Hire Payroll Specialist from Malaysia with FastLaneRecruit

Looking to optimise your payroll operations while keeping compliance airtight? With FastLaneRecruit, you don’t just outsource payroll tasks — you build a dedicated full-time payroll team in Malaysia. From salary processing and statutory contributions (EPF, SOCSO, EIS) to cross-border compliance and reporting, we help businesses hire skilled Malaysian payroll specialists who operate as an extension of your internal HR or finance department. Our offshore payroll specialist services are ideal for companies seeking accurate, compliant, and cost-efficient payroll operations.

Why Malaysian Payroll Specialists Stand Out

Build a Cost-Effective Offshore Payroll Team in Malaysia

Malaysia offers a skilled talent pool of payroll professionals trained in Malaysian Employment Act, EPF, SOCSO, EIS, and PCB (Monthly Tax Deduction). With FastLaneRecruit, you’re building a dependable team that can support local and regional payroll compliance, including Singapore CPF, Hong Kong MPF, and U.S. FICA requirements.

English Fluency & Regional Expertise

Malaysian payroll specialists are fluent in English and possess hands-on experience with multi-country payroll systems. Many have worked with MNCs and are familiar with payroll platforms like SAP, ADP, and PayAsia.

End-to-End Payroll Talent

Our outsourced payroll speicialists are experienced in: Monthly salary calculations and disbursements, Statutory contributions (EPF, SOCSO, EIS, PCB), Payroll tax filings and reconciliations and Payroll software administration (e.g., InfoTech, SQL, Talenox).

Not Just Processors — Payroll Partners

We help you build payroll teams that contribute strategically — not just administratively. From compliance updates to improving payroll efficiency, your offshore payroll specialist works proactively with your HR and finance leaders.

Trusted by Regional & Global Companies

Malaysian payroll professionals support startups, SMEs, and global enterprises across APAC, including Singapore, Australia, and the U.S. They offer high accuracy, reliable turnaround, and regulatory compliance to reduce your payroll risks.

Fast Hiring. Full Compliance. No Entity Required.

With FastLaneRecruit, you don’t need to open an entity in Malaysia. We handle sourcing, onboarding, payroll, and HR compliance through our EOR model so you can scale in weeks.

Outsourced Payroll Specialists Can Perform a Full Range of Payroll-Compliance Tasks

Outsourcing payroll to Malaysia means you gain access to a trained team that understands regional regulations and ensures compliance every step of the way:

Monthly Payroll Processing

Calculate base pay, bonuses, allowances, deductions, and generate payslips.

Statutory Compliance (Malaysia)

Ensure monthly EPF, SOCSO, EIS, and PCB contributions are submitted accurately and on time.

Multi-Country Payroll

Handle payroll compliance and filings for entities in Singapore (CPF), Hong Kong (MPF), Australia (STP), and the U.S. (IRS).

Payroll Tax Filing & Reporting

Manage EA forms, tax clearances, monthly payroll tax deductions, and reconciliations.

Payroll System Setup & Maintenance

Implement and maintain payroll software tailored to your organisation’s needs.

Leave & Attendance Integration

Connect payroll with leave tracking and attendance systems for seamless monthly processing.

Advisory & Payroll Structuring

Offer strategic input on payroll structuring, incentive planning, and benefit taxation.

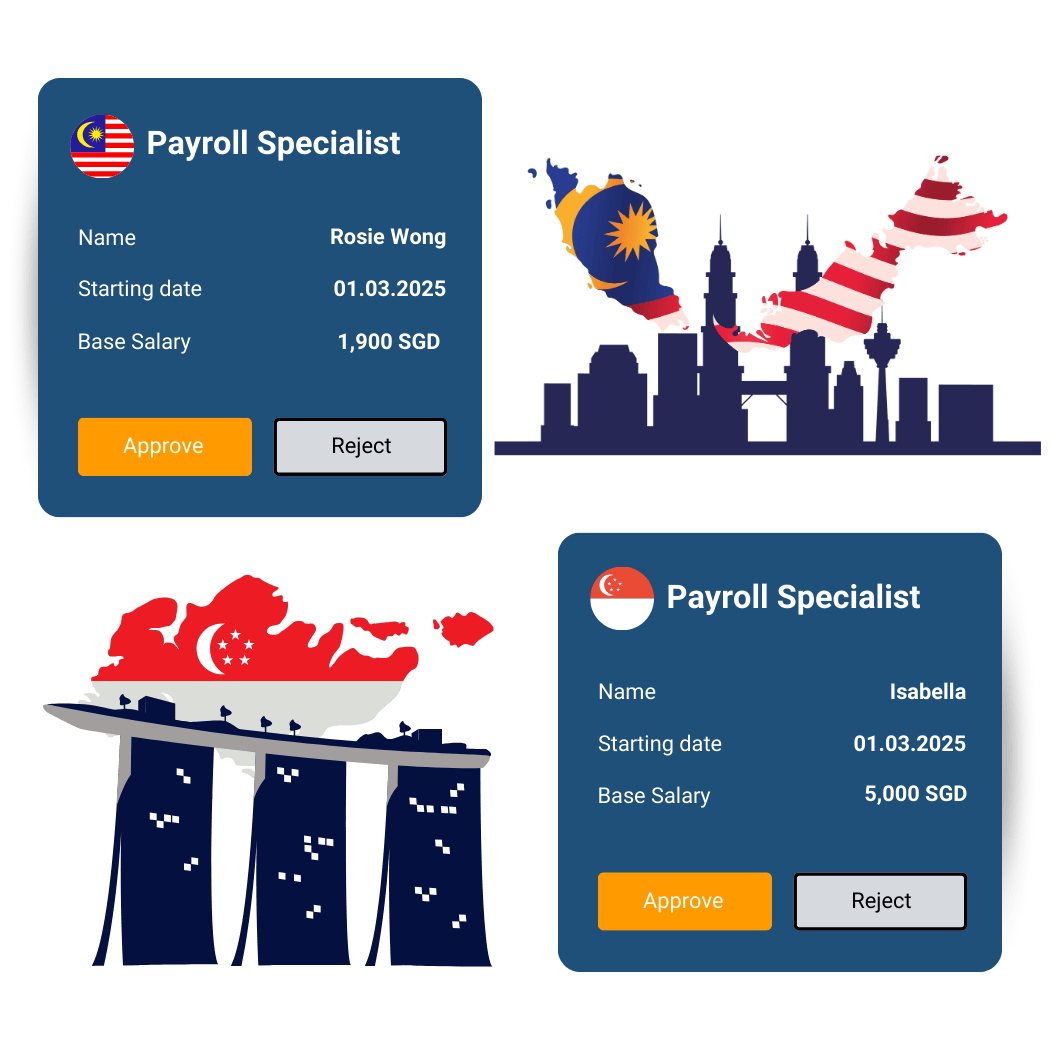

Salary Comparison: Hiring in in Malaysia vs Other Countries

| Role | Singapore (in USD) | Hong Kong (in USD) | Australia (in USD) | U.S. | Malaysia (in USD) |

| Payroll Specialist | $45,000 – $60,000 | $42,000 – $55,000 | $60,000 – $80,000 | $55,000 – $75,000 | $15,000 – $20,000 |

| Senior Payroll Analyst | $55,000 – $70,000 | $50,000 – $68,000 | $70,000 – $90,000 | $65,000 – $85,000 | $20,000 – $26,000 |

| Regional Payroll Manager | $80,000 – $110,000 | $75,000 – $100,000 | $90,000 – $120,000 | $85,000 – $115,000 | $30,000 – $40,000 |

2025 Salary Guide

FastLaneRecruit’s 2025 Salary Guide is an essential resource for hiring managers navigating today’s fast-changing job market. As industries continue to evolve, understanding competitive compensation benchmarks is crucial for attracting and retaining top talent. Our comprehensive guide provides up-to-date salary insights across key job functions and industries in Malaysia, Singapore, Hong Kong, and Australia empowering you to make informed hiring decisions and stay ahead in an increasingly competitive talent landscape.

Download 2025 Malaysia Salary GuideHiring a Payroll Specialist in Singapore vs Malaysia

Hiring a full-time Payroll Specialist in Singapore typically costs around USD $50,000 – $60,000 per year. In contrast, hiring a similarly qualified payroll professional in Malaysia costs around USD $15,000 – $20,000. That’s nearly 70% cost savings without compromising on English communication, accuracy, or compliance with regional regulations like CPF, EPF, MPF, and FICA.

Total Savings: Over 65%

With FastLaneRecruit as your recruitment partner and Employer of Record (EOR), you gain a cost-effective, regulation-compliant offshore payroll team — without needing to set up a legal entity in Malaysia.

Book A Free 30 mins Discovery Call

Why FastLaneRecruit is the Best Partner

FastLaneRecruit is part of the FastLane Group, a trusted CPA firm with a proven track record in providing professional accounting services. With years of operating history and experience working with offshore accounting teams in Malaysia, we know accounting inside out. Our expertise ensures we can identify, recruit, and manage top-tier accounting talent tailored to your business needs. As accountants hiring accountants, we offer unmatched insight into the skills and qualifications required for success in the field.

Xero Platinum Partner

We embarked on our Xero journey in 2013, becoming a trusted Xero Platinum partner. Our team of Xero experts is dedicated to unleashing the power of Xero for your business, revolutionizing your bookkeeping, credit control, and payroll processes.

We offer flexible involvement tailored to your needs. With Xero’s cloud-based platform, collaboration happens seamlessly from any device with an internet connection. Say goodbye to wasted time and unnecessary expenses of downloading or transferring data to your accountant.

Global and Malaysia Companies Leveraging Malaysia for Offshore Payroll Specialists

Forward-thinking Global and Malaysia companies are using Malaysian talent to strengthen their corporate compliance and governance functions:

Diverse Industries

Real Examples:

Global SaaS Company Reduces Payroll Costs by 68%

A Singapore-based tech company hired 3 Malaysian payroll professionals to handle multi-country payroll for Singapore, Malaysia, and Australia. The company cut its payroll operations cost by over 65% while improving accuracy and turnaround times.

U.S. Retail Brand Establishes Regional Payroll Hub

A U.S.-headquartered retail company built an offshore payroll processing team in Kuala Lumpur to serve APAC. With FastLaneRecruit, they onboarded 5 specialists in 6 weeks — reducing processing delays by 70%.

Hong Kong Firm Centralises Asia Payroll in Malaysia

A regional firm with entities in Hong Kong, Singapore, and Malaysia centralised its payroll processing in Malaysia. The team now manages MPF, CPF, and EPF filings across all locations with better compliance oversight and unified reporting.

Benefits of

Offshore and Remote Payroll Teams

Significant Cost Savings

- Cut payroll staffing costs by up to 70% without compromising on accuracy or speed.

Certified, Experienced Talent

- Access payroll professionals experienced with regional laws, statutory filings, and cloud payroll platforms.

Fast Onboarding, Easy Scaling

- Build your team in 2–8 weeks. Add roles as you expand, with full EOR support.

Full Compliance, No Entity Setup

- We handle contracts, HR, taxes, and payroll through our Malaysia-based EOR.

Seamless Integration

- Offshore teams report directly to you while FastLaneRecruit handles operations behind the scenes.

Talent Sourcing Process Overview

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Talent Sourcing Process Overview

Total Turnaround Time – 3~8 weeks (subject to role complexity and candidate availability)

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Build Your Offshore Payroll Team in Malaysia Today

Ready to reduce payroll costs and gain expert compliance support across APAC? Let FastLaneRecruit help you build a dedicated offshore payroll team in Malaysia — efficient, compliant, and seamlessly integrated with your operations.

Book Your Free 30-Min Strategy Call