For Singapore Accounting and Corporate Services Firms

Powered by FastLaneRecruit – Smart Hiring for High-Performing Remote Teams

In Singapore’s competitive accounting and corporate services sector, firms are under increasing pressure to deliver high-quality services while managing rising operational costs and a tightening local talent pool. Coupled with evolving regulatory requirements from agencies like IRAS and ACRA, finding and retaining the right professionals has become a significant challenge.

Offshore staffing offers a strategic solution. By engaging skilled professionals in Malaysia, Singapore-based firms can:

- Significantly reduce hiring costs compared to local hires

- Expand operational capacity to meet growing client demands

- Maintain regulatory compliance while scaling business activities

- Access experienced accountants, corporate secretaries, and payroll specialists familiar with regional standards

However, successfully building and integrating an offshore team goes beyond hiring. It requires a structured approach to ensure smooth integration, regulatory alignment, and sustained performance excellence.

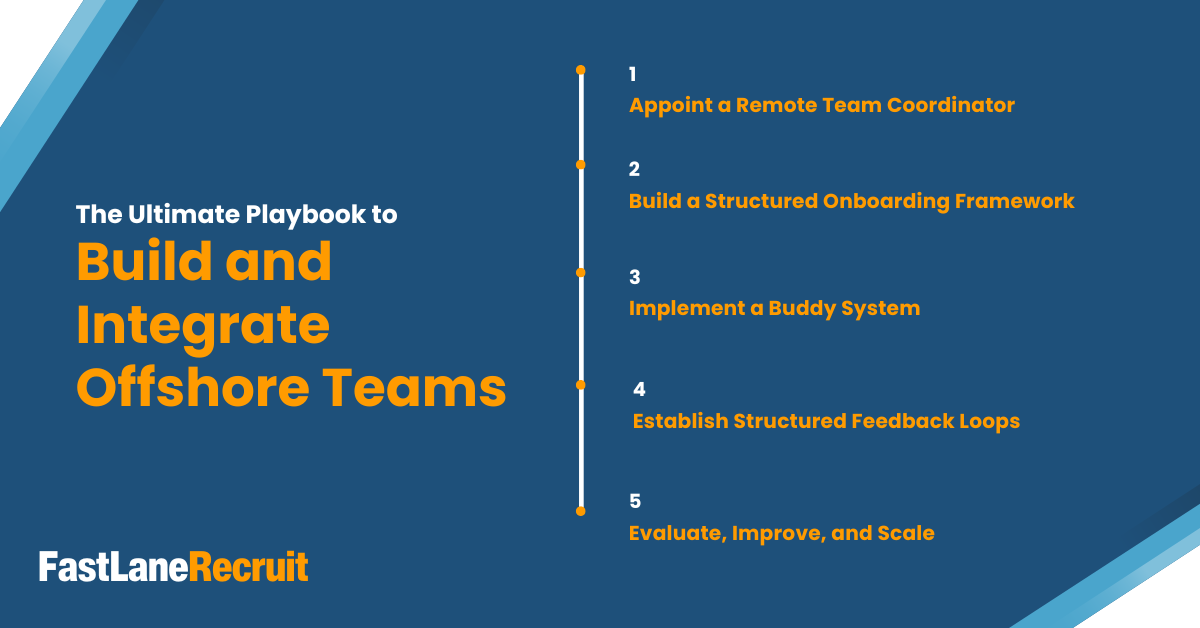

This playbook provides a comprehensive framework for Singapore accounting and corporate services firms to:

- Identify roles and functions suitable for offshoring

- Establish a secure and compliant onboarding process

- Foster effective collaboration and communication across borders

- Continuously review, improve, and scale offshore teams in alignment with evolving client needs and industry best practices

Step 1: Appoint a Remote Team Coordinator

The success of any offshore staffing initiative for Singapore firms starts with strong leadership and clear accountability. Designating a Remote Team Coordinator within your Singapore office is essential to bridging the gap and communicate between local and remote professionals and ensuring a seamless virtual team setup that supports client needs and regulatory compliance.

Key Responsibilities:

- Onboarding Oversight: Coordinate and oversee remote onboarding processes for offshore staff, ensuring they understand your firm’s workflows and operational standards.

- Central Communication Point: Serve as the primary liaison between local and offshore teams, fostering clear, consistent communication and promptly addressing questions or challenges.

- Productivity Management for Offshore Teams: Monitor productivity management for offshore teams through clear performance metrics, identifying opportunities for process improvements and ensuring offshore professionals remain aligned with client expectations and regulatory requirements.

- Alignment with Local Standards: Ensure offshore work adheres to Singapore’s regulatory frameworks, including IRAS, ACRA, CPF Board, and other relevant bodies.

Ideal Candidate Profile:

- Strong understanding of Singapore’s accounting, tax, and corporate compliance frameworks, including offshore staffing Singapore best practices.

- Demonstrated leadership and change management skills, with experience building and managing virtual team setups.

- Excellent communicator with the ability to motivate and align remote and local staff.

- Commitment to creating a cohesive, compliant, and high-performing team environment.

By appointing a Remote Team Coordinator, firms create a clear line of responsibility and accountability that forms the essential foundation for a successful offshore staffing Singapore strategy.

Also Read: Singapore Companies Hire Remote Employees from Malaysia

Step 2: Build a Structured Onboarding Framework

A well-structured onboarding process is critical to integrating offshore teams seamlessly and maintaining your firm’s high standards of compliance and client service. For accounting and corporate services firms in Singapore, effective onboarding ensures that remote accounting staff Singapore are fully aligned with local expectations and workflows.

Key Elements of a Strong Onboarding Framework:

- System Access and IT Integration: Provide secure access to essential accounting platforms such as Xero, QuickBooks, AutoCount, Talenox, Payboy, and PayrollPanda. Establish secure file sharing using tools like Google Drive, Dropbox, and ClickUp, ensuring compliance with Singapore’s Personal Data Protection Act (PDPA).

- Workflow and Compliance Training: Train offshore staff on Singapore-specific processes and IRAS compliance offshore standards, including Form C-S and GST F5 submissions, ACRA and ROC filing support through BizFile+, CPF deductions, and related statutory obligations. Use practical examples and clear SOPs to highlight your firm’s operational standards.

- Expectations and Policies: Set clear KPIs for turnaround times, accuracy, and escalation paths. Establish standardised documentation and reporting structures to maintain quality and consistency in all client deliverables.

- Security and Data Compliance: Educate offshore staff on data security protocols and best practices for handling sensitive client information, essential for Singapore payroll outsourcing and other compliance-heavy tasks. Conduct regular reviews to ensure that data security and compliance remain top priorities.

Best Practices for Offshore Onboarding:

- Develop onboarding manuals and training videos focused on Singapore’s regulatory landscape and your firm’s approach to ACRA filing support and IRAS compliance offshore.

- Schedule regular onboarding check-ins with the Remote Team Coordinator to address questions and track progress.

- Incorporate peer-to-peer training sessions with local staff to foster alignment and improve understanding of Singapore’s compliance environment.

- Continuously refine the onboarding process based on feedback and evolving best practices to ensure it remains effective and relevant.

A structured onboarding framework builds a strong foundation for offshore staff to perform confidently and compliantly, supporting your firm’s growth ambitions and upholding Singapore’s regulatory requirements.

Also Read: Big 4 Singapore vs Local Firms vs Outsourcing to Malaysia

Step 3: Implement a Buddy System

A buddy system is an effective way to promote offshore employee engagement Singapore and ensure that remote professionals integrate seamlessly with your local team. It fosters knowledge sharing, cultural alignment, and operational consistency across borders.

How the Buddy System Works:

- Assign a Local Buddy: Pair each offshore team member with a local colleague in Singapore. This buddy acts as a go-to resource, offering insights on internal workflows and Singapore’s compliance nuances.

- Foster Cultural and Professional Integration: The buddy relationship strengthens cross-border staff integration by encouraging open communication and trust. Offshore staff gain practical understanding of your firm’s work culture, client service approach, and Singapore’s professional norms.

- Facilitate Knowledge Sharing: Buddies offer practical guidance on using platforms like Xero, QuickBooks, Talenox, and other essential tools frequently used by remote accounting staff supporting Singapore firms. They also help offshore staff understand standards for IRAS compliance, ACRA filing requirements, and Singapore payroll outsourcing processes.

- Structured Support and Feedback: Buddies lead regular check-ins and provide feedback on work quality, offering practical support during peak compliance periods such as IRAS filing deadlines or ACRA submission cycles.

Best Practices for Success:

- Develop a clear framework or checklist to guide the virtual onboarding buddy program, ensuring that support is consistent and effective.

- Encourage buddies to share insights from their interactions with offshore colleagues, which can help refine processes and improve collaboration.

- Periodically review the buddy program to ensure it remains aligned with your firm’s evolving needs and continues to strengthen offshore employee engagement for your Singapore-based operations.

Implementing a buddy system strengthens cross-border staff integration and ensures that offshore professionals are fully supported, creating a collaborative and high-performing team that aligns with your Singapore firm’s standards and client expectations.

Also Read: Case Study: How a Singapore Accounting Firm Set Up a Remote Team in Malaysia

Step 4: Establish Structured Feedback Loops

A robust feedback system is essential for maintaining high performance and accountability across your offshore and local teams. For Singapore accounting and corporate services firms, clear feedback loops ensure offshore staff consistently meet your compliance and operational standards.

Key Elements of a Structured Feedback Process:

- Regular Performance Reviews: Conduct monthly or quarterly performance review remote staff sessions to evaluate key metrics such as accuracy, turnaround times, and overall contribution to the team.

- Two-Way Communication: Establish open communication channels that encourage offshore staff to share insights and suggestions for improving workflows. This two-way approach ensures that feedback is not just top-down but also incorporates valuable offshore perspectives.

- Focus on Core Compliance Tasks: Structure reviews around your firm’s key compliance activities, such as GST outsourcing for Singapore operations, IRAS filings, ACRA submissions, and corporate secretarial functions.

- Integration with Offshore Workflow Feedback: Use feedback sessions to refine offshore workflow feedback practices, ensuring that deliverables meet client expectations and align with your Singapore firm’s regulatory environment.

- Remote Payroll Support Alignment: In areas like remote payroll support, ensure that performance reviews cover not only accuracy but also adherence to deadlines and secure handling of sensitive employee data.

Best Practices for Ongoing Improvement:

- Encourage offshore staff to provide feedback on pain points and opportunities for process improvement.

- Document feedback outcomes and action points clearly to ensure accountability and measurable progress.

- Involve the Remote Team Coordinator and key local managers in review sessions to reinforce the connection between your Singapore office and offshore professionals.

Establishing structured feedback loops strengthens trust and alignment between offshore and local teams. It ensures that your offshore professionals are fully engaged, supported, and consistently meeting your firm’s expectations for high-quality service delivery.

Also Read: Benefit of Outsourcing Accounting to Malaysia

Step 5: Evaluate, Improve, and Scale

As your offshore staffing model matures, ongoing evaluation and improvement are critical to ensuring sustainable growth and continued alignment with your firm’s operational and regulatory requirements. A structured approach to performance reviews and process refinements helps you optimize your offshore team’s impact and expand your capabilities over time.

Key Elements for Evaluation and Improvement:

- Quarterly Reviews: Conduct in-depth quarterly evaluations to assess performance against KPIs, identify workflow bottlenecks, and find opportunities for improvement. These reviews also help ensure ongoing compliance with Singapore standards, particularly in critical areas such as GST outsourcing, IRAS filings, and remote payroll support.

- Refine Workflows and Processes: Use structured feedback sessions to improve offshore workflow feedback practices and integrate offshore staff input into your overall operations. This continuous improvement ensures that your remote team remains aligned with local practices and client needs.

- Expand Scope of Offshore Work: Once your offshore team demonstrates consistent performance, consider gradually shifting more complex tasks to them. This can include advanced management reports, tax advisory support, or client engagement tasks.

- Optimize Remote Workforce: Leverage insights from performance reviews to optimize remote workforce structures and build a flexible, high-performing team that scales alongside your Singapore firm’s needs.

Scaling for Long-Term Success:

- Scale Offshore Team Singapore: Use your performance data and operational insights to scale your offshore team in Singapore in a measured and sustainable way.

- Grow Virtual Accounting Team: Identify roles and functions that align with your growth plans and consider how to grow virtual accounting team capabilities strategically, ensuring that you meet client demands and expand service offerings effectively.

- Integrated Compliance Support: As you scale, ensure that all processes, especially in areas such as GST outsourcing for Singapore, IRAS submissions, and ACRA filing support, remain fully compliant and aligned with Singapore’s regulatory standards.

By focusing on continuous improvement and carefully expanding your offshore capabilities, you create a robust, future-ready team that supports your firm’s ambitions and drives long-term success.

Also Read: How FastLaneRecruit Helps Singapore Businesses Hire Top Talent

Bonus Tips for Seamless Offshore Integration

Maximising the benefits of offshore staffing requires more than simply setting up a team. Here are additional strategies and best practices to ensure your offshore team becomes a high-performing, fully integrated extension of your Singapore office.

- Train on Singapore Regulatory Standards:

Invest in training that helps offshore professionals understand essential areas such as CPF contributions, Form C-S, GST F5 filings, IR8A submissions, BizFile+ usage, and AGM/AR filing deadlines. A solid grasp of these standards is crucial for maintaining IRAS compliance and meeting your clients’ expectations. - Start with Low-Risk, High-Volume Tasks:

Begin by delegating functions like bookkeeping, bank reconciliations, payroll processing, and GST draft reports. These tasks help your offshore professionals build confidence while ensuring smooth transitions into more complex areas over time. - Clarify Public Holidays and Work Schedules:

Ensure that offshore staff understand Singapore’s public holidays and key compliance deadlines. At the same time, factor in Malaysia’s national holidays to maintain continuous workflow and avoid disruptions. - Use Familiar Accounting and HR Tech:

Equip offshore staff with the same platforms used by your Singapore office, such as Xero, Talenox, and Payroll Panda. Familiarity with these systems supports smoother collaboration and faster onboarding. - Leverage FastLaneRecruit’s EOR Solution:

Engage our Employer of Record (EOR) service to legally employ Malaysian professionals without setting up a local entity. We handle payroll, taxes, HR compliance, and leave management for your offshore staff. This ensures full alignment with local labour laws and allows you to focus on client service delivery. - Optimize Remote Workforce and Offshore Employee Engagement:

Actively engage your offshore team to foster a sense of belonging and motivation. Regular check-ins and recognition of contributions strengthen offshore employee engagement within Singapore firms and help create a collaborative, high-performing team environment. - Cross-Border Staff Integration:

Ensure that cultural alignment and workflow integration are priorities. Practical tools such as a virtual onboarding buddy program can smooth out initial transitions and foster trust and understanding across teams.

Scale Offshore Team Singapore and Grow Virtual Accounting Team

As your offshore staffing model matures, identify areas to scale offshore team Singapore capabilities and grow virtual accounting team structures strategically. This measured growth ensures that offshore resources align with your firm’s long-term goals.

These bonus tips support a thoughtful, sustainable approach to offshore staffing that delivers lasting value to your Singapore firm while maintaining the high standards your clients expect.

Also Read: The Ultimate Guide to Offshore Accounting

Why Singapore Firms Choose FastLaneRecruit

FastLaneRecruit is the offshore recruitment arm of FastLane Group, an established accounting and advisory firm in Asia. We understand the compliance demands, operational challenges, and growth ambitions of Singapore-based firms.

With FastLaneRecruit, you gain:

- Access to skilled accountants, tax assistants, payroll specialists, and corporate secretaries based in Malaysia

- A 100% compliant hiring model through our EOR platform

- Up to 60% savings in labour costs compared to Singapore hires

- A partner who understands the regional regulatory environment and your business needs

Book a Free Discovery Call

Ready to build a high-performing offshore team for your Singapore firm?

Schedule a complimentary consultation with our team. We’ll help you:

- Identify roles best suited for offshoring

- Talent Sourcing, EOR, and Payroll

- Plan a structured onboarding and integration process

Take the first step toward smarter hiring with FastLaneRecruit. Contact Us now to discuss your needs!