Hong Kong is a global business hub known for its transparent tax system, business-friendly regulations, and straightforward payroll structure. Despite this, managing payroll in compliance with local legislation requires precision, especially for foreign companies unfamiliar with local employment laws.

Whether you’re establishing a startup or expanding into Hong Kong, payroll isn’t just about paying salaries. It encompasses mandatory contributions, taxation, insurance, and legal obligations. This comprehensive guide will help you understand every aspect of managing payroll in Hong Kong and how FastLaneRecruit can support your business.

Content Outline

Key Summary

Understand your payroll structure options

Companies can either establish a local entity or use an Employer of Record (EOR) depending on their long-term presence and resource allocation in Hong Kong.

Stay compliant with statutory obligations

Employers must adhere to regulations involving MPF contributions, employee compensation insurance, and timely salary payments.

Implement accurate and timely payroll processes

Running payroll involves salary calculation, MPF deductions, tax filings, and delivering payslips — all within specific legal timelines.

Leverage payroll software and expert support

Using digital tools or outsourcing to a provider like FastLaneRecruit ensures accuracy, efficiency, and full compliance with local laws.

Avoid common payroll pitfalls

Mistakes like late MPF registration, incorrect tax deductions, and misclassification of employees can lead to penalties and reputational damage.

Keep thorough documentation and records

Employers must maintain at least seven years of payroll and tax records to meet Hong Kong’s statutory requirements and for audit readiness.

Stay updated on changes in employment law

Regular updates to minimum wage, MPF caps, and tax thresholds require proactive monitoring to avoid non-compliance.

Establishing Payroll in Hong Kong

Choosing the Right Structure

Before hiring and paying employees, businesses need to determine how they want to enter the Hong Kong market. There are two primary options:

1. Setting Up a Local Entity

Registering a company in Hong Kong enables full control over operations, including payroll management. This process involves:

- Registering with the Companies Registry

- Obtaining a Business Registration Certificate from the Inland Revenue Department

- Opening a local business bank account

- Enrolling in the Mandatory Provident Fund (MPF) scheme

This setup is ideal for companies with long-term plans in Hong Kong but requires time and resources.

2. Using an Employer of Record (EOR)

For businesses that want to hire local talent without establishing a legal entity, partnering with an EOR like FastLaneRecruit is a faster and cost-effective alternative. The EOR becomes the legal employer, handling:

- Employment contracts

- Payroll processing

- MPF and tax contributions

- Employee benefits and compliance

This allows companies to focus on operations while ensuring legal adherence.

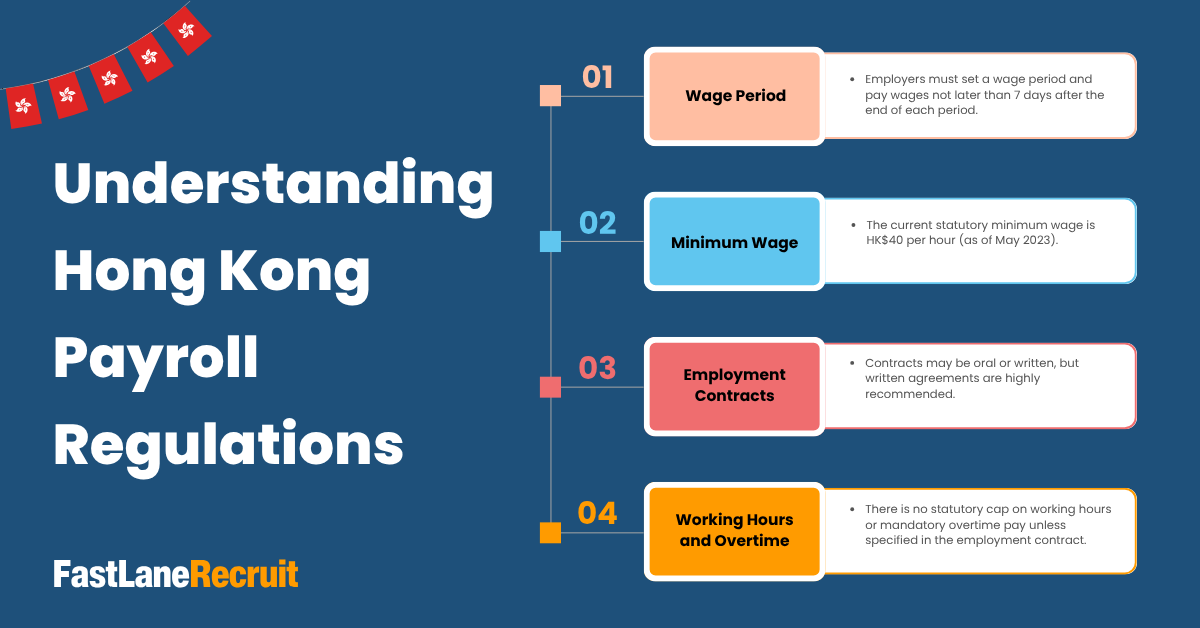

Understanding Hong Kong Payroll Regulations

Hong Kong’s Employment Ordinance governs employment terms and payroll obligations. Some key regulations include:

- Wage Period: Employers must set a wage period and pay wages not later than 7 days after the end of each period.

- Minimum Wage: The current statutory minimum wage is HK$40 per hour (as of May 2023).

- Employment Contracts: Contracts may be oral or written, but written agreements are highly recommended.

- Working Hours and Overtime: There is no statutory cap on working hours or mandatory overtime pay unless specified in the employment contract.

Violations can result in penalties, back pay, and legal liability.

Mandatory Provident Fund (MPF)

The MPF system is a retirement savings scheme that is mandatory for both employers and employees. Contributions are calculated as follows:

| Monthly Relevant Income | Employer Contribution | Employee Contribution | Total Monthly Contribution Cap |

| ≤ HK$7,100 | Not Required | Not Required | N/A |

| > HK$7,100 | 5% of salary | 5% of salary | HK$3,000 (each) |

Both employer and employee contributions must be paid to an MPF trustee by the 10th day of the following month. Non-compliance can lead to penalties and surcharges.

More information can be found on the MPFA website.

Employee Compensation Insurance

Under the Employees’ Compensation Ordinance, employers must purchase insurance to cover employees against job-related injuries, illnesses, or death. This applies to full-time, part-time, temporary, and contract employees.

Key considerations:

- Insurance is compulsory even if the business only has one employee.

- Coverage amount depends on the nature of the work and the number of employees.

- Failure to obtain ECI can result in fines up to HK$100,000 and imprisonment.

Refer to the Labour Department’s ECI guidelines for full details.

Also Read: The Ultimate Guide to Offshore Accounting

Other Statutory Requirements

Beyond MPF and compensation insurance, employers in Hong Kong must fulfill several other obligations:

- Annual Tax Filings: Employers must submit IR56B forms to the IRD annually for each employee.

- Termination Forms: IR56F or IR56G must be filed upon employee termination or departure.

- Record Keeping: Employers are required to keep payroll records (including wage history and contributions) for at least 7 years.

- Pay Slips: While not mandatory by law, providing payslips is best practice and often expected by employees.

Payroll Setup Process

Initial Setup

To initiate payroll processing in Hong Kong, the following steps should be completed:

- Company Registration: With the Companies Registry and IRD.

- Bank Account Opening: A local bank account is essential for paying salaries and making MPF contributions.

- MPF Enrollment: Choose an MPF trustee (e.g., HSBC, Manulife, BOCI-Prudential) and enroll employees.

- Payroll Policy Design: Define pay cycle, allowances, leave policies, and deductions.

- Employee Data Collection: Gather necessary employee details, including HKID, bank info, tax number, and MPF enrollment forms.

Payroll Management Solutions

Managing payroll in-house can be complex, especially when dealing with multiple hires or remote teams. Fortunately, Hong Kong companies have access to efficient solutions.

Payroll Software Integration

Businesses can automate payroll functions with software such as:

- Talenox: Integrates with MPF providers and tax reporting.

- Xero Payroll: Useful for SMEs managing accounting and payroll in one system.

- QuickBooks: Offers simplified payroll for basic operations.

Benefits of using software include:

- Time savings

- Reduced errors

- Centralized data management

- Easier compliance tracking

Payroll Outsourcing to FastLaneRecruit

FastLaneRecruit provides a tailored payroll outsourcing solution that covers every step, including:

- Salary computation and bank file preparation

- MPF enrollment and monthly contributions

- IRD form filing (IR56B, IR56E/F/G)

- Leave tracking and benefit calculation

- Payslip generation and secure employee access

Our team ensures strict compliance with all statutory regulations while offering responsive local support. This allows businesses to scale confidently without administrative overhead.

Also Read: How Remote Accounting Services Can Improve Your Business

Managing Payroll

Effective payroll management requires:

- Accurate data entry

- Timely processing of payroll and contributions

- Ongoing monitoring of compliance obligations

- Employee communication and issue resolution

Regular internal audits and payroll reviews can help identify discrepancies before they result in fines or dissatisfaction.

Payroll Calculation

Essential Components of Salary

Hong Kong employers must include various compensation elements in payroll:

- Basic salary

- Bonuses and commissions (if contractual)

- Overtime pay (where applicable)

- Allowances (e.g., housing, travel, meal)

- Leave pay (annual leave, sick leave, maternity leave)

- Deductions (e.g., MPF, taxes, authorized loan repayments)

Employers must clearly state these in the employment contract.

Also Read: Benefit of Outsourcing Accounting to Malaysia

Understanding Taxation in Hong Kong

Hong Kong applies a progressive tax rate system on net chargeable income after allowances and deductions.

| Net Chargeable Income (HKD) | Tax Rate |

| First $50,000 | 2% |

| Next $50,000 | 6% |

| Next $50,000 | 10% |

| Next $50,000 | 14% |

| Over $200,000 | 17% |

Alternatively, the Standard Rate of 15% on total income (without deductions) may apply if it’s lower.

More details can be found on the IRD Salaries Tax Guide.

Contributions and Benefits

Besides salary, employers must provide and contribute to:

- Statutory holidays (at least 13 per year)

- Paid annual leave (from 7 to 14 days depending on service)

- Maternity and paternity leave

- Long service or severance payments (if applicable)

These benefits ensure employee well-being and legal compliance.

Also Read: 7 Actionable Tips For Building High-Performance Remote Teams

Payroll Execution

Running Payroll

The monthly payroll process generally includes:

- Collecting timesheets and leave records

- Calculating gross pay and deductions

- Processing MPF and other contributions

- Generating payslips

- Transferring net salary to employee accounts

- Updating payroll and accounting records

Payroll should be run in time to meet statutory payment deadlines and avoid late penalties.

Tax Filing and Compliance

Tax filing responsibilities include:

- Annual Employer’s Return (Form BIR56A)

- Employee IR56B submission

- IR56F for terminated employees

- IR56G for employees leaving Hong Kong

Employers must also provide copies of IR56B to employees for personal tax filing. Deadlines are typically in April each year, and penalties apply for late submissions.

Best Practices and Common Mistakes for Payroll in Hong Kong

Best Practices

- Automate wherever possible using payroll software

- Keep detailed documentation of all payments, contracts, and benefits

- Regularly audit payroll records for discrepancies

- Stay updated with legal changes (e.g., MPF caps, tax updates)

- Ensure clear communication with employees on salary and deductions

Common Mistakes

- Misclassifying employees as contractors

- Failing to register with MPF on time

- Inaccurate tax or MPF deductions

- Missing compliance deadlines

- Not issuing payslips or maintaining records

Conclusion

Payroll in Hong Kong is relatively straightforward but demands attention to legal details, timely execution, and ongoing updates. Businesses must stay vigilant about compliance to avoid penalties and foster a healthy workplace.

By understanding the payroll process, using the right tools, and seeking expert support, businesses can manage payroll with confidence.

How FastLaneRecruit’s Payroll Outsourcing Can Help

FastLaneRecruit offers reliable payroll outsourcing services for businesses of all sizes operating in or expanding into Hong Kong. Our dedicated team handles:

- Payroll processing and compliance

- Tax and MPF filings

- Benefit calculations and leave tracking

- IRD and Labour Department documentation

We simplify your back-office operations, reduce compliance risks, and allow you to focus on your core business. Whether you’re a startup or multinational, our localized expertise ensures your payroll runs smoothly.

Get in touch with FastLaneRecruit to learn how we can streamline your payroll operations.