Outsource Accounting Services with FastLaneRecruit

Outsourcing accounting is a smart move for Malaysia companies looking to reduce operational costs and boost efficiency. Businesses are increasingly turning to Outsourced Accounting Services to access experienced, affordable talent and streamline their operations. At FastLaneRecruit, we deliver reliable Outsource Accounting Services tailored for Malaysia businesses. Our Malaysia-based Outsource Accountants provide top-notch accounting support at a fraction of traditional hiring costs.

Whether you need ongoing bookkeeping support or scalable accounting outsourcing, FastLaneRecruit connects you with the right accounting professionals to support your business growth. We proudly offer recruitment and outsourcing services in the United States, Singapore, Australia, Hong Kong, and Malaysia .

Outsource Accountants from Southeast Asia for Australian Companies

FastLaneRecruit connects Australian businesses with highly skilled accountants from Malaysia and Southeast Asia, delivering reliable and cost-effective solutions tailored to your needs. Whether you’re an accounting firm, audit firm, CFO or an established company, our outsourcing services help you stay competitive in today’s dynamic market.

Benefits of Hiring Malaysia-Based Outsourced Accountants

1

Significant Cost Savings

Outsourcing accounting services helps Malaysian companies cut costs on full-time salaries, benefits, office space, and training. You gain access to highly qualified accountants at a fraction of the cost, perfect for growing SMEs and established companies seeking flexible, scalable talent.

2

Improved Productivity and Focus

Our Malaysia-based outsource accountants handle complex tasks efficiently, allowing your internal teams to focus on business growth, innovation, and customer success.

3

Access to Specialised Accounting Expertise

With outsourced accounting services, you tap into professionals skilled in Malaysia’s financial regulations, SST filing, cross-border taxation, and more, strengthening your financial operations with strategic insight.

4

Proficiency in Leading Accounting Software

Our accountants are experienced with Xero, QuickBooks, MYOB, SAP, and Oracle, ensuring a smooth transition to outsourced accounting services without disrupting your existing workflows.

Key Accounting Functions You Can Outsource

Bookkeeping

Maintain accurate daily records, reconcile statements, and keep your financial ledgers organized.

Accounts Payable Support

Prepare, track, and manage supplier invoices to ensure timely payments and healthy cash flow.

Accounts Receivable Support

Issue invoices, monitor receivables, and support cash collection processes.

Payroll Preparation Support

Calculate employee wages, prepare payslips, and generate reports for compliant payroll management.

Financial Statement Preparation

Prepare accurate P&L statements, balance sheets, and cash flow reports based on your transactional data.

Corporate Tax Preparation Support

Support your in-house finance team or tax agent by preparing ECI and tax computation documents.

Sales Tax Preparation

Compile SST summaries and calculations for timely and compliant reporting.

Management Reporting

Deliver detailed monthly or quarterly financial reports to drive smarter decision-making.

Accounting Software Setup & Support

Set up and configure Xero, QuickBooks, or MYOB and train your team for operational excellence.

Why Choose FastLaneRecruit to Outsource Accountant?

Access To Offshore Accountant

FastLaneRecruit connects you with Malaysia and Southeast Asia accountants for financial reporting, tax compliance, or payroll management. We match you with experts suited to your business needs.

Cost-Effective Solutions

Save on hiring costs like salaries, benefits, and office space. FastLaneRecruit offers affordable, high-quality accounting services.

Tailored Recruitment Solutions

FastLaneRecruit helps you with tailored recruitment strategies aligned with your business goals and culture to ensure each hire integrates seamlessly into your team.

Advanced Tools and Software

Our accountants use Xero and cloud-based platforms for real-time data, accurate reporting, and smooth processes.

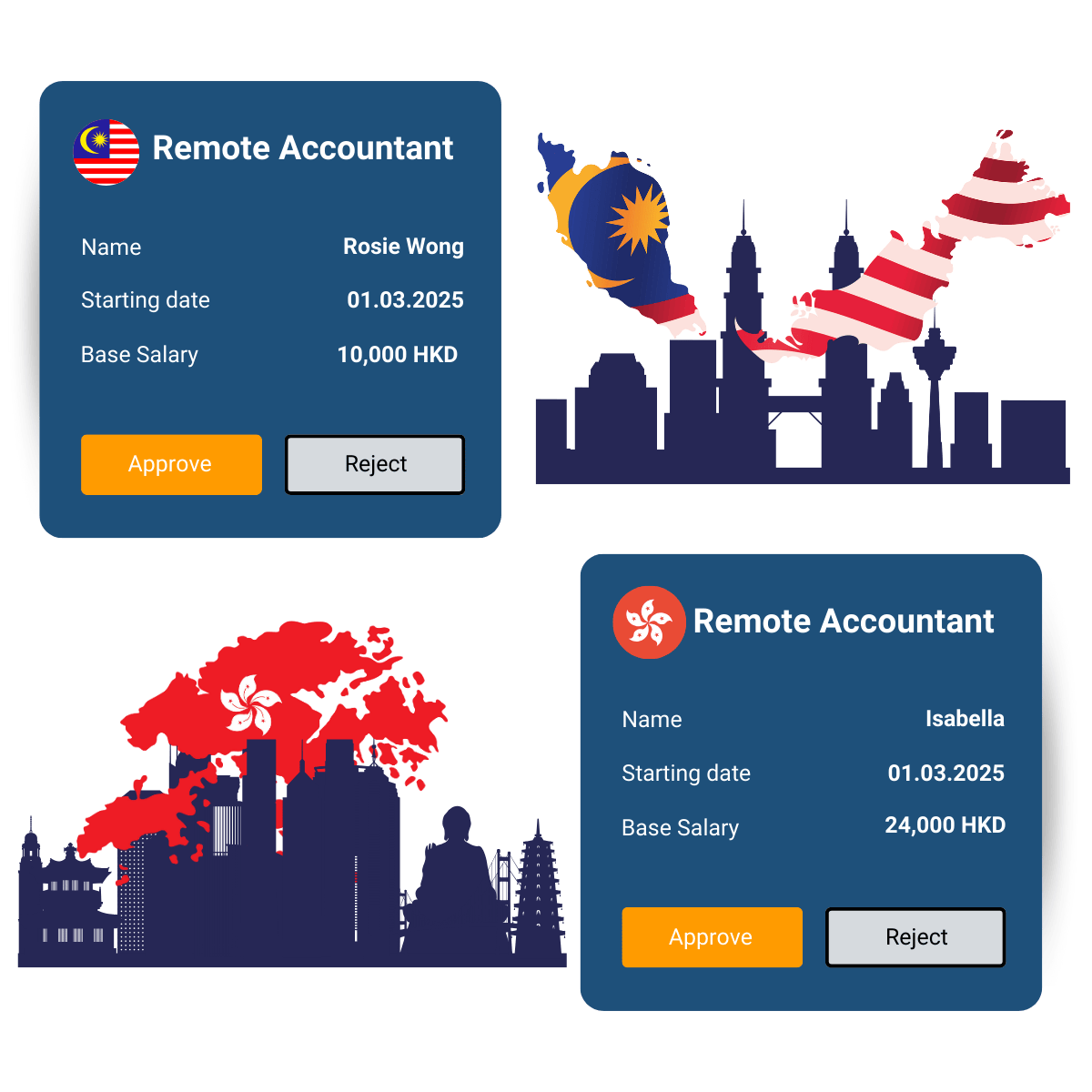

Salary Comparison: Hiring an Accountant in Malaysia vs. Other Countries

Outsourcing to Malaysia offers significant cost savings compared to hiring accountants in Hong Kong, Singapore, Australia, and the United States. Here’s a monthly breakdown:

| Role | Malaysia (USD/month) | Hong Kong (USD/month) | Singapore (USD/month) | Australia (USD/month) | United States (USD/month) |

|---|---|---|---|---|---|

| Assistant Accountant | USD 800 – 1,050 | USD 2,050 – 2,700 | USD 2,050 – 2,800 | USD 2,950 – 3,550 | USD 4,000 – 5,000 |

| Financial Accountant | USD 1,050 – 1,570 | USD 3,200 – 4,300 | USD 3,300 – 4,780 | USD 3,950 – 5,250 | USD 5,500 – 7,500 |

| Senior Accountant | USD 1,470 – 2,100 | USD 4,400 – 5,800 | USD 4,780 – 6,300 | USD 5,000 – 6,300 | USD 6,500 – 8,500 |

| Finance Manager | USD 2,100 – 3,150 | USD 6,300 – 8,900 | USD 6,300 – 9,200 | USD 6,300 – 8,400 | USD 8,000 – 11,000 |

2025 Salary Guide

FastLaneRecruit’s 2025 Salary Guide is an essential resource for hiring managers navigating today’s fast-changing job market. As industries continue to evolve, understanding competitive compensation benchmarks is crucial for attracting and retaining top talent. Our comprehensive guide provides up-to-date salary insights across key job functions and industries in Malaysia, Singapore, Hong Kong, and Australia empowering you to make informed hiring decisions and stay ahead in an increasingly competitive talent landscape.

Hiring an Assistant Accountant in Malaysia vs. Other Countries

Hiring an Assistant Accountant in Malaysia instead of Hong Kong, Singapore, Australia, or the United States offers substantial monthly and annual cost savings.

- In Hong Kong, the average monthly salary for an Assistant Accountant is approximately USD 2,400, totaling USD 28,800 per year.

- In Singapore, it’s around USD 2,400 monthly, or USD 28,800 annually.

- In Australia, the salary averages USD 3,250 per month, reaching USD 39,000 annually.

- In the United States, it can climb to USD 4,500 per month, totaling USD 54,000 annually.

- Meanwhile, in Malaysia, the average monthly salary is just around USD 925, equating to USD 11,100 per year.

Total Savings: Up to USD 43,000 Annually (Over 75% Savings!)

By leveraging recruitment and Employer of Record (EOR) services, businesses can dramatically reduce their hiring costs while gaining access to highly skilled, English-speaking accounting talent in Malaysia.

Book A Free 30 mins Discovery Call

Why FastLaneRecruit is the Best Partner

FastLaneRecruit is part of the FastLane Group, a trusted CPA firm with a proven track record in providing professional accounting services. With years of operating history and experience working with offshore accounting teams in Malaysia, we know accounting inside out. Our expertise ensures we can identify, recruit, and manage top-tier accounting talent tailored to your business needs. As accountants hiring accountants, we offer unmatched insight into the skills and qualifications required for success in the field.

Xero Platinum Partner

We embarked on our Xero journey in 2013, becoming a trusted Xero Platinum partner. Our team of Xero experts is dedicated to unleashing the power of Xero for your business, revolutionizing your bookkeeping, credit control, and payroll processes.

We offer flexible involvement tailored to your needs. With Xero’s cloud-based platform, collaboration happens seamlessly from any device with an internet connection. Say goodbye to wasted time and unnecessary expenses of downloading or transferring data to your accountant.

Global and Regional Companies Are Outsourcing Accounting to Malaysia

Many businesses across Singapore, Australia, Hong Kong, and beyond are tapping into Malaysia’s skilled workforce for Outsource Accounting Services. Malaysia has become a leading destination for offshore accounting support due to its professional expertise and competitive cost structure.

Diverse Industries

Industries such as fintech, professional services, e-commerce, manufacturing, and tech startups are increasingly outsourcing their accounting functions to Malaysia.

Real Examples:

Fintech Company Expanding Operations

A fintech firm outsourced financial reporting and compliance tasks to a Malaysia-based accounting team — achieving a 40% cost reduction while maintaining regulatory compliance and accuracy.

E-Commerce Brand Strengthening Financial Control

A Singaporean e-commerce company outsourced bookkeeping, tax preparation, and reconciliation to Malaysia, allowing its internal teams to focus on marketing and customer engagement.

Accounting Firm Expanding Capacity

A mid-sized accounting firm leveraged Malaysian offshore teams during peak audit seasons, boosting capacity while cutting operational costs by 50%.

Benefits of Offshore and Remote Accounting Teams

Cost Savings

- Significantly reduce overhead costs associated with office space and employee benefits.

- Malaysia’s competitive salary structure allows access to top-tier talent without high costs.

Access to Talent

- Overcome local talent shortages with access to a larger, skilled workforce.

- Tap into professionals trained in globally recognized standards like IFRS, Xero, and SAP.

Flexibility and Scalability

- Scale your team based on business needs without long-term commitments.

- Adapt to evolving market demands quickly and effectively.

Productivity and Efficiency

- Focus on core business operations while offshore teams manage accounting tasks efficiently.

- Benefit from dedicated professionals who excel in their field.

Comprehensive Support

- Leverage FastLane Recruit’s end-to-end recruitment, payroll administration, and Employer of Record (EOR) services for seamless hiring and management.

Productivity and Efficiency

- Focus on core business operations while offshore teams manage accounting tasks efficiently.

- Benefit from dedicated professionals who excel in their field.

Comprehensive Support

- Leverage FastLane Recruit’s end-to-end recruitment, payroll administration, and Employer of Record (EOR) services for seamless hiring and management.

Benefits of

Offshore & Remote Accounting Teams in Malaysia

Lower Overhead Costs

- Save on office rentals, HR costs, and operational expenses — reinvest your savings where it matters most.

Access to a Larger Talent Pool

- Malaysia boasts a steady stream of well-trained accountants ready to support cross-border business needs.

Scalable and Flexible Hiring Solutions

- Easily expand or scale down your accounting team based on business cycles or market conditions.

Increased Focus on Business Growth

- Free up your internal teams to focus on high-value projects while your offshore accounting team manages your financial backend.

Malaysia’s Favorable Business Environment

- With its pro-business policies and financial stability, Malaysia is a trusted hub for outsourced operations.

Time Zone Compatibility for Real-Time Collaboration

- Operating in the same time zone as Singapore, Malaysia enables fast communication, real-time updates, and operational efficiency.

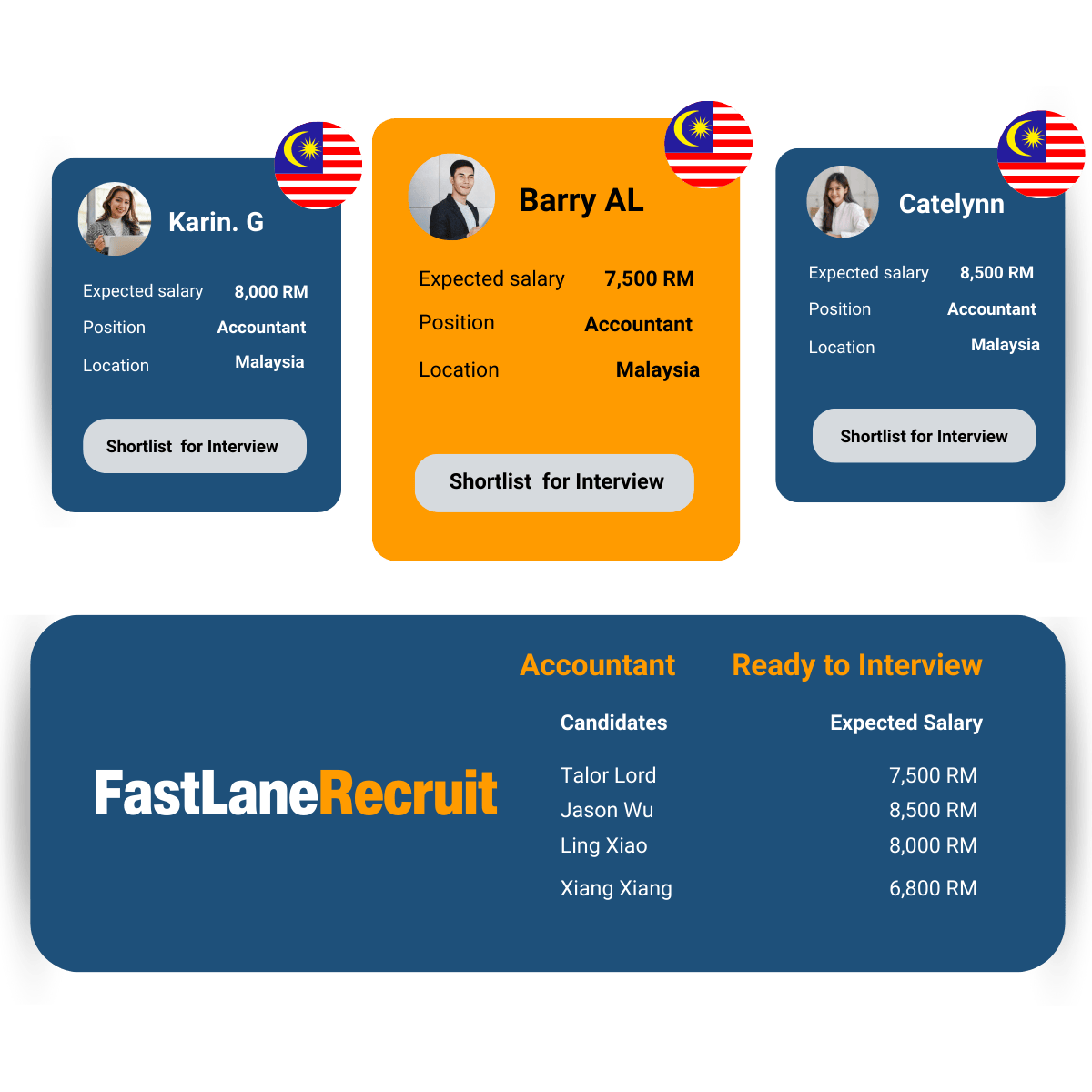

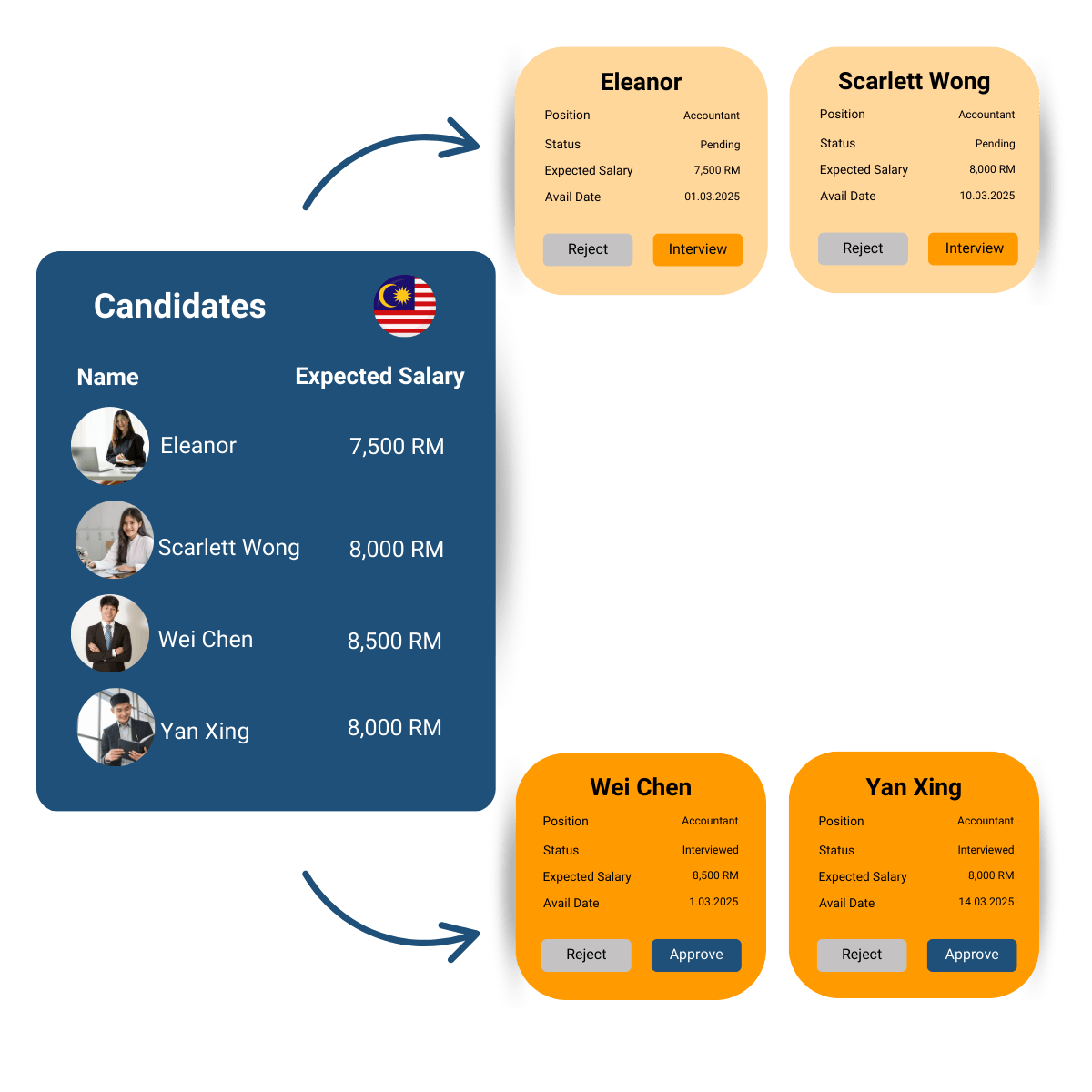

Talent Sourcing Process Overview

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Talent Sourcing Process Overview

Total Turnaround Time – 3~8 weeks (subject to role complexity and candidate availability)

1 – Discovery Call

Discuss client hiring needs, job role expectations, and recruitment timeline.

2 – Alignment Call

Understand client needs, job role, and ideal candidate profile.

3 – Talent Sourcing

Search and shortlist candidates through our database, job portals, and networks.

Screening & Interview

Conduct initial screening interviews and shortlist top candidates.

4 – Client Interviews

Arrange interviews between the client and shortlisted candidates.

Skills Test & Assessment

Arrange technical or skills-based tests as per client requirements.

Offer & Negotiation

Extend offer, manage negotiations, and confirm candidate acceptance.

5 – Onboarding & Documentation

Facilitate employment contract signing and onboarding process.

Our Recruitment Process

FastLane will support the client’s in recruitment processes which include the following:

STAGE 01

Needs Analysis

We begin by understanding your hiring requirements and company culture.

STAGE 02

Talent Search

Our expert team identifies and engages potential candidates through various channels.

STAGE 03

Screening & Assessment

We assess candidates based on skills, experience, and cultural fit.

STAGE 04

Interview & Selection

Shortlisted candidates undergo interviews, and final selections are made.

STAGE 05

Onboarding

Successful candidates are seamlessly integrated into your team with our HR support.

Our Recruitment Process

FastLane will support the client’s in recruitment processes which include the following:

STAGE 01

Needs Analysis

We begin by understanding your hiring requirements and company culture.

STAGE 02

Talent Search

Our expert team identifies and engages potential candidates through various channels.

STAGE 03

Screening & Assessment

We assess candidates based on skills, experience, and cultural fit.

STAGE 04

Interview & Selection

Shortlisted candidates undergo interviews, and final selections are made.

STAGE 05

Onboarding

Successful candidates are seamlessly integrated into your team with our HR support.

Start Building Your Malaysia Accounting Team Today

Unlock significant savings and gain access to Malaysia’s highly skilled accounting workforce. Whether you need remote accountants, financial analysts, or compliance experts, FastLaneRecruit is ready to connect you with top-tier talent. Contact us today to discuss your outsourcing and recruitment needs. Let’s help you build a smarter, more cost-effective accounting team in Malaysia.

FastLaneRecruit – Building Teams, Powering Growth!

Book A Free 30 mins Discovery Call

Download Your Free

2025 Malaysia Hiring Guide

Today!

Planning to build your team in Malaysia?

Get expert insights on hiring regulations, cultural norms, labor laws, and workforce strategies to build a winning team.

Here’s what our clients and candidates say about FastLaneRecruit:

Segovia Financial Services Limited

“Efficient and expert! Fastlane Malaysia’s talent recruitment and EOR services are integral to our corporate success.”

Wristcheck Exchange Limited

“Kudos to Fastlane Group for their outstanding payroll services. Their team’s expertise ensures precision, compliance, and timely processing. A reliable ally for our business.”

Arcadia Consulting Limited

“On-time paychecks, happy faces. FastLane keeps my team motivated and focused on what matters.”

Outsource Accountant With FastLaneRecruit

Outsourcing an accountant is simple with FastLaneRecruit:

Book A Free Consult Today1. Share Your Needs

Tell us your accounting requirements, and we’ll find the perfect offshore accountant for your business.

2. Meet Your Accountant

We’ll introduce you to a qualified offshore accountant ready to handle your accounting tasks efficiently.

3. Start Collaborating

Start working with your outsourced accountant with our tools for smooth communication and task management.

Pricing & Packages

Flexible pricing plans tailored to your needs. Our pricing model includes:

Recruitment Fees

Annual Salary

USD 12,000 or below

USD 2,500

Fixed

> USD 12,000

From 18%

of annual salary

EOR

Setup Fee

USD 369/

FTE

Includes onboarding into statutory platforms and basic KYC review

Monthly Fee

USD 259/

month

Includes payroll, tax filings, onboarding/offboarding, and payslips

Remote Assistant

USD 1,100/

month

includes remote administrative support for calendars, emails, projects, and bookkeeping

Hire the Best Offshore Accountant for Your Business

Not sure if outsourcing is right for your business?

Get in touch with our team and schedule a consultation.

FAQs for Offshore Accountant Services in Australia

What is outsourced accounting?

Outsourced accounting involves hiring external accountants or accounting firms to handle tasks such as bookkeeping, payroll, tax preparation, and financial reporting for your business.

Why should I outsource accounting for my business in Australia?

Outsourcing allows you to save costs, access skilled professionals, streamline financial processes, and focus on core business activities without the hassle of managing an in-house team.

What accounting tasks can be outsourced?

You can outsource a variety of tasks, including:

- Bookkeeping

- Tax preparation and filing

- Payroll management

- Financial reporting

- Bank reconciliation

- Expense tracking

- Invoice processing

How much does it cost to outsource an accountant in Australia?

Costs depend on the services you require, the complexity of your business needs, and the level of expertise needed. FastLaneRecruit offers tailored solutions to fit your budget.

Will outsourced accountants understand Australian accounting standards?

Yes, outsourced accountants from FastLaneRecruit are trained in Australian accounting standards and ensure compliance with local tax laws and regulations.

How secure is my financial data with an outsourced accountant?

FastLaneRecruit prioritizes data security by using secure systems and tools for communication and document management. Confidentiality agreements are also in place.

Can I hire a part-time outsourced accountant?

Yes, you can hire accountants on a part-time or full-time basis, depending on your business needs. Flexible engagement models are available.

Do outsourced accountants use accounting software?

Yes, FastLaneRecruit accountants are proficient in software like Xero, QuickBooks, MYOB, and other cloud-based tools to ensure efficient financial management.

How do I communicate with my outsourced accountant?

We provide tools for seamless communication and task management, including email, video calls, and project management platforms.

How long does it take to start working with an outsourced accountant?

Once you share your requirements, we can match you with a qualified accountant within a few days. You can start collaborating as soon as you meet your accountant.

Can outsourced accountants handle tax filings in Australia?

Yes, our accountants are experienced in preparing and filing taxes in compliance with Australian tax laws.

Is Outsourcing Accountants Suitable for Accounting Firms, Audit Firms, and CFOs in Australia?

Absolutely! Outsourcing provides access to professional expertise, reduces operational costs, and allows businesses to focus on core activities and strategic growth.

What industries do outsourced accountants specialize in?

FastLaneRecruit accountants have experience across various industries, including retail, technology, healthcare, finance, and more.

What if I’m not satisfied with the outsourced accountant?

FastLaneRecruit ensures client satisfaction by providing a replacement accountant if needed and maintaining ongoing support throughout the engagement.

How can I get started with outsourcing an accountant in Australia?

It’s simple! Share your requirements with FastLaneRecruit, meet your matched accountant, and start working together. Contact us today to get started.