRAS

- Preparation and distribution of payslips

- Leave and claims management

- Expense reimbursements

- Year-end payroll reconciliation

- Employment income reporting for foreign workers

Some providers may also offer integration with HR platforms and accounting software like Xero, QuickBooks, or SAP.

Conclusion

Payroll outsourcing in Singapore is more than just a cost-saving solution, it’s a strategic decision that enhances accuracy, compliance, and operational efficiency. With a trusted partner handling your payroll, your business can focus on its core competencies and growth.

Outsource Your Payroll to FastLaneRecruit

At FastLaneRecruit, we specialize in delivering customized payroll solutions for businesses of all sizes across Singapore. With our expert team and cutting-edge cloud-based platforms, we ensure your payroll is accurate, compliant, and effortlessly managed.

Whether you’re a startup, an SME, or an expanding multinational, we help simplify your payroll and HR processes. Let us support your business with:

- End-to-end payroll processing

- Timely salary payments and statutory compliance

- Employee self-service portals

- Scalable solutions tailored to your business needs

Get in touch with FastLaneRecruit today and experience a smarter way to manage your payroll. Contact us now!