In today’s competitive business landscape, companies are constantly seeking ways to streamline operations, reduce costs, and improve efficiency. One strategic approach that has gained significant traction is outsourcing accounting services, particularly to countries like Malaysia. With its skilled workforce, cost-effective solutions, and robust financial infrastructure, Malaysia has become a preferred destination for businesses looking to outsource their accounting functions.

At FastLaneRecruit, we understand the challenges businesses face in managing their financial operations. Outsourcing accounting to Malaysia can provide your company with expert financial management, scalability, and enhanced efficiency, allowing you to focus on core business growth. In this blog post, we’ll explore the benefits, potential drawbacks, common misconceptions, and key factors to consider when outsourcing accounting to Malaysia.

Content Outline

Key Summary

Outsourcing to Malaysia offers up to 50% cost savings compared to in-house teams.

Gain access to certified professionals (ACCA, CPA, MICPA) with global compliance expertise.

Malaysian firms provide scalable, tech-driven solutions including cloud-based tools like Xero and QuickBooks.

Businesses benefit from reduced fraud risk, improved operational efficiency, and strategic financial advisory.

Choosing the right provider requires evaluating experience, services, support, and transparent pricing.

FastLaneRecruit helps connect companies with top-tier Malaysian accounting talent through flexible hiring models.

What is Outsourced Accounting?

Outsourced accounting is the strategic delegation of a company’s financial operations to a third-party service provider, typically located offshore. This model covers a wide range of services, including:

- Bookkeeping & financial record maintenance

- Accounts payable/receivable management

- Payroll processing & statutory compliance

- Tax planning, computation, and filing

- Financial reporting & forecasting

Unlike traditional in-house accounting, outsourcing provides businesses with access to a team of experts without the overhead costs of full-time employees. According to a study by PwC, 72% of businesses that outsource financial functions report improved efficiency and cost savings.

Malaysia, in particular, has become a preferred destination due to its:

- Strong English proficiency

- Robust financial regulations aligned with IFRS and GAAP

- Cost-competitive talent pool of ACCA, CPA, and MICPA-certified professionals

Also Read: Offshore Accounting: Top 10 Offshore Roles For Accounting

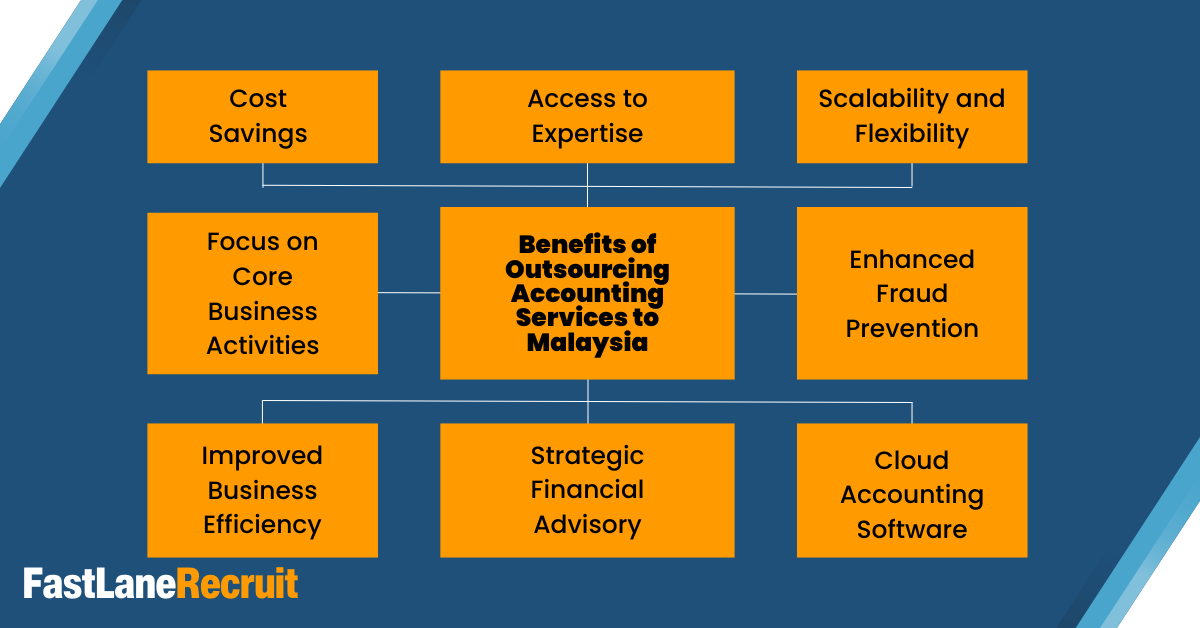

Key Benefits of Outsourcing Accounting Services to Malaysia

1. Significant Cost Savings (Up to 50% Reduction in Operational Costs)

Maintaining an in-house accounting department involves:

- Salaries, bonuses, and employee benefits

- Training and upskilling costs

- Accounting software licenses (e.g., QuickBooks, Xero)

- Office space and infrastructure

By outsourcing to Malaysia, businesses can reduce accounting costs by 40-50% while maintaining high-quality financial management.

Example: A Singapore-based SME saves $30,000 annually by outsourcing payroll and tax compliance to Malaysia instead of hiring locally.

Also Read: Benefits Of Offshoring Accounting In Malaysia

2. Access to Expertise

Malaysian accounting firms boast professionals well-versed in both local and international accounting standards, including the International Financial Reporting Standards (IFRS) and Malaysian Financial Reporting Standards (MFRS). This expertise ensures accurate financial reporting, compliance with regulatory requirements, and insightful financial analysis.

3. Scalability and Flexibility

Outsourcing provides businesses with the agility to scale accounting services up or down based on evolving needs. Whether it’s handling increased workloads during peak seasons or reducing services during slower periods, outsourcing offers the flexibility to adapt without the challenges of hiring or downsizing staff.

Also Read: Hiring Malaysian Talent: Employer of Record Malaysia Guide

4. Focus on Core Business Activities

By entrusting accounting tasks to external experts, businesses can redirect their focus towards strategic initiatives, such as product development, market expansion, and customer engagement. This shift enhances overall productivity and fosters business growth.

5. Enhanced Fraud Prevention

Outsourcing introduces a system of checks and balances, reducing the risk of internal fraud. External accounting firms implement stringent internal controls, conduct regular audits, and maintain transparency, thereby safeguarding the company’s financial integrity. A 2023 ACFE report found that companies with outsourced accounting experience 30% fewer fraud cases.

6. Improved Business Efficiency

Leveraging the advanced tools and streamlined processes of outsourcing firms leads to increased operational efficiency. Real-time financial reporting, automated workflows, and timely insights enable informed decision-making and agile business operations.

Also Read: Benefits of Global Outsourcing

7. Strategic Financial Advisory

Beyond routine accounting tasks, many Malaysian firms offer strategic advisory services. These include budgeting, forecasting, financial planning, and risk management, providing businesses with comprehensive financial guidance to navigate complex market dynamics.

8. Adoption of Cloud Accounting Software

Outsourcing firms in Malaysia often utilize cutting-edge cloud-based accounting platforms like Xero, QuickBooks, and MYOB. These platforms offer real-time access to financial data, facilitate seamless collaboration, and ensure data security through robust encryption protocols.

Cons of Outsourcing Accounting Services

While outsourcing offers numerous advantages, it’s essential to consider potential challenges:

Limited Control and Oversight

Delegating accounting functions may lead to reduced direct oversight. Establishing clear communication channels and setting defined expectations can mitigate this concern.

Cultural and Operational Misalignment

Differences in business culture, communication styles, and operational practices can pose challenges. Regular interactions and cultural sensitivity training can bridge these gaps.

Hidden Costs

Some outsourcing agreements may entail unforeseen expenses, such as charges for additional services or software upgrades. Thoroughly reviewing contracts and clarifying all cost components upfront is crucial.

Communication Delays

Time zone differences and reliance on digital communication can sometimes lead to delays. Scheduling regular meetings and utilizing collaborative tools can enhance communication efficiency.

Common Misconceptions About Outsourcing Accounting Services

- Only Large Corporations Benefit from Outsourcing: In reality, small and medium-sized enterprises (SMEs) often gain the most from outsourcing due to limited internal resources and the need for specialized expertise.

- Outsourcing Compromises Data Security: Reputable Malaysian accounting firms adhere to stringent data protection laws, including the Personal Data Protection Act (PDPA), ensuring the confidentiality and security of client information.

- Loss of Control Over Financial Processes: Effective outsourcing partnerships involve transparent communication, regular reporting, and collaborative decision-making, maintaining the client’s control over financial operations.

Services Offered by Accounting Service Providers in Malaysia

Malaysian accounting firms offer a comprehensive suite of services tailored to diverse business needs:

1. Bookkeeping

Systematic recording of financial transactions, maintenance of ledgers, and reconciliation of accounts to ensure accurate financial records.

2. Transaction Management

Efficient handling of accounts payable and receivable, invoice processing, and management of financial transactions to maintain healthy cash flow.

3. Cash Flow Forecasting

Analyzing historical data and market trends to predict future cash inflows and outflows, aiding in financial planning and liquidity management.

4. Tax Computation and Filing

Accurate calculation of tax liabilities, preparation of tax returns, and timely filing in compliance with the Inland Revenue Board of Malaysia (LHDN) regulations.

5. Payroll Processing

Comprehensive management of employee compensation, including salary calculations, statutory deductions (EPF, SOCSO, EIS), and issuance of payslips.

6. Operational Support

Assistance in budgeting, financial reporting, internal audits, and implementation of financial controls to enhance operational efficiency.

7. Statutory Compliance

Ensuring adherence to legal requirements, including the preparation and submission of annual returns, maintenance of statutory registers, and compliance with the Companies Commission of Malaysia (SSM) guidelines.

Factors to Consider When Choosing an Accounting Service Provider in Malaysia

1. Reputation and Experience

Evaluate the firm’s track record, client testimonials, and industry experience to ensure reliability and expertise.

2. Range of Services

Opt for providers offering a broad spectrum of services to cater to current needs and accommodate future business growth.

3. Pricing Model

Understand the firm’s pricing structure, including any additional fees, to ensure transparency and alignment with your budget.

4. Level of Support and Responsiveness

Assess the firm’s commitment to client support, including response times, availability of dedicated account managers, and communication channels.

Conclusion

Outsourcing accounting functions to Malaysia presents a strategic opportunity for businesses to enhance financial management, achieve cost savings, and focus on core competencies. With its blend of skilled professionals, cost efficiency, and regulatory expertise, Malaysia stands out as a top-tier accounting outsourcing hub. Businesses leveraging Malaysian accounting services gain:

- 30-50% operational cost reduction

- Enhanced compliance with local/international standards

- Scalable solutions that grow with your business.

By partnering with experienced Malaysian accounting firms, companies can navigate complex financial landscapes with confidence and agility.

Elevate Your Financial Operations with FastLaneRecruit

Ready to transform your accounting processes?

At FastLaneRecruit, we specialize in connecting businesses with top-tier accounting professionals in Malaysia. Our curated network ensures you find the perfect match to meet your unique financial needs.

- Customized Recruitment Solutions: Tailored to your specific accounting requirements.

- Flexible Engagement Models: Choose from part-time, full-time, or project-based arrangements.