Outsourcing accounting functions has become a strategic move for businesses aiming to reduce costs, increase efficiency, and access top-tier financial expertise. From startups to established enterprises, outsourcing allows companies to focus on core operations while ensuring their financial processes are managed accurately and in compliance with regulations.

In this blog, we will explore the most common types of accounting services that can be outsourced, why businesses choose to outsource, when to consider outsourcing, and how FastLaneRecruit can help businesses find qualified professionals to handle these critical financial tasks.

Content Outline

Key Summary

Outsourcing Advantages

Outsourcing accounting services offers cost savings, improved efficiency, and access to specialized skills.

Outsource Various Functions

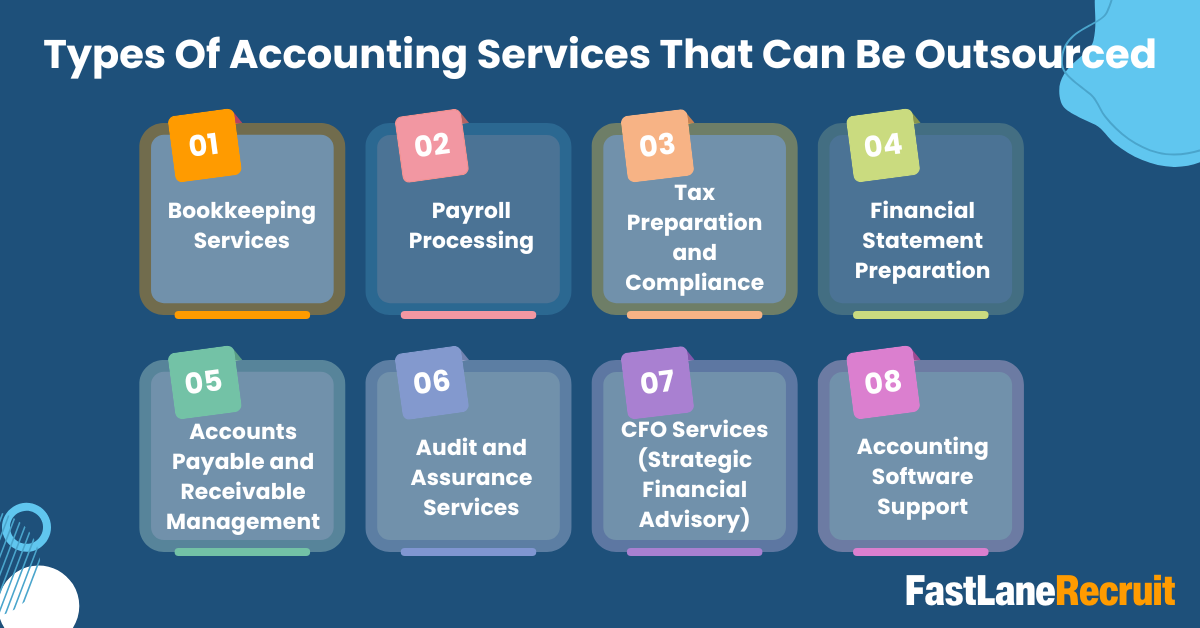

Businesses can outsource various functions such as bookkeeping, payroll, tax filing, and CFO-level advisory.

How FastLaneRecruit Can Help

FastLaneRecruit connects companies with qualified accounting professionals across various specialties.

Outsourcing Accounting

Outsourcing accounting refers to the practice of hiring external professionals or firms to manage a business’s financial tasks and responsibilities. This approach has become increasingly popular among startups, SMEs, and even large enterprises looking to reduce costs, access specialized expertise, and improve financial accuracy without expanding internal teams.

Also Read: Benefit of Outsourcing Accounting to Malaysia

What Does It Involve?

Outsourced accounting can cover a wide range of functions, including but not limited to:

- Bookkeeping and transaction recording

- Payroll processing

- Tax preparation and filing

- Financial reporting and compliance

- Budgeting, forecasting, and financial planning

These services can be performed remotely or on-site, depending on the needs and structure of the business.

1. Bookkeeping Services

Bookkeeping involves the day-to-day recording of financial transactions, including purchases, sales, receipts, and payments. It forms the backbone of a business’s accounting system.

Why Outsource?

- Save time and reduce errors: Professional bookkeepers maintain accurate records, reducing the risk of costly mistakes.

- Ensure compliance: Outsourced providers stay updated with local and international bookkeeping standards.

- Scalable service: As your business grows, outsourced providers can scale with your financial needs.

2. Payroll Processing

Payroll processing includes calculating employee wages, withholding taxes, and ensuring timely salary disbursements.

Why Outsource?

- Compliance assurance: Avoid penalties due to payroll tax errors or late filings.

- Data security: Outsourced firms use secure systems to protect sensitive employee data.

- Reduced administrative burden: Free up HR or admin teams to focus on strategic HR tasks.

Also Read: Guide to Payroll Outsourcing in Singapore

3. Tax Preparation and Compliance

This includes preparing and filing tax returns, managing GST/VAT, and handling correspondence with tax authorities.

Why Outsource?

- Expertise in changing regulations: Tax laws change frequently; professionals ensure compliance and minimize liabilities.

- Accuracy: Prevent costly misreporting and errors.

- Strategic tax planning: Benefit from tax-saving strategies tailored to your business.

4. Financial Statement Preparation

Includes compiling income statements, balance sheets, and cash flow statements, which are critical for investors, lenders, and internal planning.

Why Outsource?

- Financial transparency: Gain access to clear and professionally prepared reports.

- Regulatory compliance: Align with reporting standards such as IFRS or GAAP.

- Time-saving: Focus on business growth instead of administrative tasks.

5. Accounts Payable and Receivable Management

Accounts Payable (AP) and Accounts Receivable (AR) management ensure your business maintains healthy cash flow.

Why Outsource?

- Faster invoicing and collections: Improve cash flow and reduce delays.

- Avoid late payments and penalties: Timely processing of bills and vendor payments.

- Better vendor and customer relationships: Reliable financial processes build trust.

Also Read: The Ultimate Guide to Offshore Accounting

6. Audit and Assurance Services

Auditing involves reviewing financial statements for accuracy and compliance, often required by law or investors.

Why Outsource?

- Unbiased insights: External auditors provide an objective review.

- Compliance: Meet statutory and stakeholder requirements.

- Risk mitigation: Detect errors or potential fraud early.

7. CFO Services (Strategic Financial Advisory)

Outsourced CFO services offer high-level financial strategy, budgeting, forecasting, and decision support.

Why Outsource?

- Access to expert advice: Engage experienced CFOs without the full-time cost.

- Better financial planning: Navigate investment decisions, expansions, or risk management.

- Improve investor confidence: Professional reporting and insights reassure stakeholders.

8. Accounting Software Implementation and Support

This involves setting up tools like Xero, QuickBooks, or SAP and training staff to use them effectively.

Why Outsource?

- Faster setup and training: Get expert support from certified professionals.

- Reduce tech errors: Avoid disruptions in workflow during transitions.

- Ongoing support: Access to helpdesk or troubleshooting as needed.

Why Businesses Choose to Outsource

- Cost Efficiency: Eliminates the need to hire, train, and retain in-house accountants. Businesses only pay for the services they use.

- Expertise on Demand: Gain access to certified accountants, tax advisors, and financial consultants with deep knowledge of industry-specific standards and regulations.

- Focus on Core Business: Entrepreneurs and business leaders can dedicate more time to growth, operations, and customer experience.

- Scalability: Services can be scaled up or down based on seasonal needs or business growth without the hassle of restructuring internal teams.

- Reduced Risk and Enhanced Compliance: Professional accounting firms stay up-to-date with regulatory changes, helping businesses avoid penalties and legal issues.

When to Consider Outsourcing

Businesses may consider outsourcing their accounting when:

- They lack the resources or expertise in-house

- Financial reporting and compliance requirements are becoming more complex

- They are expanding into new markets or jurisdictions

- There’s a need for advanced financial strategy or systems implementation

- They want to cut back on overhead costs

Whether you’re a startup needing basic bookkeeping or a growing enterprise seeking CFO-level guidance, outsourcing offers a flexible and cost-effective way to keep your finances in top shape.

Pro Tip: Always partner with a reputable recruitment or outsourcing firm like FastLaneRecruit to ensure you’re matched with qualified professionals who understand your industry and compliance landscape.

Also Read: How FastLaneRecruit Helps Singapore Businesses Hire Top Talent

Conclusion

Outsourcing accounting services is no longer limited to large corporations. SMEs and startups are increasingly turning to external experts for their accounting needs. Whether it’s basic bookkeeping or high-level financial strategy, outsourcing provides flexibility, accuracy, and cost savings. With today’s technology and the rise of remote talent, it’s easier than ever to access global accounting expertise.

Why You Should Outsource with FastLaneRecruit

At FastLaneRecruit, we specialize in connecting businesses with qualified accounting professionals for every function, such as bookkeeping, payroll, tax, CFO advisory, and more. Our extensive talent pool covers various industries and accounting systems, ensuring you get the right fit for your financial operations.

What we offer:

- Accounting and finance talent

- Flexible engagement models (part-time, full-time, project-based)

- Talent experienced in leading platforms like Xero, QuickBooks, and MYOB

- Multilingual professionals for regional support

- Seamless hiring process with FastLaneRecruit’s recruitment expertise

Ready to outsource your accounting needs with confidence?

Get in touch with FastLaneRecruit today.