As Hong Kong grapples with a significant talent shortage—with projections indicating a manpower gap of 180,000 by 2028, businesses are seeking innovative strategies to attract and retain skilled professionals. A recent survey revealed that 78% of companies in Hong Kong faced challenges in sourcing new employees as they approached 2024, particularly in sectors like IT, engineering, and sustainability .

To address these challenges, many organizations are turning to outsourced employment solutions such as Professional Employer Organizations (PEO) and Employers of Record (EOR). These models offer streamlined HR administration, payroll processing, and benefits management, ensuring compliance with local labor laws. However, their operational structures differ significantly, and selecting the appropriate model is crucial for the success and scalability of your overseas hiring strategy.

In this blog, we explore the differences, use cases, and benefits of each model in the Hong Kong business environment.

Also Read: Why Do Companies in Hong Kong Choose to Hire Offshore?

Content Outline

Key Summary

PEO (Professional Employer Organisation) and EOR (Employer of Record) both offer outsourced HR solutions, but they serve different business needs.

PEOs require a local legal entity, while EORs do not, making EOR ideal for testing markets or quick hiring in Hong Kong.

Choosing the right model depends on your expansion strategy, compliance tolerance, and speed-to-hire requirements.

FastLaneRecruit offers trusted, fully compliant EOR services in Hong Kong to help companies scale with ease.

PEO vs EOR: The Main Difference

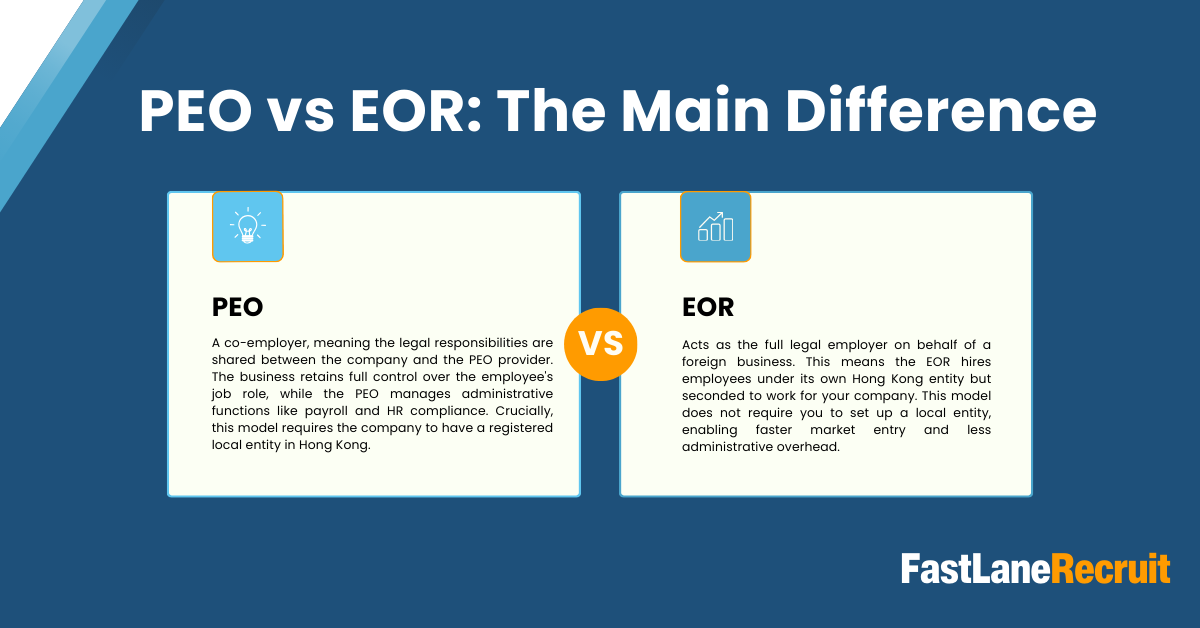

The key difference between a PEO and an EOR lies in the employer of record status.

- A PEO becomes a co-employer, meaning the legal responsibilities are shared between the company and the PEO provider. The business retains full control over the employee’s job role, while the PEO manages administrative functions like payroll and HR compliance. Crucially, this model requires the company to have a registered local entity in Hong Kong.

- In contrast, an EOR acts as the full legal employer on behalf of a foreign business. This means the EOR hires employees under its own Hong Kong entity but seconded to work for your company. This model does not require you to set up a local entity, enabling faster market entry and less administrative overhead.

Understanding this distinction is critical for making a compliant and cost-effective hiring decision in Hong Kong.

Also Read: Hong Kong Seeks Malaysian Talent to Strengthen Workforce

Understanding the Comparison

To better understand the differences, here is a comprehensive comparison of Hong Kong companies hiring in Malaysia:

| Category | PEO | EOR |

| Legal Employer | Shared (client and PEO) | EOR is the sole legal employer |

| Requires Local Entity | Yes – the company must be registered with SSM | No – EOR uses its own legal entity |

| Best For | Businesses with a Malaysia entity seeking HR support | Businesses without a local entity are hiring remotely or testing the market |

| Compliance Risk | Shared compliance burden | EOR assumes full compliance responsibilities |

| Payroll & Benefits | Outsourced, but the entity remains responsible for some local filings | Fully managed by EOR in compliance with Malaysia laws |

| Speed to Hire | Slower – dependent on entity setup and registrations | Faster – hiring can begin in days |

Legal Employer

The legal employer is responsible for statutory obligations, including tax reporting, EPF contributions (MPF equivalent), and ensuring employment contracts adhere to the Employment Law.

- In a PEO model, this responsibility is shared. While the PEO handles HR admin, your company remains jointly liable for ensuring employment terms and legal compliance.

- In an EOR model, the EOR becomes the sole legal employer, taking full accountability for employment contracts, benefits, and compliance issues under Hong Kong law.

This distinction reduces liability and operational friction, especially for companies unfamiliar with local employment regulations.

Also Read: How to Effectively Hire and Manage Remote Employees: A Comprehensive Guide

Requires a Local Entity

To engage a PEO in Malaysia or in any jurisdiction outside of Hong Kong, you must first establish a local legal entity in that country. This setup typically involves the following steps:

- Registering a business with the local authorities

- Obtaining a Business Registration Certificate

- Opening a corporate bank account

- Setting up statutory contributions such as the Employees Provident Fund (EPF) and relevant tax accounts

An EOR bypasses this requirement. You can legally hire staff overseas without forming an entity in that country, making this the preferred model for businesses wanting to operate lean and fast.

Best For

| PEO is best for | EOR is best for |

| Companies planning a long-term presence | Startups or SMEs entering new markets |

| Businesses that want HR support only | Businesses hiring in new countries without a local entity |

| Companies with in-house HR compliance expertise | Companies needing full compliance handled externally |

Compliance Risk

Non-compliance with obligations such as Retirement Scheme contributions, tax filings, or severance pay can result in penalties and legal action.

- With a PEO, your business shares the legal and financial risk.

- With an EOR, the provider assumes full compliance responsibility, shielding you from inadvertent missteps.

Payroll & Benefits

- A PEO can manage your payroll system, but your company still bears the burden of reporting employee income and managing the Retirement Scheme contributions directly.

- An EOR streamlines this by managing gross-to-net salary, benefits administration, tax remittance, and payslip distribution, all under their legal structure, ensuring total alignment with that country’s employment laws.

Speed to Hire

Time is critical in recruitment. In a PEO model, hiring is delayed by the weeks or months it may take to establish your local entity.

In contrast, with an EOR:

- Employee onboarding can happen within a few business days

- Employment contracts are issued immediately under the EOR’s registered entity

- You gain instant access to a local workforce while maintaining full operational control

When Should You Use a PEO?

A PEO is ideal if you already operate in that country or are committed to setting up a permanent presence. It suits companies that:

- Need local HR support but want to retain legal employment responsibilities

- Prefer a long-term operational strategy with full brand presence

- Have internal legal and payroll teams who can coordinate with a PEO

- Are focused on sustained growth, not just talent acquisition

This model is common among multinational enterprises that want to consolidate HR operations while retaining legal autonomy.

When Should You Use an EOR?

EORs are designed for businesses that value flexibility and speed, especially when entering new markets. You should consider an EOR if:

- You don’t want to incur the cost of incorporating a new entity

- You need to hire quickly for a project or client in that country

- You’re testing the new market and want to reduce risk

- You want to ensure full compliance without internal legal resources

This model is especially useful for startups, SMEs, and companies conducting remote or cross-border operations.

Can You Switch from PEO to EOR (or vice versa)?

Yes, many companies start with an EOR and later transition to a PEO or even a direct employment model once they’ve built a local presence.

The process typically involves:

- Offboarding employees from the EOR

- Registering your local entity (if moving to a PEO)

- Re-issuing contracts and benefits to ensure continuity

- Transferring payroll data and compliance records

It is important to partner with an experienced provider like FastLaneRecruit to ensure legal compliance and smooth workforce transitions.

Which Model is Best for You?

To determine the right model, ask yourself:

- Do I need to hire quickly without establishing a legal entity? – Go with an EOR

- Do I want to invest long-term and grow a local presence? – Choose a PEO

- Do I have in-house legal/HR resources? – PEO may be suitable

- Do I want to outsource compliance completely? – An EOR is ideal

Every business situation is unique. Assess your current goals and future plans before deciding.

Also Read: Benefit of Outsourcing Accounting to Malaysia

Conclusion

Both PEO and EOR offer valuable solutions to facilitate international hiring in overseas. Whether you need the compliance simplicity of an EOR or the shared responsibilities of a PEO, making an informed decision is essential for your global expansion success.

By understanding the structural, legal, and operational differences, your business can create a more agile and compliant workforce in one of Asia’s most competitive markets.

Build Your Offshore Team with FastLaneRecruit’s EOR Service

Expanding your business into Asia doesn’t need to be complex or time-consuming. With FastLaneRecruit’s trusted Employer of Record (EOR) services in Hong Kong and Malaysia, you can onboard talent compliantly, manage local employment obligations, and focus on scaling your business, without needing to set up a local legal entity.

Whether you’re entering the Hong Kong market with its dynamic financial and professional services landscape or tapping into Malaysia’s growing digital economy, FastLaneRecruit handles everything from employment contracts and statutory benefits to payroll and tax filings. We ensure compliance with local labour laws such as the Employment Ordinance in Hong Kong and Malaysia’s Employment Act 1955, so you can confidently grow your workforce without legal or administrative setbacks.

Our EOR solution is ideal for companies looking to:

- Hire quickly in Hong Kong or Malaysia

- Test new markets without long-term commitment

- Outsource complex HR, payroll, and compliance tasks

- Scale across Asia with operational efficiency

Contact FastLaneRecruit today to learn how our EOR services in Hong Kong and Malaysia can help you hire top talent swiftly, legally, and seamlessly.