Filing employee income information with the Inland Revenue Authority of Singapore (IRAS) is a mandatory task for employers. One key component of this requirement is Form IR8A, which must be submitted annually for each employee. Whether you’re running a small business or managing a large enterprise, understanding the obligations tied to IR8A filing is crucial for avoiding penalties and ensuring compliance.

In this guide, we’ll break down what Form IR8A entails, who needs to submit it, how to file it, and what pitfalls to avoid.

Content Outline

Key Summary

Form IR8A is mandatory for all employers in Singapore to report employee income annually.

It must be filed by 1 March each year, preferably through the Auto-Inclusion Scheme (AIS).

Some individuals, like freelancers and short-term hires, are exempt from IR8A filing.

Supporting documents may be required for non-cash benefits, CPF contributions, and stock options.

Errors in filing can lead to penalties—stay updated through IRAS.

FastLaneRecruit offers end-to-end HR support, including payroll and tax reporting solutions.

What is Form IR8A in Singapore?

Form IR8A is an annual tax form that employers in Singapore must complete and submit to IRAS for each employee. It details the total remuneration paid to the employee in the preceding calendar year, including salary, bonuses, benefits-in-kind, and other taxable income.

Employers are legally required to provide this form to their employees by 1 March every year. IRAS uses this information to assess individual income tax returns.

Learn more on the IRAS website

Who is Exempted From Form IR8A?

Not all individuals working for a business are subject to IR8A reporting. Employers do not need to submit IR8A for the following:

- Freelancers or independent contractors

- Board directors who are not employees

- Employees who worked for less than 60 days (e.g., short-term contract staff)

- Foreign employees seconded to Singapore from overseas headquarters, provided their income is not taxable in Singapore

If you’re unsure whether an individual falls under exemption criteria, it’s best to consult the IRAS employment income guidelines.

What is the Difference Between Form IR8A and IR21?

While both forms relate to employment income, they serve different purposes:

- Form IR8A is for reporting annual income of current employees.

- Form IR21 (Tax Clearance) must be filed when a foreign employee ceases employment or leaves Singapore permanently. This form ensures taxes are cleared before the employee departs.

Employers must file IR21 at least one month before the employee’s last day of work in Singapore. More details can be found on the IRAS IR21 page.

Also Read: Benefit of Outsourcing Accounting to Malaysia

Supporting Paperwork With Form IR8A

In addition to Form IR8A, employers may also need to file the following supporting forms depending on the nature of the employee’s income:

- Appendix 8A: For benefits-in-kind (e.g., housing, cars)

- Appendix 8B: For employee stock option gains

- Form IR8S: For excess CPF contributions

Failing to include these where applicable may result in incorrect tax reporting.

What is the Form IR8A Due Date for Submission?

The due date for filing Form IR8A is 1 March each year. Employers who are under the Auto-Inclusion Scheme (AIS) must submit electronically, while others may provide hardcopies.

Late submission or failure to submit may result in penalties or prosecution under the Income Tax Act.

Also Read: How Remote Accounting Services Can Improve Your Business

How to Submit Form IR8A

There are two primary ways employers can submit Form IR8A:

- Electronically through the Auto-Inclusion Scheme (AIS)

- Manually in hardcopy

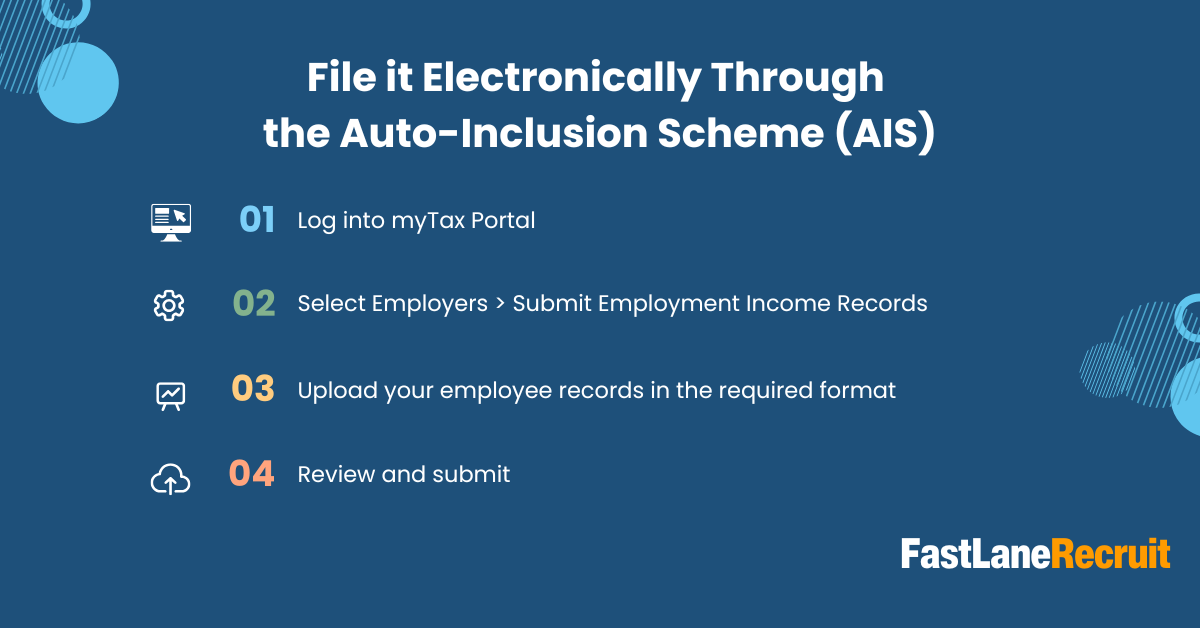

File it Electronically Through the Auto-Inclusion Scheme (AIS)

Most employers are now required to file Form IR8A electronically through the Auto-Inclusion Scheme (AIS), which automates submission to IRAS. From 2024, AIS is compulsory for employers with 5 or more employees or who have received a notice from IRAS.

Steps to file via AIS:

- Log into myTax Portal

- Select Employers > Submit Employment Income Records

- Upload your employee records in the required format

- Review and submit

IRAS provides templates and validation tools to assist employers in submitting correct format.

Provide a Hardcopy

Employers not under the AIS may provide hardcopies directly to employees and need not submit them to IRAS. However, you must ensure employees use the information to complete their personal tax returns accurately.

IR8A Filing Mistakes

Common errors employers make during IR8A submission include:

- Incorrect or missing employee identification (NRIC/FIN)

- Excluding taxable benefits

- Omitting required supplementary forms (8A, 8B, IR8S)

- Failing to validate the digital form before uploading to IRAS

To prevent mistakes, always refer to the IRAS IR8A preparation guide.

Also Read: The Ultimate Guide to Offshore Accounting

InCorp is Here to Help With Your Tax Filing Matters

For employers managing a growing team, handling tax compliance alone can be overwhelming. Whether it’s preparing IR8A forms, determining taxable allowances, or managing AIS submissions, a trusted corporate services provider like InCorp can help you stay compliant, accurate, and timely with your tax reporting obligations.

What are the scenarios requiring supporting documents for the Singapore IR8A Form?

Supporting documents are generally required when:

- The employee received benefits-in-kind

- There were stock options or share awards

- The employer made voluntary CPF contributions

- The employee received non-cash remuneration (e.g., accommodation, transport benefits)

Always prepare relevant documentation and calculations for benefits disclosed in Appendix 8A or 8B to support IR8A claims.

Conclusion

Navigating the requirements of Singapore’s Form IR8A may seem daunting at first, but with proper understanding and timely action, employers can ensure full compliance with IRAS regulations. From knowing who is exempted to submitting through the Auto-Inclusion Scheme and attaching the right supporting forms, every detail matters in maintaining your organisation’s credibility and avoiding penalties. Whether you’re a startup hiring your first employee or an established business managing a large workforce, staying on top of your tax filing obligations is a vital part of responsible employment.

With professional support from trusted service providers like FastLaneRecruit, you can simplify the complexities of IR8A reporting and focus more on growing your business and managing talent efficiently.

How FastLaneRecruit Can Help Employers

At FastLaneRecruit, we go beyond recruitment. We understand that compliance with Singapore’s employment regulations, such as IR8A filing, is just as crucial as hiring the right talent. Our integrated HR and payroll solutions ensure all employee income details are properly recorded and submitted on time, giving employers peace of mind during the tax season.

Let us help streamline your compliance processes so you can focus on growing your team with confidence. Contact Us Now!