Hire Bookkeeper from Malaysia with FastLaneRecruit

Looking for a smarter, more cost-effective way to keep your ledgers clean and your ATO deadlines under control? With FastLaneRecruit, you don’t just outsource bookkeeping tasks — you build a dedicated offshore bookkeeping team in Malaysia. From daily bank reconciliations and BAS preparation to Single Touch Payroll (STP) submissions, we help Australian businesses hire qualified bookkeepers who work as a seamless extension of your finance department. Our offshore bookkeeping solution is perfect for Australian SMEs, e-commerce brands and professional-services firms that need flexible, regulation-ready support at a fraction of local payroll costs.

Why Malaysian Bookkeepers Stand Out

Build a Cost-Efficient Offshore Bookkeeping Team in Malaysia

Malaysia offers a deep pool of diploma- and degree-qualified accountants and bookkeepers with hands-on experience in Australian Bookkeeping Standards, GST and BAS lodgement requirements. Your team is hired specifically for you, works your preferred hours and follows your chart of accounts.

English Proficiency & Cloud-Accounting Expertise

Malaysian finance professionals are fluent in English and widely certified in Xero, MYOB and QuickBooks Online, ensuring friction-free collaboration with your Australian staff and advisors.

End-to-End Bookkeeping Talent

Our outsourced bookkeeper gives you access to experts skilled in: Accounts payable & receivable management, Bank & credit-card reconciliation, BAS & IAS preparation, Superannuation Guarantee and workers’ comp calculations, Monthly management reporting, cash-flow forecasting & KPI dashboards and Year-end audit file preparation for your tax accountant

Proactive, Not Just Data Entry

Your offshore bookkeeper flags cash-flow issues, overdue debtors and coding anomalies before they become problems so you get actionable insights, not just reconciled numbers.

Trusted by Australian Enterprises

Malaysian bookkeepers support retail chains, tech scale-ups and boutique accounting practices across Australia and the wider APAC region, delivering ATO-compliant statements on time, every time.

Fast Setup. Local Compliance. Zero Bureaucracy.

FastLaneRecruit sources, vets, onboards and payrolls your team through our Malaysia Employer-of-Record (EOR) platform, letting you launch in as little as 2–8 weeks with no local entity required.

Outsourced Bookkeepers Can Perform a Full Range of Accounting & Compliance Tasks

By outsourcing your bookkeeping, you gain access to skilled professionals who understand Australian regulations and help keep your records audit-ready:

Daily Transactions & Bank Feeds

Post, match and reconcile feeds from all major Australian banks and payment gateways.

Accounts Payable & Receivable

Three-way matching, supplier statement reconciliation and automated invoice reminders.

BAS & GST Compliance

Prepare and lodge BAS, IAS and fuel-tax credits, ensuring accurate GST coding and on-time ATO submissions.

Payroll & STP

Process weekly/fortnightly payroll, superannuation and entitlements, then submit STP files directly to the ATO.

Month-End Management Reports

Profit-and-loss, balance sheet, cash-flow forecast and customised KPI packs for management or investors.

Year-End Support

Draft workpapers, reconcile asset registers and liaise with external tax agents or auditors.

Software Setup & App Integrations

Implement or optimise Xero, MYOB, Receipt Bank, Hubdoc, Shopify and other add-ons for real-time automation.

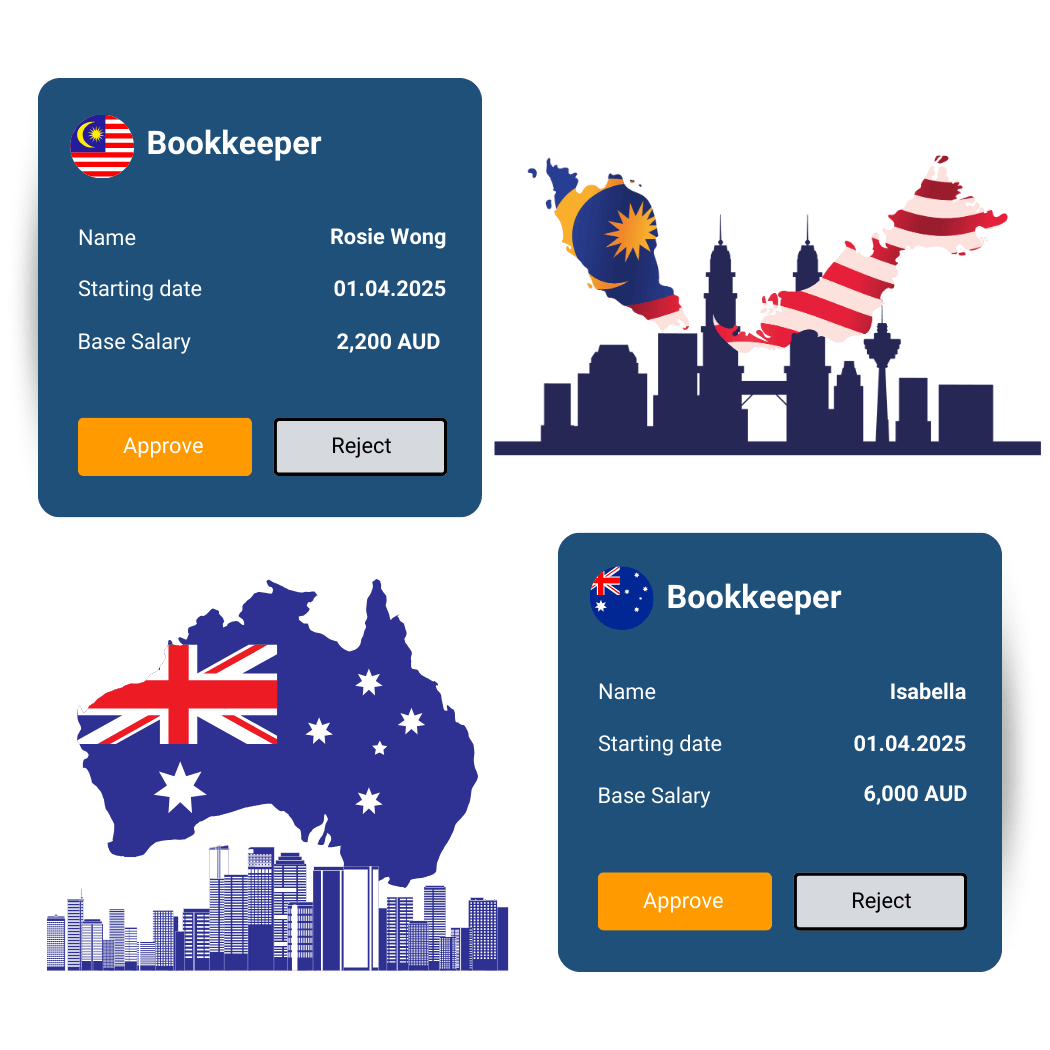

Salary Comparison: Hiring in Australia vs. Malaysia

| Role | Australia | Malaysia |

| Bookkeeper | AUD $65,000 – $80,000 / year | MYR 45,000 – 72,000 / year (≈ AUD $15,000 – $23,000) |

| Senior Bookkeeper / BAS Agent | AUD $80,000 – $95,000 / year | MYR 60,000 – 90,000 / year (≈ AUD $19,000 – $29,000) |

| Payroll & Compliance Bookkeeper | AUD $75,000 – $90,000 / year | MYR 66,000 – 96,000 / year (≈ AUD $21,000 – $31,000) |

2025 Salary Guide

FastLaneRecruit’s 2025 Salary Guide is an essential resource for hiring managers navigating today’s fast-changing job market. As industries continue to evolve, understanding competitive compensation benchmarks is crucial for attracting and retaining top talent. Our comprehensive guide provides up-to-date salary insights across key job functions and industries in Malaysia, Singapore, Hong Kong, and Australia empowering you to make informed hiring decisions and stay ahead in an increasingly competitive talent landscape.

Download 2025 Malaysia Salary GuideHiring a Bookkeeper in Australia vs Malaysia

Hiring a full-time Bookkeeper in Australia can cost ~AUD $70,000 – $90,000 per year, depending on experience and BAS-agent status. An equivalent Malaysian professional typically costs AUD $20,000 – $30,000 annually, while still possessing strong IFRS knowledge, Xero certification and proven familiarity with Australian GST and STP requirements.

Total Savings: 60-70 %

With FastLaneRecruit as your recruitment and Employer-of-Record partner, you can establish a dependable offshore bookkeeping team in Malaysia — cost-effective, compliant and seamlessly aligned with Australian accounting standards.

Book A Free 30 mins Discovery Call

Why FastLaneRecruit is the Best Partner

FastLaneRecruit is part of the FastLane Group, a trusted CPA firm with a proven track record in providing professional accounting services. With years of operating history and experience working with offshore accounting teams in Malaysia, we know accounting inside out. Our expertise ensures we can identify, recruit, and manage top-tier accounting talent tailored to your business needs. As accountants hiring accountants, we offer unmatched insight into the skills and qualifications required for success in the field.

Xero Platinum Partner

We embarked on our Xero journey in 2013, becoming a trusted Xero Platinum partner. Our team of Xero experts is dedicated to unleashing the power of Xero for your business, revolutionizing your bookkeeping, credit control, and payroll processes.

We offer flexible involvement tailored to your needs. With Xero’s cloud-based platform, collaboration happens seamlessly from any device with an internet connection. Say goodbye to wasted time and unnecessary expenses of downloading or transferring data to your accountant.

Global and Australian Companies Leveraging Malaysia for Offshore Bookkeepers

Forward-thinking Australian businesses are boosting their finance capacity by tapping Malaysian talent:

Diverse Industries

Real Examples:

E-Commerce Retailer Slashes Month-End Close

A Brisbane-based Shopify brand hired two Malaysian bookkeepers to reconcile daily sales feeds, leading to same-day revenue visibility and a 65 percent reduction in month-end closing time.

Professional-Services Firm Cuts BAS Prep Costs

A mid-tier accounting practice in Perth added offshore assistants to handle data entry and BAS draft preparation for 120 clients, saving AUD $85 k in annual labour costs while freeing local seniors for advisory work.

Tech Startup Gains Real-Time Cash-Flow Insights

A Melbourne SaaS company onboarded a Malaysian management-reporting specialist to build rolling forecasts and KPI dashboards, impressing investors ahead of a Series A raise.

Benefits of

Offshore and Remote Bookkeeping Teams

Significant Cost Savings

- Reduce bookkeeping labour spend by 60 percent+ without compromising accuracy.

Certified & Experienced Professionals

- Access Xero-certified advisors, registered BAS agents and experienced payroll officers.

Faster Hiring, Flexible Scaling

- Start with one bookkeeper or build a full finance back office in 2–8 weeks.

More Time for Strategic Finance

- Free your Australian CFO and accountants to focus on cash-flow strategy, forecasting and growth.

Seamless Integration & Full Control

- Your offshore team follows your processes and reporting lines; FastLaneRecruit handles HR, payroll and Malaysian labour compliance.

Talent Sourcing Process Overview

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Talent Sourcing Process Overview

Total Turnaround Time – 3~8 weeks (subject to role complexity and candidate availability)

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Build Your Offshore Bookkeeping Team Today

Ready to streamline compliance and gain real-time financial clarity without inflating your local payroll? FastLaneRecruit helps you build an offshore bookkeeping team in Malaysia that keeps your ledgers spotless, your BAS on time and your cash-flow visible, all at a price that fuels growth.

Book Your Free 30-Min Strategy Call